BRI: embracing Chinese green practices for a sustainable future

Editor's Note: This year marks the 10th anniversary of the Belt and Road Initiative (BRI) proposed by Chinese President Xi Jinping. Through the lens of foreign pundits, we take a look at 10 years of the BRI - how it achieves win-win cooperation between China and participating countries of the BRI and how it has given the people of these countries a sense of fulfillment. In an interview with Global Times (GT) reporter Li Aixin, Erik Solheim (Solheim), former under-secretary-general of the United Nations and former executive director of the UN Environment Programme, recalled how the BRI helped shorten a previously long journey in Sri Lanka to a half-hour trip. "We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together," Solheim said. This is the 18th piece of the series. GT: How do you evaluate the role of the BRI in promoting development in participating countries over the past 10 years? Solheim: The BRI has been a major driver of development since it was announced by President Xi Jinping in Kazakhstan 10 years ago. The China-Laos Railway has connected landlocked Laos to the Chinese and European rail network, making it possible for Laos to sell more goods and welcome more tourists. Rail corridors in Kenya and from Djibouti to Addis Ababa connect the interior of Africa to the coast, bringing opportunities for much faster development in East Africa. The Bandung-Jakarta railway in Indonesia, Hanoi metro, roads and ports in Sri Lanka - there are great examples of good south-south and BRI projects in almost every corner of the world. GT: In your experience of traveling around the world, has any BRI-related story left a deep impression on you? Solheim: Yes, many! I'll just mention two. When I was chief negotiator in the Sri Lanka peace process 15 years ago, it took a long time to travel from the airport to Colombo, the capital of Sri Lanka. When I came back last year, it took half an hour on wonderful Chinese-built highways. Traveling through Mombasa, a coastal city in Kenya, you see a lot of poverty and run down houses. Then all of a sudden, a green, clean, well-run oasis opens up. It's the end station of the Nairobi-Mombasa railway which links the capital Nairobi to the coast. The rail station stands out and is showing the future for Kenya. GT: The EU proposed the Global Gateway, and the US proposed the Build Back Better World. What do you think are the similarities and differences between these projects and the BRI? Solheim: I really wish success for the Western initiatives. What developing nations ask for is a choice of good cooperation with both China and the West. Unfortunately, up to now, a number of the Western-led initiatives have been more like media events. They lack structure, secretariat, finances and clear direction. Nearly all nations in the world want to see close people-to-people relations, investment and political cooperation with both China and the West. No one wants to choose. GT: Some people from the West are talking about "de-coupling" and "de-risking." Both seem to be another way of saying "de-globalization." Do you think "de-coupling" and "de-risking" will affect the BRI? And what role will the BRI play in maintaining globalization? Solheim: Decoupling is probably the most unwise idea in the world today. It's outright dangerous. Facing climate change, environmental degradation, economic troubles, war in Ukraine and other places, and the threat of pandemics, we need more, not less, cooperation. We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together. Almost all developing countries have made BRI agreements with China. As an example, when President Xi met all the leaders of Central Asia recently in Xi'an, Northwest China's Shaanxi Province, they made a very ambitious declaration on future green cooperation between China and Central Asia. GT: You have previously said that the BRI is a fantastic vehicle to promote green global development, which can boost the economy and ecology at the same time. Could you elaborate on how you think the BRI has achieved development of the economy and ecology? Solheim: In the beginning there were too many fossil fuel projects among BRI programs. In the BRI International Green Development Coalition, we argued this should stop. When President Xi pledged to stop building new coal-fired power projects overseas, it was one of the most important environmental decisions ever. Also, it happened at a time when important BRI nations like Bangladesh, Kenya and Pakistan decided they could grow their economies and go green without coal. The BRI will in the next decade become the world's most important vehicle for green energy and green transport. We will see massive investments in solar and wind power, hydrogen, electric batteries and more. GT: How do you view China's goal of achieving harmony between humanity and nature in modernization? In what way is China's story in pursuing harmony between humanity and nature relevant to other countries? Solheim: China now covers between 60 percent and 80 percent of all major green technologies in the world - solar, wind, hydro, batteries, electric cars and high-speed rail. Companies like Longi, BYD and CATL are the world leaders in their sectors. More remarkably and maybe less noticed abroad, China is also a global leader in protecting nature. It's embarking upon one of the most massive national park programs, with a focus on Qinghai Province and Xizang Autonomous Region. China is by far the biggest tree planter in the world and the global leader in desert control in Kubuqi, Inner Mongolia and other places. China has been hugely successful in the recovery of endangered species like the Giant Panda, Tibetan Antelope and Snow Leopard. A new center for mangrove restoration is being set up in Shenzhen and the fishing ban in the Yangtze will restore that magnificent ecosystem. The Belt and Road is a great opportunity for the world to learn from good Chinese green practices.

