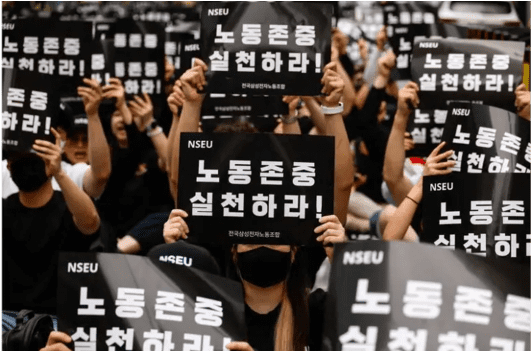

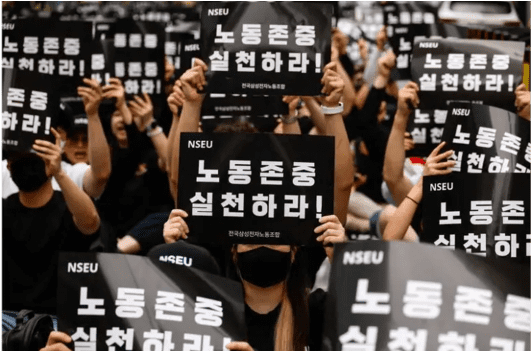

Samsung hit the biggest strike! Over 6,500 people attended.

More than 6,500 employees at South Korea's Samsung Electronics began a three-day mass strike on Monday (July 8), demanding an extra day of paid annual leave, higher pay raises and changes to the way performance bonuses are currently calculated. This is the largest organized strike in Samsung Electronics' more than half century of existence, and the union said that if this strike does not push employees' demands to be met, a new strike may be called. One of the core issues of the current dispute between the labor union and Samsung Electronics is raising wages and increasing the number of paid vacation days. The second demand is a pay rise. The union originally wanted a pay rise of more than 3% for its 855 employees, but last week they changed their demand to include all employees (rather than just 855). The third issue involves performance bonuses linked to Samsung's outsized profits - chip workers did not receive the bonuses last year when Samsung lost about Won15tn and, according to unions, fear they will still not get the money even if the company manages to turn around this year.

How the iPhone 16 With AI Could Send Apple's Market Value to $4T

Apple could be on track to reach a $4 trillion market capitalization with the artificial intelligence (AI) iPhone 16 upgrade cycle coming, Wedbush analysts said. The analysts said the iPhone 16 supercharged with AI could bring a "golden upgrade cycle" for Apple. Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. Apple (AAPL) could be on the path to a $4 trillion market capitalization as an iPhone upgrade cycle approaches, driven by the iPhone 16 supercharged with artificial intelligence (AI) capabilities, according to Wedbush analysts. 1 Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. AI iPhone 16 Upgrade Cycle Coming Soon Wedbush analyst said that an AI iPhone 16 could bring "a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally." "The Street is now starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution," they said, with 2.2 billion iOS devices globally and 1.5 billion iPhones. Wedbush suggested a "consumer AI tidal wave" could start with the iPhone 16 in mid-September, adding that estimates indicate 270 million iPhones users have not upgraded in over four years. Recovery in China To Support Upgrade Cycle The analysts indicated that iPhone supply stabilization in Asia is also "a very good sign heading into a monumental iPhone 16 upgrade cycle." Wedbush's projections come amid ongoing concerns for the iPhone maker in the China region amid increased competition, though there have been recent signs of improving shipments. They projected that June "will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter," when the iPhone 16 is expected to be released. AI and iOS 18 Could Also Boost Share Value Apple unveiled iOS 18 supercharged by Apple Intelligence and an AI partnership with OpenAI at its developers' conference in June. Wedbush analysts said the partnership with the Chat-GPT maker "creates the highway for developers around the globe to focus on iOS 18 and this in turn will create a myriad of monetization opportunities for Cook & Co. over the coming years." The analysts estimated that "this could result in incremental Services high margin growth annually of $10 billion for Apple" driven by hardware and software. They added they believe "AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share." Apple shares were little changed in early trading Monday, though they have gained more than 17% since the start of the year. Do you have a news tip for Investopedia reporters? Please email us at tips@investopedia.com SPONSORED Trade on the Go. Anywhere, Anytime One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

