Japan and the Philippines signed the "Reciprocal Access Agreement". Experts: Japan wants to use the Philippines to strategically contain China

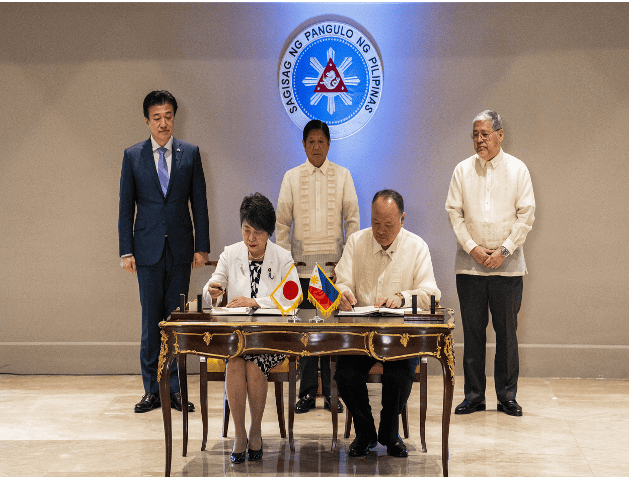

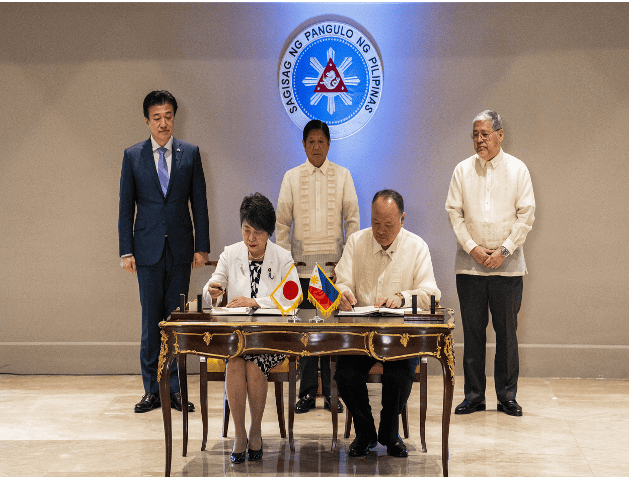

Japan and the Philippines signed an important defense agreement, and the two sides became "quasi-allies". On July 8, local time, Japan and the Philippines signed the "Reciprocal Access Agreement" in Manila. The agreement will relax restrictions on the movement of personnel between the Japanese Self-Defense Forces and the Philippine military during joint exercises, mutual visits and other operations in each other's countries. In response, Chinese Foreign Ministry spokesman Lin Jian responded at a regular press conference on the 8th that exchanges and cooperation between countries should not undermine mutual understanding and trust between regional countries, should not undermine regional peace and stability, and should not target third parties or undermine the interests of third parties. The Asia-Pacific region does not need military groups, let alone "small circles" that provoke camp confrontation and instigate a "new Cold War". Any actions that undermine peace and stability in the region and undermine unity and cooperation in the region will arouse the vigilance and common opposition of the people in the region. Japan and the Philippines upgraded to a "quasi-alliance" relationship On the same day, a "2+2" meeting attended by the foreign ministers and defense ministers of Japan and the Philippines was held in Manila. Japanese Defense Minister Minoru Kihara and Foreign Minister Yoko Kamikawa attended the talks with Philippine Defense Minister Gilbert Teodoro and Foreign Minister Enrique Manalo. This is the second Japan-Philippines "2+2" meeting. The last one was held in Tokyo in April 2022. Witnessed by Philippine President Marcos, the two sides signed the "Reciprocal Access Agreement". Marcos expressed the hope that the bilateral relations between the Philippines and Japan and the trilateral cooperation between the Philippines, Japan and the United States will be further deepened. The "Reciprocal Access Agreement" is also known as the "Military Visits Agreement". Military and defense cooperation between sovereign states, especially sending troops into each other's territory, usually faces complicated procedures and other problems. In order to simplify the procedures, the two countries will reach relevant agreements to simplify the approval procedures for the entry of troops from both sides into each other's countries, and facilitate mutual visits and joint military activities between the two countries' troops. The "Reciprocal Access Agreement" was born. Take the "Reciprocal Access Agreement" signed by Japan and Australia (full name "Agreement between Japan and Australia on Promoting Mutual Access and Cooperation Facilitation between the Japanese Self-Defense Forces and the Australian Defense Force") as an example. The agreement has 29 articles, covering many areas such as entry and exit procedures for troops, jurisdiction, taxation, cost burden and compensation. The key is to simplify the entry and exit procedures for visiting troops and their members, ships, aircraft, etc., relax restrictions on the transportation of weapons, ammunition and materials carried by visiting troops, and provide a legal basis for the two countries' troops and weapons and equipment to enter each other's territory. Japan and the Philippines signed the "Reciprocal Access Agreement", making the Philippines the third country to conclude this agreement with Japan after Australia and the United Kingdom. Cai Liang, Secretary-General and Researcher of the China-Japan Relations Research Center of the Shanghai Institute for International Studies, analyzed to The Paper (www.thepaper.cn) that Japan and the Philippines have their own strategic considerations for signing the "Reciprocal Access Agreement". As for the Philippines, due to its limited strength, it does not exclude any foreign power willing to strengthen military cooperation with the Philippines from intervening in the South China Sea situation. Therefore, it can be seen that in the past two years, the Philippines has actively promoted Australia, France, India and other countries to intervene in the South China Sea and strengthen military cooperation with them, involving intelligence, weapons and equipment, and training and exercises. "Japan's purpose is very simple. Strengthening military cooperation with the Philippines is to strategically balance China. The United States and the Philippines are allies, and the US-Japan alliance has been upgraded to a 'quasi-alliance'. The military cooperation between the United States, Japan and the Philippines has been upgraded to a new level." Cai Liang said, "The signing of an important defense