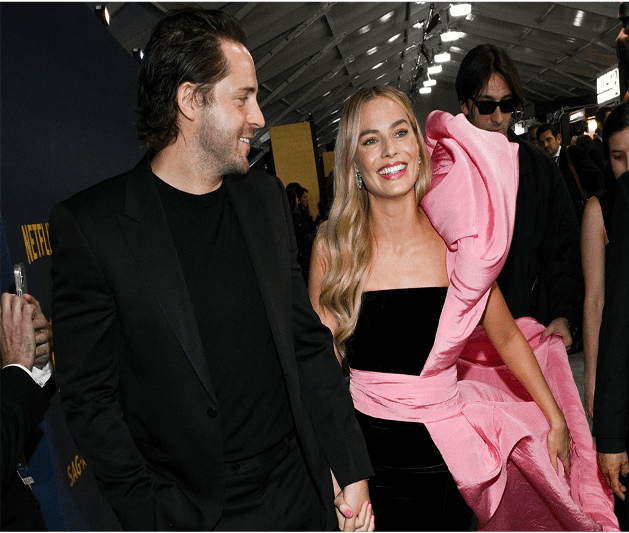

This Barbie is going to be a mother.

And Margot Robbie has no problem putting her burgeoning baby bump on full display. In fact, the Barbie star, who is pregnant with her Tom Ackerley’s first baby, debuted recently her bump while vacationing on Italy’s Lake Como with her husband July 7.

For the outing, Margot donned a black blazer over a white tee that was cropped above her stomach, showing off a sweet baby bump. She finished off the look with low-rise black trousers, black platform sandals and a summery straw bag.

For his part, Tom—whom Margot wed in a 2016 ceremony in her native Australia—wore olive green trousers and a cream-colored button-down shirt and tan sneakers.

The couple were photographed waiting on a dock in Lake Como before they hopped in a boat and sailed off into a literal sunset.

While Margot and Tom, both 34, haven’t spoken publicly about their upcoming bundle of joy, the I, Tonya alum has previously expressed hope to have a big family one day. As she told Porter in 2018, “If I'm looking into my future 30 years from now, I want to see a big Christmas dinner with tons of kids there.”

Tom and Margot’s new chapter comes over ten years after their love story first began on the set of 2014's Suite Française, in which Margot starred while Tom worked as a third assistant director.

But while she was immediately smitten, Margot was convinced her love would go unrequited.

"I was always in love with him, but I thought, ‘Oh, he would never love me back,'" she admitted to Vogue in 2016. "'Don't make it weird, Margot. Don't be stupid and tell him that you like him.' And then it happened, and I was like, ‘Of course we're together. This makes so much sense, the way nothing has ever made sense before.'"