Hollywood's strongest supporting actor has been launched, AI is not far from subverting "Dreamworks"?

As a major city in the United States and even the global film industry, Hollywood has gathered a large number of veteran film and television production companies, including Universal Pictures, Warner Bros., Paramount Pictures, Disney Pictures, MGM Pictures, etc. In addition, new streaming forces such as Netflix have also entered in recent years. When the new generation of technology represented by generative AI sweeps the world, the movie "dream factory" is also experiencing a transformative moment. In early May last year, the US film and television industry launched a series of strikes that lasted for five months. Two labor disputes, led by the Writers Guild and the Screen Actors Guild, have caused the worst industry disruption since the 2020 pandemic, forcing many film projects and TV shows to halt or delay production. The strike has been costly, with Kevin Klowden, chief global strategist at the Milken Institute think tank, estimating it has cost the U.S. economy more than $5 billion, affecting not only film and television production companies, but also surrounding service industries such as catering, trucking and dry cleaning. One of the main conflicts between labor and management is that many actors and screenwriters have expressed concerns about "unemployment" due to the "invasion" of artificial intelligence. Luo Chenya has been working in the film and television industry for more than 10 years, including scriptwriter, documentary photographer and assistant director. She told the first financial reporter that after ChatGPT became popular, she also tried to use chatbots to assist script creation. "I can talk to the AI about my ideas and ideas, and it will help analyze and refine my ideas, and even make some suggestions that I think are quite effective." But on the execution level, the idea of writing it down into a very specific scene, character action, it doesn't really help me." Luo Chenya said that AI still needs more training and evolution in script writing, but the ability to present images is amazing. "AI can directly generate images, which can indeed save labor to a great extent, and may even replace photographers in the future." In post-production, AI can beautify images and modify flaws." A place to be fought over Earlier this year, OpenAI released the Vincennes video model Sora on its website, which can create videos up to a minute long, generating complex scenes with multiple characters, specific types of movement, and precise theme and background details. In addition to being able to generate video from text, the model can also generate video from still images, precisely animating the image content. "Vincennes Video can quickly produce high-quality video content, greatly improving production efficiency, and generative AI helps to improve the analysis of user preferences and personalized recommendations, and enhance the attractiveness of content." These technologies will disrupt traditional video production and content distribution models, and media companies need to adapt and change their operating models." Wang Haoyu, CEO of Mairui Asset Management, said in an interview with the first financial reporter. For this reason, Hollywood giants have long made big bets and stepped up their layout.

ChatGPT: Explained to Kids(How ChatGPT works)

Chat means chat, and GPT is the acronym for Gene Rate Pre trained Transformer. Genrative means generation, and its function is to create or produce something new; Pre trained refers to a model of artificial intelligence that is learned from a large amount of textual materials, while Transformer refers to a model of artificial intelligence. Don't worry about T, just focus on the words G and P. We mainly use its Generative function to generate various types of content; But we need to know why it can produce various types of content, and the reason lies in P. Only by learning a large amount of content can we proceed with reproduction. And this kind of learning actually has limitations, which is very natural. For example, if you have learned a lot of knowledge since childhood, can you guarantee that your answer to a question is completely correct? Almost impossible, firstly due to the limitations of knowledge, ChatGPT is no exception, as it is impossible to master all knowledge; The second is the accuracy of knowledge, how to ensure that all knowledge is accurate and error free; The third aspect is the complexity of knowledge, where the same concept is manifested differently in different contexts, making it difficult for even humans to grasp it perfectly, let alone AI. So when we use ChatGPT, we also need to monitor the accuracy of the output content of ChatGPT. It is likely not a problem, but if you want to use it on critical issues, you will need to manually review it again. And now ChatGPT has actually been upgraded twice, one is GPT4 with more accurate answering ability, and the other is the recent GPT Turbo. The current ChatGPT is a large model called multimodality, which differs from the first generation in that it can not only receive and output text, but also other types of input, such as images, documents, videos, etc. The output is also more diverse. In addition to text, it can also output images or files, and so on.

