Coexisting and cooperating with China is the only choice for the US

US Secretary of State Antony Blinken declared at the Munich Security Conference: "If you're not at the table in the international system, you're going to be on the menu." The arrogant thinking of American political elites is evident: Whoever does not comply with the US will be excluded from the table of the American-led system and put on the menu. How arrogant. The US is actively pushing for "decoupling" from China and trying to persuade the entire West to "decouple" from China, using the term "de-risking." Washington hopes to ultimately contain China's development in order to maintain American hegemony. However, this time, Washington is facing a historically experienced and strategically rich Eastern civilization. Previous opponents targeted by the US have chosen to confront the US strategically. The US not only has the strongest technological and military capabilities but also controls global financial and information networks with a large number of allies. Those countries that had engaged in direct confrontations had suffered losses. Some of them had disintegrated, some had been weakened, and some had fallen into difficulties. However, what Washington sees from China is strategic composure and resilience. China is now staging an unprecedented and grand "Tai Chi." However, some Chinese people feel that this is not enough: Why can't we confront the US head-on? But I want to say that this is precisely the brilliance of China. This grand "Tai Chi" is about dismantling the pressure the US is putting on China. Europe is different from the US. A European diplomat once said in private that the topic of China has become toxic in the US, but in Europe, it is still possible to openly display friendliness toward China. There is genuine competition between the Europe and China despite Europe leans more toward the US between China and the US. Only in terms of ideology does the term "West" truly exist. In terms of fundamental economic interests, Europe has considerable independence. In terms of security, their attitude toward China also differs greatly from that of the US. In the Asia-Pacific region or China's periphery, the US wants to create an "Asian NATO." The specific situations of countries in dispute with China are very different. China has enormous influence in the region, is the largest trading partner of the vast majority of countries in the region and has friendly relations with most countries in the region. The disputes with countries are not fundamental strategic conflicts, and China has the ability to manage disputes with each specific country and push them to move toward neutrality to varying degrees without being tied to the US' policy toward China. China has a lot of trading partners and stakeholders in the US. The trade volume between China and the US, despite the decline, reached $664.4 billion in 2023, which shows China's huge presence in the US, and is the bond of the two countries in the current situation. The US is not a country where the political elites can have absolute say, and the huge interests have forced the US president and senior officials to repeatedly proclaim that they "don't want to decouple from China" and instead they want to "manage the US-China competition" and see "preventing a war with China" as clearly in everyone's best interest. China should engage in a "strategic battle" with the US at the closest possible distance. We need to maintain friendly relations with certain forces within the US, speed up the resumption of flights between the two countries, increase personnel exchanges and completely reverse the downturn of China-US contacts during the pandemic. In addition to the above dismantling, we also have the huge increment in the "Belt and Road." This initiative will increase China's power to compete with the US, greatly extending the front line that the US needs to maintain in containing China, making the US more powerless. In order to dismantle the US strategy toward China, China must become more diversified while maintaining strategic consistency. Our national diplomacy toward the US is very principled, rational and determined, which is clearly different from other countries targeted by the US. Our public diplomacy toward the US needs to be unique, with both "anti-American voices" and efforts to maintain friendly relations between the two societies and further expand economic and practical cooperation with the US. Just as eagles have their own way of flying and doves have their own formation, just as we see the US as complex, China must also be seen as complex in the eyes of the US. China is both a geopolitical concern and a profitable investment destination for them, and is one of the largest trading partners that is difficult to replace. Some American political elites proclaim China as an "enemy," but it is important to make the majority of Americans feel that China is not. No matter how intense the struggles between China and the US may be, we cannot shape the entire US toward an enemy direction. China has to make the US political elites recognize that it is futile to deal with China in the same way as it historically dealt with the Soviet Union and other major powers. Furthermore, willingly or unwillingly, coexistence and cooperation with China will be their only choice.

