Carlsberg to buy Britvic for $4.2 billion

Carlsberg to buy Britvic for 1,315p per share Carlsberg will also buy out Marston's from brewing joint venture Danish brewer plans to create integrated beverage business in UK Shares in Carlsberg, Britvic, Marston's all rise July 8 (Reuters) - Carlsberg (CARLb.CO), opens new tab has agreed to buy British soft drinks maker Britvic (BVIC.L), opens new tab for 3.3 billion pounds ($4.23 billion), a move the Danish brewer said would forge a UK beverage "powerhouse" and that sent both companies' shares higher. Carlsberg clinched the takeover with a sweetened bid of 1,315 pence per share - comprising cash and a special dividend of 25 pence a share - after the British company rejected 1,250 pence per share last month. The acquisition will create value for shareholders, contribute to growth and forge a combined beer and soft drink company that is unique in the UK, CEO Jacob Aarup-Andersen told investors on a conference call. "With this transaction we are creating a UK powerhouse," he said. He brushed off concerns from some analysts about integration risks, saying Carlsberg has a strong track record of running beer and soft drink businesses in several markets. Soft drinks already make up 16% of Carlsberg's volumes. COST SAVINGS As drinkers in some markets ditch beer for spirits or cut back on drinking altogether, brewers have looked to broaden their portfolio into new categories like hard seltzer, canned cocktails and cider, as well as zero-alcohol brews. Britvic sells non-alcoholic drinks in Britain, Ireland, Brazil and other international markets such as France, the Middle East and Asia. Carlsberg said the deal will deliver a number of benefits, including cost and efficiency savings worth 100 million pounds ($128 million) over five years as it takes advantage of common procurement, production and distribution networks. It will also see Carlsberg take over Britvic's bottling agreement with PepsiCo (PEP.O), opens new tab. Carlsberg already bottles PepsiCo drinks in several markets and there is scope to add more geographies in future, Aarup-Andersen said. arlsberg halted share buy backs on Monday as a result of the deal. Chief financial officer Ulrica Fearn said these would resume once Carlsberg reaches its revised target for net debt of 2.5 times EBITDA, from 3.5 times currently - a goal it expects to meet in 2027. "Whilst this represents a shift in the strategy away from organic top- and bottom-line growth and consistent returns to shareholders, we view it as a relatively low risk transaction with attractive financials," Jefferies analysts said in a note. Carlsberg also said on Monday it will buy out UK pub group Marston's (MARS.L), opens new tab from a joint venture for 206 million pounds. That will give it full ownership of the newly formed Carlsberg Britvic after the deal. ($1 = 0.7805 pounds) Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here. Reporting by Stine Jacobsen, Yadarisa Shabong and Emma Rumney Editing by Sherry Jacob-Phillips, Rashmi Aich, David Goodman and David Evans

