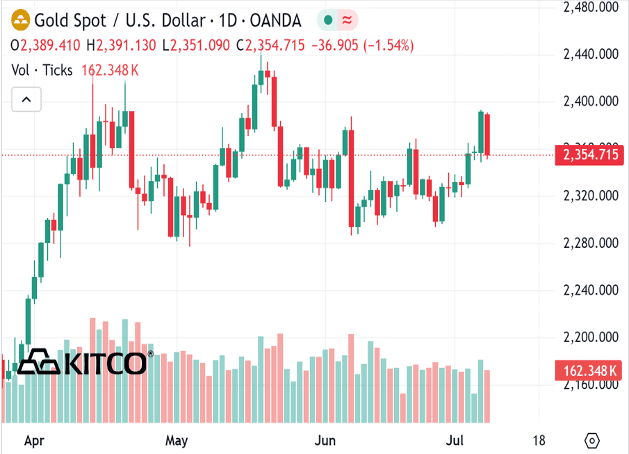

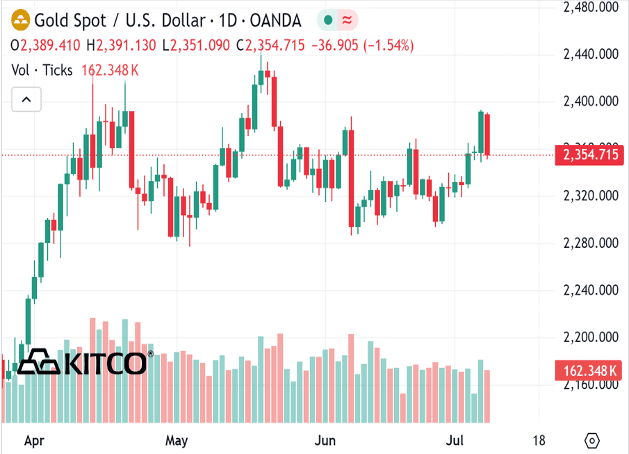

Gold, silver caught in downdraft of broad commodity market sell off

(Kitco News) - Gold and silver prices are sharply lower in midday U.S. trading Monday, on heavy profit-taking from the shorter-term futures traders after recent good price advances. The selling pressure today across most of the raw commodity spectrum is also keeping the precious metals bulls on the sidelines to start the trading week. August gold was last down $37.50 at $2,360.10. September silver was down $0.849 at $30.85. U.S. stock indexes mixed but near their record highs scored last week. The rallying stock market is a bearish element for the gold and silver markets, from a competing asset class perspective. The key U.S. data points of the week include Fed Chairman Powell’s speeches to the U.S. Congress on Tuesday and Wednesday, and the consumer and producer price indexes on Thursday and Friday, respectively. The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are lower and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.288%. Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at $2,382.60 and then at $2,400070. First support is seen at $2,350.00 and then at last week’s low of $2,327.40. Wyckoff's Market Rating: 6.0. September silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at the June low of $28.90. First resistance is seen at $31.00 and then at $31.50. Next support is seen at Friday’s low of $30.45 and then at $30.00. Wyckoff's Market Rating: 6.5. (Hey! My “Markets Front Burner” weekly email report is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to my Front Burner list.)

