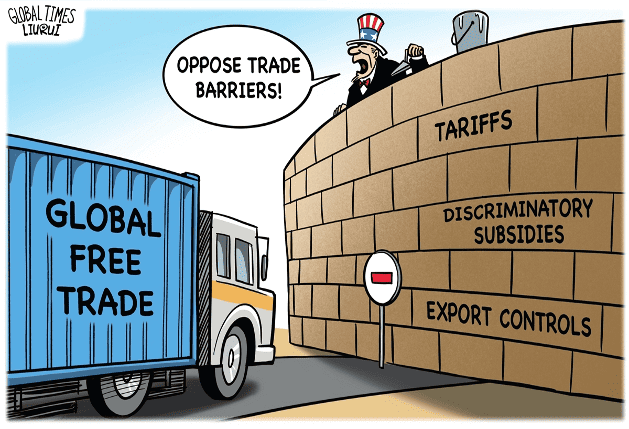

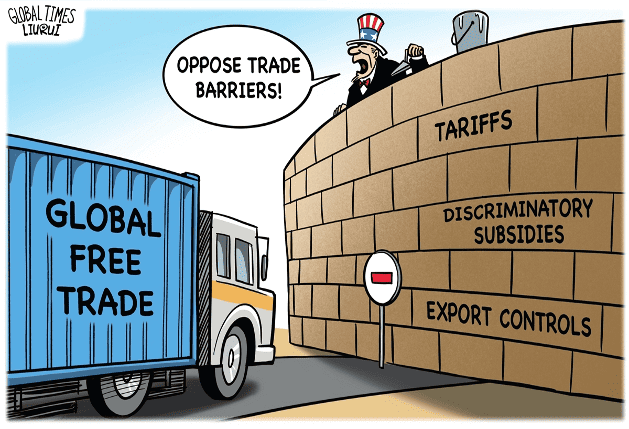

US politicians' lurch to levying high tariffs to damage global economic sustainability

US politicians are advocating for steep tariffs, echoing the protectionist Fordney-McCumber Tariff of 1922. Despite potential international retaliation, risks to global economic rules and a shift from post-World War II principles, US politicians have promised to increase trade barriers against China, causing concerns for the sustainability of global economic harmony. A century ago, the Republican Congress passed the Fordney-McCumber Tariff of 1922. This post-World War-I effort to protect the US from German competition and rescue America's own businesses from falling prices sparked a global wave of tariff hikes. While long forgotten, echoes of Fordney-McCumber now reverberate across the US political landscape. Once again, politicians are grasping the tariff as a magic talisman against its own economic ills and to contain the rise of China. The Democratic Party of the 1920s opposed tariffs, because duties are harmful to consumers and farmers, but today both President Joe Biden and former President Donald Trump favor national delivery through protectionism. Trump promised that his second term, if elected, would impose 60-percent tariffs on everything arriving from China and 10-percent tariffs on imports from the rest of the world, apparently including the imports covered by 14 free trade agreements with America's 20 partners. He initially promised 100-percent tariffs on electric vehicles (EVs), but when Biden declared that he was hiking tariffs on EVs from China to 100-percent, Trump raised the ante to 200-percent. On May 14, 2024, the White House imposed tariffs ranging from 25 percent (on items such as steel, aluminum and lithium batteries) to 50 percent (semiconductors, solar cells, syringes and needles) and 100 percent (electric vehicles) on Chinese imports. US government officials offer "national security" and "supply chain vulnerability" as the justification for levying high tariffs. To deflect worries about inflation, US Trade Representative Katherine Tai declared, "first of all, I think that that link, in terms of tariffs to prices, has been largely debunked." Contrary findings by the United States International Trade Commission and a number of distinguished economists, as well as Biden's own 2019 statement criticizing Trump's tariffs - "Trump doesn't get the basics. He thinks tariffs are being paid by China… [but] the American people are paying his tariffs" - forced Tai's office to wind back her declaration. The fact that prohibitive barriers to imports of solar cells, batteries and EVs will delay the green economy carries zero political weight with Trump and little with Biden. Nor does either of them worry about the prospects of Chinese retaliation and damage to the fabric of global economic rules. Historical lessons - unanticipated consequences of the foolish Fordney-McCumber Tariff of 1922 and the Smoot-Hawley Tariff of 1930 - are seen as irrelevant by the candidates and their advisers. The US' lurch from its post-World War II free trade principles offers China a golden opportunity. On the world stage, China will espouse open free trade and investment. China will encourage EV and battery firms to establish plants in Europe, Brazil, Mexico and elsewhere, essentially daring the US to damage its own alliances by restricting third country imports containing Chinese components. Whether the fabric of global economic rules that has delivered astounding prosperity to the world will survive through the 21st century remains to be seen. Much will depend on the decisions of other large economic powers, not only China but also the European Union and Japan, as well as middle powers, such as Australia, Brazil, Chile, ASEAN and South Korea. Their actions and reactions will reshape the rules of the 21st century. If others follow America down this costly path, the world will become less prosperous and vastly more unpredictable. If they resist, the US risks being diminished and more isolated. The author is a non-resident Senior Fellow at the Peterson Institute of International Economics. bizopinion@globaltimes.com.cn

