Audi RS e-tron GT intelligent cockpit innovation analysis

RS e-tron GT: Shares J1 platform with Porsche Taycan. The iconic closed hexagonal "big mouth" is quite a brand recognition, and the rear of the car uses a decorative design shaped like a diffuser. Although the difference between it and the regular e-tron GT is very limited, the "RS" nameplate on the rear of the car means that it is not an ordinary person, of course, low-key is also the style of AUD-Sport. The center console continues the family design of the Audi brand, the lines are simple and refined, and the center control screen, the front air conditioning control panel and the function keys below are obviously tilted to the driver's side, echoing the product positioning of the driver's car. Sports seats, leather fabrics with red stitches, etc. appear in the configuration table of the car, rendering the interior sports atmosphere just right, and the overall beauty of the cabin has been affirmed by the reviewers. Although the official model of the cockpit chip selected by the car has not been announced, it has a high score in the evaluation items such as the cold start speed of the car, the start speed of the core application and the navigation search speed, which shows that the car performance is good. In addition, in terms of specifications and accuracy, the car received full marks in the touch accuracy and screen sharpness evaluation, and the daily high-frequency interaction experience is excellent. Of course, if you optimize the voice car control ability, its intelligent experience will be a higher level.

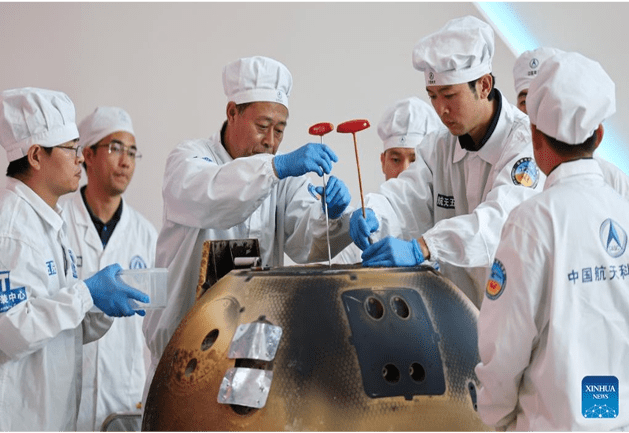

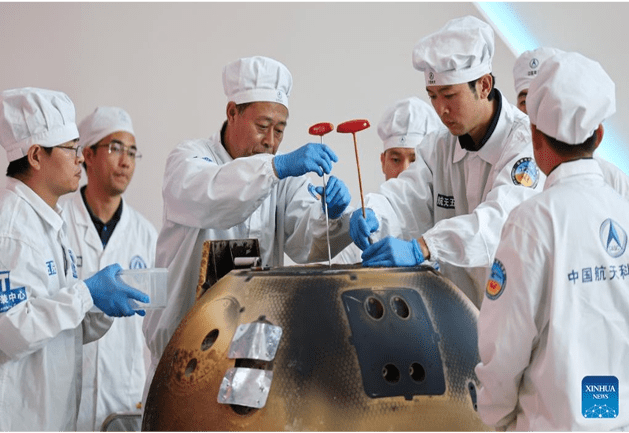

NASA plays 'blame-shifting' game with China as lunar soil research set to start

The returner of the Chang'e-6 lunar probe is opened during a ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation in Beijing, capital of China, June 26, 2024. The returner of the Chang'e-6 lunar probe was opened at a ceremony in Beijing on Wednesday afternoon. During the ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation, researchers opened the returner and examined key technical indicators. Photo: Xinhua As the US space industry recently faced yet more delays and stagnation with key components including manned spacecraft and space suits "going wrong," NASA has once again resorted to its "sour grapes" rhetoric upon seeing China's successful retrieval of fresh lunar soils from the far side of the moon, by claiming that China did not directly invite its scientists to participate in the lunar soil research. This behavior is a typical blame-shifting trick, Chinese experts said, noting it is clear to all that it is the US' own laws, not China, that are restricting space cooperation between the two sides. Instead of deceiving themselves by distorting the truth, the US should face up to its own problem of overall weakening engineering capability and the lack of long-term planning in its space industry. After the Chang'e-6 samples, weighing nearly 2 kilograms, were safely transported to a special laboratory for further study on Friday, NASA spokesperson Faith McKie told media that while China worked with the European Space Agency, France, Italy and Pakistan on this mission, "NASA wasn't invited to take part in the moon probe." NASA also didn't get "any direct invitation" to study China's moon rocks, after it welcomed all scientists from around the world to apply to study them, McKie told NatSec Daily. Responding to the remarks, Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on Monday that China is open to having space exchanges with the US, and we also welcome countries