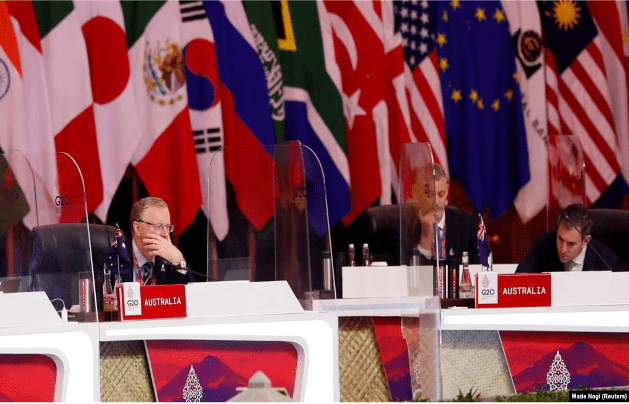

Australia pledged on Tuesday to increase investment in Pacific island nations, offering A$6.3 million ($4.3 million) to support their financial systems. Some Western banks are cutting ties with the region because of risk factors, while China is trying to increase its influence there.

Some Western bankers have terminated long-standing banking relationships with small Pacific nations, while others are considering closing operations and restricting access to dollar-denominated bank accounts in those countries.

"We know that the Pacific is the fastest-moving region in the world for correspondent banking services," Australian Treasurer Jim Chalmers said in a speech at the Pacific Banking Forum in Brisbane.

"What's at stake here is the Pacific's ability to engage with the world," he said, with much of the region at risk of being cut off from the global financial system.

Chalmers said Australia would provide A$6.3 million ($4.3 million) to the Pacific to develop secure digital identity infrastructure and strengthen compliance with anti-money laundering and counter-terrorist financing requirements.

Experts say Western banks are de-risking to meet financial regulations, making it harder for them to do business in Pacific island nations, where compliance standards sometimes lag, undermining their financial resilience.

Australia's ANZ Bank is in talks with governments about how to make its Pacific island businesses more profitable amid concerns about rising Chinese influence as financial services leave the West, Chief Executive Shayne Elliott said Tuesday.

ANZ is the largest bank in the Pacific region, with operations in nine countries, though some of those businesses are not financially sustainable, Elliott said in an interview on the sidelines of the forum. "If we were there purely for commercial purposes, we would have closed it a long time ago," he said.

Western countries, which have traditionally dominated the Pacific, are increasingly concerned about China's plans to expand its influence in the region after it signed several major defense, trade and financial agreements with the region.

Bank of China signed an agreement with Nauru this year to explore opportunities in the country, following Australia's Bendigo Bank saying it would withdraw from the country.

Mr. Chalmers said Australia was working with Nauru to ensure that banking services in the country could continue.

ANZ Bank exited its retail business in Papua New Guinea in recent years, while Westpac considered selling its operations in Fiji and Papua New Guinea but decided to keep them.

The Pacific lost about 80% of its correspondent banking relationships for dollar-denominated services between 2011 and 2022, Australian Assistant Treasurer Stephen Jones told the forum, which was co-hosted by Australia and the United States.

“We would be very concerned if there were countries acting in the region whose primary objective was to advance their own national interests rather than the interests of Pacific island countries,” Mr. Jones said on the first day of the forum in Brisbane. He made the comment when asked about Chinese banks filling a vacuum in the Pacific.

Meanwhile, Washington is stepping up efforts to support Pacific island countries in limiting Chinese influence. "We recognize the economic and strategic importance of the Pacific region, and we are committed to deepening engagement and cooperation with our allies and partners to enhance financial connectivity, investment and integration," said Brian Nelson, U.S. Treasury Undersecretary for Counterterrorism and Financial Intelligence.

The United States is aware of the problem of Western banks de-risking in the Pacific region and is committed to addressing it, Nelson told the forum's participants. He said data showed that the number of correspondent banking relationships in the Pacific region has declined at twice the global average rate over the past decade, and the World Bank and the Asian Development Bank are developing plans to improve correspondent banking relationships.

U.S. Treasury Secretary Janet Yellen said in a video address to the forum on Monday (July 8) that the United States is focused on supporting economic resilience in the Pacific region, including by strengthening access to correspondent banks. She said that when President Biden and Australian Prime Minister Anthony Albanese met at the White House last year, they particularly emphasized the importance of increasing economic connectivity, development and opportunities in the Pacific region, and a key to achieving that goal is to ensure that people and businesses in the region have access to the global financial system.