Exclusive: Japan must strengthen NATO ties to safeguard global peace, PM says

TOKYO, July 9 (Reuters) - Russia's deepening military cooperation with North Korea has underlined the need for Japan to forge closer ties with NATO as regional security threats become increasingly intertwined, Prime Minister Fumio Kishida told Reuters. In written remarks ahead of his attendance at a NATO summit in Washington DC this week, Kishida also signalled concern over Beijing's alleged role in aiding Moscow's two-year-old war in Ukraine, although he did not name China. "The securities of the Euro-Atlantic and the Indo-Pacific are inseparable, and Russia’s aggression against Ukraine and its deepened military cooperation with North Korea are strong reminders of that," Kishida said. "Japan is determined to strengthen its cooperation with NATO and its partners," he added. The world, the Japanese leader said, should not tolerate attempts by some countries to disrupt the established international order and reiterated a warning that Ukraine today could be East Asia tomorrow. He also urged cooperation to confront new security threats that transcend geographical boundaries, such as cyber-attacks and conflicts in space. The U.S. and its allies have accused Pyongyang of providing ballistic missiles and artillery shells that Russia has used in its war in Ukraine and say they fear Moscow in return could provide support for North Korea's nuclear missile development. Washington has also said China is supplying droneWithout naming China, Kishida told Reuters "some countries" have allegedly transferred dual-use civilian-military goods to Russia which has served "as a lifeline" for its Ukraine war. "It is necessary to grapple with such situations in a multi-faceted and strategic manner, taking a panoramic view that considers the full range of international actors fuelling Russia’s attempt to change the status quo by force," he said. "The geographical boundary of 'Euro-Atlantic' or 'Indo-Pacific' is no longer relevant in safeguarding global peace and security. Japan and Indo-Pacific partners can play a great role for NATO allies from this perspective." Constrained by decades of pacifism, Tokyo has been reluctant to supply lethal aid to Ukraine. It has, however, provided financial aid to Kyiv, spearheaded efforts to prepare for its post-war reconstruction, and contributed to NATO’s fund to provide Ukraine with non-lethal equipment such as anti-drone detection systems. Tokyo has also repeatedly warned about the risks of a similar conflict emerging in East Asia, where China has been taking an increasingly muscular stance towards its territorial claims including the democratic island of Taiwan. "This summit is a critical opportunity for Japan, the U.S., and the other NATO allies to confront the ongoing challenges against the international order and to reaffirm values and principles that have shaped global peace and prosperity," he said. There may be limits, however, over how far NATO members are prepared to go in forging closer ties in Asia. A plan that surfaced last year for NATO to open a liaison office in Japan, its first in Asia, was blocked by France and criticised by China. and missile technology, satellite imagery and machine tools to Russia, items which fall short of lethal assistance but are helping Moscow build its military to sustain the Ukraine war. Beijing has said it has not provided any weaponry to any party.

