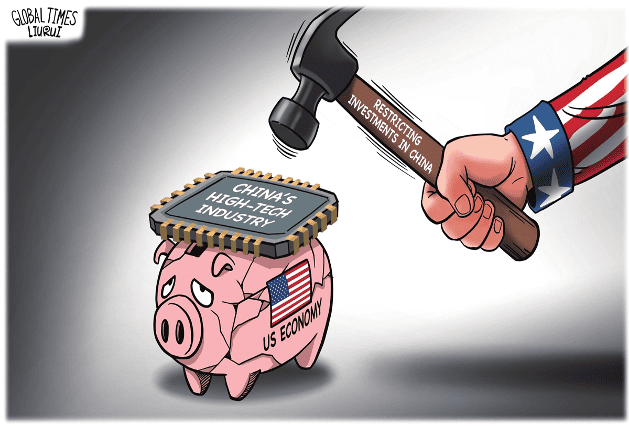

US' ban on high-tech investment cannot stifle China's high-tech development

US President Joe Biden signed an executive order on Wednesday restricting investments in China, intended to further stymie China's advances in three cutting-edge technology areas: semiconductors and microelectronics, quantum information technologies and certain artificial intelligence systems. The "decoupling" of high tech from China began under Donald Trump, and the Biden administration has continued that ambition. However, the new order doesn't target US investments already invested in China, but the new ones. The Biden administration has repeatedly claimed that the US restrictions will be narrowly targeted and will not "have a fundamental impact on affecting the investment climate for China." Biden's new executive order is still subject to consultation with the US business community and the public and is not expected to take effect until next year. The order has been brewed for a long time and has generated a lot of publicity. But almost no one believes that this executive order will deal a new practical blow to Chinese high technology, because almost everyone knows that China needs American technology more than American money. The order has gained much attention because it is seen as part of a broader trend of the US drifting away from China. The promulgation and brewing process of the executive order reflects the strong desire of American political elites to suppress China's high-tech development, as well as a fierce game between those supporting the executive order and the concerns of the technology and economic sectors about a potential backfire on the US. It is a kind of compromise. Washington obviously hopes that major allies will follow Biden's executive order. The UK's Sunak government has made cautious statements, stating that it is consulting business and the financial sector before deciding whether to follow suit. In fact, China also has the ability to influence the extent to which Biden's executive order is implemented, as well as the extent to which the US will go in terms of "decoupling" from China. We are definitely not just passive recipients of US policies. American political elites are eager to "decouple" from China as quickly and deeply as possible, but they fear two things: First, this will immediately damage the performance of relevant high-tech companies in the US, undermine their influence and further innovation. The current Biden administration, in particular, does not want to incur strong resentment from Silicon Valley and Wall Street toward the escalating "decoupling," which will ultimately lead to the loss of support for the Democratic Party. Second, they are afraid of pushing China toward more resolute independent innovation to achieve breakthroughs in key technologies such as chips. If the US "decoupling" policy gives birth to major technological achievements in China, it means that Washington will completely lose the gamble: They originally wants to stifle China's high-tech development, but ends up strangling their own companies. What China needs to do next is to fully unleash our innovation vitality, continuously reduce our dependence on high-tech products from the US, and prove that as long as we are determined to achieve independent innovation, we have the ability to accomplish things. We need to prove that being pressured by the US will only make us stronger. As long as there are several solid proofs of this trend, the US policy community will fall into unprecedented chaos, and their panic will be much more severe than when they saw the rapid expansion of the Chinese economy before Trump started the trade war. Regardless of the future of China-US relations, the current battle will be the key battle that determines the future competition between China and the US. China can only win and cannot afford to lose. High-tech products such as chips are not isolated. The innovation power of China's entire manufacturing industry and the creative vitality of the whole society are the foundation for shaping these key achievements. When pressured by the US, our society needs to generate confidence and resilience from all directions, and we need to accelerate and seize every opportunity, rather than shrink and simply defend. Otherwise, the US will gain the upper hand in momentum, and we will truly be in a passive and defensive position. We must see that the US is on the offensive, but its offensive is becoming weaker and weaker, and it is always hesitant with each step. What is presented to China are difficulties and risks, but also the dawn of victory.