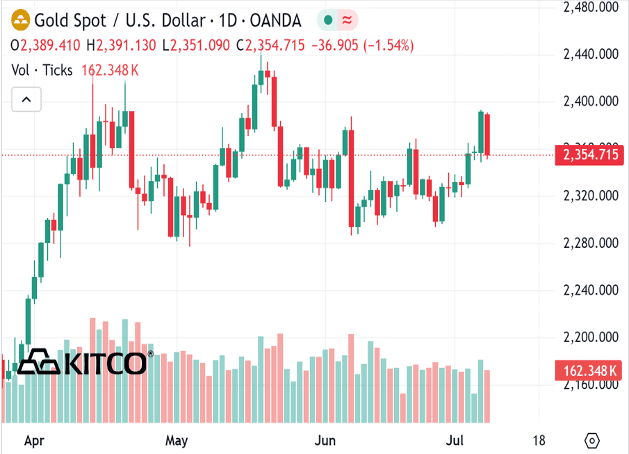

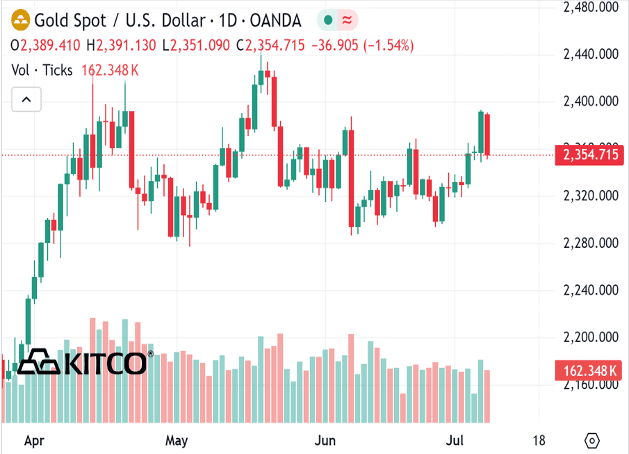

Gold, silver caught in downdraft of broad commodity market sell off

(Kitco News) - Gold and silver prices are sharply lower in midday U.S. trading Monday, on heavy profit-taking from the shorter-term futures traders after recent good price advances. The selling pressure today across most of the raw commodity spectrum is also keeping the precious metals bulls on the sidelines to start the trading week. August gold was last down $37.50 at $2,360.10. September silver was down $0.849 at $30.85. U.S. stock indexes mixed but near their record highs scored last week. The rallying stock market is a bearish element for the gold and silver markets, from a competing asset class perspective. The key U.S. data points of the week include Fed Chairman Powell’s speeches to the U.S. Congress on Tuesday and Wednesday, and the consumer and producer price indexes on Thursday and Friday, respectively. The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are lower and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.288%. Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at $2,382.60 and then at $2,400070. First support is seen at $2,350.00 and then at last week’s low of $2,327.40. Wyckoff's Market Rating: 6.0. September silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at the June low of $28.90. First resistance is seen at $31.00 and then at $31.50. Next support is seen at Friday’s low of $30.45 and then at $30.00. Wyckoff's Market Rating: 6.5. (Hey! My “Markets Front Burner” weekly email report is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to my Front Burner list.)

Koenigsegg Fused Three Hypercars Into One To Make The Chimera

Koenigsegg Agera RS Chimera combines technologies from Agera RS, CC850, and Jesko. An Agera RS platform features the engine from the Jesko and the simulated manual gearbox from the CC850. Development took three years, thanks to software and hardware integration challenges. A "chimera," for the uninitiated, is described as a mythical creature whose anatomy comes from multiple animals, creating a hybrid of two or more creatures' best bits. It's also the name of the latest one-off creation from Koenigsegg, and it's certainly apt; the Koenigsegg Agera RS Chimera is an amalgam of technologies from the decade-old, record-breaking Agera RS, the fascinatingly innovative CC850, and the awe-inspiring Jesko - which just recently set four new acceleration records. There's also a hint of Regera in here, which had some impressive records of its own. As reported by Mr. JWW, the strictly one-off special edition was commissioned by FIA President Mohammed Ben Sulayem, and both he and one of Koenigsegg's engineers arrived at the same name. Let's take a closer look and see exactly why this is a hybrid, even though it's not electrified. Three Cars In One The Chimera was originally a regular Agera RS and one of several Koenigsegg megacars owned by Ben Sulayem, but he asked Christian and the team to initiate a special project on his behalf. Around the same time, the extraordinary Koenigsegg CC850 was revealed at Monterey Car Week 2022, introducing the innovative Engage Shift System (ESS). This was based on the already astonishingly fast nine-speed Light Speed Transmission, with new actuators and sensors added to enable the simulation of a manual transmission without a physical link between the shifter and the gearbox. Like the rest of the world, the FIA boss was enamored by this novel technology, and as a wealthy 'Egg collector, he asked for it to be put into his special Agera-based project. Christian pondered this and ultimately decided to fulfill the request, in the process turning Ben Sulayem's special edition into something of a development mule for the ESS. But unlike the CC850, the Chimera got the larger turbos of the Jesko, enabling around 1,280 horsepower on regular gas and up to 1,600 hp on E85. That means this is an Agera RS with a CC850 transmission and a Jesko engine. On paper, that sounds simple, but the reality was anything but... Three Shifting Experiences Took Three Years To Combine According to a video from YouTuber and Koenigsegg distributor Mr. JWW, this development process took three years and required the relocation of the battery, new mounts for the powertrain, new harnesses, new software and controllers, and even a new infotainment system. To ensure all the electronics worked seamlessly was a challenge, but then Ben Sulayem asked for another layer of intricacy, requesting that paddle shifters be added, like in the Jesko Absolut and Jesko Attack. In the CC850, you could only switch between the simulated manual mode and fully automatic shifts, but now, the Chimera's development has unlocked manually operable paddles, which have now been added as the only option you can add to a CC850. There was also significant relocation and redesigning of suspension components, with parts from the Jesko and the Regera forming the subframe and elements of the suspension, respectively. A new scoop for the new transmission's cooler was also added, but it looks like it was always planned. Christian von Koenigsegg says this is a true one-off, saying that it would be cheaper and easier to start something all-new from scratch than to mix new and old technologies again, and that it's simply "too much work" to tackle a retrofit project. The Chimera is not completed just yet, as there are still subtle elements to refine, such as the bite point of the clutch pedal, but these minor issues will surely be resolved soon. It's an amazing feat, combining three hypercars in one, and we can't even fathom how Koenigsegg will top this in the future, but we don't doubt that Christian and his team will continue to do just that.

