Wto: Members have more trade promotion measures than restrictions

The latest trade monitor released recently by the World Trade Organization shows that between mid-October 2023 and mid-May 2024, WTO members continued to introduce more trade promotion measures than trade restrictive measures. The WTO said it was an important signal of members' commitment to keep trade flowing amid the current geopolitical uncertainty. According to WTO statistics, during the monitoring period, WTO members adopted 169 trade promotion measures on commodities, more than the 99 trade restrictive measures introduced. Most of the measures are aimed at imports. Commenting on the findings, WTO Director-General Ngozi Okonjo-Iweala said that despite the challenging geopolitical environment, this latest trade monitoring report highlights the resilience of world trade. Even against the backdrop of rising protectionist pressures and signs of economic fragmentation, governments around the world are taking meaningful steps to liberalize and boost trade. This demonstrates the benefits of trade on people's purchasing power, business competitiveness and price stability. The WTO monitoring also identified significant new developments in economic support measures. Subsidies as part of industrial policy are increasing rapidly, especially in areas related to climate change and national security.

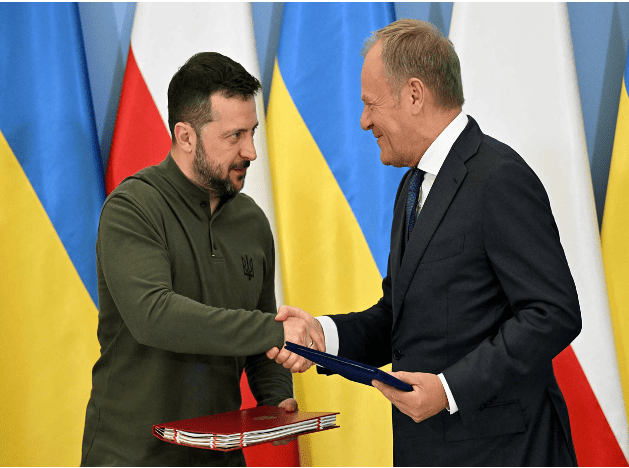

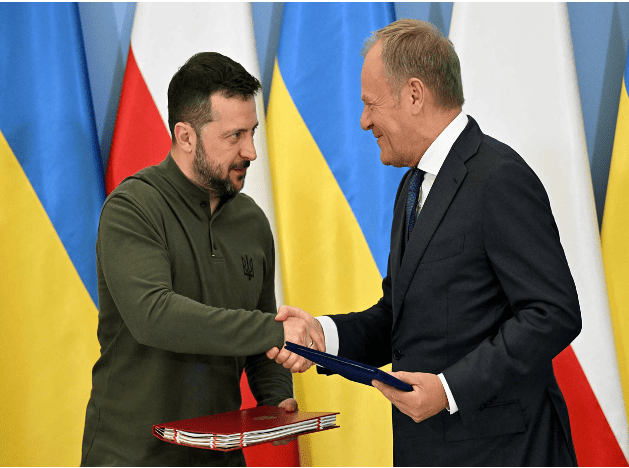

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland. The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises." Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.

