Insurers fret over militant attacks, AI hacks at Paris Olympics

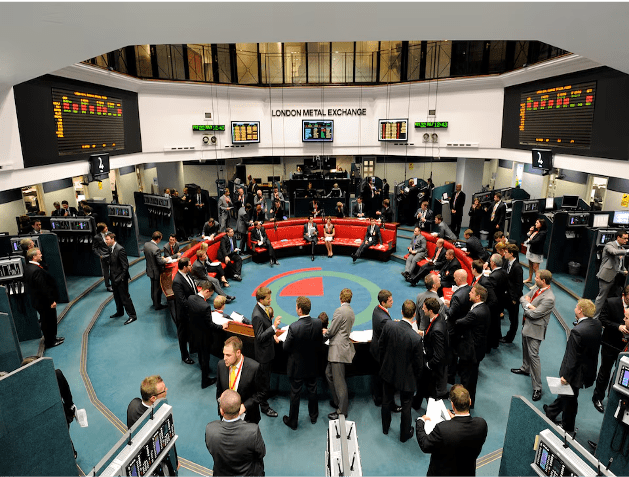

LONDON, July 5 (Reuters) - Insurers are nervous that militant attacks or AI-generated fake images could derail the Paris Olympics, risking event cancellations and millions of dollars in claims. Insurers faced losses after the 2020 Tokyo Olympics were postponed for a year due to the COVID-19 pandemic. Since then, wars in Ukraine and Gaza and a spate of elections this year, including in France, have driven up fears of politically-motivated violence at high-profile global events. The Olympics take place in Paris from July 26-Aug 11 and the Paralympics from Aug 28-Sept 8. German insurer Allianz (ALVG.DE), opens new tab is insurance partner for the Games. Other insurers, such as the Lloyd's of London (SOLYD.UL) market, are also providing cover. "We are all aware of the geopolitical situation the world is in," said Eike Buergel, head of Allianz's Olympic and Paralympic programme. "We are convinced that the IOC (International Olympic Committee), Paris 2024 and the national organising committees, together with the French authorities, are taking the right measures when it comes to challenges on the ground."