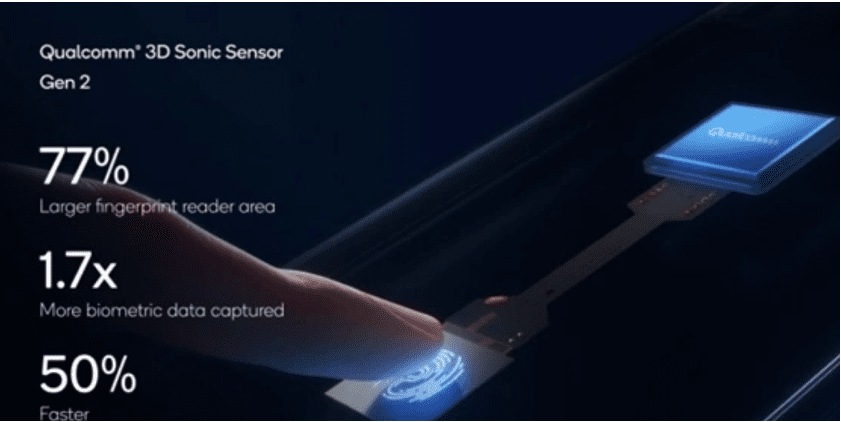

Google Pixel 9 series phones will use Qualcomm ultrasonic fingerprint recognition technology

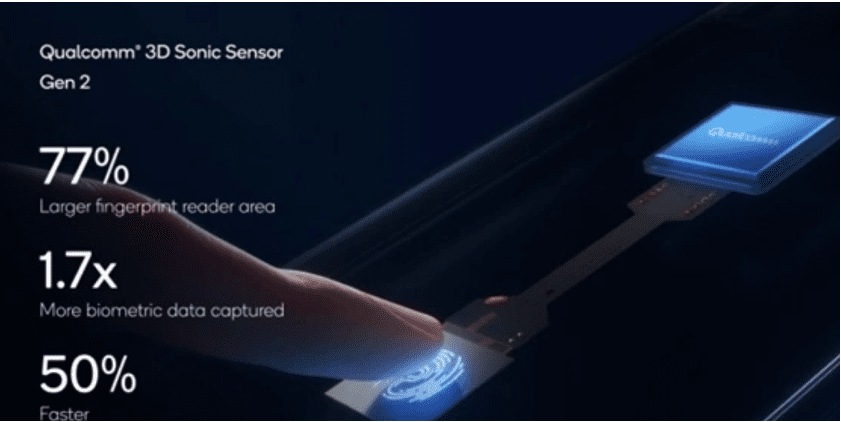

Google's new generation of flagship smartphone Pixel 9 series is expected to be officially released in mid-August, and the new machine is likely to be equipped with ultrasonic fingerprint recognition technology for the first time to replace the original optical fingerprint recognition. According to core intelligence, Google Pixel 9 series will use the same Qualcomm 3D Sonic Gen 2 ultrasonic fingerprint recognition sensor as the Samsung Galaxy S24 Ultra. This ultrasonic technology under the screen fingerprint sensor is Qualcomm released at the CES2021 conference, compared with the previous generation of solutions, the module thickness is further reduced to 0.2mm, while the scanning area is expanded to 8mm×8mm, that is, the recognition area is increased by 77%. This will also allow users to realize fingerprint recognition without having to point their fingertips 100% accurately at the identification area indicated on the screen.

South African rand stable as markets await US interest rate hints

JOHANNESBURG, July 9 (Reuters) - The South African rand was little changed in early trade on Tuesday, as markets awaited the Federal Reserve chair's testimony in Washington and U.S. June inflation data for clues on the country's future interest rate path. At 0644 GMT, the rand traded at 18.1300 against the dollar , near its previous close of 18.1175. "The rand has opened marginally softer at 18.13 this morning, and we expect trading to remain range-bound in the short term," said Andre Cilliers, currency strategist at TreasuryONE. Markets will listen to the tone of Fed Chair Jerome Powell's testimony in Washington on Tuesday and Wednesday and look to June inflation data out of the U.S. later this week for hints on the future interest rate path in the world's biggest economy. "Analysts will be gauging the Fed's response to the recent softer U.S. economic and labour data, with markets already starting to price in two rate cuts this year," Cilliers added. The risk-sensitive rand often takes cues from global drivers like U.S. economic policy in the absence of major local factors. South Africa's benchmark 2030 government bond was slightly stronger in early deals, with the yield down 1 basis point at 9.74%.