HONG KONG, July 9 (Reuters) - Nornickel (GMKN.MM), opens new tab is in talks with China Copper to form a joint venture that would allow the Russian mining giant to move its entire copper smelting base to China, four sources with knowledge of the matter told Reuters.

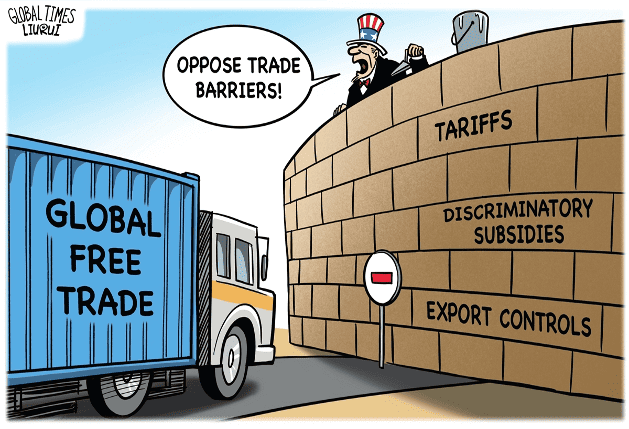

If the move goes ahead, it would mark Russia's first uprooting of a domestic plant since the U.S. and Britain banned metal exchanges from accepting new aluminium, copper and nickel produced by Russia.

It also means Nornickel's copper will be produced within the country where it is most consumed.

Nornickel said in April it planned to close its Arctic facility and build a new plant in China with an unnamed partner.

Executives at China Copper, owned by the world's largest aluminium producer Chinalco (601600.SS), opens new tab, flew to Moscow in June to discuss a possible joint venture, one of the sources said, adding that details of the structure and investment are still under discussion.

Nornickel declined to comment. Chinalco and China Copper did not respond to requests for comment via email and phone.

Sites being considered in China include Fangchenggang and Qinzhou in the Guangxi region, the two sources said, with another source saying Qingdao in Shandong province was also possible.

A decision on a joint venture will be made over the next few months, a fifth source said, adding that Nornickel's Chinese output is likely to be consumed domestically.

The new facility will have capacity to produce 450,000 tonnes of copper annually, two of the sources said, amounting to around 2% of global mined supplies estimated at around 22 million metric tons this year.

Nornickel, which according to its annual report produced 425,400 tonnes of refined copper last year, processed all of its concentrates in 2023 at the Arctic plant, its only operation producing finished copper suitable for delivery to exchanges.