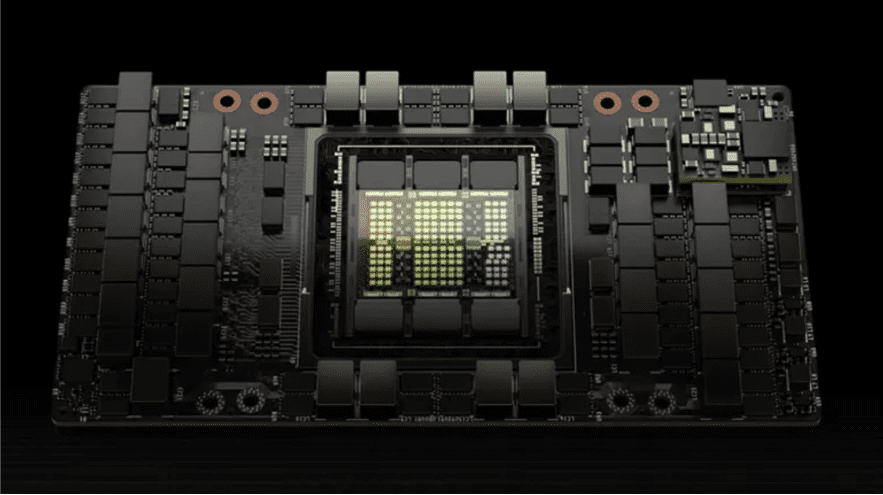

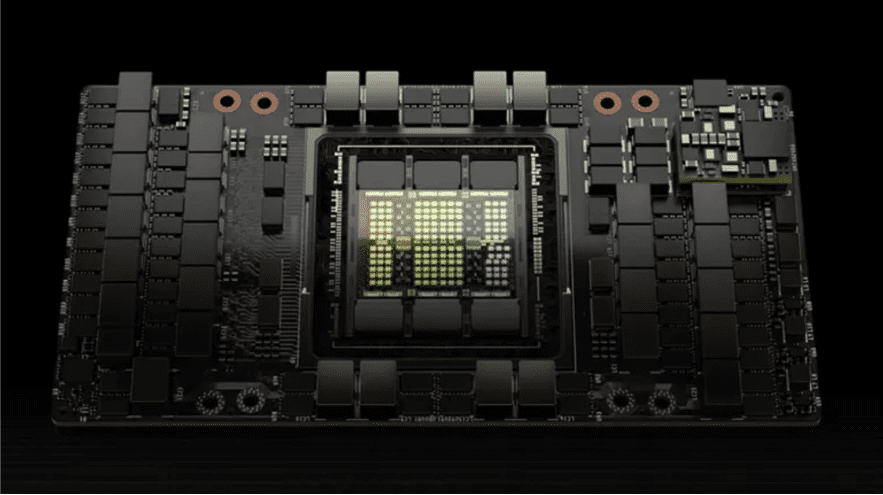

Nvidia H20 will sell 1 million units this year, contributing $12 billion in revenue!

Recently, according to the FT, citing the latest forecast data of the market research institute SemiAnalysis, AI chip giant NVIDIA will ship more than 1 million new NVIDIA H20 acceleration chips to the Chinese market this year, and it is expected that the cost of each chip is between $12,000 and $13,000. This is expected to generate more than $12 billion in revenue for Nvidia. Affected by the United States export control policy, Nvidia's advanced AI chip exports to China have been restricted, H20 is Nvidia based on H100 specifically for the Chinese market to launch the three "castration version" GPU among the strongest performance, but its AI performance is only less than 15% of H100, some performance is even less than the domestic Ascend 910B. When Nvidia launched the new H20 in the spring of this year, there were reports that due to the large castration of H20 performance, coupled with the high price, Chinese customers' interest in buying is insufficient, and they will turn more to choose China's domestic AI chips. Then there are rumors that Nvidia has lowered the price of the H20 in order to improve its competitiveness. However, the latest news shows that due to supply issues caused by the low yield of the Ascend 910B chip, Chinese manufacturers in the absence of supply and other better options, Nvidia H20 has started to attract new purchases from Chinese tech giants such as Baidu, Alibaba, Tencent and Bytedance. Analysts at both Morgan Stanley and SemiAnalysis said the H20 chip is now being shipped in bulk and is popular with Chinese customers, despite its performance degradation compared to chips Nvidia sells in the United States.

Amid rising regional tensions, the US announced that it will hold another Rim of the Pacific military exercise

The U.S. Navy's Pacific Fleet announced on Wednesday (May 22) that the 2024 Rim of the Pacific Exercise (RIMPAC 2024) is expected to take place on June 26, with 29 countries participating in and around the Hawaiian Islands, a larger lineup than the previous exercise in 2022. The Philippines, which has had multiple maritime conflicts with China recently, and Japan, which has tense diplomatic relations with China, will send troops to participate. China has been excluded from participating in the international military exercise since 2018, and its aggressive actions and reactions are causing tensions in the Pacific region to continue to rise. The biennial Rim of the Pacific military exercise is the world's largest international maritime exercise. The U.S. Navy said that the exercise will last until August 2, and it is expected to involve 29 countries, 40 surface ships, 3 submarines, 14 countries' army forces, more than 150 aircraft and more than 25,000 personnel. The U.S. Navy said that the theme of the 29th RIMPAC 2024 is "Partners: Integrated and Ready", emphasizing inclusiveness as the core, promoting multinational cooperation and trust, and using military interoperability to achieve their respective national goals to strengthen integrated and ready alliance partners. Its goal is to "enhance collective strength and promote a free and open Indo-Pacific region" through joint training and operations. The 29 countries participating in the exercise this year include Australia, Belgium, Brazil, Brunei, Canada, Chile, Colombia, Denmark, Ecuador, France, Germany, India, Indonesia, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Peru, South Korea, the Philippines, Singapore, Sri Lanka, Thailand, Tonga, the United Kingdom and the United States. Compared with the 28th RIMPAC held in 2022, which involved 26 countries, 38 surface ships, 4 submarines, 9 countries' army forces, more than 170 aircraft, and about 25,000 officers and soldiers, the number of countries, ships and army forces participating in this exercise has increased. The countries participating in this year's RIMPAC military exercise include all members of the Quadrilateral Security Dialogue (QUAD) between the United States, Japan, India and Australia, and the Australia-UK-US Trilateral Security Partnership (AUKUS), as in the previous exercise. In addition, countries surrounding the South China Sea and the South Pacific island nation of Tonga are also participating. Many analysts believe that the military exercise itself is sending a message to China: China's expansion in the Western Pacific region will be blocked and defeated. The United States invited China to participate in the RIMPAC military exercise twice in 2014 and 2016. In 2018, due to China's expansion in the South China Sea, the United States withdrew its invitation to China. In addition, despite Taiwan's repeated willingness to participate, Taiwan is still not included in the 29 countries participating in this year's RIMPAC military exercise. Analysts pointed out that the US-led RIMPAC military exercise is intended to unite allies to militarily intimidate China. If Taiwan is invited to join, it will be too provocative to China, which will not only aggravate the tension between the United States and China, but also embarrass some allies. The U.S. Navy said the commander of the U.S. Third Fleet will serve as the commander of the joint task force for the exercise, while Chilean Navy Commodore Alberto Guerrero will serve as deputy commander of the joint task force, which is a first in the history of the RIMPAC military exercise. In addition, Japan Maritime Self-Defense Force Rear Admiral Kazushi Yokota will also serve as deputy commander. Other key leaders of the multinational force exercise include Canadian Commodore Kristjan Monaghan, who will command the maritime forces, and Australian Air Force Commodore Louise Desjardins, who will command the air forces. According to the U.S. Stars and Stripes, Vice Admiral Michael Boyle is currently the commander of the U.S. Third Fleet. Vice Admiral John Wade has been nominated to replace Boyle. The U.S. Navy press release said the exercise will enhance the ability of international joint forces to "deter and defeat aggression by major powers in all domains and conflict levels," but did not provide specific information on which exercises will be held this summer. Previous RIMPAC training exercises have included sinking ships at sea with missiles, amphibious landings and the first landing of a Marine Corps Osprey aircraft on an Australian ship.