Koenigsegg Fused Three Hypercars Into One To Make The Chimera

Koenigsegg Agera RS Chimera combines technologies from Agera RS, CC850, and Jesko. An Agera RS platform features the engine from the Jesko and the simulated manual gearbox from the CC850. Development took three years, thanks to software and hardware integration challenges. A "chimera," for the uninitiated, is described as a mythical creature whose anatomy comes from multiple animals, creating a hybrid of two or more creatures' best bits. It's also the name of the latest one-off creation from Koenigsegg, and it's certainly apt; the Koenigsegg Agera RS Chimera is an amalgam of technologies from the decade-old, record-breaking Agera RS, the fascinatingly innovative CC850, and the awe-inspiring Jesko - which just recently set four new acceleration records. There's also a hint of Regera in here, which had some impressive records of its own. As reported by Mr. JWW, the strictly one-off special edition was commissioned by FIA President Mohammed Ben Sulayem, and both he and one of Koenigsegg's engineers arrived at the same name. Let's take a closer look and see exactly why this is a hybrid, even though it's not electrified. Three Cars In One The Chimera was originally a regular Agera RS and one of several Koenigsegg megacars owned by Ben Sulayem, but he asked Christian and the team to initiate a special project on his behalf. Around the same time, the extraordinary Koenigsegg CC850 was revealed at Monterey Car Week 2022, introducing the innovative Engage Shift System (ESS). This was based on the already astonishingly fast nine-speed Light Speed Transmission, with new actuators and sensors added to enable the simulation of a manual transmission without a physical link between the shifter and the gearbox. Like the rest of the world, the FIA boss was enamored by this novel technology, and as a wealthy 'Egg collector, he asked for it to be put into his special Agera-based project. Christian pondered this and ultimately decided to fulfill the request, in the process turning Ben Sulayem's special edition into something of a development mule for the ESS. But unlike the CC850, the Chimera got the larger turbos of the Jesko, enabling around 1,280 horsepower on regular gas and up to 1,600 hp on E85. That means this is an Agera RS with a CC850 transmission and a Jesko engine. On paper, that sounds simple, but the reality was anything but... Three Shifting Experiences Took Three Years To Combine According to a video from YouTuber and Koenigsegg distributor Mr. JWW, this development process took three years and required the relocation of the battery, new mounts for the powertrain, new harnesses, new software and controllers, and even a new infotainment system. To ensure all the electronics worked seamlessly was a challenge, but then Ben Sulayem asked for another layer of intricacy, requesting that paddle shifters be added, like in the Jesko Absolut and Jesko Attack. In the CC850, you could only switch between the simulated manual mode and fully automatic shifts, but now, the Chimera's development has unlocked manually operable paddles, which have now been added as the only option you can add to a CC850. There was also significant relocation and redesigning of suspension components, with parts from the Jesko and the Regera forming the subframe and elements of the suspension, respectively. A new scoop for the new transmission's cooler was also added, but it looks like it was always planned. Christian von Koenigsegg says this is a true one-off, saying that it would be cheaper and easier to start something all-new from scratch than to mix new and old technologies again, and that it's simply "too much work" to tackle a retrofit project. The Chimera is not completed just yet, as there are still subtle elements to refine, such as the bite point of the clutch pedal, but these minor issues will surely be resolved soon. It's an amazing feat, combining three hypercars in one, and we can't even fathom how Koenigsegg will top this in the future, but we don't doubt that Christian and his team will continue to do just that.

WhatsApp's new feature will let Meta AI edit your photos for you

WhatsApp beta version 2.24.14.20 has a new feature that allows users to share photos with Meta AI. The AI chatbot will analyze uploaded images and provide information or context about the content. Users may be able to request specific edits to their photos directly through Meta AI, though the extent of this feature is still unknown. As the battle for AI dominance heats up, Meta is adding a new trick to its AI chatbot, Meta AI, which is already part of Facebook, Instagram, and WhatsApp. While Meta AI already has impressive text capabilities, such as replying to questions, suggesting captions, and holding conversations, users cannot currently share or upload photos to the Meta AI chat. WaBetaInfo has uncovered the exciting new feature in the WhatsApp beta for Android version 2.24.14.20. This feature will allow Meta AI to interact with photos shared by users, reply to photos, and even edit them. As shown in the attached screenshot, WhatsApp is testing a new camera button in the Meta AI chat, designed to function similarly to the camera button in regular chats. This addition will allow users to manually share photos with Meta AI, a capability that is currently unavailable. With this new functionality, users will be able to ask questions about their photos, presumably allowing users to ask the AI to identify objects or locations or provide context about the photo’s content. Moreover, the screenshot suggests that Meta AI will also offer the option to edit photos, enabling users to make changes to their images directly within the chat by sharing a prompt. The exact scope of this image editing feature remains unclear, leaving us to wonder if it will be limited to simple tweaks or if it will unleash a powerful AI-driven photo editing suite. The possibilities are both exciting and intriguing, and this feature could definitely be a big hit, especially if it performs as promised. While this new image-sharing feature would mean Meta will analyze and face-scan the photos you upload, the screenshot includes a disclaimer indicating that users will have the option to delete their photos whenever they want. As of now, it seems that the feature is still in development, so it might be some time before we finally get to see it roll out publicly. Recently, we also reported about WhatsApp working on an “Imagine Me” feature that would allow Meta AI to generate AI avatars of you based on a set of your photos. WhatsApp in our newsletters WhatsApp is a leading messaging app, keep up to date on the latest, and learn about more Android apps today!