around the world to take part in the study of lunar samples. "However, the US side seems to have forgotten to mention its domestic legislation such as the Wolf Amendment. The real question is whether US scientists and institutions are allowed by their own government to participate in cooperation with China," Mao said. "The existence of the Wolf Amendment has basically shut the door to space collaboration between the two countries," Wang Yanan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times on Monday. Even if research institutions of the US have the willingness to work with China on opportunities such as lunar sample research, institutions there must obtain special approval from the US Congress due to the presence of this amendment, Wang explained. Currently, no such "green light" is in sight from the Congress. Furthermore, China's collaboration with international partners is based on equality and mutual benefit, leveraging their respective scientific resources, facilities, and expertise. However, the US only wants what it doesn't have, and its engagement with China would be advantageous only to itself, Wang noted. NASA has found itself embroiled in a number of thorny issues recently, with the latest being Boeing's Starliner manned spaceship experiencing both helium leaks and thruster issues during a June 6 docking with the International Space Station (ISS), which led to an indefinite delay for its crew's return to Earth, despite NASA's insistence that they are not "stranded" in space. The return of the Starliner capsule, while has already been delayed by two weeks, will be put on hold "well into the summer" pending results of new thruster tests, which are scheduled to start Tuesday and will take approximately two weeks or even more, per NASA officials. Previously on June 24, NASA cancelled a spacewalk on the ISS following a "serious situation," when one of the spacesuits experienced coolant leak in the hatch. While being broadcast on a livestream, the astronauts reported "literally water everywhere" as they were preparing for the extravehicular activity, space.com reported. The report said that this is the second time this particular spacewalk was postponed, after a June 13 attempt with a different astronaut group was pushed back due to a "spacesuit discomfort." The recurring issues with the spacesuits are due to their much-extended service lifespan, media reported, as the puffy white ones US astronauts currently wear were designed more than 40 years ago. Despite the pressing need to replace them, NASA announced recently that it is abandoning a plan to develop next-generation spacesuits, which had been committed to be delivered by 2026, CNN reported on Thursday. One of the root causes for such problems is that the US has developed many large technology conglomerates, which for a long time have benefited significantly from government orders and industry monopolies. Consequently, in many complex engineering fields, the level of attention given is greatly insufficient, Wang noted. It also reflected the US' lack of long-term strategic planning for its manned space program. For instance, the ageing spacesuits should have been replaced a decade ago to ensure that operational suits remain in usable condition. Failure to address this issue results in a hindrance to the space station's necessary maintenance tasks and even poses life-threatening risks to astronauts in emergency situations, experts said. The issues with Boeing's spacecraft and the spacesuits are not isolated problems, but reflected a systemic issue in the US space industry - the overall weakening of engineering capabilities, they noted.