SpaceX astronaut returns with an incredible change in his body

A provocative new study reveals the complex effects of the space environment on human health, providing insight into potential damage to blood, cell structure and the immune system. The study focused on SpaceX's Inspiration4 mission, which successfully sent two men and two women into space in 2021 to orbit the Earth for three days and shed some light on the effects of space travel on the human body. The research data, derived directly from the Inspiration4 mission, shows that even a brief trip to space can significantly damage the human immune system, trigger an inflammatory response, and profoundly affect cell structure. In particular, space travel triggered unprecedented changes in cytokines that play a key role in immune response and muscle regulation but are not usually directly associated with inflammation. In particular, the study found a significant increase in muscle factors, which are physiological responses specific to skeletal muscle cells in microgravity, rather than a simple immune response. Although non-muscular tissues did not show changes in proteins associated with inflammation, specific leg muscles such as soleus and tibialis anterior muscles showed significant signs of metabolic activity, especially increased interleukin in the latter, further enhancing the activation of immune cells.

China proposes to establish BCI committee to strive for domestic innovation

China is mulling over establishing a Brain-Computer Interface (BCI) standardization technical committee under its Ministry of Industry and Information Technology (MIIT), aiming to guide enterprises to enhance industrial standards and boost domestic innovation. The proposed committee, revealed by the MIIT on Monday, will work on composing a BCI standards roadmap for the entire industry development as well as the standards for the research and development of the key technologies involved, according to the MIIT. China has taken strides in developing the BCI industry over the years, not only providing abundant policy support but also generous financial investment, Li Wenyu, secretary of the Brain-Computer Interface Industrial Alliance, told the Global Times. From last year to 2024, both the central and local governments have successively issued relevant policies to support industrial development. The MIIT in 2023 rolled out a plan selecting and promoting a group of units with strong innovation capabilities to break through landmark technological products and accelerate the application of new technologies and products. The Beijing local government also released an action plan to accelerate the industry in the capital (2024-2030) this year. In 2023, there were no fewer than 20 publicly disclosed financing events for BCI companies in China, with a total disclosed amount exceeding 150 million yuan ($20.6 million), Li said. “The strong support from the government has injected momentum into industrial innovation.” The fact that China's BCI industry started later than Western countries such as the US is a reality, leading to the gap in China regarding technological breakthroughs, industrial synergy, and talent development, according to Li. To further close gaps and solve bottlenecks in BCI industrial development, Li suggested that the industry explore various technological approaches to suit different application scenarios and encourage more medical facilities powered by BCI to initiate clinical trials by optimizing the development of BCI-related ethics. Additionally, he highlighted that standard development is one of the aspects to enhance the overall level and competitiveness of the industry chain, which could, in turn, empower domestic BCI innovation. While China's BCI technology generally lags behind leading countries like the US in terms of system integration and clinical application, this has not hindered the release of Neucyber, which stands as China's first "high-performance invasive BCI." Neucyber, an invasive implanted BCI technology, was independently developed by Chinese scientists from the Chinese Institute for Brain Research in Beijing. Li Yuan, Business Development Director of Beijing Xinzhida Neurotechnology, the company that co-developed this BCI system, told the Global Times that the breakthrough of Neucyber could not have been achieved without the efforts of the institute gathering superior resources from various teams in Beijing. A group of mature talents were gathered within the institute, from specific fields involving electrodes, chips, algorithms, software, and materials, Li Yuan said. Shrugging off the outside world's focus on China’s competition with the US in this regard, Li Yuan said her team doesn’t want to be imaginative and talk too much, but strives to produce a set of products step by step that can be useful in actual applications. In addition, Li Wenyu also attributed the emergence of Neucyber to the independent research atmosphere and the well-established talent nurturing mechanism in the Chinese Institute for Brain Research. He said that to advance China’s BCI industry, it is necessary not only to cultivate domestic talents but also to introduce foreign talents to enhance China's research and innovation capabilities. The proposed plan for establishing the BCI standardization technical committee under the MIIT will solicit public opinions until July 30, 2024.

