Will chatGPT lead to job losses?

In fact, ChatGPT can bring more opportunities to many industries, such as customer service, marketing, speech recognition, and more. ChatGPT can help businesses engage with customers more effectively, improve the customer experience, and give businesses more time and resources to focus on other tasks. Come to see

While ChatGPT can replace humans in certain situations, it is not a complete replacement for humans. In many cases, human-to-human communication is still the most effective way. Therefore, the emergence of ChatGPT will not lead to the unemployment of all people, but will cause structural changes in the labor force and the redistribution of occupations.

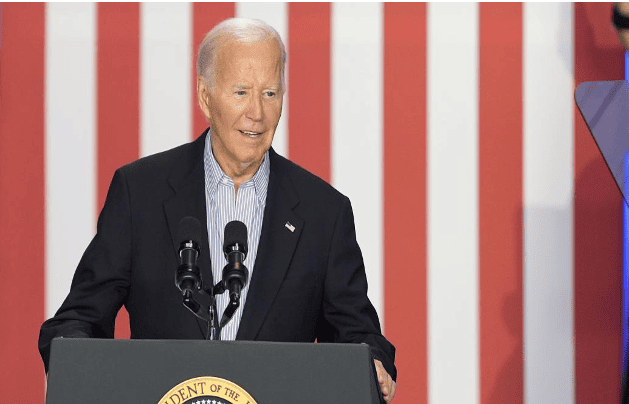

Doctors visited the White House 8 times? White House: Biden did not receive treatment for Parkinson's disease

White House spokeswoman Karina Jean-Pierre denied a report in the U.S. media on the 8th that President Joseph Biden did not receive treatment for Parkinson's disease. Biden had the first televised debate of the 2024 presidential election with Republican opponent Donald Trump on June 27, and his poor performance on the spot triggered discussions about his physical condition. The New York Times reported that a doctor specializing in the treatment of Parkinson's disease had "visited" the White House eight times from August last year to March this year. Facing the media's questions about Biden's health, Jean-Pierre asked and answered himself at a regular White House press conference on the 8th: "Has the president received treatment for Parkinson's disease? No. Is he currently receiving treatment for Parkinson's disease? No, he is not. Is he taking medication for Parkinson's disease? No." Jean-Pierre said Biden had seen a neurologist three times, all related to his annual physical examination. She also took out the report issued by the doctor after Biden's most recent physical examination in February this year. The report said, "An extremely detailed neurological examination was once again reassuring" because no symptoms consistent with stroke, multiple sclerosis or Parkinson's disease were found. The doctor who went to the White House mentioned by the New York Times is Kevin Kanal, a neurology and movement disorder expert at the Walter Reed National Military Medical Center in Maryland and an authority on Parkinson's disease. Jean-Pierre suggested that the doctor might have come to treat military personnel on duty at the White House.