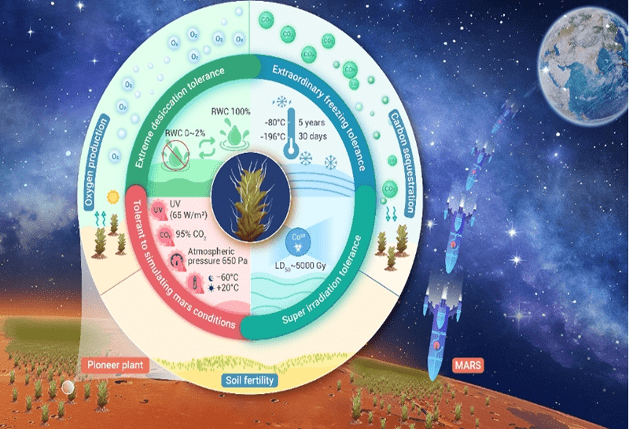

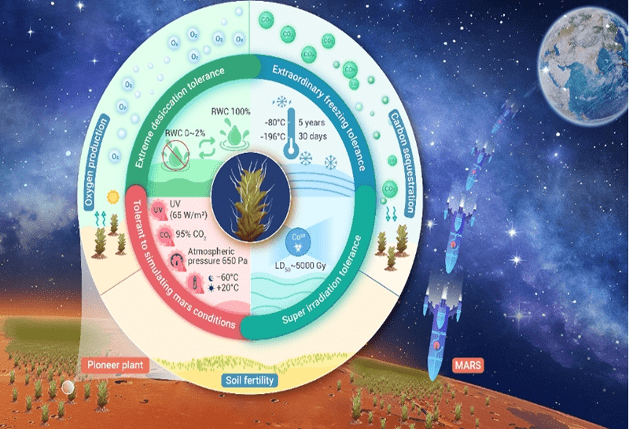

Xinjiang scientists discover plant with potential to survive on Mars

In a groundbreaking discovery, researchers from the Xinjiang Institute of Ecology and Geography of the Chinese Academy of Sciences have found a desert moss species, known as Syntrichia caninervis, that has the potential to survive in the extreme conditions on Mars. The Global Times learned from the institute that during the third Xinjiang scientific expedition, the research team focused on studying the desert moss and found that it not only challenges people's understanding of the tolerance of organisms in extreme environments, but also demonstrates the ability to survive and regenerate under simulated Martian conditions. Supported by the Xinjiang scientific expedition project, researchers Li Xiaoshuang, Zhang Daoyuan and Zhang Yuanming from the Xinjiang Institute of Ecology and Geography and Kuang Tingyun, an academician from the Chinese Academy of Sciences, concentrated on studying the "pioneer species" Syntrichia caninervis in an extreme desert environment, according to the institute in an article it sent to the Global Times on Sunday. Through scientific experiments, the researchers systematically proved that the moss can tolerate over 98 percent cell dehydration, survive at temperatures as low as -196 C without dying, withstand over 5000Gy of gamma radiation without perishing, and quickly recover, turn green, and resume growth, showcasing extraordinary resilience. These findings push the boundaries of human knowledge on the tolerance of organisms in extreme environments. Furthermore, the research revealed that under simulated Martian conditions with multiple adversities, Syntrichia caninervis can still survive and regenerate when returned to suitable conditions. This marks the first report of higher plants surviving under simulated Martian conditions. The research team also identified unique characteristics of Syntrichia caninervis. Its overlapping leaves reduce water evaporation, while the white tips of the leaves reflect intense sunlight. Additionally, the innovative "top-down" water absorption mode of the white tips efficiently collects and transports water from the atmosphere. Moreover, the moss can enter a selective metabolic dormancy state in adverse environments and rapidly provide the energy needed for recovery when its surrounding environment improves. Based on the extreme environmental tolerance of Syntrichia caninervis, the research team plans to conduct experiments on spacecraft to monitor the survival response and adaptation capabilities of the species under microgravity and various ionizing radiation adversities. They aim to unravel the physiological and molecular basis of the moss and explore the key life tolerance regulatory mechanisms, laying the foundation for future applications of Syntrichia caninervis in outer space colonization.