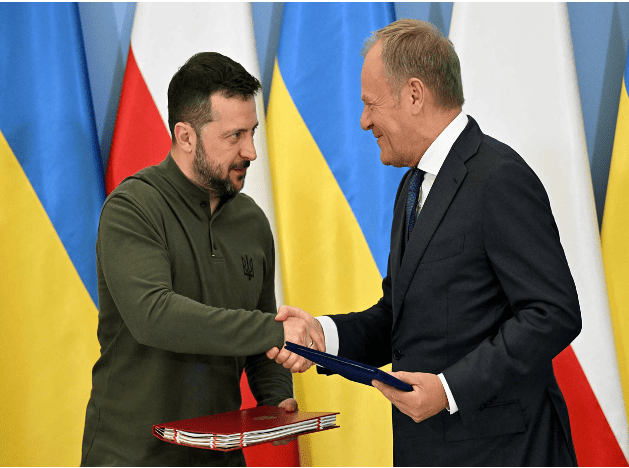

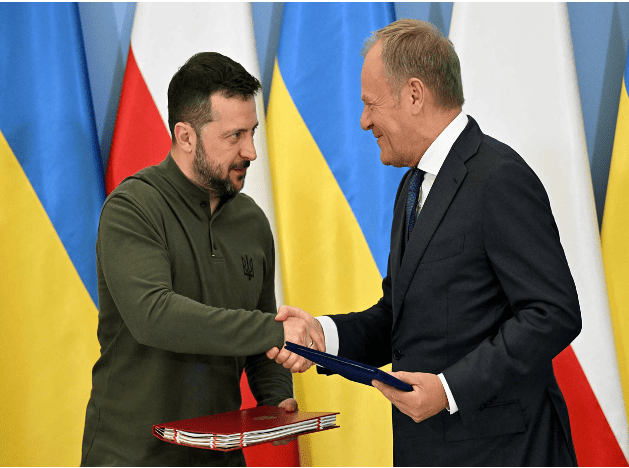

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland. The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises." Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.

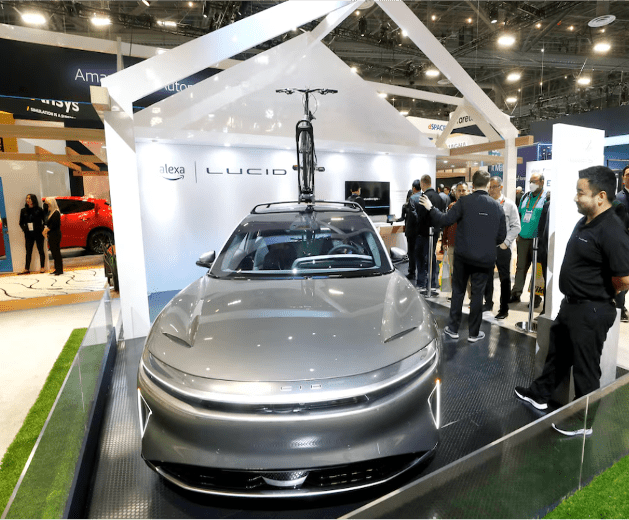

The Apple Watch is reportedly getting a birthday makeover

Apple is planning to revamp its smartwatch as its 10th birthday nears. The improvements include larger displays and thinner builds, Bloomberg reported. The revamped watches may also get a new chip, which could enable some AI enhancements. The Apple Watch is about to turn 10, so Apple is planning a birthday revamp, including larger displays and thinner builds, Bloomberg reported. Both versions of the new Series 10 watches will have screens similar to the large displays found on the Apple Watch Ultra, the report said. The revamped watches are also expected to contain a new chip that may permit some AI enhancements later on. Last month, Apple pulled back the curtain on its generative-AI plans with Apple Intelligence. Advertisement It hopes the artificial-intelligence features will prove alluring enough to persuade consumers to buy new Apple products. The announcement has been generally well received by Wall Street. Dan Ives of Wedbush Securities wrote in a Monday note that the "iPhone 16 AI-driven upgrade could represent a golden upgrade cycle for Cupertino." "We believe AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share," he added. Apple's stock closed on Friday at just over $226 a share, up 22% this year and valuing the company at $3.47 trillion. That puts it just behind Microsoft, which was worth $3.48 trillion at Friday's close. The tech giants have been vying for the title of the world's most valuable company in recent months — with the chipmaker Nvidia briefing claiming the crown last month. Apple also announced some software updates for the watch at its Worldwide Developers Conference last month. The latest version of the device's software, watchOS 11, emphasizes fitness and health, introducing tools that allow users to rate workouts and adjust effort ratings. WatchOS 11 will also use machine learning to curate the best photos for users' displays. Apple has previously used product birthdays to release new versions of devices. The iPhone X's release marked the 10th anniversary of the smartphone. However, it's not clear exactly when Apple plans to release the revamped watches, Bloomberg said. The company announced the Apple Watch in September 2014, with CEO Tim Cook calling it "the most personal product we've ever made." Apple did not immediately respond to a request for comment made outside normal working hours.