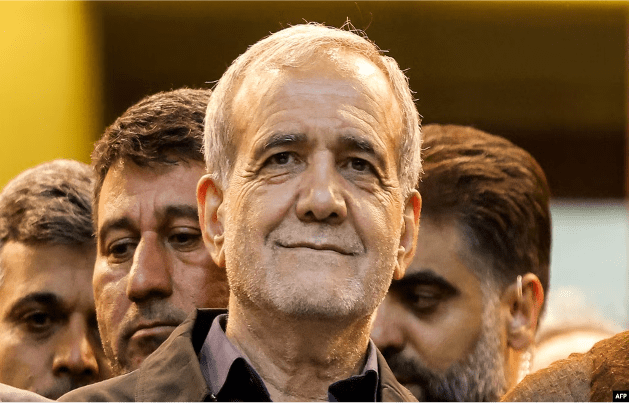

Iran's president-elect reaffirms policy toward Israel

Iran's President-elect Masoud Pezeshkian reiterated Iran's anti-Israel stance on Monday, saying resistance movements across the region will not allow Israel's "criminal policies" against Palestinians to continue. Pezeshkian told Hassan Nasrallah, the leader of Iran-backed Lebanese Hezbollah, that "the Islamic Republic will always support the people of the region in their resistance against the illegal Zionist regime." This suggests that the incoming government will not change its regional policy under the relatively moderate Pezeshkian, who defeated his hard-line opponent in a runoff election last week. Pezeshkian was quoted as saying by Iranian media, "I am sure that the regional resistance movement will not allow this regime to continue its militant and criminal policies against the oppressed people of Palestine and other countries in the region." The Shiite Muslim Hezbollah and the Palestinian Sunni Muslim Hamas are both part of the local "resistance axis" faction organization supported by Iran. Israel did not immediately comment on Pezeshkian's speech. Hamas led an attack on southern Israel on October 7. According to Israeli statistics, Hamas killed 1,200 people and kidnapped about 250 hostages, triggering the Israeli-Palestinian war. The Gaza Health Ministry said that the Israeli military attack killed more than 38,000 Palestinians and injured nearly 88,000 people.

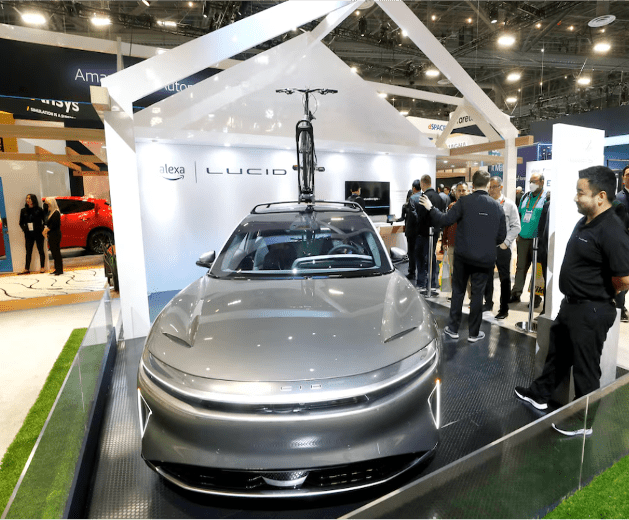

EV maker Lucid to recall over 5,200 Air luxury sedans for software error, US regulator says

July 9 (Reuters) - Lucid Group (LCID.O), opens new tab will recall about 5,251 of its 2022-2023 Air luxury sedans due to a software error that could cause a loss of power, according to a notice from the U.S. National Highway Traffic Safety Administration published on Tuesday. The regulator added the EV maker will also recall about 7,506 of its 2022-2024 Air luxury sedans due to an issue with a coolant heater that could fail to defrost the windshield. Lucid had released an over-the-air software update in June as a fix for the software error and a separate update to identify a high voltage coolant heater failure and provide a warning to the drivers of the affected vehicles. The company had reported second-quarter deliveries above market expectations on Monday, as price cuts helped boost demand for its luxury electric sedans.