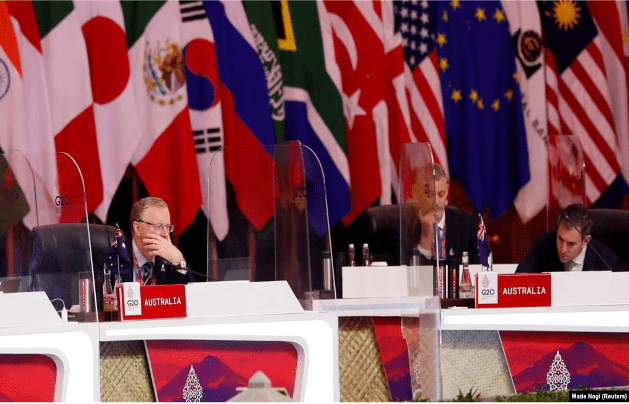

Australia pledges to provide more funds to Pacific island banks to counter China's influence

Australia pledged on Tuesday to increase investment in Pacific island nations, offering A$6.3 million ($4.3 million) to support their financial systems. Some Western banks are cutting ties with the region because of risk factors, while China is trying to increase its influence there. Some Western bankers have terminated long-standing banking relationships with small Pacific nations, while others are considering closing operations and restricting access to dollar-denominated bank accounts in those countries. "We know that the Pacific is the fastest-moving region in the world for correspondent banking services," Australian Treasurer Jim Chalmers said in a speech at the Pacific Banking Forum in Brisbane. "What's at stake here is the Pacific's ability to engage with the world," he said, with much of the region at risk of being cut off from the global financial system. Chalmers said Australia would provide A$6.3 million ($4.3 million) to the Pacific to develop secure digital identity infrastructure and strengthen compliance with anti-money laundering and counter-terrorist financing requirements. Experts say Western banks are de-risking to meet financial regulations, making it harder for them to do business in Pacific island nations, where compliance standards sometimes lag, undermining their financial resilience. Australia's ANZ Bank is in talks with governments about how to make its Pacific island businesses more profitable amid concerns about rising Chinese influence as financial services leave the West, Chief Executive Shayne Elliott said Tuesday. ANZ is the largest bank in the Pacific region, with operations in nine countries, though some of those businesses are not financially sustainable, Elliott said in an interview on the sidelines of the forum. "If we were there purely for commercial purposes, we would have closed it a long time ago," he said. Western countries, which have traditionally dominated the Pacific, are increasingly concerned about China's plans to expand its influence in the region after it signed several major defense, trade and financial agreements with the region. Bank of China signed an agreement with Nauru this year to explore opportunities in the country, following Australia's Bendigo Bank saying it would withdraw from the country. Mr. Chalmers said Australia was working with Nauru to ensure that banking services in the country could continue. ANZ Bank exited its retail business in Papua New Guinea in recent years, while Westpac considered selling its operations in Fiji and Papua New Guinea but decided to keep them. The Pacific lost about 80% of its correspondent banking relationships for dollar-denominated services between 2011 and 2022, Australian Assistant Treasurer Stephen Jones told the forum, which was co-hosted by Australia and the United States. “We would be very concerned if there were countries acting in the region whose primary objective was to advance their own national interests rather than the interests of Pacific island countries,” Mr. Jones said on the first day of the forum in Brisbane. He made the comment when asked about Chinese banks filling a vacuum in the Pacific. Meanwhile, Washington is stepping up efforts to support Pacific island countries in limiting Chinese influence. "We recognize the economic and strategic importance of the Pacific region, and we are committed to deepening engagement and cooperation with our allies and partners to enhance financial connectivity, investment and integration," said Brian Nelson, U.S. Treasury Undersecretary for Counterterrorism and Financial Intelligence. The United States is aware of the problem of Western banks de-risking in the Pacific region and is committed to addressing it, Nelson told the forum's participants. He said data showed that the number of correspondent banking relationships in the Pacific region has declined at twice the global average rate over the past decade, and the World Bank and the Asian Development Bank are developing plans to improve correspondent banking relationships. U.S. Treasury Secretary Janet Yellen said in a video address to the forum on Monday (July 8) that the United States is focused on supporting economic resilience in the Pacific region, including by strengthening access to correspondent banks. She said that when President Biden and Australian Prime Minister Anthony Albanese met at the White House last year, they particularly emphasized the importance of increasing economic connectivity, development and opportunities in the Pacific region, and a key to achieving that goal is to ensure that people and businesses in the region have access to the global financial system.