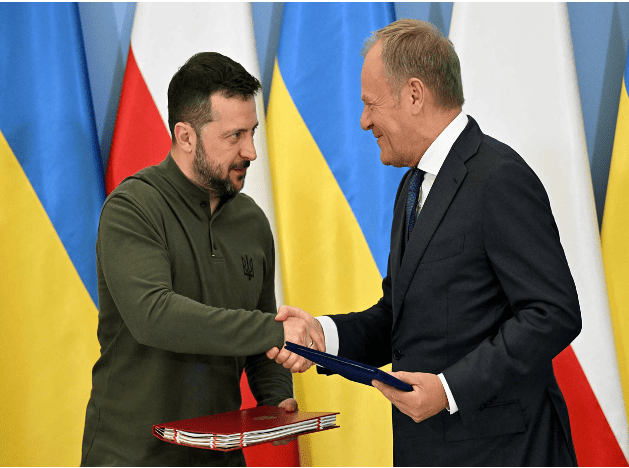

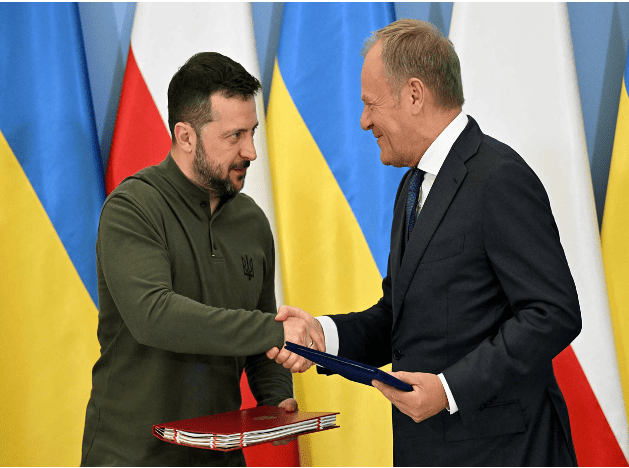

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland. The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises." Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.

