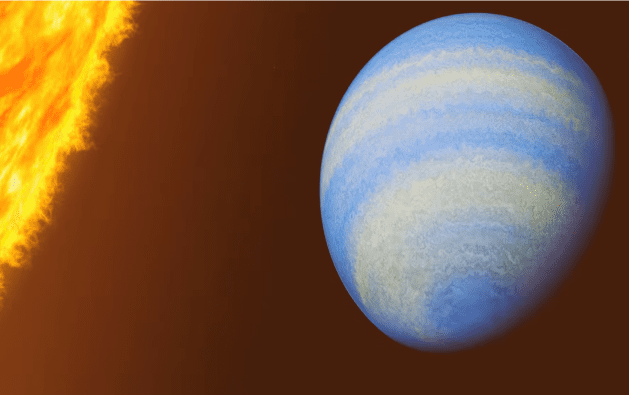

WASHINGTON, July 8 (Reuters) - The planet known as HD 189733b, discovered in 2005, already had a reputation as a rather extreme place, a scorching hot gas giant a bit larger than Jupiter that is a striking cobalt blue color and has molten glass rain that blows sideways in its fierce atmospheric winds. So how can you top that?

Add hydrogen sulfide, the chemical compound behind the stench of rotten eggs. Researchers said on Monday new data from the James Webb Space Telescope is giving a fuller picture of HD 189733b, already among the most thoroughly studied exoplanets, as planets beyond our solar system are called. A trace amount of hydrogen sulfide was detected in its atmosphere, a first for any exoplanet.

"Yes, the stinky smell would certainly add to its already infamous reputation. This is not a planet we humans want to visit, but a valuable target for furthering our understanding of planetary science," said astrophysicist Guangwei Fu of Johns Hopkins University in Baltimore, lead author of the study published in the journal Nature, opens new tab.

It is a type called a "hot Jupiter" - gas giants similar to the largest planet in our solar system, only much hotter owing to their close proximity to their host stars. This planet orbits 170 times closer to its host star than Jupiter does to the sun. It completes one orbit every two days as opposed to the 12 years Jupiter takes for one orbit of the sun.

In fact, its orbit is 13 times nearer to its host star than our innermost planet Mercury is to the sun, leaving the temperature on the side of the planet facing the star at about 1,700 degrees Fahrenheit (930 degrees Celsius).

"They are quite rare," Fu said of hot Jupiters. "About less than one in 100 star systems have them."

This planet is located 64 light-years from Earth, considered in our neighborhood within the Milky Way galaxy, in the constellation Vulpecula. A light-year is the distance light travels in a year, 5.9 trillion miles (9.5 trillion km).

"The close distance makes it bright and easy for detailed studies. For example, the hydrogen sulfide detection reported here would be much more challenging to make on other faraway planets," Fu said.

The star it orbits is smaller and cooler than the sun, and only about a third as luminous. That star is part of a binary system, meaning it is gravitationally bound to another star.

Webb, which became operational in 2022, observes a wider wavelength range than earlier space telescopes, allowing for more thorough examinations of exoplanet atmospheres.