World's deepest diving pool opens in Poland, 45.5 meters deep

The world's deepest diving pool, Deepspot, opened this weekend near the Polish capital Warsaw. The 45.5-meter pool contains artificial underwater caves, Mayan ruins and a small shipwreck for scuba divers and free divers to explore. Deepspot can hold 8,000 cubic meters of water, more than 20 times the capacity of a normal 25-meter swimming pool. Unlike ordinary swimming pools, Deepspot can still open despite Poland's COVID-19 epidemic prevention restrictions because it is a training center that provides courses. The operator also plans to open a hotel where guests can observe divers at a depth of 5 meters from their rooms. "This is the deepest diving pool in the world," Michael Braszczynski, 47, Deepspot's director and a diving enthusiast, told AFP at the opening yesterday. The current Guinness World Record holder is a 42-meter-deep pool in Montegrotto Terme, Italy. The 50-meter-deep Blue Abyss pool in the UK is scheduled to open in 2021. On the first day of Deepspot's opening, about a dozen people visited, including eight experienced divers who wanted to pass the instructor exam. "There are no spectacular fish or coral reefs here, so it can't replace the ocean, but it is certainly a good place to learn and train safe open water diving," said 39-year-old diving instructor Przemyslaw Kacprzak. "And it's fun! It's like a kindergarten for divers."

Could a $600 billion funding gap crush the AI industry?

On July 5, Microsoft co-founder Bill Gates appeared on the Next Big Idea podcast to discuss his vision for Superhuman artificial intelligence and technological progress. At the same time, it said that the enthusiasm of the AI market is far more than the Internet bubble. Gates believes that the current threshold for entry in the AI field is very low, and the entire market is in a fever period, AI startups can easily get hundreds of millions of dollars in financing, and even have raised $6 billion (about 43.734 billion yuan) in cash for a company. "Never before has so much capital poured into a new area, and the entire AI market has fallen into a 'frenzy' in terms of market capitalization and valuation, which dwarfs the frenzy of the Internet and automotive periods in history." Gates said. At this stage, the rapid development of the artificial intelligence industry is a veritable gold industry, and Nvidia's market value is therefore soaring, and the total market value reached 3.34 trillion US dollars on June 18 local time, surpassing Microsoft and Apple in one fell fell, becoming the world's most valuable listed enterprise. But in fact, doubts about the field of artificial intelligence have also risen one after another and have never stopped.