UAE insurance sector continued to grow in Q4-23: CBUAE

The UAE insurance sector continued to grow in Q4-2023, as reflected by increase in the gross written premiums. As of year-end, the number of licensed insurance companies in the UAE remained at 60, according to the Central Bank of the UAE's (CBUAE) Quarterly Economic Review (Q4-2023). The insurance sector comprised 23 traditional national companies, 10 Takaful national and 27 foreign companies, while the number of insurance related professions remained at 491. The review on insurance sector structure and activity showed that the gross written premium increased by 12.7% Y-o-Y in Q4 2023 to AED 53.2 billion, mostly due to an increase in health insurance premiums by 16.5% Y-o-Y and an increase in property and liability insurance premiums by 18.9% Y-o-Y, while the insurance of persons and fund accumulation premiums decreased by 12.4% Y-o-Y, resulting primarily from decrease in individual life premiums. Gross paid claims of all types of insurance plans increased by 12.8% Y-o-Y to AED 31.1 billion at the end of 2023. This was mainly driven by the increase in claims paid in health insurance by 16.9% Y-o-Y and increase in paid claims in property and liability insurance by 10.9% Y-o-Y, partially offset by the decline in claims paid in insurance of persons and fund accumulation by 2.8% Y-o-Y. The total technical provisions of all types of insurance increased by 8.4% Y-o-Y to AED 74.4 billion in Q4 2023 compared to AED68.6 billion in Q4 2022. The volume of invested assets in the insurance sector amounted to AED 76 billion (60.4% of total assets) in Q4 2023 compared to AED 71.4 billion (59.4% of total assets) in Q4 2022. The retention ratio of written insurance premiums for all types of insurance was 52.9 % (AED 28.1 billion) in Q4 2023, compared to 54.9% (AED 25.9 billion) at the end of 2022. The UAE insurance sector remained well capitalized in terms of early warning ratios and risk assessment. Own funds to minimum capital requirement ratio increased to 335.7% in Q4 2023, compared to 309.3% at the end of 2022, due to an increase in own funds eligible to meet the minimum capital requirements. Also, own funds to solvency capital requirement ratio rose to 221% in Q4 2023 compared to 208.5% in Q4 2022, due to an increase in own funds eligible to meet solvency capital requirements. Finally, own funds to minimum guarantee fund ratio reached to 316.3% at the end of 2023 down from 314.6% a year earlier, due to higher eligible funds to meet minimum guarantee funds. In terms of profitability, the net total profit to net written premiums increased to 6.5% in Q4 2023, compared to 2.9% at the end of 2022. The return on average assets increased to 0.3% in Q4 2023 compared to the 0.1% at the of the previous year.

Israeli strike kills 16 at Gaza school, military says it targeted gunmen

CAIRO/GAZA, July 6 (Reuters) - At least 16 people were killed in an Israeli strike on a school sheltering displaced Palestinian families in central Gaza on Saturday, the Palestinian health ministry said, in an attack Israel said had targeted militants. The health ministry said the attack on the school in Al-Nuseirat killed at least 16 people and wounded more than 50. The Israeli military said it took precautions to minimize risk to civilians before it targeted the gunmen who were using the area as a hideout to plan and carry out attacks against soldiers. Hamas denied its fighters were there. At the scene, Ayman al-Atouneh said he saw children among the dead. "We came here running to see the targeted area, we saw bodies of children, in pieces, this is a playground, there was a trampoline here, there were swing-sets, and vendors," he said. Mahmoud Basal, spokesman of the Gaza Civil Emergency Service, said in a statement that the number of dead could rise because many of the wounded were in critical condition. The attack meant no place in the enclave was safe for families who leave their houses to seek shelters, he said. Al-Nuseirat, one of Gaza Strip's eight historic refugee camps, was the site of stepped-up Israeli bombardment on Saturday. An air strike earlier on a house in the camp killed at least 10 people and wounded many others, according to medics. In its daily update of people killed in the nearly nine-month-old war, the Gaza health ministry said Israeli military strikes across the enclave killed at least 29 Palestinians in the past 24 hours and wounded 100 others.

