NASA plays 'blame-shifting' game with China as lunar soil research set to start

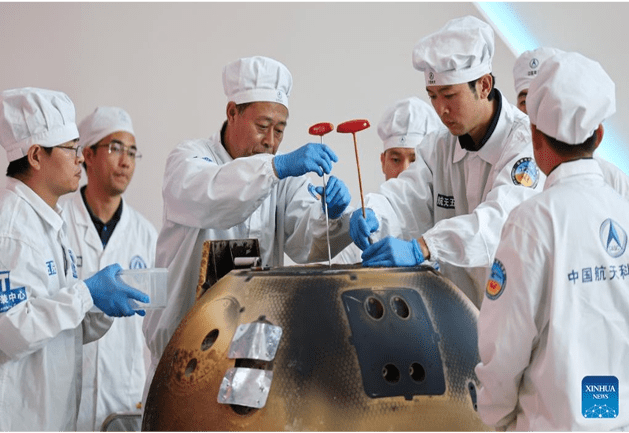

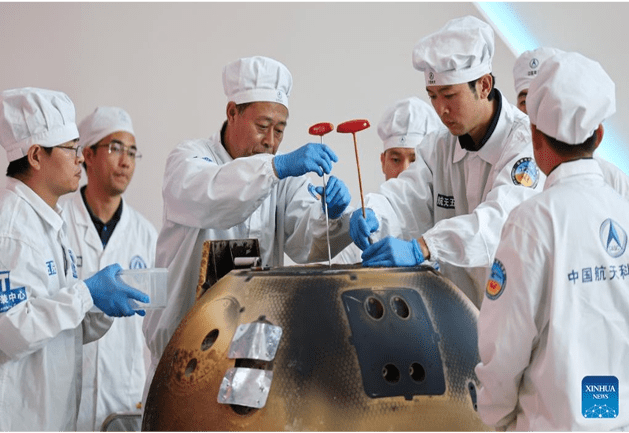

The returner of the Chang'e-6 lunar probe is opened during a ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation in Beijing, capital of China, June 26, 2024. The returner of the Chang'e-6 lunar probe was opened at a ceremony in Beijing on Wednesday afternoon. During the ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation, researchers opened the returner and examined key technical indicators. Photo: Xinhua As the US space industry recently faced yet more delays and stagnation with key components including manned spacecraft and space suits "going wrong," NASA has once again resorted to its "sour grapes" rhetoric upon seeing China's successful retrieval of fresh lunar soils from the far side of the moon, by claiming that China did not directly invite its scientists to participate in the lunar soil research. This behavior is a typical blame-shifting trick, Chinese experts said, noting it is clear to all that it is the US' own laws, not China, that are restricting space cooperation between the two sides. Instead of deceiving themselves by distorting the truth, the US should face up to its own problem of overall weakening engineering capability and the lack of long-term planning in its space industry. After the Chang'e-6 samples, weighing nearly 2 kilograms, were safely transported to a special laboratory for further study on Friday, NASA spokesperson Faith McKie told media that while China worked with the European Space Agency, France, Italy and Pakistan on this mission, "NASA wasn't invited to take part in the moon probe." NASA also didn't get "any direct invitation" to study China's moon rocks, after it welcomed all scientists from around the world to apply to study them, McKie told NatSec Daily. Responding to the remarks, Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on Monday that China is open to having space exchanges with the US, and we also welcome countries around the world to take part in the study of lunar samples. "However, the US side seems to have forgotten to mention its domestic legislation such as the Wolf Amendment. The real question is whether US scientists and institutions are allowed by their own government to participate in cooperation with China," Mao said. "The existence of the Wolf Amendment has basically shut the door to space collaboration between the two countries," Wang Yanan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times on Monday. Even if research institutions of the US have the willingness to work with China on opportunities such as lunar sample research, institutions there must obtain special approval from the US Congress due to the presence of this amendment, Wang explained. Currently, no such "green