JOHANNESBURG, July 9 (Reuters) - The South African rand was little changed in early trade on Tuesday, as markets awaited the Federal Reserve chair's testimony in Washington and U.S. June inflation data for clues on the country's future interest rate path.

At 0644 GMT, the rand traded at 18.1300 against the dollar , near its previous close of 18.1175.

"The rand has opened marginally softer at 18.13 this morning, and we expect trading to remain range-bound in the short term," said Andre Cilliers, currency strategist at TreasuryONE.

Markets will listen to the tone of Fed Chair Jerome Powell's testimony in Washington on Tuesday and Wednesday and look to June inflation data out of the U.S. later this week for hints on the future interest rate path in the world's biggest economy.

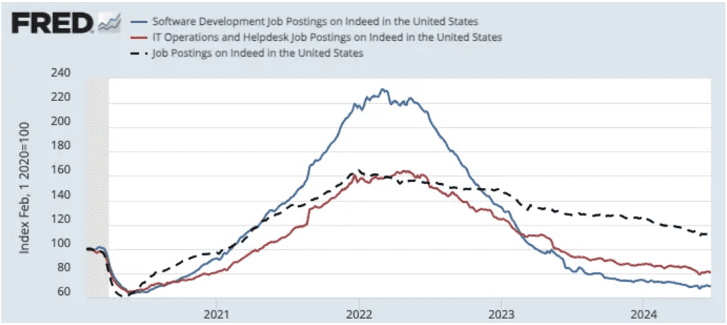

"Analysts will be gauging the Fed's response to the recent softer U.S. economic and labour data, with markets already starting to price in two rate cuts this year," Cilliers added.

The risk-sensitive rand often takes cues from global drivers like U.S. economic policy in the absence of major local factors.

South Africa's benchmark 2030 government bond was slightly stronger in early deals, with the yield down 1 basis point at 9.74%.