Koenigsegg Fused Three Hypercars Into One To Make The Chimera

Koenigsegg Agera RS Chimera combines technologies from Agera RS, CC850, and Jesko. An Agera RS platform features the engine from the Jesko and the simulated manual gearbox from the CC850. Development took three years, thanks to software and hardware integration challenges. A "chimera," for the uninitiated, is described as a mythical creature whose anatomy comes from multiple animals, creating a hybrid of two or more creatures' best bits. It's also the name of the latest one-off creation from Koenigsegg, and it's certainly apt; the Koenigsegg Agera RS Chimera is an amalgam of technologies from the decade-old, record-breaking Agera RS, the fascinatingly innovative CC850, and the awe-inspiring Jesko - which just recently set four new acceleration records. There's also a hint of Regera in here, which had some impressive records of its own. As reported by Mr. JWW, the strictly one-off special edition was commissioned by FIA President Mohammed Ben Sulayem, and both he and one of Koenigsegg's engineers arrived at the same name. Let's take a closer look and see exactly why this is a hybrid, even though it's not electrified. Three Cars In One The Chimera was originally a regular Agera RS and one of several Koenigsegg megacars owned by Ben Sulayem, but he asked Christian and the team to initiate a special project on his behalf. Around the same time, the extraordinary Koenigsegg CC850 was revealed at Monterey Car Week 2022, introducing the innovative Engage Shift System (ESS). This was based on the already astonishingly fast nine-speed Light Speed Transmission, with new actuators and sensors added to enable the simulation of a manual transmission without a physical link between the shifter and the gearbox. Like the rest of the world, the FIA boss was enamored by this novel technology, and as a wealthy 'Egg collector, he asked for it to be put into his special Agera-based project. Christian pondered this and ultimately decided to fulfill the request, in the process turning Ben Sulayem's special edition into something of a development mule for the ESS. But unlike the CC850, the Chimera got the larger turbos of the Jesko, enabling around 1,280 horsepower on regular gas and up to 1,600 hp on E85. That means this is an Agera RS with a CC850 transmission and a Jesko engine. On paper, that sounds simple, but the reality was anything but... Three Shifting Experiences Took Three Years To Combine According to a video from YouTuber and Koenigsegg distributor Mr. JWW, this development process took three years and required the relocation of the battery, new mounts for the powertrain, new harnesses, new software and controllers, and even a new infotainment system. To ensure all the electronics worked seamlessly was a challenge, but then Ben Sulayem asked for another layer of intricacy, requesting that paddle shifters be added, like in the Jesko Absolut and Jesko Attack. In the CC850, you could only switch between the simulated manual mode and fully automatic shifts, but now, the Chimera's development has unlocked manually operable paddles, which have now been added as the only option you can add to a CC850. There was also significant relocation and redesigning of suspension components, with parts from the Jesko and the Regera forming the subframe and elements of the suspension, respectively. A new scoop for the new transmission's cooler was also added, but it looks like it was always planned. Christian von Koenigsegg says this is a true one-off, saying that it would be cheaper and easier to start something all-new from scratch than to mix new and old technologies again, and that it's simply "too much work" to tackle a retrofit project. The Chimera is not completed just yet, as there are still subtle elements to refine, such as the bite point of the clutch pedal, but these minor issues will surely be resolved soon. It's an amazing feat, combining three hypercars in one, and we can't even fathom how Koenigsegg will top this in the future, but we don't doubt that Christian and his team will continue to do just that.

MOFCOM refutes EU comments on anti-subsidy investigation into Chinese EVs

A spokesperson for the Ministry of Commerce (MOFCOM) on Monday rejected remarks from the EU Ambassador to China on the anti-subsidy investigation into Chinese electric vehicles (EVs). MOFCOM said China had expressed strong opposition through various channels since October 2023 and has always advocated for handling economic and trade frictions through dialogue and consultation in order to maintain the overall strategic partnership between China and Europe. EU Ambassador to China Jorge Toledo claimed on Sunday that the EU has been trying to engage with China for months regarding the imposition of tariffs on Chinese EVs but that China had only recently sought to initiate discussions. This is false, the spokesperson said. MOFCOM said that after the European Commission (EC) officially filed a case, Chinese Commerce Minister Wang Wentao sent a letter to European Commission Executive Vice-President Valdis Dombrovskis on October 24, 2023, expressing hope to resolve the case through dialogue and negotiation. On November 13, 2023, Wang sent another letter to the European side proposing negotiation suggestions. In February 2024, Wang met with Dombrovskis during the WTO's 13th Ministerial Conference face to face and proposed dialogue and negotiation with the European side. On May 19, 2024, Wang reiterated the hope for dialogue and negotiation to resolve the case in a letter to the European side. Additionally, Chinese technical experts have been sending signals to the European side regarding on-site inspections, hearings, and other channels since the case was filed, expressing willingness to resolve trade frictions through dialogue and negotiation. On the day the preliminary ruling was announced on June 12, Dombrovskis replied to Wang in a letter, expressing the desire for both sides to strengthen dialogue to resolve the case. On June 22, Wang held a video conference with Dombrovskis, and they agreed to start negotiations on the EU's anti-subsidy investigation into Chinese EVs. Subsequently, China sent a working group to Europe for negotiations on June 23, and multiple rounds of technical consultations were held simultaneously via video. MOFCOM said that China has shown the utmost sincerity and hopes that the European side will meet China halfway, show sincerity, and push forward the negotiation process to reach a mutually acceptable solution as soon as possible. China has always believed that trade protectionist measures are not conducive to the development of global green industries and automotive industry cooperation. Efforts should be made to adhere to dialogue and cooperation to promote economic green transformation, rather than creating divisions and disrupting global industrial and supply chains, MOFCOM said. China firmly opposes any unilateralism and protectionism that politicizes and weaponizes economic and trade issues, and will take all necessary measures to defend its own interests against any abuse of rules and suppression of China, MOFCOM added.

