Will chatGPT lead to job losses?

In fact, ChatGPT can bring more opportunities to many industries, such as customer service, marketing, speech recognition, and more. ChatGPT can help businesses engage with customers more effectively, improve the customer experience, and give businesses more time and resources to focus on other tasks. Come to see

While ChatGPT can replace humans in certain situations, it is not a complete replacement for humans. In many cases, human-to-human communication is still the most effective way. Therefore, the emergence of ChatGPT will not lead to the unemployment of all people, but will cause structural changes in the labor force and the redistribution of occupations.

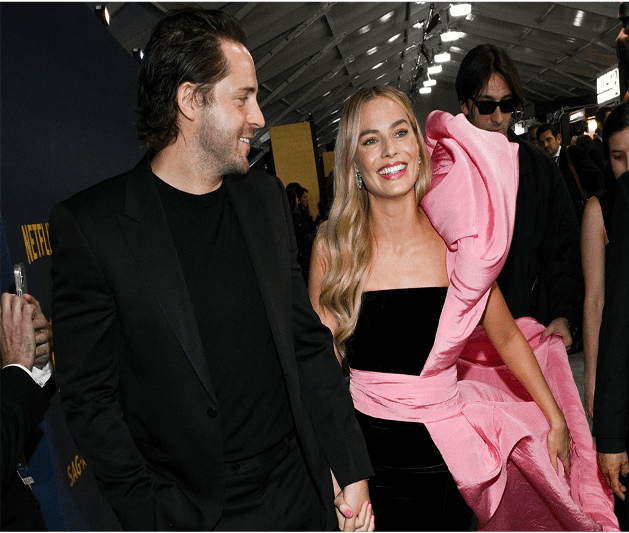

See Pregnant Margot Robbie Debut Her Baby Bump

This Barbie is going to be a mother. And Margot Robbie has no problem putting her burgeoning baby bump on full display. In fact, the Barbie star, who is pregnant with her Tom Ackerley’s first baby, debuted recently her bump while vacationing on Italy’s Lake Como with her husband July 7. For the outing, Margot donned a black blazer over a white tee that was cropped above her stomach, showing off a sweet baby bump. She finished off the look with low-rise black trousers, black platform sandals and a summery straw bag. For his part, Tom—whom Margot wed in a 2016 ceremony in her native Australia—wore olive green trousers and a cream-colored button-down shirt and tan sneakers. The couple were photographed waiting on a dock in Lake Como before they hopped in a boat and sailed off into a literal sunset. While Margot and Tom, both 34, haven’t spoken publicly about their upcoming bundle of joy, the I, Tonya alum has previously expressed hope to have a big family one day. As she told Porter in 2018, “If I'm looking into my future 30 years from now, I want to see a big Christmas dinner with tons of kids there.” Tom and Margot’s new chapter comes over ten years after their love story first began on the set of 2014's Suite Française, in which Margot starred while Tom worked as a third assistant director. But while she was immediately smitten, Margot was convinced her love would go unrequited. "I was always in love with him, but I thought, ‘Oh, he would never love me back,'" she admitted to Vogue in 2016. "'Don't make it weird, Margot. Don't be stupid and tell him that you like him.' And then it happened, and I was like, ‘Of course we're together. This makes so much sense, the way nothing has ever made sense before.'"

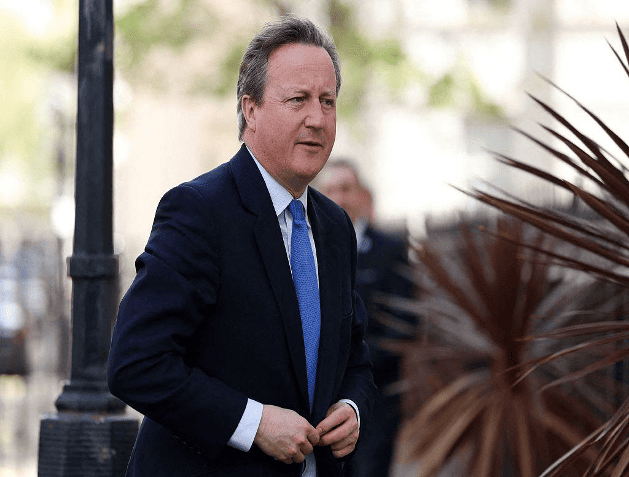

Former British PM Sunak appoints Conservative Party shadow cabinet

On July 8, local time, former British Prime Minister Sunak announced the appointment of the Conservative Party Shadow Cabinet, which is the first shadow cabinet of the Conservative Party in 14 years. Several former British cabinet members during Sunak's tenure as prime minister were appointed to the Conservative Party Shadow Cabinet, including James Cleverly as Shadow Home Secretary and Jeremy Hunt as Shadow Chancellor of the Exchequer. But former Foreign Secretary Cameron was not appointed as Shadow Foreign Secretary. In addition, the new leader of the Conservative Party will be elected as early as this week. On July 4, the UK held a parliamentary election. The counting results showed that the British Labour Party won more than half of the seats and won an overwhelming victory; the Conservative Party suffered a disastrous defeat, ending its 14-year continuous rule.

