How China can transform from passive to active amid US chip curbs

On Monday, executives from the three major chip giants in the US - Intel, Qualcomm, and Nvidia - met with US officials, including Antony Blinken, to voice their opposition to the Biden administration's plan of imposing further restrictions on chip sales to Chinese companies and investments in China. The Semiconductor Industry Association also released a similar statement, opposing the exclusion of US semiconductor companies from the Chinese market. First of all, we mustn't believe that the appeals of these companies and industry associations will collectively change the determination of US political elites to stifle China's progress. These US elites are very fearful of China's rapid development, and they see "chip chokehold" as a new discovery and a successful tactic formed under US leadership and with the cooperation of allies. Currently, the chip industry is the most complex technology in human history, with only a few companies being at the forefront. They are mainly from the Netherlands, Taiwan island, South Korea, and Japan, most of which are in the Western Pacific. These countries and regions are heavily influenced by the US. Although these companies have their own expertise, they still use some American technologies in their products. Therefore, Washington quickly persuaded them to form an alliance to collectively prevent the Chinese mainland from obtaining chips and manufacturing technology. Washington is proud of this and wants to continuously tighten the noose on China. The New York Times directly titled an article "'An Act of War': Inside America's Silicon Blockade Against China, " in which an American AI expert, Gregory Allen, publicly claimed that this is an act of war against China. He further stated that there are two dates that will echo in history from 2022: The first is February 24, when the Russia-Ukraine conflict broke out, and the second is October 7, when the US imposed a sweeping set of export controls on selling microchips to China. China must abandon its illusions and launch a challenging and effective counterattack. We already have the capability to produce 28nm chips, and we can use "small chip" technology to assemble small semiconductors into a more powerful "brain," exploring 14nm or even 7nm. Additionally, China is the world's largest commercial market for commodity semiconductors. Last year, semiconductor procurement in China amounted to $180 billion, surpassing one-third of the global total. In the past, China had been faced with the choice between independent innovation and external purchases. Due to the high returns from external purchases, it is easy for it to become the overwhelming choice over independent research and development. However, now the US is gradually blocking the option of external purchases, and China has no strategic choice but to independently innovate, which in turn puts tremendous pressure on American companies. Scientists generally expect that, although China may take some detours, such as recently apprehending several company leaders who fraudulently obtained subsidies from national semiconductor policies, China has the ability to gradually overcome the chip difficulties. And we will form our own breakthroughs and industrial chain, which is expected to put quite a lot of pressure on US companies. If domestic firms acquire half of China's $180 billion per year in chip acquisitions, this would provide a significant boost for the industry as a whole and help it advance steadily. The New York Times refers to the battle on chips as a bet by Washington. "If the controls are successful, they could handicap China for a generation; if they fail, they may backfire spectacularly, hastening the very future the United States is trying desperately to avoid," it argued. Whether it is a war or a game, when the future is uncertain, what US companies hope for most of all is that they can sell simplified versions of high-end chips to China, so that the option of external purchases by China continues to exist and remains attractive. This can not only maintain the interests of the US companies, enabling them to obtain sufficient funds to develop more advanced technologies, but also disrupt China's plans for independent innovation. This idea is entirely based on their own commercial interests and also has a certain political and national strategic appeal. Hence, there is no shortage of supporters within the US government. US Secretary of the Treasury Janet Yellen seems to be one of them, as she has repeatedly stated that the US' restrictions on China will not "fundamentally" hurt China, but will only be "narrowly targeted." The US will balance its strict suppression on China from the perspective of maintaining its technological hegemony, while also leaving some room for China, in order to undermine China's determination to counterattack in terms of independent innovation. China needs to use this mentality of the US to its advantage. On the one hand, China should continue to purchase US chips to maintain its economic fundamentals, and on the other hand, it should firmly support the development of domestic semiconductor companies from both financial and market perspectives. If China were to continue relying on exploiting the gaps in US chip policies in the long term, akin to a dependency on opium, it would only serve to weaken China further as it becomes increasingly addicted. China's market is extremely vast, and its innovation capabilities are generally improving and expanding. Although the chip industry is highly advanced, if there is one country that can win this counterattack, it is China. As long as we resolutely continue on the path of independent innovation, this road will definitely become wider. Various breakthroughs and turning points that are unimaginable today may soon occur.

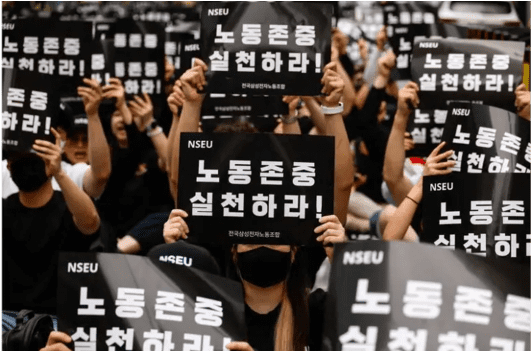

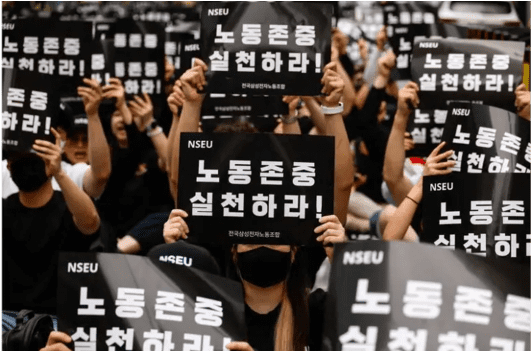

Samsung hit the biggest strike! Over 6,500 people attended.