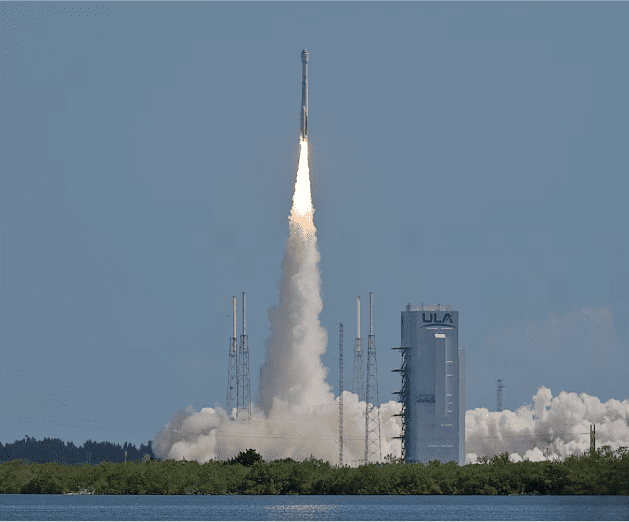

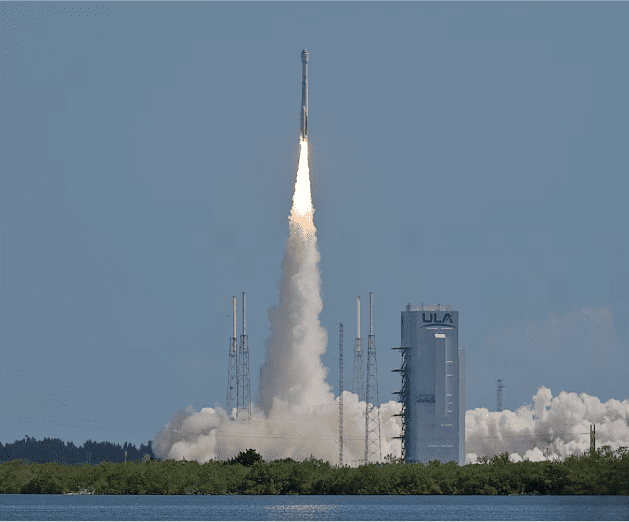

Explainer: How Boeing's Starliner can bring its astronauts back to Earth

WASHINGTON, June 24 (Reuters) - Problems with Boeing's Starliner capsule, still docked at the International Space Station (ISS), have upended the original plans for its return of its two astronauts to Earth, as last-minute fixes and tests draw out a mission crucial to the future of Boeing's (BA.N), opens new tab space division. NASA has rescheduled the planned return three times, and now has no date set for it. Since its June 5 liftoff, the capsule has had five helium leaks, five maneuvering thrusters go dead and a propellant valve fail to close completely, prompting the crew in space and mission managers in Houston to spend more time than expected pursuing fixes mid-mission. Here is an explanation of potential paths forward for Starliner and its veteran NASA astronauts, Barry "Butch" Wilmore and Sunita "Suni" Williams. THE CURRENT SITUATION Starliner can stay docked at the ISS for up to 45 days, according to comments by NASA's commercial crew manager Steve Stich to reporters. But if absolutely necessary, such as if more problems arise that mission officials cannot fix in time, it could stay docked for up to 72 days, relying on various backup systems, according to a person familiar with flight planning. Internally at NASA, Starliner's latest targeted return date is July 6, according to this source, who spoke on condition of anonymity. Such a return date would mean that the mission, originally planned for eight days, instead would last a month. Starliner's expendable propulsion system is part of the craft's "service module." The current problems center on this system, which is needed to back the capsule away from the ISS and position it to dive through Earth's atmosphere. Many of Starliner's thrusters have overheated when fired, and the leaks of helium - used to pressurize the thrusters - appear to be connected to how frequently they are used, according to Stich.

Amid rising regional tensions, the US announced that it will hold another Rim of the Pacific military exercise

The U.S. Navy's Pacific Fleet announced on Wednesday (May 22) that the 2024 Rim of the Pacific Exercise (RIMPAC 2024) is expected to take place on June 26, with 29 countries participating in and around the Hawaiian Islands, a larger lineup than the previous exercise in 2022. The Philippines, which has had multiple maritime conflicts with China recently, and Japan, which has tense diplomatic relations with China, will send troops to participate. China has been excluded from participating in the international military exercise since 2018, and its aggressive actions and reactions are causing tensions in the Pacific region to continue to rise. The biennial Rim of the Pacific military exercise is the world's largest international maritime exercise. The U.S. Navy said that the exercise will last until August 2, and it is expected to involve 29 countries, 40 surface ships, 3 submarines, 14 countries' army forces, more than 150 aircraft and more than 25,000 personnel. The U.S. Navy said that the theme of the 29th RIMPAC 2024 is "Partners: Integrated and Ready", emphasizing inclusiveness as the core, promoting multinational cooperation and trust, and using military interoperability to achieve their respective national goals to strengthen integrated and ready alliance partners. Its goal is to "enhance collective strength and promote a free and open Indo-Pacific region" through joint training and operations. The 29 countries participating in the exercise this year include Australia, Belgium, Brazil, Brunei, Canada, Chile, Colombia, Denmark, Ecuador, France, Germany, India, Indonesia, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Peru, South Korea, the Philippines, Singapore, Sri Lanka, Thailand, Tonga, the United Kingdom and the United States. Compared with the 28th RIMPAC held in 2022, which involved 26 countries, 38 surface ships, 4 submarines, 9 countries' army forces, more than 170 aircraft, and about 25,000 officers and soldiers, the number of countries, ships and army forces participating in this exercise has increased. The countries participating in this year's RIMPAC military exercise include all members of the Quadrilateral Security Dialogue (QUAD) between the United States, Japan, India and Australia, and the Australia-UK-US Trilateral Security Partnership (AUKUS), as in the previous exercise. In addition, countries surrounding the South China Sea and the South Pacific island nation of Tonga are also participating. Many analysts believe that the military exercise itself is sending a message to China: China's expansion in the Western Pacific region will be blocked and defeated. The United States invited China to participate in the RIMPAC military exercise twice in 2014 and 2016. In 2018, due to China's expansion in the South China Sea, the United States withdrew its invitation to China. In addition, despite Taiwan's repeated willingness to participate, Taiwan is still not included in the 29 countries participating in this year's RIMPAC military exercise. Analysts pointed out that the US-led RIMPAC military exercise is intended to unite allies to militarily intimidate China. If Taiwan is invited to join, it will be too provocative to China, which will not only aggravate the tension between the United States and China, but also embarrass some allies. The U.S. Navy said the commander of the U.S. Third Fleet will serve as the commander of the joint task force for the exercise, while Chilean Navy Commodore Alberto Guerrero will serve as deputy commander of the joint task force, which is a first in the history of the RIMPAC military exercise. In addition, Japan Maritime Self-Defense Force Rear Admiral Kazushi Yokota will also serve as deputy commander. Other key leaders of the multinational force exercise include Canadian Commodore Kristjan Monaghan, who will command the maritime forces, and Australian Air Force Commodore Louise Desjardins, who will command the air forces. According to the U.S. Stars and Stripes, Vice Admiral Michael Boyle is currently the commander of the U.S. Third Fleet. Vice Admiral John Wade has been nominated to replace Boyle. The U.S. Navy press release said the exercise will enhance the ability of international joint forces to "deter and defeat aggression by major powers in all domains and conflict levels," but did not provide specific information on which exercises will be held this summer. Previous RIMPAC training exercises have included sinking ships at sea with missiles, amphibious landings and the first landing of a Marine Corps Osprey aircraft on an Australian ship.