agreement between Japan and the Philippines will make it easier for Japan to intervene in the South China Sea situation and seek the 'three seas linkage' of the East China Sea, the South China Sea, and the Taiwan Strait, in order to better respond to China's strategy and enhance its international influence." As for whether the signing of the "Reciprocal Access Agreement" means that Japan will deploy the Self-Defense Forces in the Philippines, Cai Liang pointed out that this agreement only simplifies the procedures for the troops of both sides to enter each other's territory, and is more suitable for short-term training, military exercises, etc., and is not a long-term deployment of the Self-Defense Forces in the Philippines. The two countries deepen military cooperation The Philippine presidential office also said in a statement that Japan is one of the four major strategic partners of the Philippines, and the two countries have established a strategic partnership for more than ten years. It seems no coincidence that Japan and the Philippines signed the "Reciprocal Access Agreement" at this time. Recently, China-Philippines relations have become tense around the situation in the South China Sea. The Global Times quoted Japan's Kyodo News Agency as saying that the two sides are seeking to strengthen cooperation against China. Minoru Kihara said last week: "The Philippines is located in a strategically important region, occupies a key position on Japan's sea lanes, and is also an ally of the United States. Joint training and strengthening cooperation with the Philippines are of great significance to the realization of a 'free and open Indo-Pacific region'." Cai Liang said that Japan's intervention in the South China Sea situation is mainly to reduce strategic pressure in the East China Sea and southwest of Japan, but it is not conducive to peace and stability in the South China Sea. It is reported that Japan and the Philippines began negotiations on the agreement in November last year. The signing of the "Reciprocal Access Agreement" by the two sides lays the foundation for the two countries to strengthen bilateral and even multilateral military cooperation in the future. The Japanese government intends to allow the Self-Defense Forces to formally participate in the annual US-Philippines "Shoulder to Shoulder" joint exercises around the Philippines after the agreement comes into effect. The Self-Defense Forces previously participated in the "Shoulder to Shoulder" exercises as observers, and will be able to formally participate after signing the agreement. In April this year, the United States and the Philippines held the largest "Shoulder to Shoulder" exercise to date, involving 5,000 Philippine personnel and 11,000 US personnel. The military exercise also included about 150 Australian military personnel and 100 French naval personnel. According to the plan, 14 countries including Japan and India sent personnel as observers. The "Typhon" medium-range missile launch system deployed by the US military on Luzon Island in the Philippines for the first time participated in the exercise, which aroused great attention from all walks of life. In terms of weapons and equipment exports, Japan and the Philippines have gradually strengthened military cooperation in recent years. The Philippines recently agreed to purchase five Coast Guard patrol ships from Japan to enhance its patrol capabilities in the South China Sea. Defense News reported in November last year that the Philippines had received an early warning radar system from Japan in 2023, the first major equipment transfer since the Japanese government lifted the postwar defense export ban in 2014. The Japanese Ministry of Foreign Affairs stated that Kamikawa mentioned topics such as defense equipment transfer, "government security capability enhancement support" (OSA), and economic and trade cooperation. The OSA project was created by the Kishida government and plans to allocate billions of yen in budget to assist the military construction of the Philippines and other countries, including providing the Philippines with 5 sets of coastal surveillance radars. Regarding Japan's relaxation of restrictions on defense equipment exports, the Chinese Ministry of Defense previously responded that Japan has continuously broken through the constraints of the "peace constitution" and the principle of "exclusive defense", and has been making small moves in the field of military security, which has aroused high vigilance and strong concern from the international community. China requires Japan to deeply reflect on its history of aggression, attach importance to the security concerns of its Asian neighbors, adhere to the path of peaceful development, and win the trust of its Asian neighbors and the international community with practical actions.

