Portadown businessman avoids jail for sexual assault of teen under his employment

Defence said the defendant 'continues to deny' the charges and bail in the sum of £1,000 was fixed for appeal

A Portadown man has avoided jail after sexually assaulting a 16-year-old shop worker under his employment. -ADVERTISEMENT- Brian Thomas Chapman (58), of Moyallan Road, appeared before Newry Magistrates’ Court on Monday for sentencing on two counts of sexual assault. The prosecution outlined that on September 23, 2020, a 16-year-old student in the employment of Brian Chapman, disclosed to her mother about incidents that had occurred in her workplace. She said Chapman had put his hand on her thigh and the back of her leg. She also disclosed that she had been getting extra money from him and he had been sending her text messages. The allegations were reported to police the next day, September 24. The victim then took part in an interview on October 9, in which she said, when she was alone in Chapman’s office, he placed his hand on her upper thigh and his other hand on her lower back, underneath her trousers. The defendant was arrested and interviewed at Lurgan police station, where he denied the allegations. His phone was seized and an examination was carried out. The first interview of the defendant took place on October 9, during which he admitted to sending a message about wanting the victim to work 24/7, but stated this was a joke. The second interview took place on January 28, 2021, where he admitted to sending the 24/7 message, but denied sending other messages, such as “hope you’re spending the pounds on something special”. Throughout this process, Chapman denied sending the messages and denied any of the sexual assaults alleged by the victim. On the Chapman’s criminal record, the prosecution added that he was convicted of three common assaults on appeal. In terms of commission, these matters pre-dated this case but the conviction occurred during the running of this case and also involved a female working for the defendant. Prosecution continued that the age of the victim was an aggravating feature, arguing there was a “vulnerability” due to the “power-imbalance” between Chapman and the young student working for him. An additional aggravating feature, they said, was that during the course of the defence, part of the defence was that the victim had “manipulated or manufactured” some of the text messages that were sent. A defence lawyer, speaking on the pre-sentence report, noted the author deemed Chapman to be of low risk. He also noted that similar offences were contested in the County Court in respect of another complaint, with the judge substituting indecent assault charges for common assault. He also argued a Sexual Offences Prevention Order (SOPO) was not necessary as the offending was four years ago, there has been no repetition and risk had been addressed. District Judge Eamonn King noted the defendant was convicted on two of four original charges following a contest, which ran over a number of days, with the case adjourned for a pre-sentence report and victim impact statement to be produced. He added the defendant “continues to deny” the charges and seeks to appeal the outcome. District Judge King, on reading the pre-sentence report, noted the defendant “denies ever hugging or touching the individual and he denies any sexual attraction to the victim”, but pointed to a paragraph in the report which stated, “From the available evidence, it’s possible to surmise that he demonstrated risk taking and impulsive behaviour. It appears that he took advantage of his position and power in a bid to meet his sexual needs, given the victim’s young age and the fact that he was her employer”. The report added that this demonstrated “limited victim empathy and responsibility due to his denial of the offences”. On the victim impact statement, District Judge King described her as a young girl getting her first job, with the “world as her oyster”. He continued: “As a result of what she says occurred, that turned on its head. It left her feeling inwardly uncomfortable, anxious and lonely. She cut herself off from her friends. She stopped going out. She didn’t want to go to school.” He also described a “degree of manipulation” in the case, as this was the victim’s first job and there was a power imbalance between her as an employee, and Chapman as the employer. In his sentencing remarks, District Judge King, said: “I’ve taken time to emphasise to the victim in this case that the victim did nothing wrong. The victim did everything right and the victim shouldn’t feel lonely, anxious or isolated. “The victim should feel confident, strong and outgoing.” Owing to the defendant’s ongoing denial of the charges, he added: “My sentencing exercise isn’t the conclusion of the case today, but I will sentence, so that we can move towards the conclusion going forward. “I am satisfied, irrespective of what the pre-sentence report says, that the defendant took advantage of someone, attempted to groom someone and was guilty of the two offences.” On the two counts, Chapman was sentenced to three months in prison, suspended for two years. He was also made subject to a Sexual Offences Prevention Order (SOPO) for five years and placed on the sex offenders’ register for seven years. Following sentencing, District Judge King fixed bail for appeal at £1,000.

South Korean government decides not to punish interns who resign

South Korea's Minister of Health and Welfare Cho Kyu-hong said at a press conference on the 8th local time that after comprehensively considering the suggestions of frontline interns and the situation on the front line of medical care, the government decided that from that day on, all interns and residents who resigned would not be given administrative sanctions such as revoking their medical licenses. Cho Kyu-hong also said that for interns and residents who have returned to work and those who have resigned and are preparing to re-register for internship courses in September, the government will make special cases to try to minimize the internship gap and not affect the relevant doctors from obtaining specialist medical licenses. Cho Kyu-hong said that the government believes that in order to minimize the diagnosis and treatment gaps for critically ill and emergency patients and ensure the smooth training process of interns and residents, it is in the public interest, so it has made a decision not to punish interns and residents who resigned. It is hoped that major hospitals will complete the resignation processing of doctors who have not returned to work before July 15 and determine the scale of vacancies. Previously, large general hospitals in South Korea, such as Seoul National University Hospital, Yonsei University Severance Hospital, and Seoul Asan Medical Center, suspended or limited their medical services in an effort to cancel all penalties against interns and residents.

