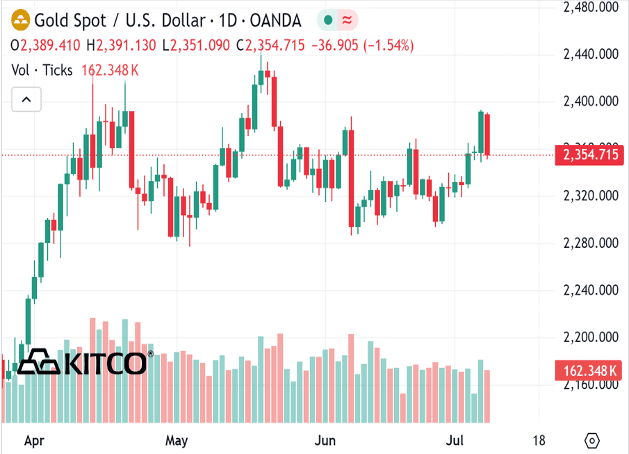

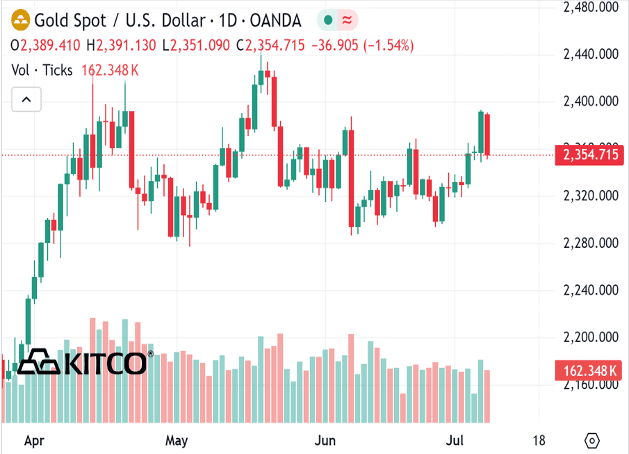

Gold, silver caught in downdraft of broad commodity market sell off

(Kitco News) - Gold and silver prices are sharply lower in midday U.S. trading Monday, on heavy profit-taking from the shorter-term futures traders after recent good price advances. The selling pressure today across most of the raw commodity spectrum is also keeping the precious metals bulls on the sidelines to start the trading week. August gold was last down $37.50 at $2,360.10. September silver was down $0.849 at $30.85. U.S. stock indexes mixed but near their record highs scored last week. The rallying stock market is a bearish element for the gold and silver markets, from a competing asset class perspective. The key U.S. data points of the week include Fed Chairman Powell’s speeches to the U.S. Congress on Tuesday and Wednesday, and the consumer and producer price indexes on Thursday and Friday, respectively. The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are lower and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.288%. Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at $2,382.60 and then at $2,400070. First support is seen at $2,350.00 and then at last week’s low of $2,327.40. Wyckoff's Market Rating: 6.0. September silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at the June low of $28.90. First resistance is seen at $31.00 and then at $31.50. Next support is seen at Friday’s low of $30.45 and then at $30.00. Wyckoff's Market Rating: 6.5. (Hey! My “Markets Front Burner” weekly email report is my best writing and analysis, I think, because I get to look ahead at the marketplace and do some market price forecasting. Plus, I’ll throw in an educational feature to move you up the ladder of trading/investing success. And it’s free! Email me at jim@jimwyckoff.com and I’ll add your email address to my Front Burner list.)