light" is in sight from the Congress. Furthermore, China's collaboration with international partners is based on equality and mutual benefit, leveraging their respective scientific resources, facilities, and expertise. However, the US only wants what it doesn't have, and its engagement with China would be advantageous only to itself, Wang noted. NASA has found itself embroiled in a number of thorny issues recently, with the latest being Boeing's Starliner manned spaceship experiencing both helium leaks and thruster issues during a June 6 docking with the International Space Station (ISS), which led to an indefinite delay for its crew's return to Earth, despite NASA's insistence that they are not "stranded" in space. The return of the Starliner capsule, while has already been delayed by two weeks, will be put on hold "well into the summer" pending results of new thruster tests, which are scheduled to start Tuesday and will take approximately two weeks or even more, per NASA officials. Previously on June 24, NASA cancelled a spacewalk on the ISS following a "serious situation," when one of the spacesuits experienced coolant leak in the hatch. While being broadcast on a livestream, the astronauts reported "literally water everywhere" as they were preparing for the extravehicular activity, space.com reported. The report said that this is the second time this particular spacewalk was postponed, after a June 13 attempt with a different astronaut group was pushed back due to a "spacesuit discomfort." The recurring issues with the spacesuits are due to their much-extended service lifespan, media reported, as the puffy white ones US astronauts currently wear were designed more than 40 years ago. Despite the pressing need to replace them, NASA announced recently that it is abandoning a plan to develop next-generation spacesuits, which had been committed to be delivered by 2026, CNN reported on Thursday. One of the root causes for such problems is that the US has developed many large technology conglomerates, which for a long time have benefited significantly from government orders and industry monopolies. Consequently, in many complex engineering fields, the level of attention given is greatly insufficient, Wang noted. It also reflected the US' lack of long-term strategic planning for its manned space program. For instance, the ageing spacesuits should have been replaced a decade ago to ensure that operational suits remain in usable condition. Failure to address this issue results in a hindrance to the space station's necessary maintenance tasks and even poses life-threatening risks to astronauts in emergency situations, experts said. The issues with Boeing's spacecraft and the spacesuits are not isolated problems, but reflected a systemic issue in the US space industry - the overall weakening of engineering capabilities, they noted.