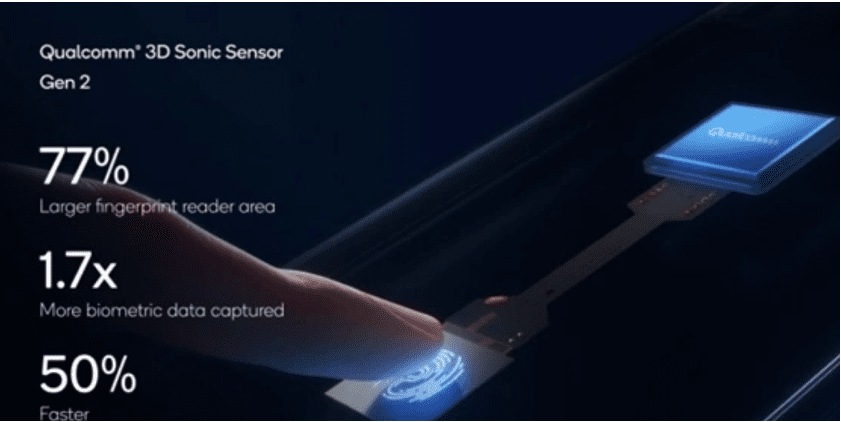

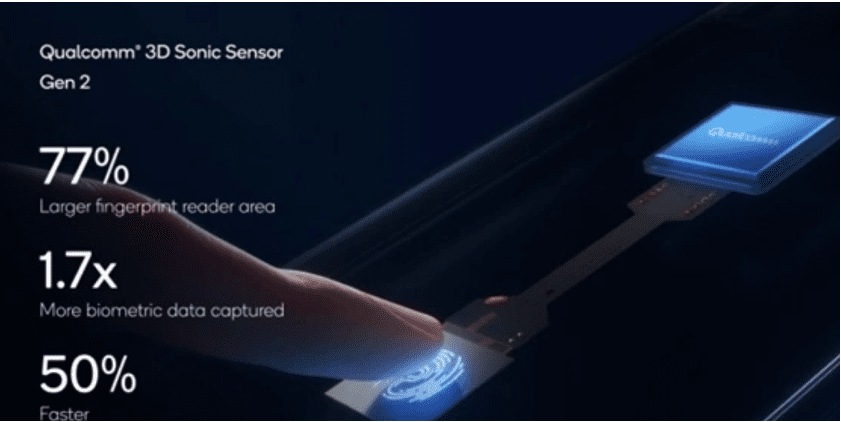

Google Pixel 9 series phones will use Qualcomm ultrasonic fingerprint recognition technology

Google's new generation of flagship smartphone Pixel 9 series is expected to be officially released in mid-August, and the new machine is likely to be equipped with ultrasonic fingerprint recognition technology for the first time to replace the original optical fingerprint recognition. According to core intelligence, Google Pixel 9 series will use the same Qualcomm 3D Sonic Gen 2 ultrasonic fingerprint recognition sensor as the Samsung Galaxy S24 Ultra. This ultrasonic technology under the screen fingerprint sensor is Qualcomm released at the CES2021 conference, compared with the previous generation of solutions, the module thickness is further reduced to 0.2mm, while the scanning area is expanded to 8mm×8mm, that is, the recognition area is increased by 77%. This will also allow users to realize fingerprint recognition without having to point their fingertips 100% accurately at the identification area indicated on the screen.