Carlsberg to buy Britvic for $4.2 billion

Carlsberg to buy Britvic for 1,315p per share Carlsberg will also buy out Marston's from brewing joint venture Danish brewer plans to create integrated beverage business in UK Shares in Carlsberg, Britvic, Marston's all rise July 8 (Reuters) - Carlsberg (CARLb.CO), opens new tab has agreed to buy British soft drinks maker Britvic (BVIC.L), opens new tab for 3.3 billion pounds ($4.23 billion), a move the Danish brewer said would forge a UK beverage "powerhouse" and that sent both companies' shares higher. Carlsberg clinched the takeover with a sweetened bid of 1,315 pence per share - comprising cash and a special dividend of 25 pence a share - after the British company rejected 1,250 pence per share last month. The acquisition will create value for shareholders, contribute to growth and forge a combined beer and soft drink company that is unique in the UK, CEO Jacob Aarup-Andersen told investors on a conference call. "With this transaction we are creating a UK powerhouse," he said. He brushed off concerns from some analysts about integration risks, saying Carlsberg has a strong track record of running beer and soft drink businesses in several markets. Soft drinks already make up 16% of Carlsberg's volumes. COST SAVINGS As drinkers in some markets ditch beer for spirits or cut back on drinking altogether, brewers have looked to broaden their portfolio into new categories like hard seltzer, canned cocktails and cider, as well as zero-alcohol brews. Britvic sells non-alcoholic drinks in Britain, Ireland, Brazil and other international markets such as France, the Middle East and Asia. Carlsberg said the deal will deliver a number of benefits, including cost and efficiency savings worth 100 million pounds ($128 million) over five years as it takes advantage of common procurement, production and distribution networks. It will also see Carlsberg take over Britvic's bottling agreement with PepsiCo (PEP.O), opens new tab. Carlsberg already bottles PepsiCo drinks in several markets and there is scope to add more geographies in future, Aarup-Andersen said. arlsberg halted share buy backs on Monday as a result of the deal. Chief financial officer Ulrica Fearn said these would resume once Carlsberg reaches its revised target for net debt of 2.5 times EBITDA, from 3.5 times currently - a goal it expects to meet in 2027. "Whilst this represents a shift in the strategy away from organic top- and bottom-line growth and consistent returns to shareholders, we view it as a relatively low risk transaction with attractive financials," Jefferies analysts said in a note. Carlsberg also said on Monday it will buy out UK pub group Marston's (MARS.L), opens new tab from a joint venture for 206 million pounds. That will give it full ownership of the newly formed Carlsberg Britvic after the deal. ($1 = 0.7805 pounds) Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here. Reporting by Stine Jacobsen, Yadarisa Shabong and Emma Rumney Editing by Sherry Jacob-Phillips, Rashmi Aich, David Goodman and David Evans

"Pictures on the wall were falling," New Yorkers rattled by earthquake

An earthquake jolted New York City on Friday morning, followed by more than 10 aftershocks which shook New Jersey, sending tremors as far as Philadelphia to Boston and jolting buildings in Manhattan and throughout its five boroughs. The preliminary quake, measuring 4.8 magnitude, centered around Lebanon, New Jersey, approximately 60 kilometers from New York City, with a depth of about 5 kilometers. Following the earthquake, New York City mayor Eric Adams stated at a press conference that no injuries had been reported, but they would continue to monitor and inspect critical infrastructure. The densely populated New York City was caught off guard by the unusual event. Broadcaster CBS reported that New York had not experienced an earthquake of this magnitude since 1884. Residents in Brooklyn expressed their shock when experiencing tremors which shook the city. "At first, I thought it was just construction next door, but then I noticed the pictures on the wall had fallen," Jennifer Wu, a resident in New York, told the Global Times on Saturday. Video footage circulating online showed the Statue of Liberty and the New York City skyline trembling as the earthquake struck. An angle from directly above Lady Liberty caught Ellis Island shaking during the incident. "It is fine," New York's famous Empire State Building posted on social platform X after the earthquake. The United Nations headquarters located in New York was hosting a Security Council meeting on the Israeli-Palestinian issue, and diplomats present in the meeting felt the tremors, local media reported. According to the Weather Channel, residents in Baltimore, Philadelphia, New Jersey, Connecticut, Boston and other areas of the Northeast seaboard also reported shaking. Tremors lasting for several seconds were felt over 200 miles away near the Massachusetts-New Hampshire border. The New York mayor told the press that New Yorkers should go about their normal day, while the governor Kathy Hochul emphasized the seriousness of the situation. She initiated assessments for damage across the state and had discussions with New Jersey Governor Phil Murphy. The quake caused flight delays throughout the New York area, with temporary control measures put in place across New York's John F. Kennedy International Airport, Newark Liberty International Airport in Newark, New Jersey, and Baltimore-Washington's Thurgood Marshall International Airport, checking for damage to runways. Operations resumed around Friday noon, ABC reported.