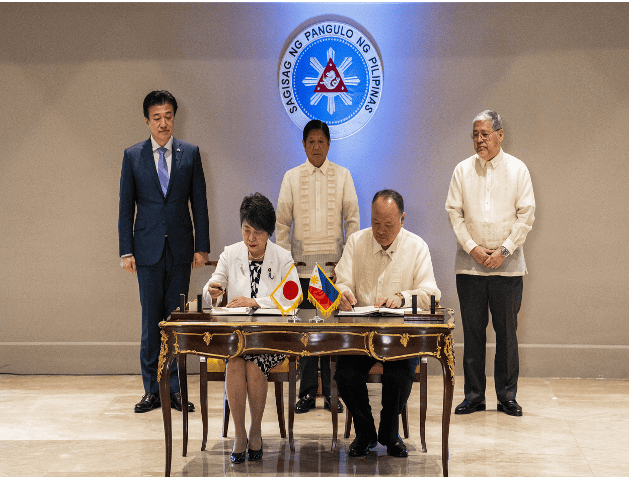

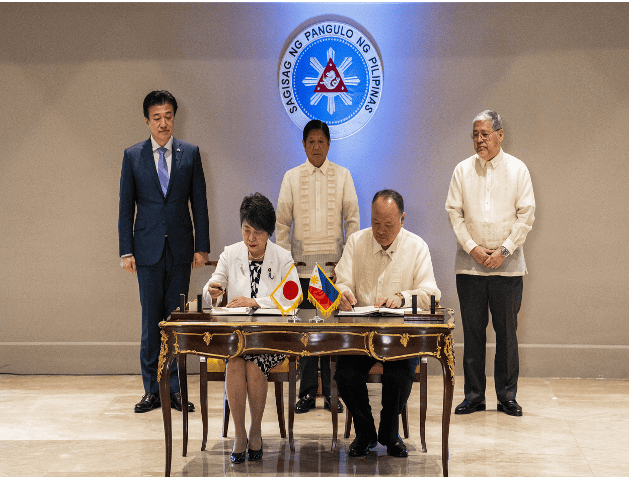

Japan and the Philippines signed the "Reciprocal Access Agreement". Experts: Japan wants to use the Philippines to strategically contain China