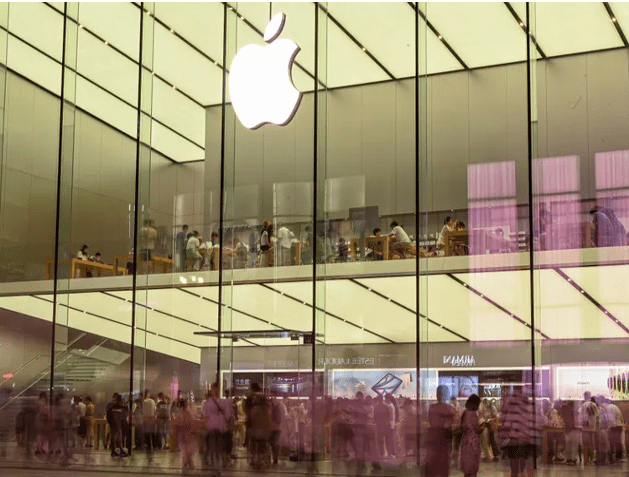

How the iPhone 16 With AI Could Send Apple's Market Value to $4T

Apple could be on track to reach a $4 trillion market capitalization with the artificial intelligence (AI) iPhone 16 upgrade cycle coming, Wedbush analysts said. The analysts said the iPhone 16 supercharged with AI could bring a "golden upgrade cycle" for Apple. Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. Apple (AAPL) could be on the path to a $4 trillion market capitalization as an iPhone upgrade cycle approaches, driven by the iPhone 16 supercharged with artificial intelligence (AI) capabilities, according to Wedbush analysts. 1 Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. AI iPhone 16 Upgrade Cycle Coming Soon Wedbush analyst said that an AI iPhone 16 could bring "a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally." "The Street is now starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution," they said, with 2.2 billion iOS devices globally and 1.5 billion iPhones. Wedbush suggested a "consumer AI tidal wave" could start with the iPhone 16 in mid-September, adding that estimates indicate 270 million iPhones users have not upgraded in over four years. Recovery in China To Support Upgrade Cycle The analysts indicated that iPhone supply stabilization in Asia is also "a very good sign heading into a monumental iPhone 16 upgrade cycle." Wedbush's projections come amid ongoing concerns for the iPhone maker in the China region amid increased competition, though there have been recent signs of improving shipments. They projected that June "will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter," when the iPhone 16 is expected to be released. AI and iOS 18 Could Also Boost Share Value Apple unveiled iOS 18 supercharged by Apple Intelligence and an AI partnership with OpenAI at its developers' conference in June. Wedbush analysts said the partnership with the Chat-GPT maker "creates the highway for developers around the globe to focus on iOS 18 and this in turn will create a myriad of monetization opportunities for Cook & Co. over the coming years." The analysts estimated that "this could result in incremental Services high margin growth annually of $10 billion for Apple" driven by hardware and software. They added they believe "AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share." Apple shares were little changed in early trading Monday, though they have gained more than 17% since the start of the year. Do you have a news tip for Investopedia reporters? Please email us at tips@investopedia.com SPONSORED Trade on the Go. Anywhere, Anytime One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

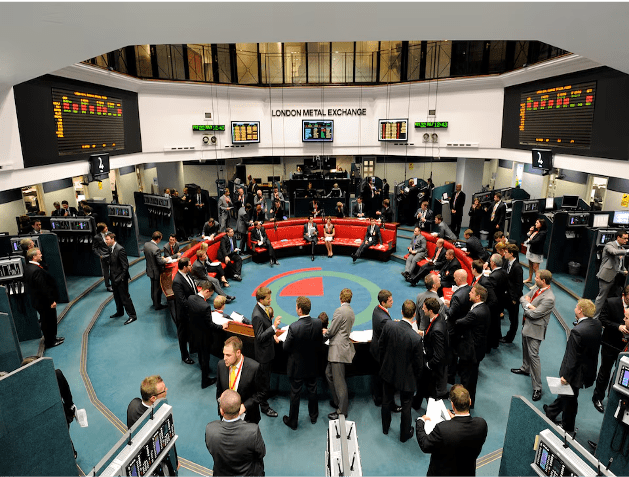

Hedge fund Elliott challenges court verdict it lost against LME on nickel

LONDON, July 9 (Reuters) - U.S.-based hedge fund Elliott Associates on Tuesday urged a London court to overturn a verdict supporting the London Metal Exchange's (LME) cancellation of nickel trades partly because the exchange failed to disclose documents. The LME annulled $12 billion in nickel trades in March 2022 when prices shot to records above $100,000 a metric ton in a few hours of chaotic trade. Elliott and market maker Jane Street Global Trading brought a case demanding a combined $472 million in compensation, alleging at a trial in June last year that the 146-year-old exchange had acted unlawfully. London's High Court ruled last November that the LME had the right to cancel the trades because of exceptional circumstances, and was not obligated to consult market players prior to its decision. Lawyers for Elliott told London's Court of Appeal that the LME belatedly released documents in May detailing its "Kill Switch" and "Trade Halt" internal procedures. It also newly disclosed an internal report that Elliott said detailed potential conflicts of interest at the exchange. "It was troubling that one gets disclosure out of the blue in the Court of Appeal for the first time," Elliott lawyer Monica Carss-Frisk told the court. Jane Street Global did not appeal the ruling. "If we had had them (documents) in the proceedings before the divisional court, we may well have sought permission to cross examine." LME lawyers said the new documents were not relevant. "The disclosed documents do not affect the reasoning of the divisional court or the merits of the arguments on appeal," the exchange said in documents prepared for the appeal hearing. "Elliott's appeal is largely a repetition of the arguments which were advanced, and rightly rejected." The LME said it had both the power and a duty to unwind the trades because a record $20 billion in margin calls could have led to at least seven clearing members defaulting, systemic risk and a potential "death spiral". Elliott said the ruling diluted protection provided by the Human Rights Act and also wrongly concluded the LME had the power to cancel the trades.