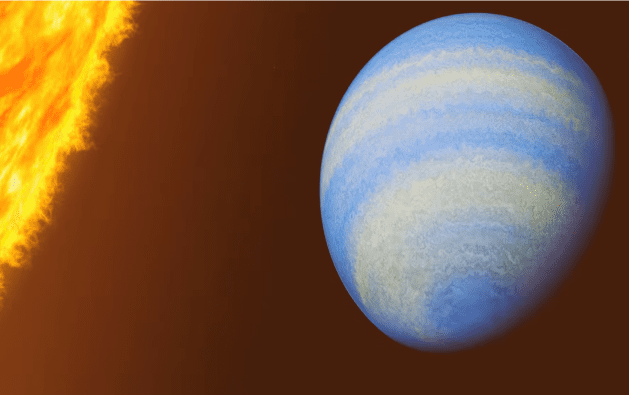

Rotten eggs chemical detected on Jupiter-like alien planet

WASHINGTON, July 8 (Reuters) - The planet known as HD 189733b, discovered in 2005, already had a reputation as a rather extreme place, a scorching hot gas giant a bit larger than Jupiter that is a striking cobalt blue color and has molten glass rain that blows sideways in its fierce atmospheric winds. So how can you top that? Add hydrogen sulfide, the chemical compound behind the stench of rotten eggs. Researchers said on Monday new data from the James Webb Space Telescope is giving a fuller picture of HD 189733b, already among the most thoroughly studied exoplanets, as planets beyond our solar system are called. A trace amount of hydrogen sulfide was detected in its atmosphere, a first for any exoplanet. "Yes, the stinky smell would certainly add to its already infamous reputation. This is not a planet we humans want to visit, but a valuable target for furthering our understanding of planetary science," said astrophysicist Guangwei Fu of Johns Hopkins University in Baltimore, lead author of the study published in the journal Nature, opens new tab. It is a type called a "hot Jupiter" - gas giants similar to the largest planet in our solar system, only much hotter owing to their close proximity to their host stars. This planet orbits 170 times closer to its host star than Jupiter does to the sun. It completes one orbit every two days as opposed to the 12 years Jupiter takes for one orbit of the sun. In fact, its orbit is 13 times nearer to its host star than our innermost planet Mercury is to the sun, leaving the temperature on the side of the planet facing the star at about 1,700 degrees Fahrenheit (930 degrees Celsius). "They are quite rare," Fu said of hot Jupiters. "About less than one in 100 star systems have them." This planet is located 64 light-years from Earth, considered in our neighborhood within the Milky Way galaxy, in the constellation Vulpecula. A light-year is the distance light travels in a year, 5.9 trillion miles (9.5 trillion km). "The close distance makes it bright and easy for detailed studies. For example, the hydrogen sulfide detection reported here would be much more challenging to make on other faraway planets," Fu said. The star it orbits is smaller and cooler than the sun, and only about a third as luminous. That star is part of a binary system, meaning it is gravitationally bound to another star. Webb, which became operational in 2022, observes a wider wavelength range than earlier space telescopes, allowing for more thorough examinations of exoplanet atmospheres.

Apple's low-end Apple Watch uses a plastic case

Apple is giving the Apple Watch a major update for its 10th anniversary. The watch's display will be larger, and the entire device will be thinner and lighter. Both the Apple Watch Series 10 and the new Apple Watch Ultra 3 will be equipped with new chips, which may be paving the way for future Apple AI capabilities. According to sources, the Apple Watch health detection function has encountered some technical obstacles in the upgrade process, the blood pressure measurement function or can only realistically display fluctuations and cannot display values, and the sleep apnea detection and other functions can not appear on the new product. The shell material of Apple Watch SE series products may be replaced by hard plastic from aluminum shell. The plastic-clad Apple Watch may be sold at a lower price to compete with Samsung's cheapest Watch, the Galaxy Watch FE. In addition, Siri's new features may be delayed, and AirPods with cameras may arrive in 2026.

Will chatGPT lead to job losses?

In fact, ChatGPT can bring more opportunities to many industries, such as customer service, marketing, speech recognition, and more. ChatGPT can help businesses engage with customers more effectively, improve the customer experience, and give businesses more time and resources to focus on other tasks. Come to see While ChatGPT can replace humans in certain situations, it is not a complete replacement for humans. In many cases, human-to-human communication is still the most effective way. Therefore, the emergence of ChatGPT will not lead to the unemployment of all people, but will cause structural changes in the labor force and the redistribution of occupations.