McDonald’s expands operational map in Chinese market, to roll out more outlets in the country

McDonald's China, together with its four major suppliers announced the launch of an industrial park in Xiaogan city, Central China's Hubei Province on Wednesday, highlighting the importance of Chinese market in terms of supply chain for food business. With a combined investment of 1.5 billion yuan ($206 million), the park, named Hubei Smart Food Industrial Park, is a joint project with Bimbo QSR, XH Supply Chain, Tyson Foods Inc, and Zidan, according to information provided to the Global Times. The park is expected to produce 34,000 tons of meat products, 270 million buns, 30 million pastries, and 2 billion packaged products annually. It also features a 25,000-square-meter high-standard automated warehouse for frozen, refrigerated, and dry goods, reducing logistics time by 90 percent from manufacturing to arriving at the destination. Leveraging local geographical advantages, the park will become a supply hub for McDonald's in central and western China, enhancing supply efficiency and stability for its outlets there, the company said. "McDonald's has been deeply rooted in China for over 30 years, and the park is an echo of our long-term development in China," said Phyllis Cheung, CEO of McDonald's China. "Without any long-term strategy, we don't have any structural advantage in China," Cheung noted. The US food giant continues to expand its business map in China. As of the end of June in 2024, there were over 6,000 restaurants and over 200,000 employees in the market. China has become the second largest and fastest-growing market of McDonald's. In 2023, McDonald's China unveiled the ambition of operating 10,000 restaurants by 2028. To support this, McDonald's and its suppliers have invested over 12 billion yuan from between 2018 to 2023 to develop new production capacities and enhance supply chain sustainability. Observers said that the industrial park reflect foreign companies' confidence in operating in China as the country takes concrete measures in furthering reform and opening-up. China's foreign direct investment from January to May 2024 reached 412.51 billion yuan, with the number of newly-established foreign-backed companies reaching 21,764, rising by 17.4 percent year-on-year, data from China's Ministry of Commerce revealed. According to a recent survey by the American Chamber of Commerce in China, the majority of US companies saw improved profitability in China in 2023, and half of the survey participants put China as their first choice or within their top three investment destinations globally. Olaf Korzinovski, EVP of Volkswagen China, who is responsible for production and components, also shared his understanding of supply chains in China with the Global Times. Volkswagen has been operating in China for about 40 years. "In order to seize greater value for our customers," Volkswagen Group is stepping up pace of innovation in China, and systematically purshing forward the digitalization process, Korzinovski noted, adding the company is strengthening local capabilities with accelerated decision-making efficiency. Global Times

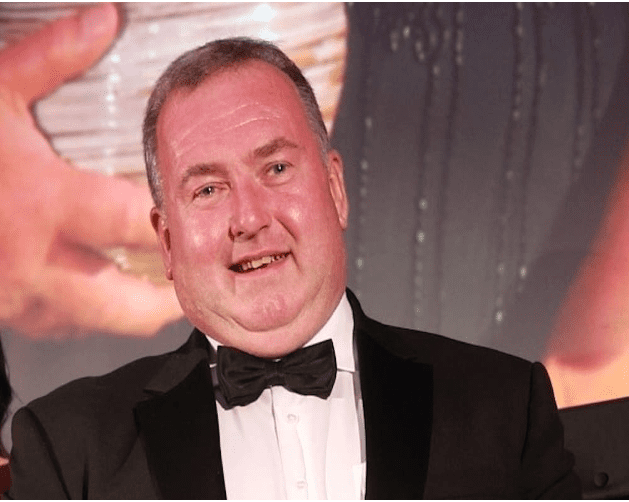

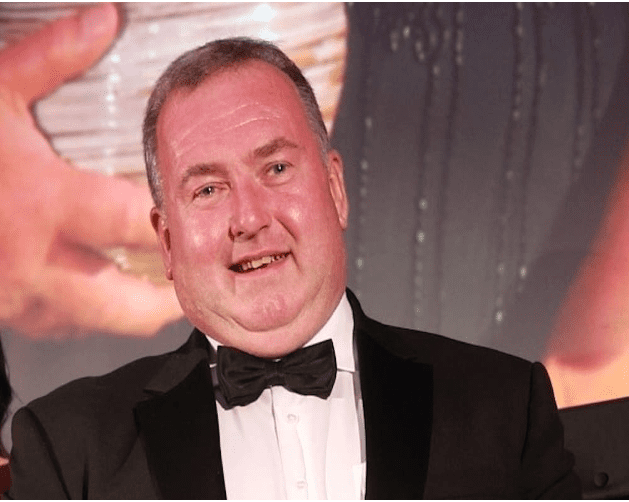

Portadown businessman avoids jail for sexual assault of teen under his employment