When Amazon also started upgrading "refund only"

Amazon official said that the freight from the Chinese warehouse will be lower than the traditional FBA(Fulfillment by Amazon) fee, similar to the domestic air delivery small package service, which will undoubtedly greatly reduce the logistics costs of sellers. In addition to logistics, Amazon is also responsible for promotion and traffic, of course, sellers can still independently carry out product advertising, pricing and promotion activities, to maintain the personalized and independent brand. Many industry insiders said that Amazon launched the "low-price store" move to fight China's cross-border e-commerce platforms Temu, Shein, AliExpress and so on. Although it provides another platform for China's e-commerce to go to sea, many sellers said that the cost of settling in Amazon cross-border e-commerce has become lower, and they have asked about the conditions of settling in, but the rules look down, in fact, it is not so friendly for sellers.

The Apple Watch is reportedly getting a birthday makeover

Apple is planning to revamp its smartwatch as its 10th birthday nears. The improvements include larger displays and thinner builds, Bloomberg reported. The revamped watches may also get a new chip, which could enable some AI enhancements. The Apple Watch is about to turn 10, so Apple is planning a birthday revamp, including larger displays and thinner builds, Bloomberg reported. Both versions of the new Series 10 watches will have screens similar to the large displays found on the Apple Watch Ultra, the report said. The revamped watches are also expected to contain a new chip that may permit some AI enhancements later on. Last month, Apple pulled back the curtain on its generative-AI plans with Apple Intelligence. Advertisement It hopes the artificial-intelligence features will prove alluring enough to persuade consumers to buy new Apple products. The announcement has been generally well received by Wall Street. Dan Ives of Wedbush Securities wrote in a Monday note that the "iPhone 16 AI-driven upgrade could represent a golden upgrade cycle for Cupertino." "We believe AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share," he added. Apple's stock closed on Friday at just over $226 a share, up 22% this year and valuing the company at $3.47 trillion. That puts it just behind Microsoft, which was worth $3.48 trillion at Friday's close. The tech giants have been vying for the title of the world's most valuable company in recent months — with the chipmaker Nvidia briefing claiming the crown last month. Apple also announced some software updates for the watch at its Worldwide Developers Conference last month. The latest version of the device's software, watchOS 11, emphasizes fitness and health, introducing tools that allow users to rate workouts and adjust effort ratings. WatchOS 11 will also use machine learning to curate the best photos for users' displays. Apple has previously used product birthdays to release new versions of devices. The iPhone X's release marked the 10th anniversary of the smartphone. However, it's not clear exactly when Apple plans to release the revamped watches, Bloomberg said. The company announced the Apple Watch in September 2014, with CEO Tim Cook calling it "the most personal product we've ever made." Apple did not immediately respond to a request for comment made outside normal working hours.

Russian military launches massive missile attack, Kiev children's hospital hit; President Biden issues statement condemning Russia's "brutalism"