Japan and the Philippines signed an important defense agreement, and the two sides became "quasi-allies". On July 8, local time, Japan and the Philippines signed the "Reciprocal Access Agreement" in Manila. The agreement will relax restrictions on the movement of personnel between the Japanese Self-Defense Forces and the Philippine military during joint exercises, mutual visits and other operations in each other's countries. In response, Chinese Foreign Ministry spokesman Lin Jian responded at a regular press conference on the 8th that exchanges and cooperation between countries should not undermine mutual understanding and trust between regional countries, should not undermine regional peace and stability, and should not target third parties or undermine the interests of third parties. The Asia-Pacific region does not need military groups, let alone "small circles" that provoke camp confrontation and instigate a "new Cold War". Any actions that undermine peace and stability in the region and undermine unity and cooperation in the region will arouse the vigilance and common opposition of the people in the region. Japan and the Philippines upgraded to a "quasi-alliance" relationship On the same day, a "2+2" meeting attended by the foreign ministers and defense ministers of Japan and the Philippines was held in Manila. Japanese Defense Minister Minoru Kihara and Foreign Minister Yoko Kamikawa attended the talks with Philippine Defense Minister Gilbert Teodoro and Foreign Minister Enrique Manalo. This is the second Japan-Philippines "2+2" meeting. The last one was held in Tokyo in April 2022. Witnessed by Philippine President Marcos, the two sides signed the "Reciprocal Access Agreement". Marcos expressed the hope that the bilateral relations between the Philippines and Japan and the trilateral cooperation between the Philippines, Japan and the United States will be further deepened. The "Reciprocal Access Agreement" is also known as the "Military Visits Agreement". Military and defense cooperation between sovereign states, especially sending troops into each other's territory, usually faces complicated procedures and other problems. In order to simplify the procedures, the two countries will reach relevant agreements to simplify the approval procedures for the entry of troops from both sides into each other's countries, and facilitate mutual visits and joint military activities between the two countries' troops. The "Reciprocal Access Agreement" was born. Take the "Reciprocal Access Agreement" signed by Japan and Australia (full name "Agreement between Japan and Australia on Promoting Mutual Access and Cooperation Facilitation between the Japanese Self-Defense Forces and the Australian Defense Force") as an example. The agreement has 29 articles, covering many areas such as entry and exit procedures for troops, jurisdiction, taxation, cost burden and compensation. The key is to simplify the entry and exit procedures for visiting troops and their members, ships, aircraft, etc., relax restrictions on the transportation of weapons, ammunition and materials carried by visiting troops, and provide a legal basis for the two countries' troops and weapons and equipment to enter each other's territory. Japan and the Philippines signed the "Reciprocal Access Agreement", making the Philippines the third country to conclude this agreement with Japan after Australia and the United Kingdom. Cai Liang, Secretary-General and Researcher of the China-Japan Relations Research Center of the Shanghai Institute for International Studies, analyzed to The Paper (www.thepaper.cn) that Japan and the Philippines have their own strategic considerations for signing the "Reciprocal Access Agreement". As for the Philippines, due to its limited strength, it does not exclude any foreign power willing to strengthen military cooperation with the Philippines from intervening in the South China Sea situation. Therefore, it can be seen that in the past two years, the Philippines has actively promoted Australia, France, India and other countries to intervene in the South China Sea and strengthen military cooperation with them, involving intelligence, weapons and equipment, and training and exercises. "Japan's purpose is very simple. Strengthening military cooperation with the Philippines is to strategically balance China. The United States and the Philippines are allies, and the US-Japan alliance has been upgraded to a 'quasi-alliance'. The military cooperation between the United States, Japan and the Philippines has been upgraded to a new level." Cai Liang said, "The signing of an important defense agreement between Japan and the Philippines will make it easier for Japan to intervene in the South China Sea