Chat means chat, and GPT is the acronym for Gene Rate Pre trained Transformer.

Genrative means generation, and its function is to create or produce something new; Pre trained refers to a model of artificial intelligence that is learned from a large amount of textual materials, while Transformer refers to a model of artificial intelligence.

Don't worry about T, just focus on the words G and P.

We mainly use its Generative function to generate various types of content; But we need to know why it can produce various types of content, and the reason lies in P.

Only by learning a large amount of content can we proceed with reproduction.

And this kind of learning actually has limitations, which is very natural. For example, if you have learned a lot of knowledge since childhood, can you guarantee that your answer to a question is completely correct?

Almost impossible, firstly due to the limitations of knowledge, ChatGPT is no exception, as it is impossible to master all knowledge; The second is the accuracy of knowledge, how to ensure that all knowledge is accurate and error free; The third aspect is the complexity of knowledge, where the same concept is manifested differently in different contexts, making it difficult for even humans to grasp it perfectly, let alone AI.

So when we use ChatGPT, we also need to monitor the accuracy of the output content of ChatGPT. It is likely not a problem, but if you want to use it on critical issues, you will need to manually review it again.

And now ChatGPT has actually been upgraded twice, one is GPT4 with more accurate answering ability, and the other is the recent GPT Turbo.

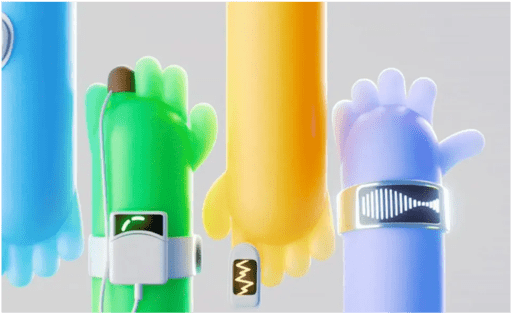

The current ChatGPT is a large model called multimodality, which differs from the first generation in that it can not only receive and output text, but also other types of input, such as images, documents, videos, etc. The output is also more diverse. In addition to text, it can also output images or files, and so on.