Coexisting and cooperating with China is the only choice for the US

US Secretary of State Antony Blinken declared at the Munich Security Conference: "If you're not at the table in the international system, you're going to be on the menu." The arrogant thinking of American political elites is evident: Whoever does not comply with the US will be excluded from the table of the American-led system and put on the menu. How arrogant. The US is actively pushing for "decoupling" from China and trying to persuade the entire West to "decouple" from China, using the term "de-risking." Washington hopes to ultimately contain China's development in order to maintain American hegemony. However, this time, Washington is facing a historically experienced and strategically rich Eastern civilization. Previous opponents targeted by the US have chosen to confront the US strategically. The US not only has the strongest technological and military capabilities but also controls global financial and information networks with a large number of allies. Those countries that had engaged in direct confrontations had suffered losses. Some of them had disintegrated, some had been weakened, and some had fallen into difficulties. However, what Washington sees from China is strategic composure and resilience. China is now staging an unprecedented and grand "Tai Chi." However, some Chinese people feel that this is not enough: Why can't we confront the US head-on? But I want to say that this is precisely the brilliance of China. This grand "Tai Chi" is about dismantling the pressure the US is putting on China. Europe is different from the US. A European diplomat once said in private that the topic of China has become toxic in the US, but in Europe, it is still possible to openly display friendliness toward China. There is genuine competition between the Europe and China despite Europe leans more toward the US between China and the US. Only in terms of ideology does the term "West" truly exist. In terms of fundamental economic interests, Europe has considerable independence. In terms of security, their attitude toward China also differs greatly from that of the US. In the Asia-Pacific region or China's periphery, the US wants to create an "Asian NATO." The specific situations of countries in dispute with China are very different. China has enormous influence in the region, is the largest trading partner of the vast majority of countries in the region and has friendly relations with most countries in the region. The disputes with countries are not fundamental strategic conflicts, and China has the ability to manage disputes with each specific country and push them to move toward neutrality to varying degrees without being tied to the US' policy toward China. China has a lot of trading partners and stakeholders in the US. The trade volume between China and the US, despite the decline, reached $664.4 billion in 2023, which shows China's huge presence in the US, and is the bond of the two countries in the current situation. The US is not a country where the political elites can have absolute say, and the huge interests have forced the US president and senior officials to repeatedly proclaim that they "don't want to decouple from China" and instead they want to "manage the US-China competition" and see "preventing a war with China" as clearly in everyone's best interest. China should engage in a "strategic battle" with the US at the closest possible distance. We need to maintain friendly relations with certain forces within the US, speed up the resumption of flights between the two countries, increase personnel exchanges and completely reverse the downturn of China-US contacts during the pandemic. In addition to the above dismantling, we also have the huge increment in the "Belt and Road." This initiative will increase China's power to compete with the US, greatly extending the front line that the US needs to maintain in containing China, making the US more powerless. In order to dismantle the US strategy toward China, China must become more diversified while maintaining strategic consistency. Our national diplomacy toward the US is very principled, rational and determined, which is clearly different from other countries targeted by the US. Our public diplomacy toward the US needs to be unique, with both "anti-American voices" and efforts to maintain friendly relations between the two societies and further expand economic and practical cooperation with the US. Just as eagles have their own way of flying and doves have their own formation, just as we see the US as complex, China must also be seen as complex in the eyes of the US. China is both a geopolitical concern and a profitable investment destination for them, and is one of the largest trading partners that is difficult to replace. Some American political elites proclaim China as an "enemy," but it is important to make the majority of Americans feel that China is not. No matter how intense the struggles between China and the US may be, we cannot shape the entire US toward an enemy direction. China has to make the US political elites recognize that it is futile to deal with China in the same way as it historically dealt with the Soviet Union and other major powers. Furthermore, willingly or unwillingly, coexistence and cooperation with China will be their only choice.