situation and seek the 'three seas linkage' of the East China Sea, the South China Sea, and the Taiwan Strait, in order to better respond to China's strategy and enhance its international influence." As for whether the signing of the "Reciprocal Access Agreement" means that Japan will deploy the Self-Defense Forces in the Philippines, Cai Liang pointed out that this agreement only simplifies the procedures for the troops of both sides to enter each other's territory, and is more suitable for short-term training, military exercises, etc., and is not a long-term deployment of the Self-Defense Forces in the Philippines. The two countries deepen military cooperation The Philippine presidential office also said in a statement that Japan is one of the four major strategic partners of the Philippines, and the two countries have established a strategic partnership for more than ten years. It seems no coincidence that Japan and the Philippines signed the "Reciprocal Access Agreement" at this time. Recently, China-Philippines relations have become tense around the situation in the South China Sea. The Global Times quoted Japan's Kyodo News Agency as saying that the two sides are seeking to strengthen cooperation against China. Minoru Kihara said last week: "The Philippines is located in a strategically important region, occupies a key position on Japan's sea lanes, and is also an ally of the United States. Joint training and strengthening cooperation with the Philippines are of great significance to the realization of a 'free and open Indo-Pacific region'." Cai Liang said that Japan's intervention in the South China Sea situation is mainly to reduce strategic pressure in the East China Sea and southwest of Japan, but it is not conducive to peace and stability in the South China Sea. It is reported that Japan and the Philippines began negotiations on the agreement in November last year. The signing of the "Reciprocal Access Agreement" by the two sides lays the foundation for the two countries to strengthen bilateral and even multilateral military cooperation in the future. The Japanese government intends to allow the Self-Defense Forces to formally participate in the annual US-Philippines "Shoulder to Shoulder" joint exercises around the Philippines after the agreement comes into effect. The Self-Defense Forces previously participated in the "Shoulder to Shoulder" exercises as observers, and will be able to formally participate after signing the agreement. In April this year, the United States and the Philippines held the largest "Shoulder to Shoulder" exercise to date, involving 5,000 Philippine personnel and 11,000 US personnel. The military exercise also included about 150 Australian military personnel and 100 French naval personnel. According to the plan, 14 countries including Japan and India sent personnel as observers. The "Typhon" medium-range missile launch system deployed by the US military on Luzon Island in the Philippines for the first time participated in the exercise, which aroused great attention from all walks of life. In terms of weapons and equipment exports, Japan and the Philippines have gradually strengthened military cooperation in recent years. The Philippines recently agreed to purchase five Coast Guard patrol ships from Japan to enhance its patrol capabilities in the South China Sea. Defense News reported in November last year that the Philippines had received an early warning radar system from Japan in 2023, the first major equipment transfer since the Japanese government lifted the postwar defense export ban in 2014. The Japanese Ministry of Foreign Affairs stated that Kamikawa mentioned topics such as defense equipment transfer, "government security capability enhancement support" (OSA), and economic and trade cooperation. The OSA project was created by the Kishida government and plans to allocate billions of yen in budget to assist the military construction of the Philippines and other countries, including providing the Philippines with 5 sets of coastal surveillance radars. Regarding Japan's relaxation of restrictions on defense equipment exports, the Chinese Ministry of Defense previously responded that Japan has continuously broken through the constraints of the "peace constitution" and the principle of "exclusive defense", and has been making small moves in the field of military security, which has aroused high vigilance and strong concern from the international community. China requires Japan to deeply reflect on its history of aggression, attach importance to the security concerns of its Asian neighbors, adhere to the path of peaceful development, and win the trust of its Asian neighbors and the international community with practical actions.

