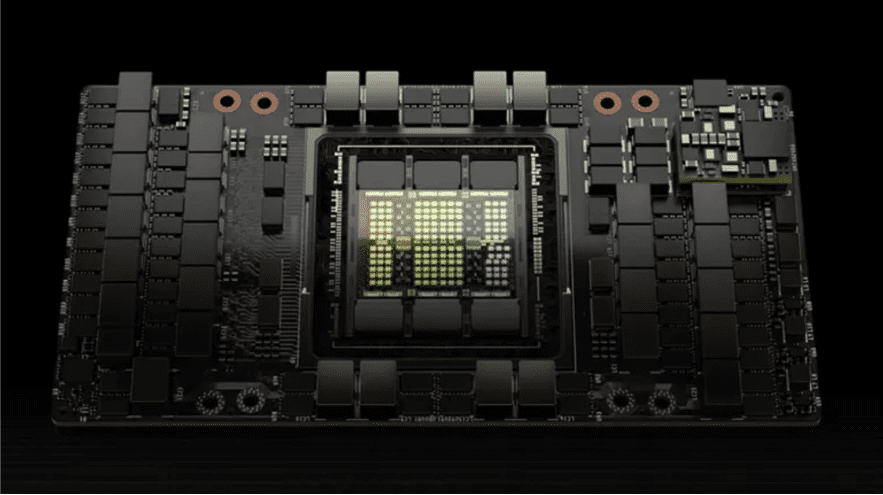

Recently, according to the FT, citing the latest forecast data of the market research institute SemiAnalysis, AI chip giant NVIDIA will ship more than 1 million new NVIDIA H20 acceleration chips to the Chinese market this year, and it is expected that the cost of each chip is between $12,000 and $13,000. This is expected to generate more than $12 billion in revenue for Nvidia.

Affected by the United States export control policy, Nvidia's advanced AI chip exports to China have been restricted, H20 is Nvidia based on H100 specifically for the Chinese market to launch the three "castration version" GPU among the strongest performance, but its AI performance is only less than 15% of H100, some performance is even less than the domestic Ascend 910B.

When Nvidia launched the new H20 in the spring of this year, there were reports that due to the large castration of H20 performance, coupled with the high price, Chinese customers' interest in buying is insufficient, and they will turn more to choose China's domestic AI chips. Then there are rumors that Nvidia has lowered the price of the H20 in order to improve its competitiveness.

However, the latest news shows that due to supply issues caused by the low yield of the Ascend 910B chip, Chinese manufacturers in the absence of supply and other better options, Nvidia H20 has started to attract new purchases from Chinese tech giants such as Baidu, Alibaba, Tencent and Bytedance.

Analysts at both Morgan Stanley and SemiAnalysis said the H20 chip is now being shipped in bulk and is popular with Chinese customers, despite its performance degradation compared to chips Nvidia sells in the United States.