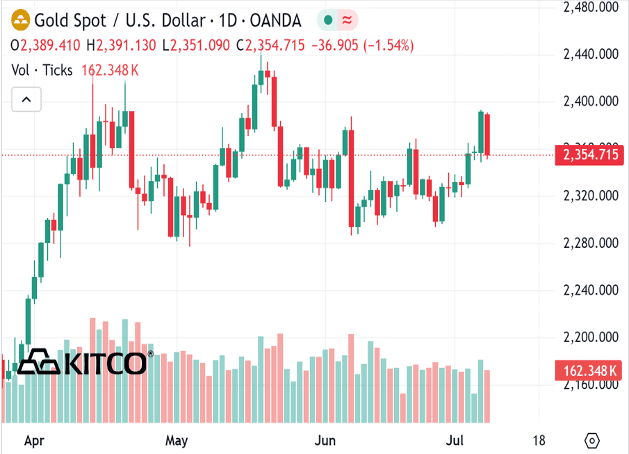

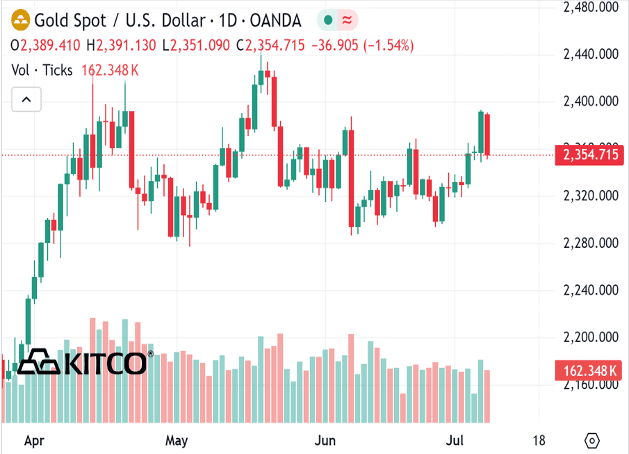

Gold, silver caught in downdraft of broad commodity market sell off

(Kitco News) - Gold and silver prices are sharply lower in midday U.S. trading Monday, on heavy profit-taking from the shorter-term futures traders after recent good price advances. The selling pressure today across most of the raw commodity spectrum is also keeping the precious metals bulls on the sidelines to start the trading week. August gold was last down $37.50 at $2,360.10. September silver was down $0.849 at $30.85. U.S. stock indexes mixed but near their record highs scored last week. The rallying stock market is a bearish element for the gold and silver markets, from a competing asset class perspective. The key U.S. data points of the week include Fed Chairman Powell’s speeches to the U.S. Congress on Tuesday and Wednesday, and the consumer and producer price indexes on Thursday and Friday, respectively. The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are lower and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.288%. Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at $2,382.60 and then at $2,400070. First support is seen at $2,350.00 and then at last week’s low of $2,327.40. Wyckoff's Market Rating: 6.0. September silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at the June low of $28.90. First resistance is seen at $31.00 and then at $31.50. Next support is seen at Friday’s low of $30.45 and then at $30.00. Wyckoff's Market Rating: 6.5. (Hey! My “Markets Front Burner” weekly email report is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to my Front Burner list.)

Argentina's government reform bill officially takes effect: granting the president special powers in areas such as administration

On the 8th, the Argentine government promulgated the "Foundations and Starting Points for Argentine Freedom" comprehensive bill and a package of fiscal measures, marking the official entry into force of the government reform bill. According to the official gazette of the Argentine government, Argentine President Milley, Chief Cabinet Minister Guillermo Francos and Economy Minister Luis Caputo jointly signed Decrees No. 592 and No. 593 to promulgate these two new reform measures. The comprehensive bill declared Argentina to enter a one-year public emergency in the administrative, economic, financial and energy fields, and granted the president special powers in these fields. It also includes the relaxation of economic regulations, labor reforms and the implementation of a large-scale investment incentive system. The package of fiscal measures involves anti-money laundering, tax deferral, tariffs, re-imposition of high-salary income tax and reduction of personal property taxes. On June 28, after six months of negotiations, the two reform bills were finally passed by the Argentine Congress.

SpaceX astronaut returns with an incredible change in his body

A provocative new study reveals the complex effects of the space environment on human health, providing insight into potential damage to blood, cell structure and the immune system. The study focused on SpaceX's Inspiration4 mission, which successfully sent two men and two women into space in 2021 to orbit the Earth for three days and shed some light on the effects of space travel on the human body. The research data, derived directly from the Inspiration4 mission, shows that even a brief trip to space can significantly damage the human immune system, trigger an inflammatory response, and profoundly affect cell structure. In particular, space travel triggered unprecedented changes in cytokines that play a key role in immune response and muscle regulation but are not usually directly associated with inflammation. In particular, the study found a significant increase in muscle factors, which are physiological responses specific to skeletal muscle cells in microgravity, rather than a simple immune response. Although non-muscular tissues did not show changes in proteins associated with inflammation, specific leg muscles such as soleus and tibialis anterior muscles showed significant signs of metabolic activity, especially increased interleukin in the latter, further enhancing the activation of immune cells.

When Amazon also started upgrading "refund only"

Amazon official said that the freight from the Chinese warehouse will be lower than the traditional FBA(Fulfillment by Amazon) fee, similar to the domestic air delivery small package service, which will undoubtedly greatly reduce the logistics costs of sellers. In addition to logistics, Amazon is also responsible for promotion and traffic, of course, sellers can still independently carry out product advertising, pricing and promotion activities, to maintain the personalized and independent brand. Many industry insiders said that Amazon launched the "low-price store" move to fight China's cross-border e-commerce platforms Temu, Shein, AliExpress and so on. Although it provides another platform for China's e-commerce to go to sea, many sellers said that the cost of settling in Amazon cross-border e-commerce has become lower, and they have asked about the conditions of settling in, but the rules look down, in fact, it is not so friendly for sellers.