Microsoft to offer Apple devices to employees in China, cites absence of Android services

July 8 (Reuters) - Microsoft (MSFT.O), opens new tab intends to offer Apple's (AAPL.O), opens new tab iOS-based devices to its employees in China to access authentication apps, a company spokesperson said on Monday, citing absence of Google's (GOOGL.O), opens new tab Android services in the country. Microsoft has been under increased scrutiny after a series of security breaches, the latest being that of Russian hackers who spied and accessed emails of the company's employees and customers earlier this year. The development was first reported by Bloomberg News, which, citing an internal memo, said the Windows OS-maker instructed its employees in China to use Apple devices at workplace from September. As a part of Microsoft's global Secure Future Initiative, the move to switch to iOS-devices stems from the lack of availability of Google Play Store in China that limits its employees' access to security apps such as Microsoft Authenticator and Identity Pass, the report added. "Due to the lack of availability of Google Mobile Services in this region, we look to offer employees a means of accessing these required apps, such as an iOS device," a company spokesperson told Reuters in an email. Microsoft is among those U.S. companies that have a strong presence in China. It entered the Chinese market in 1992 and also operates a large research and development center in the country. The company will provide iPhone 15 models to employees, currently using Android handsets across China, including Hong Kong, the Bloomberg report said.

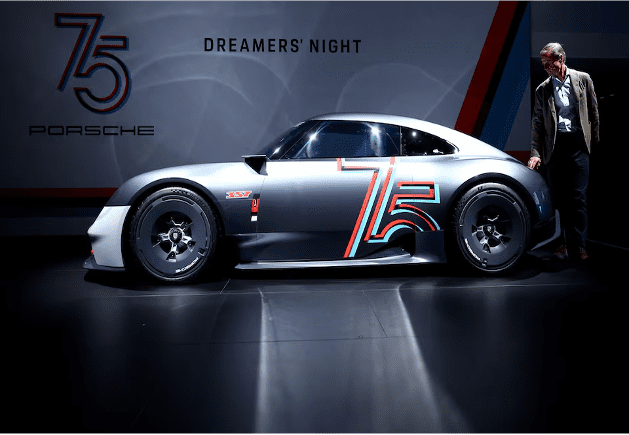

Porsche AG reports sharp fall in China deliveries

July 9 (Reuters) - German sportscar maker Porsche (P911_p.DE), opens new tab said on Tuesday that global vehicle deliveries were down 7% in the first half of the year compared to the same period in 2023, primarily driven by a 33% year-on-year drop in China. Porsche, majority-owned by Volkswagen (VOWG_p.DE), opens new tab, is highly exposed to the EU-China tariff tensions, with deliveries to China accounting for nearly 20% of global deliveries. An HSBC analyst pointed to weakness in the European car market, saying that "the market is, understandably, worried about China pricing weakness and the prospect of needing to pay dealer compensation." Overall, Porsche delivered 155,945 cars worldwide during the first six months of the year. In North America, deliveries were down 6% year-on-year. Meanwhile, in Porsche’s home market of Germany, deliveries increased by 22% to 20,811 vehicles.

Musk is the billionaire who lost the most money in the first half of 2024: $5 billion a month

At the beginning of this year, Elon Musk had a fortune of $251 billion and could almost single-handedly solve world hunger. However, Tesla's stagnant sales, the endless struggle to buy Twitter, and the volatility of Tesla's stock price meant he lost a lot of money this year. According to Forbes, Musk is the billionaire with the most losses so far this year, with his wealth shrinking at a rate of about $5 billion a month. According to the website, his wealth shrank by more than 10% from the end of 2023 to June 28, 2024. As the website explains: Between December 31, 2023, and June 28, the last day of regular stock market trading for the first half of the year, Musk's net worth fell from $251.3 billion to $221.4 billion, a bigger drop than any other billionaire tracked by Forbes, but Musk remains the richest person on the planet. The main reason for the dip in Musk's pocketbook is that a Delaware judge in January canceled Musk's then-record Tesla compensation package worth $51 billion, which led Forbes to cut the value of the equity award by 50 percent because of uncertainty about whether Musk would receive those stock options. Excluding that bonus, Musk's wealth has remained volatile over the past six months, with the value of his 13 percent stake in Tesla shrinking by about $20 billion as falling profits and car deliveries sent the stock down 20 percent. But that was partly offset by the growth of Musk's stake in his generative artificial intelligence startup xAI to $14.4 billion (Musk also has a roughly $75 billion stake in private aerospace company SpaceX, a $7 billion stake in social media company X, And smaller stakes in other companies, such as brain experimentation startup Neuralink).