"Corrupt Politicians GPT" "Fiscal Bill GPT", Kenyan protesters use AI to "protest"

In the past few weeks of anti-government activities in Kenya, AI tools have been creatively used by protesters to serve protests. According to the US "Flag" News Agency on July 5, protests in Kenya triggered by the 2024 fiscal bill are still continuing. In the past few weeks, Kenyan protesters, mainly young people, have creatively developed a series of AI tools to assist anti-government activities. The Kenyan government expressed concern about the risks associated with the use of AI tools in protests. Kelvin Onkundi, a software engineer in Kenya, developed the "Fiscal Bill GPT", which operates similarly to ChatGPT and can receive questions about the fiscal bill and generate responses. Martin Siele, a reporter from the "Flag" News Agency, analyzed: "The 'Fiscal Bill GPT' can convert professional terms in many legislative fields into easy-to-understand information for protesters, helping Kenyans understand the potential impact of the fiscal bill." Another software engineer, Marion Kavengi, developed the "SHIF GPT" to provide Kenyans with information about the upcoming Social Health Insurance Fund (SHIF). In addition to AI tools designed to help people understand controversial policies, protesters have also developed "Corrupt Politicians GPT" to assist protest demonstrations. After entering the name of a politician on the platform, the platform will generate a list of corruption scandals about the politician in chronological order. Developer BenwithSon wrote on the social platform X on June 28: "'Corrupt Politicians GPT' allows people to search for any scandal related to any politician. I have seen some leaders stand at the forefront of the political arena, but they are corrupt behind the scenes." Kenyan Chief Minister and Foreign Minister Mudavadi issued a communiqué to ambassadors of various countries in Nairobi on July 2 local time on protests and relevant government measures, expressing concerns about the use of AI and false information in protests. Mudavadi said: "AI technology is used by people with ulterior motives, which will fill the global information system with false narratives." The Kenya Times reported on June 30 that AI technology enables people to force the government to increase transparency and strengthen accountability, and its role in Kenyan political activities is becoming increasingly prominent. Martin Siller believes that AI is reshaping African political behavior in many ways. AI is a new tool for both governments and opposition parties in Africa, but Kenya is one of the African countries with the most developers, and its young protesters are particularly good at using AI technology to fight the government. The 2024 fiscal bill voted and passed by the Kenyan National Assembly on June 25 clearly stated that additional taxes will be levied to repay the interest on high sovereign debt, triggering large-scale demonstrations. After President Ruto announced the withdrawal of the tax increase bill on the evening of the 26th, demonstrations in many parts of Kenya continued. According to Reuters on July 3, Kenyan anti-government protesters are re-adjusting their activities to prevent the protests from turning into violent incidents.