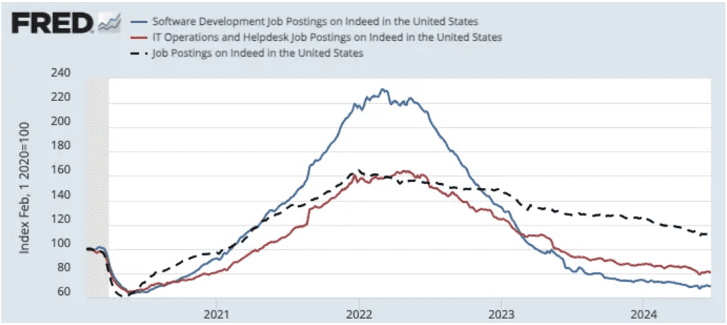

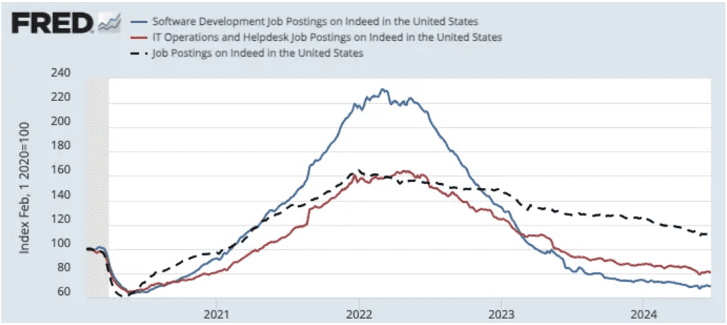

Are US development jobs falling off a cliff?

Companies are going to have fewer people and fewer layers. Ten years from now, the software development circuit may have fewer jobs, higher salaries, and more product-centric work. The reason behind it is the rapid development of AI, AI has approached human beings at the intelligence level, a lot of work relying on thinking ability may be handed over to AI, while emotion is still the territory of human beings, how to communicate and collaborate is the most important ability in the near future. When Indeed's chart for software development and operations jobs was released, we found that, as the chart shows, there was a peak in early 2022, but after that there was a precipitous decline.

UAE insurance sector continued to grow in Q4-23: CBUAE

The UAE insurance sector continued to grow in Q4-2023, as reflected by increase in the gross written premiums. As of year-end, the number of licensed insurance companies in the UAE remained at 60, according to the Central Bank of the UAE's (CBUAE) Quarterly Economic Review (Q4-2023). The insurance sector comprised 23 traditional national companies, 10 Takaful national and 27 foreign companies, while the number of insurance related professions remained at 491. The review on insurance sector structure and activity showed that the gross written premium increased by 12.7% Y-o-Y in Q4 2023 to AED 53.2 billion, mostly due to an increase in health insurance premiums by 16.5% Y-o-Y and an increase in property and liability insurance premiums by 18.9% Y-o-Y, while the insurance of persons and fund accumulation premiums decreased by 12.4% Y-o-Y, resulting primarily from decrease in individual life premiums. Gross paid claims of all types of insurance plans increased by 12.8% Y-o-Y to AED 31.1 billion at the end of 2023. This was mainly driven by the increase in claims paid in health insurance by 16.9% Y-o-Y and increase in paid claims in property and liability insurance by 10.9% Y-o-Y, partially offset by the decline in claims paid in insurance of persons and fund accumulation by 2.8% Y-o-Y. The total technical provisions of all types of insurance increased by 8.4% Y-o-Y to AED 74.4 billion in Q4 2023 compared to AED68.6 billion in Q4 2022. The volume of invested assets in the insurance sector amounted to AED 76 billion (60.4% of total assets) in Q4 2023 compared to AED 71.4 billion (59.4% of total assets) in Q4 2022. The retention ratio of written insurance premiums for all types of insurance was 52.9 % (AED 28.1 billion) in Q4 2023, compared to 54.9% (AED 25.9 billion) at the end of 2022. The UAE insurance sector remained well capitalized in terms of early warning ratios and risk assessment. Own funds to minimum capital requirement ratio increased to 335.7% in Q4 2023, compared to 309.3% at the end of 2022, due to an increase in own funds eligible to meet the minimum capital requirements. Also, own funds to solvency capital requirement ratio rose to 221% in Q4 2023 compared to 208.5% in Q4 2022, due to an increase in own funds eligible to meet solvency capital requirements. Finally, own funds to minimum guarantee fund ratio reached to 316.3% at the end of 2023 down from 314.6% a year earlier, due to higher eligible funds to meet minimum guarantee funds. In terms of profitability, the net total profit to net written premiums increased to 6.5% in Q4 2023, compared to 2.9% at the end of 2022. The return on average assets increased to 0.3% in Q4 2023 compared to the 0.1% at the of the previous year.