"Pictures on the wall were falling," New Yorkers rattled by earthquake

An earthquake jolted New York City on Friday morning, followed by more than 10 aftershocks which shook New Jersey, sending tremors as far as Philadelphia to Boston and jolting buildings in Manhattan and throughout its five boroughs. The preliminary quake, measuring 4.8 magnitude, centered around Lebanon, New Jersey, approximately 60 kilometers from New York City, with a depth of about 5 kilometers. Following the earthquake, New York City mayor Eric Adams stated at a press conference that no injuries had been reported, but they would continue to monitor and inspect critical infrastructure. The densely populated New York City was caught off guard by the unusual event. Broadcaster CBS reported that New York had not experienced an earthquake of this magnitude since 1884. Residents in Brooklyn expressed their shock when experiencing tremors which shook the city. "At first, I thought it was just construction next door, but then I noticed the pictures on the wall had fallen," Jennifer Wu, a resident in New York, told the Global Times on Saturday. Video footage circulating online showed the Statue of Liberty and the New York City skyline trembling as the earthquake struck. An angle from directly above Lady Liberty caught Ellis Island shaking during the incident. "It is fine," New York's famous Empire State Building posted on social platform X after the earthquake. The United Nations headquarters located in New York was hosting a Security Council meeting on the Israeli-Palestinian issue, and diplomats present in the meeting felt the tremors, local media reported. According to the Weather Channel, residents in Baltimore, Philadelphia, New Jersey, Connecticut, Boston and other areas of the Northeast seaboard also reported shaking. Tremors lasting for several seconds were felt over 200 miles away near the Massachusetts-New Hampshire border. The New York mayor told the press that New Yorkers should go about their normal day, while the governor Kathy Hochul emphasized the seriousness of the situation. She initiated assessments for damage across the state and had discussions with New Jersey Governor Phil Murphy. The quake caused flight delays throughout the New York area, with temporary control measures put in place across New York's John F. Kennedy International Airport, Newark Liberty International Airport in Newark, New Jersey, and Baltimore-Washington's Thurgood Marshall International Airport, checking for damage to runways. Operations resumed around Friday noon, ABC reported.

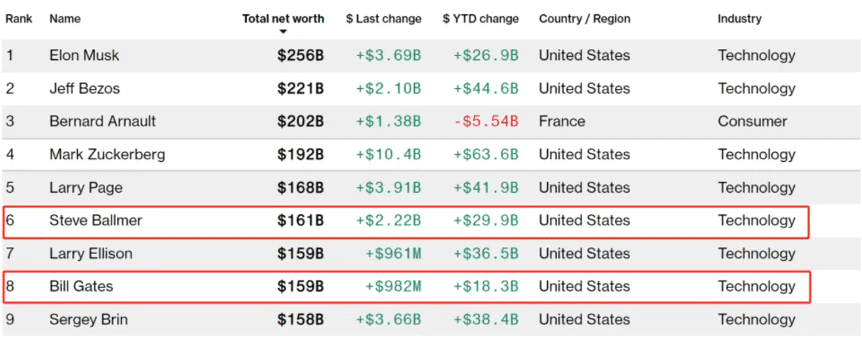

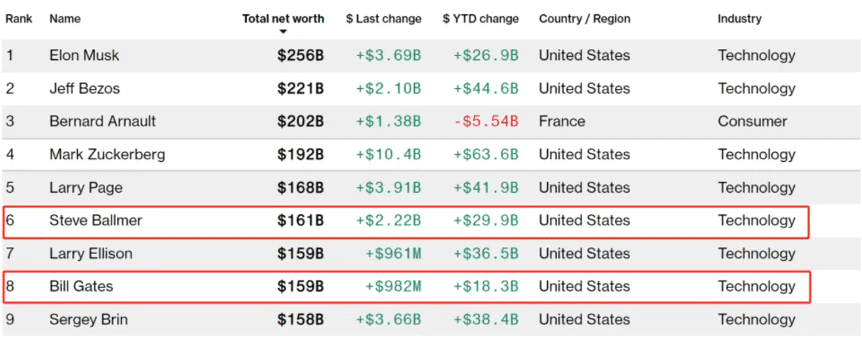

Former Microsoft CEO Ballmer wealth surpassed Gates, he only did one thing

On July 1, former Microsoft CEO and President Steve Ballmer surpassed Microsoft co-founder Bill Gates for the first time on the Bloomberg list of the world's richest people to become the sixth richest person in the world. According to the data, as of the same day, Ballmer's net worth reached $157.2 billion, while Gates's wealth was $156.7 billion, falling to seventh place. The latest figures, as of July 6, show that Ballmer's wealth has grown further to $161 billion, and Gates' wealth is $159 billion. This is the first time Ballmer's net worth has surpassed Gates', and it is also the rare time in history that an employee's net worth has surpassed that of a company founder. Unlike Musk, Jeff Bezos and others, Ballmer's wealth was not accumulated through entrepreneurial success as a business founder, but simply because he chose to hold Microsoft "indefinitely." As Fortune previously reported, Ballmer is the only individual with a net worth of more than $100 billion as an employee rather than a founder.