More than 6,500 employees at South Korea's Samsung Electronics began a three-day mass strike on Monday (July 8), demanding an extra day of paid annual leave, higher pay raises and changes to the way performance bonuses are currently calculated. This is the largest organized strike in Samsung Electronics' more than half century of existence, and the union said that if this strike does not push employees' demands to be met, a new strike may be called. One of the core issues of the current dispute between the labor union and Samsung Electronics is raising wages and increasing the number of paid vacation days. The second demand is a pay rise. The union originally wanted a pay rise of more than 3% for its 855 employees, but last week they changed their demand to include all employees (rather than just 855). The third issue involves performance bonuses linked to Samsung's outsized profits - chip workers did not receive the bonuses last year when Samsung lost about Won15tn and, according to unions, fear they will still not get the money even if the company manages to turn around this year.

Adult Film Star Jesse Jane's Cause of Death Revealed

New details about Jesse Jane’s death have emerged. More than six months after the former adult film star was found dead alongside her boyfriend Brett Hasenmueller in her Moore, Oklahoma, home from a suspected overdose, authorities confirmed what led to the tragedy. Jane and Hasenmueller reportedly died of an accidental fentanyl and cocaine overdose according to TMZ, citing the Oklahoma City Medical Examiner’s Office. E! News has reached out to the Examiner’s Office for comment but had not yet heard back. In late January, local outlet KFOR reported that Moore Police found Jane and Hasemueller’s bodies while performing a wellness check after the couple had not been heard from in several days. Moore PD's Lt. Francisco Franco told The New York Times at the time that it was believed Jane died from a drug overdose, but that both deaths remained under investigation. Jane, who was 43 at the time of her passing, acted in a number of adult films starting in 2003 before transitioning to other projects, including an appearance in Baywatch: Hawaiian Wedding and 2004's Starsky and Hutch, as well as season two of Entourage. Pretty Pastel Please, YouTuber, Instagram By 2007, Jane had officially retired from the adult film industry, pivoting into making her own line of sex toys. At the time of her death, BSG Public Relations President Brian Gross shared in a statement to E! News, "Jesse Jane was a vivacious person who had an absolute and ultimate love for life. During her time in the adult industry, of which I was able to spend wonderful moments with her, she was an incredible professional who cheered everyone on and brought sunshine to every film set she worked on." "There is not one person in the adult industry who didn't spend time with her, whether onset or in a social setting, that she didn't make smile, laugh or both. She would light up a room as soon as she walked in," he continued, "I will personally miss her very much for the reasons above. Her smile was everything."

How the iPhone 16 With AI Could Send Apple's Market Value to $4T

Apple could be on track to reach a $4 trillion market capitalization with the artificial intelligence (AI) iPhone 16 upgrade cycle coming, Wedbush analysts said. The analysts said the iPhone 16 supercharged with AI could bring a "golden upgrade cycle" for Apple. Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. Apple (AAPL) could be on the path to a $4 trillion market capitalization as an iPhone upgrade cycle approaches, driven by the iPhone 16 supercharged with artificial intelligence (AI) capabilities, according to Wedbush analysts. 1 Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. AI iPhone 16 Upgrade Cycle Coming Soon Wedbush analyst said that an AI iPhone 16 could bring "a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally." "The Street is now starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution," they said, with 2.2 billion iOS devices globally and 1.5 billion iPhones. Wedbush suggested a "consumer AI tidal wave" could start with the iPhone 16 in mid-September, adding that estimates indicate 270 million iPhones users have not upgraded in over four years. Recovery in China To Support Upgrade Cycle The analysts indicated that iPhone supply stabilization in Asia is also "a very good sign heading into a monumental iPhone 16 upgrade cycle." Wedbush's projections come amid ongoing concerns for the iPhone maker in the China region amid increased competition, though there have been recent signs of improving shipments. They projected that June "will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter," when the iPhone 16 is expected to be released. AI and iOS 18 Could Also Boost Share Value Apple unveiled iOS 18 supercharged by Apple Intelligence and an AI partnership with OpenAI at its developers' conference in June. Wedbush analysts said the partnership with the Chat-GPT maker "creates the highway for developers around the globe to focus on iOS 18 and this in turn will create a myriad of monetization opportunities for Cook & Co. over the coming years." The analysts estimated that "this could result in incremental Services high margin growth annually of $10 billion for Apple" driven by hardware and software. They added they believe "AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share." Apple shares were little changed in early trading Monday, though they have gained more than 17% since the start of the year. Do you have a news tip for Investopedia reporters? Please email us at tips@investopedia.com SPONSORED Trade on the Go. Anywhere, Anytime One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.