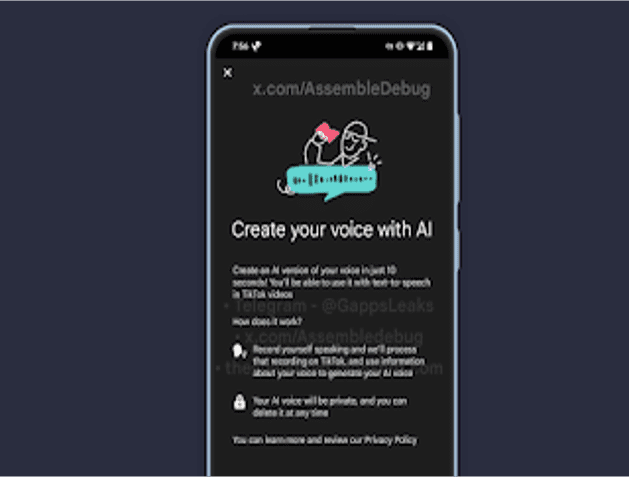

TikTok to introduce a new feature that can clone your voice with AI in just 10 second

Use of AI is certainly the hottest topic in the tech industry and every major and minor player in this industry is using AI in some way. Tools like ChatGPT can help you do a wide range of task and even help you generate images. The other thing is - Voice Cloning. OpenAI recently introduced a voice engine that can generate clone of your voice with just 15 seconds of your audio. There is no shortage of voice cloning tools on the web which can help you do the same. The newest tech giant which is going to use AI to clone your voice is - TikTok. We all know TikTok, posting short videos with filters, effects and all other kind of things. So TikTok found a way to use the voice cloning AI in its app. TikTok is working on this feature, which does not seem to really have a proper name, it just references it as "Create your voice with AI" and "TikTok Voice Library". In the latest version of TikTok I came across some strings which indicates that TikTok is working on it. I was also able to access the initial UI which introduces the feature and was able to see the terms and condition of "TikTok Voice Library" which user have to accept in order to use the feature. Here are the screenshots from the app- As you can in the screenshot above, this is the initial screen which a user will see for the first time they access this feature. Tiktok claims that it can create an AI verison of your voice in just 10 seconds. The generated AI voice clone can be used with text-to-speech in TikTok videos. It also outline the process of how it will work. You have to record yourself speaking and TikTok will process the voice and use information about your voice to generate your AI voice. When it comes to privacy, your AI voice will stay private and you can delete it anytime. Tapping the "Continue" button brings "TikTok Voice Library Terms" screen which a user should definitely read, you can see here and read as well - How it will work After agreeing to terms and conditions I was introduced with a screen where TikTok will show some text and user have to press the record button while reading the text. Now unfortunately I did not see any text. This is probably because the feature is not fully ready or the backend from which it fetches the text is not live yet. Manually pressing the record button and saying random things also shows an error. So, it's also not possible to provide any sample voice generated with it and see how it compares to other voice cloning competitors. If it starts working someday, it will process your recorded voice and generate AI version of your voice. Here is a screenshot of that screen - My guess is that whenever the feature starts working, users have to clone voice only one time and the saved AI voice can be used through the text-to-speech method to add voice in your videos. You just have to type the words, choice is yours :p