TSX futures rise ahead of Fed chair Powell's testimony

July 9 (Reuters) - Futures linked to Canada's main stock index rose on the back of metal prices on Tuesday, while investors awaited U.S. Federal Reserve Chair Jerome Powell's congressional testimony on monetary policy later in the day. The S&P/TSX 60 futures were up 0.25% by 06:28 a.m. ET (1028 GMT). The Toronto Stock Exchange's materials sector was set to re Oil futures , dipped as fears over supply disruption eased after Hurricane Beryl, which hit major refineries along with the U.S. Gulf Coast, caused minimal impact. Markets will be heavily focussed on Powell's two-day monetary policy testimony before the Senate Banking Committee, starting at 10 a.m. ET (1400 GMT), which can help investors gauge the Fed's rate-cut path. Following last week's softer jobs data, market participants are now pricing in a 77% chance of a rate cut by the U.S. central bank in September. The main macro event for the markets this week will be the U.S. consumer prices data due on Thursday, which can help assess the trajectory of inflation in the world' biggest economy. Wall Street futures were also up on Tuesday after the S&P 500 (.SPX), opens new tab and Nasdaq (.IXIC), opens new tab touched record closing highs in the previous session. In Canada, fears of the economy slipping into recession advanced after the latest data showed that the unemployment rate rose to a 29-month high in June. Traders are now pricing in a 65% chance of another cut by the Bank of Canada, which already trimmed interest rates last month. In corporate news, Cenovus Energy (CVE.TO), opens new tab said it is demobilizing some staff at its Sunrise oil sands project in northern Alberta as a precaution due to the evolving wildfire situation in the area.

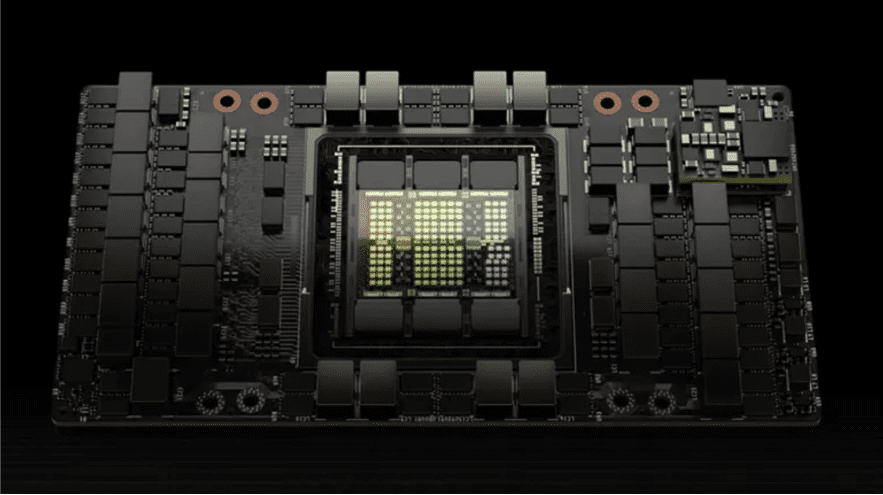

Nvidia H20 will sell 1 million units this year, contributing $12 billion in revenue!

Recently, according to the FT, citing the latest forecast data of the market research institute SemiAnalysis, AI chip giant NVIDIA will ship more than 1 million new NVIDIA H20 acceleration chips to the Chinese market this year, and it is expected that the cost of each chip is between $12,000 and $13,000. This is expected to generate more than $12 billion in revenue for Nvidia. Affected by the United States export control policy, Nvidia's advanced AI chip exports to China have been restricted, H20 is Nvidia based on H100 specifically for the Chinese market to launch the three "castration version" GPU among the strongest performance, but its AI performance is only less than 15% of H100, some performance is even less than the domestic Ascend 910B. When Nvidia launched the new H20 in the spring of this year, there were reports that due to the large castration of H20 performance, coupled with the high price, Chinese customers' interest in buying is insufficient, and they will turn more to choose China's domestic AI chips. Then there are rumors that Nvidia has lowered the price of the H20 in order to improve its competitiveness. However, the latest news shows that due to supply issues caused by the low yield of the Ascend 910B chip, Chinese manufacturers in the absence of supply and other better options, Nvidia H20 has started to attract new purchases from Chinese tech giants such as Baidu, Alibaba, Tencent and Bytedance. Analysts at both Morgan Stanley and SemiAnalysis said the H20 chip is now being shipped in bulk and is popular with Chinese customers, despite its performance degradation compared to chips Nvidia sells in the United States.