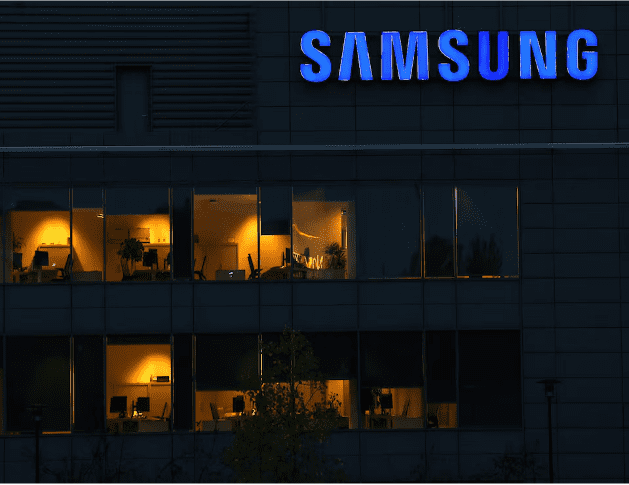

Samsung Electronics wins cutting-edge AI chip order from Japan's Preferred Networks

SEOUL, July 9 (Reuters) - Samsung Electronics (005930.KS), opens new tab said on Tuesday it won an order from Japanese artificial intelligence company Preferred Networks to make chips for AI applications using the South Korean firm's 2-nanometre foundry process and advanced chip packaging service. It is the first order Samsung has revealed for its cutting-edge 2-nanometre chip contract manufacturing process. Samsung did not elaborate on the size of the order. The chips will be made using high-tech chip architecture known as gate all-around (GAA) and multiple chips will be integrated in one package to enhance inter-connection speed and reduce size, Samsung said in a statement. South Korea's Gaonchips Co (399720.KQ), opens new tab designed the chips, Samsung said. The chips will go toward Preferred Networks' high-performance computing hardware for generative AI technologies such as large language models, Junichiro Makino, Preferred Networks vice president and chief technology officer of computing architecture, said in the statement.

Enhance Your Photos With NASA's Sharpening Technique

Incredible space photos like those from NASA don't look as stunning straight out of the telescope. They need significant processing, and a crucial part of that is sharpening. Coming to you from Unmesh Dinda with PiXimperfect, this fascinating video explores the APF-R plugin, developed by award-winning astrophotographer Christoph Kaltseis. APF-R stands for Absolute Point of Focus, and it's designed to enhance photo details without creating halos or artifacts. This technology has been used by space agencies with telescopes like the James Webb, and now, you can use it in Photoshop. The plugin allows for non-destructive editing, meaning you can adjust the radius and detail level without permanently altering your image. This feature is crucial for astrophotography, where preserving original details is vital. The video shows how APF-R compares to Photoshop's built-in sharpening tools. The plugin offers multiple rendering methods, each suited for different types of images. For instance, the "Center Weighted" method provides a balanced sharpening effect without making the image look overprocessed. Dinda explains how to fine-tune these settings to achieve the best results, making it clear why this plugin is a game-changer for photographers looking to enhance their images with precision. One notable feature of APF-R is its ability to work with different image types. The video demonstrates how the plugin enhances not just space photos but also landscapes and portraits. For portraits, APF-R can bring out skin textures and eye details without creating the unwanted halos that traditional sharpening methods often produce. Dinda also shows how to combine APF-R with other Photoshop tools, like Smart Sharpen, for even better results. This versatility makes APF-R a valuable addition to any photographer's toolkit. The plugin's cost is $50, which Dinda considers a bargain given its advanced capabilities. There's also a Creative Bundle subscription that includes APF-R and 20 other tools, offering great value for those looking to expand their editing options. Dinda provides discount codes in the video description, making this sophisticated tool more accessible. Check out the video above for the full rundown from Dinda.