A children's hospital in the Ukrainian capital was hit by a Russian missile on Monday as part of a wave of airstrikes across Ukraine that has killed at least 31 people and injured 154 others. "Russian terrorists have once again launched a massive missile attack on Ukrainian cities - Kiev, Dnipro, Kryvyi Rih, Slaviansk, Kramatorsk," said Ukrainian President Volodymyr Zelenskyy. Zelensky said Russia fired more than 40 missiles of different types at the five cities in daytime attacks, hitting residential buildings and public infrastructure. The Ukrainian air force said it intercepted 30 missiles. Authorities said the attack on Kiev killed seven people, while the attack on Kryvyi Rih, Zelensky's birthplace in central Ukraine, killed 10 and injured 47. United Nations Secretary-General António Guterres condemned the attacks, calling the assault on the Kiev hospital and another medical facility in the capital's Dniprovsky district "particularly egregious," said his spokesman, Stephane Dujarric. "Direct attacks on civilians and civilian objects are prohibited under international humanitarian law. Any such attacks are unacceptable and must cease immediately," Dujarric said. The U.N. Security Council will meet Tuesday to discuss the Russian strikes, diplomats said. The Russian Defense Ministry said the strikes targeted Ukrainian defense factories and a military aviation base and were successful. It denied striking any civilian facilities and claimed, without evidence, that photos from Kiev showed the damage was caused by a Ukrainian anti-aircraft missile. Ukrainian Air Force Colonel Yurii Ignat said Russia has been improving the effectiveness of its air strikes by equipping its missiles with enhanced features, including so-called heat decoys that can throw air defense systems off target. In comments sent to The Associated Press, he said the cruise missiles flew low in Monday's attack -- just 50 meters off the ground -- making them harder to hit. Western countries, led by the United States, have provided Ukraine with billions of dollars in arms support. They will hold a three-day NATO summit in Washington starting Tuesday to work out how to reassure Kiev of NATO's strong support and give Ukrainians hope that their country can survive the largest conflict in Europe since World War II. "Today's Russian missile strike that killed dozens of Ukrainian civilians and caused damage and loss of life to Kyiv's largest children's hospital is a horrifying reminder of Russia's brutality," U.S. President Joe Biden said in a statement Monday. "It is critical that the world continues to stand with Ukraine at this important moment and that we do not ignore Russian aggression." Biden said in the statement that he will meet with President Zelensky during the NATO summit in Washington this week "to make clear our unwavering support for Ukraine." Biden continued: "We will join our allies in announcing new measures to strengthen Ukraine's air defenses and help protect their cities and civilians from Russian attacks. The United States stands with the Ukrainian people." Czech President Petr Pavel said the hospital attack was "inexcusable" and he hoped the NATO summit would reach a consensus that Russia is "the greatest threat and we must be fully prepared to deal with it." Zelensky said during a visit to Poland that he hoped the NATO summit would provide Ukraine with more air defense systems. The Ukrainian leader said rescuers were digging through the rubble of the Ohmatdit Children's Hospital in Kyiv and that the number of casualties was not yet known. Kyiv Mayor Vitali Klitschko said at least 16 people were injured, including seven children, and the attack caused a two-story wing of the hospital to partially collapse. Doors and windows were blown off the hospital's 10-story main building, and the walls were charred. The floor of one room was splattered with blood. Hospital officials said the intensive care unit, operating room and oncology department were damaged.

Hamas chief says latest Israeli attack on Gaza could jeopardise ceasefire talks

AIRO, July 8 (Reuters) - A new Israeli assault on Gaza on Monday threatened ceasefire talks at a crucial moment, the head of Hamas said, as Israeli tanks pressed into the heart of Gaza City and ordered residents out after a night of massive bombardment. Residents said the airstrikes and artillery barrages were among the heaviest in nine months of conflict between Israeli forces and Hamas militants in the enclave. Thousands fled. The assault unfolded as senior U.S. officials were in the region pushing for a ceasefire after Hamas made major concessions last week. The militant group said the new offensive appeared intended to derail the talks and called for mediators to rein in Israel's Prime Minister Benjamin Netanyahu. The assault "could bring the negotiation process back to square one. Netanyahu and his army will bear full responsibility for the collapse of this path," Hamas quoted leader Ismail Haniyeh as saying. Gaza City, in the north of the Palestinian enclave, was one of Israel's first targets at the start of the war in October. But clashes with militants there have persisted and civilians have sought shelter elsewhere, adding to waves of displacement. Much of the city lies in ruins. Residents said Gaza City neighbourhoods were bombed through the night into the early morning hours of Monday. Several multi-storey buildings were destroyed, they said. The Gaza Civil Emergency Service said it believed dozens of people were killed but emergency teams were unable to reach them because of ongoing offensives. Gaza residents said tanks advanced from at least three directions on Monday and reached the heart of Gaza City, backed by heavy Israeli fire from the air and ground. That forced thousands of people out of their homes to look for safer shelter, which for many was impossible to find, and some slept on the roadside.