China will reach climate goal while West falls short

There has been constant low-level sniping in the West against China's record on climate change, in particular its expansion of coal mining, and its target of 2060 rather than 2050 for carbon zero. I have viewed this with mild if irritated amusement, because when it comes to results, then China, we can be sure, will deliver and most Western countries will fall short, probably well short. It is now becoming clear, however, that we will not have to wait much longer to judge their relative performances. The answer is already near at hand. We now know that in 2023 China's share of renewable energy capacity reached about 50 percent of its total energy capacity. China is on track to shatter its target of installing 1200GW of solar and wind energy capacity by 2030, five years ahead of schedule. And international experts are forecasting that China's target of reaching peak CO2 emissions by 2030 will probably be achieved ahead of schedule, perhaps even by a matter of years. Hitherto, China has advisedly spoken with a quiet voice about its climate targets, sensitive to the fact that it has become by far the world's largest CO2 emitter and aware that its own targets constituted a huge challenge. Now, however, it looks as if China's voice on global warming will carry an authority that no other nation will be able to compete with. There is another angle to this. China is by far the biggest producer of green tech, notably EVs, and renewable energy, namely solar photovoltaics and wind energy. Increasingly China will be able to export these at steadily reducing prices to the rest of the world. The process has already begun. It leaves the West with what it already sees as a tricky problem. How can it become dependent on China for the supply of these crucial elements of a carbon-free economy when it is seeking to de-risk (EU) or decouple (US) its supply chains from China? Climate change poses the greatest risk to humanity of all the issues we face today. There are growing fears that the 1.5-degree Celsius target for global warming will not be met. 2023 was the hottest year ever recorded. Few people are now unaware of the grave threat global warming poses to humanity. This requires the whole world to make common cause and accept this as our overarching priority. Alas, the EU is already talking about introducing tariffs to make Chinese EVs more expensive. And it is making the same kind of noises about Chinese solar panels. The problem is this. Whether Europe likes it or not, it needs a plentiful supply of Chinese EVs and solar panels if it is to reduce its carbon emissions at the speed that the climate crisis requires. According to the International Energy Authority, China "deployed as much solar capacity last year as the entire world did in 2022 and is expected to add nearly four times more than the EU and five times more than the US from 2023-28." The IEA adds, "two-thirds of global wind manufacturing expansion planned for 2025 will occur in China, primarily for its domestic market." In other words, willy-nilly, the West desperately needs China's green tech products. Knee-jerk protectionism demeans Europe; it is a petty and narrow-minded response to the greatest crisis humanity has ever faced. Instead of seeking to resist or obstruct Chinese green imports, it should cooperate with China and eagerly embrace its products. As a recent Financial Times editorial stated: "Beijing's green advances should be seen as positive for China, and for the world." The climate crisis is now in the process of transforming the global political debate. Hitherto it seemed relatively disconnected. That period is coming to an end. China's dramatic breakthrough in new green technologies is offering hope not just to China, but to the whole world, because China will increasingly be able to supply both the developed and developing world with the green technology needed to meet their global targets. Or, to put it another way, it looks very much as if China's economic and technological prowess will play a crucial role in the global fight against climate change. We should not be under any illusion about the kind of challenge humanity faces. We are now required to change the source of energy that powers our societies and economies. This is not new. It has happened before. But previously it was always a consequence of scientific and technological discoveries. Never before has humanity been required to make a conscious decision that, to ensure its own survival, it must adopt new sources of energy. Such an unprecedented challenge will fundamentally transform our economies, societies, cultures, technologies, and the way we live our lives. It will also change the nature of geopolitics. The latter will operate according to a different paradigm, different choices, and different priorities. The process may have barely started, but it is beginning with a vengeance. Can the world rise to the challenge, or will it prioritize petty bickering over the vision needed to save humanity? On the front line, mundane as it might sound, are EVs, wind power, and solar photovoltaics. The author is a visiting professor at the Institute of Modern International Relations at Tsinghua University and a senior fellow at the China Institute, Fudan University. Follow him on X @martjacques.