Will chatGPT lead to job losses?

In fact, ChatGPT can bring more opportunities to many industries, such as customer service, marketing, speech recognition, and more. ChatGPT can help businesses engage with customers more effectively, improve the customer experience, and give businesses more time and resources to focus on other tasks. Come to see While ChatGPT can replace humans in certain situations, it is not a complete replacement for humans. In many cases, human-to-human communication is still the most effective way. Therefore, the emergence of ChatGPT will not lead to the unemployment of all people, but will cause structural changes in the labor force and the redistribution of occupations.

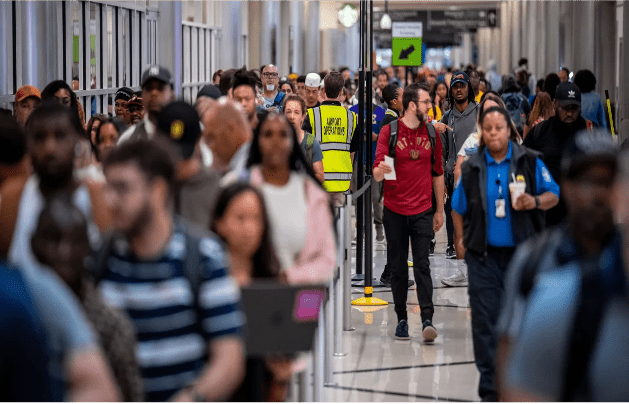

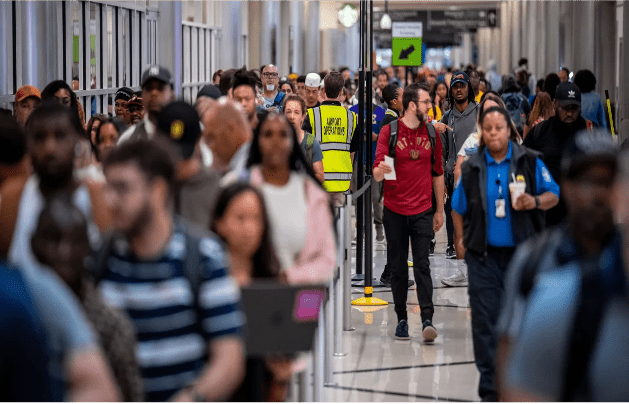

Record numbers of people are flying. So why are airlines’ profits plunging?

New York CNN — A record number of passengers are expected to pass through US airports this holiday travel week. You’d think this would be a great time to run an airline. You’d be wrong. Airlines face numerous problems, including higher costs, such as fuel, wages and interest rates. And problems at Boeing mean airlines have too few planes to expand routes to support a record numbers of flyers. Strong bookings can’t entirely offset that financial squeeze. The good news for passengers is they will be spared most of the problems hurting airlines’ bottom lines — at least in the near term. Airfares are driven far more by supply and demand, not their costs. But in the long run, the airlines’ difficulties could mean fewer airline routes, less passenger choice and ultimately a less pleasant flying experience. Profit squeeze Industry analysts expect airlines to report a drop of about $2 billion in profit, or 33%, when they report financial results for the April to June period this year. That would follow losses of nearly $800 million across the industry in the first quarter. Labor costs and jet fuel prices, the airlines’ two largest costs, are both sharply higher this year. Airline pilot unions just landed double-digit pay hikes to make up for years of stagnant wages; flight attendant unions now want comparable raises. Jet fuel prices are climbing because of higher demand in the summer. According to the International Air Transport Association’s jet fuel monitor, prices are up 1.4% in just the last week, and about 4% in the last month. Adding to the airlines’ problems is the crisis at Boeing, as well as the less-well-publicized problems with some of the jet engines on planes from rival Airbus. Since an Alaska Airlines Boeing 737 Max jet lost a door plug on a January 5 flight, leaving a gaping hole in the side of the plane 10 minutes after takeoff, the Federal Aviation Administration has limited how many jets Boeing can make over concerns about quality and safety. As a result, airlines have dramatically reduced plans to expand their fleets and replace older planes with more fuel efficient models. In some cases, airlines have asked pilots to take time off without pay, and carriers such as Southwest and United have announced pilot hiring freezes. In addition to the problems at Boeing, hundreds of the Airbus A220 and A320 family of jets globally have also been grounded for at least a month or more to deal with engine problems. Just about all the planes with those engines have been out of sevice for at least a few days to undergo examinations. And Airbus has also cut back the number of planes it expects to deliver to airlines this year because of supply chain problems. Problems for flyers For now, competition in the industry remains fierce: There are 6% more seats available this month compared to July of 2023, according to aviation analytics firm Cirium. And that’s helped to drive fares down — good news for passengers, but more bad news for airlines’ profits. Southwest announced in April that it would stop serving four airports to trim costs — Bellingham International Airport in Washington state, Cozumel International Airport in Mexico, Syracuse Hancock International Airport in New York and Houston’s George Bush Intercontinental Airport. Many more cities lost air service during the financial hard times of the pandemic. While upstart airlines are driving prices lower for travelers, those discount carriers might not survive long term. As the major carriers are making less money, many of the upstarts are flat-out losing money.