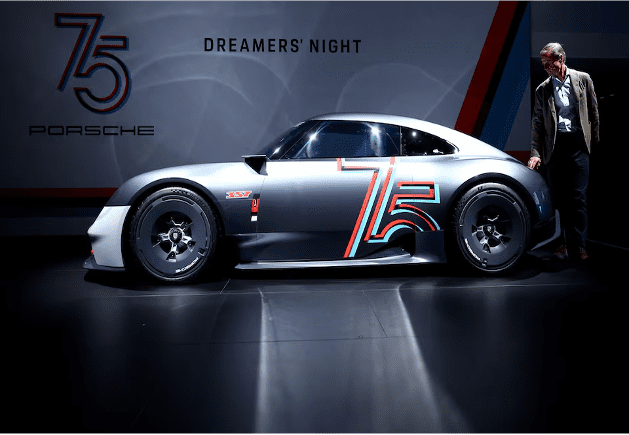

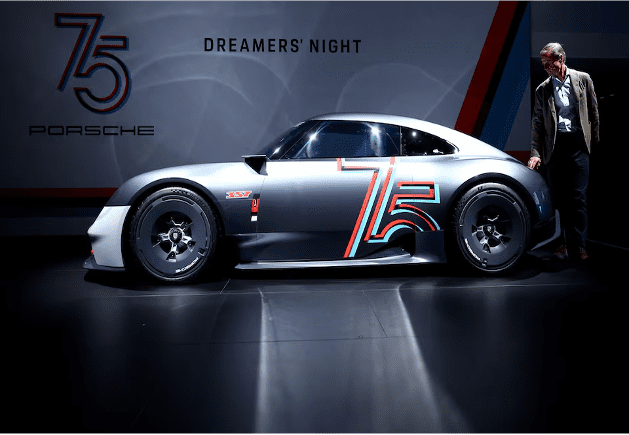

Porsche AG reports sharp fall in China deliveries

July 9 (Reuters) - German sportscar maker Porsche (P911_p.DE), opens new tab said on Tuesday that global vehicle deliveries were down 7% in the first half of the year compared to the same period in 2023, primarily driven by a 33% year-on-year drop in China. Porsche, majority-owned by Volkswagen (VOWG_p.DE), opens new tab, is highly exposed to the EU-China tariff tensions, with deliveries to China accounting for nearly 20% of global deliveries. An HSBC analyst pointed to weakness in the European car market, saying that "the market is, understandably, worried about China pricing weakness and the prospect of needing to pay dealer compensation." Overall, Porsche delivered 155,945 cars worldwide during the first six months of the year. In North America, deliveries were down 6% year-on-year. Meanwhile, in Porsche’s home market of Germany, deliveries increased by 22% to 20,811 vehicles.

Samsung Electronics wins cutting-edge AI chip order from Japan's Preferred Networks

SEOUL, July 9 (Reuters) - Samsung Electronics (005930.KS), opens new tab said on Tuesday it won an order from Japanese artificial intelligence company Preferred Networks to make chips for AI applications using the South Korean firm's 2-nanometre foundry process and advanced chip packaging service. It is the first order Samsung has revealed for its cutting-edge 2-nanometre chip contract manufacturing process. Samsung did not elaborate on the size of the order. The chips will be made using high-tech chip architecture known as gate all-around (GAA) and multiple chips will be integrated in one package to enhance inter-connection speed and reduce size, Samsung said in a statement. South Korea's Gaonchips Co (399720.KQ), opens new tab designed the chips, Samsung said. The chips will go toward Preferred Networks' high-performance computing hardware for generative AI technologies such as large language models, Junichiro Makino, Preferred Networks vice president and chief technology officer of computing architecture, said in the statement.