Defence said the defendant 'continues to deny' the charges and bail in the sum of £1,000 was fixed for appeal

A Portadown man has avoided jail after sexually assaulting a 16-year-old shop worker under his employment. -ADVERTISEMENT- Brian Thomas Chapman (58), of Moyallan Road, appeared before Newry Magistrates’ Court on Monday for sentencing on two counts of sexual assault. The prosecution outlined that on September 23, 2020, a 16-year-old student in the employment of Brian Chapman, disclosed to her mother about incidents that had occurred in her workplace. She said Chapman had put his hand on her thigh and the back of her leg. She also disclosed that she had been getting extra money from him and he had been sending her text messages. The allegations were reported to police the next day, September 24. The victim then took part in an interview on October 9, in which she said, when she was alone in Chapman’s office, he placed his hand on her upper thigh and his other hand on her lower back, underneath her trousers. The defendant was arrested and interviewed at Lurgan police station, where he denied the allegations. His phone was seized and an examination was carried out. The first interview of the defendant took place on October 9, during which he admitted to sending a message about wanting the victim to work 24/7, but stated this was a joke. The second interview took place on January 28, 2021, where he admitted to sending the 24/7 message, but denied sending other messages, such as “hope you’re spending the pounds on something special”. Throughout this process, Chapman denied sending the messages and denied any of the sexual assaults alleged by the victim. On the Chapman’s criminal record, the prosecution added that he was convicted of three common assaults on appeal. In terms of commission, these matters pre-dated this case but the conviction occurred during the running of this case and also involved a female working for the defendant. Prosecution continued that the age of the victim was an aggravating feature, arguing there was a “vulnerability” due to the “power-imbalance” between Chapman and the young student working for him. An additional aggravating feature, they said, was that during the course of the defence, part of the defence was that the victim had “manipulated or manufactured” some of the text messages that were sent. A defence lawyer, speaking on the pre-sentence report, noted the author deemed Chapman to be of low risk. He also noted that similar offences were contested in the County Court in respect of another complaint, with the judge substituting indecent assault charges for common assault. He also argued a Sexual Offences Prevention Order (SOPO) was not necessary as the offending was four years ago, there has been no repetition and risk had been addressed. District Judge Eamonn King noted the defendant was convicted on two of four original charges following a contest, which ran over a number of days, with the case adjourned for a pre-sentence report and victim impact statement to be produced. He added the defendant “continues to deny” the charges and seeks to appeal the outcome. District Judge King, on reading the pre-sentence report, noted the defendant “denies ever hugging or touching the individual and he denies any sexual attraction to the victim”, but pointed to a paragraph in the report which stated, “From the available evidence, it’s possible to surmise that he demonstrated risk taking and impulsive behaviour. It appears that he took advantage of his position and power in a bid to meet his sexual needs, given the victim’s young age and the fact that he was her employer”. The report added that this demonstrated “limited victim empathy and responsibility due to his denial of the offences”. On the victim impact statement, District Judge King described her as a young girl getting her first job, with the “world as her oyster”. He continued: “As a result of what she says occurred, that turned on its head. It left her feeling inwardly uncomfortable, anxious and lonely. She cut herself off from her friends. She stopped going out. She didn’t want to go to school.” He also described a “degree of manipulation” in the case, as this was the victim’s first job and there was a power imbalance between her as an employee, and Chapman as the employer. In his sentencing remarks, District Judge King, said: “I’ve taken time to emphasise to the victim in this case that the victim did nothing wrong. The victim did everything right and the victim shouldn’t feel lonely, anxious or isolated. “The victim should feel confident, strong and outgoing.” Owing to the defendant’s ongoing denial of the charges, he added: “My sentencing exercise isn’t the conclusion of the case today, but I will sentence, so that we can move towards the conclusion going forward. “I am satisfied, irrespective of what the pre-sentence report says, that the defendant took advantage of someone, attempted to groom someone and was guilty of the two offences.” On the two counts, Chapman was sentenced to three months in prison, suspended for two years. He was also made subject to a Sexual Offences Prevention Order (SOPO) for five years and placed on the sex offenders’ register for seven years. Following sentencing, District Judge King fixed bail for appeal at £1,000.