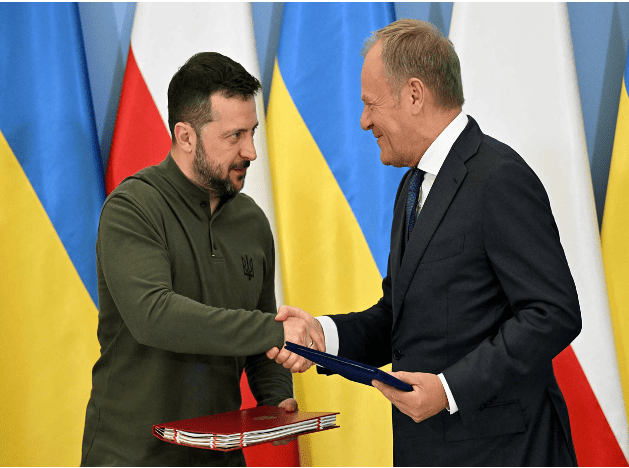

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland.

The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises."

Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.

WhatsApp's new feature will let Meta AI edit your photos for you

WhatsApp beta version 2.24.14.20 has a new feature that allows users to share photos with Meta AI. The AI chatbot will analyze uploaded images and provide information or context about the content. Users may be able to request specific edits to their photos directly through Meta AI, though the extent of this feature is still unknown. As the battle for AI dominance heats up, Meta is adding a new trick to its AI chatbot, Meta AI, which is already part of Facebook, Instagram, and WhatsApp. While Meta AI already has impressive text capabilities, such as replying to questions, suggesting captions, and holding conversations, users cannot currently share or upload photos to the Meta AI chat. WaBetaInfo has uncovered the exciting new feature in the WhatsApp beta for Android version 2.24.14.20. This feature will allow Meta AI to interact with photos shared by users, reply to photos, and even edit them. As shown in the attached screenshot, WhatsApp is testing a new camera button in the Meta AI chat, designed to function similarly to the camera button in regular chats. This addition will allow users to manually share photos with Meta AI, a capability that is currently unavailable. With this new functionality, users will be able to ask questions about their photos, presumably allowing users to ask the AI to identify objects or locations or provide context about the photo’s content. Moreover, the screenshot suggests that Meta AI will also offer the option to edit photos, enabling users to make changes to their images directly within the chat by sharing a prompt. The exact scope of this image editing feature remains unclear, leaving us to wonder if it will be limited to simple tweaks or if it will unleash a powerful AI-driven photo editing suite. The possibilities are both exciting and intriguing, and this feature could definitely be a big hit, especially if it performs as promised. While this new image-sharing feature would mean Meta will analyze and face-scan the photos you upload, the screenshot includes a disclaimer indicating that users will have the option to delete their photos whenever they want. As of now, it seems that the feature is still in development, so it might be some time before we finally get to see it roll out publicly. Recently, we also reported about WhatsApp working on an “Imagine Me” feature that would allow Meta AI to generate AI avatars of you based on a set of your photos. WhatsApp in our newsletters WhatsApp is a leading messaging app, keep up to date on the latest, and learn about more Android apps today!

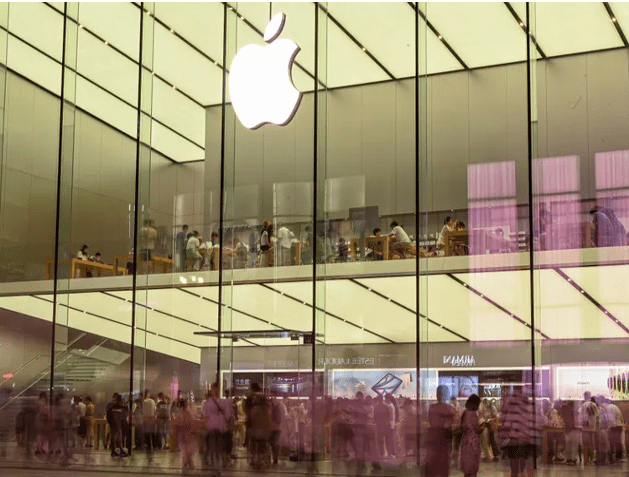

How the iPhone 16 With AI Could Send Apple's Market Value to $4T

Apple could be on track to reach a $4 trillion market capitalization with the artificial intelligence (AI) iPhone 16 upgrade cycle coming, Wedbush analysts said. The analysts said the iPhone 16 supercharged with AI could bring a "golden upgrade cycle" for Apple. Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. Apple (AAPL) could be on the path to a $4 trillion market capitalization as an iPhone upgrade cycle approaches, driven by the iPhone 16 supercharged with artificial intelligence (AI) capabilities, according to Wedbush analysts. 1 Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value. AI iPhone 16 Upgrade Cycle Coming Soon Wedbush analyst said that an AI iPhone 16 could bring "a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally." "The Street is now starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution," they said, with 2.2 billion iOS devices globally and 1.5 billion iPhones. Wedbush suggested a "consumer AI tidal wave" could start with the iPhone 16 in mid-September, adding that estimates indicate 270 million iPhones users have not upgraded in over four years. Recovery in China To Support Upgrade Cycle The analysts indicated that iPhone supply stabilization in Asia is also "a very good sign heading into a monumental iPhone 16 upgrade cycle." Wedbush's projections come amid ongoing concerns for the iPhone maker in the China region amid increased competition, though there have been recent signs of improving shipments. They projected that June "will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter," when the iPhone 16 is expected to be released. AI and iOS 18 Could Also Boost Share Value Apple unveiled iOS 18 supercharged by Apple Intelligence and an AI partnership with OpenAI at its developers' conference in June. Wedbush analysts said the partnership with the Chat-GPT maker "creates the highway for developers around the globe to focus on iOS 18 and this in turn will create a myriad of monetization opportunities for Cook & Co. over the coming years." The analysts estimated that "this could result in incremental Services high margin growth annually of $10 billion for Apple" driven by hardware and software. They added they believe "AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share." Apple shares were little changed in early trading Monday, though they have gained more than 17% since the start of the year. Do you have a news tip for Investopedia reporters? Please email us at tips@investopedia.com SPONSORED Trade on the Go. Anywhere, Anytime One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

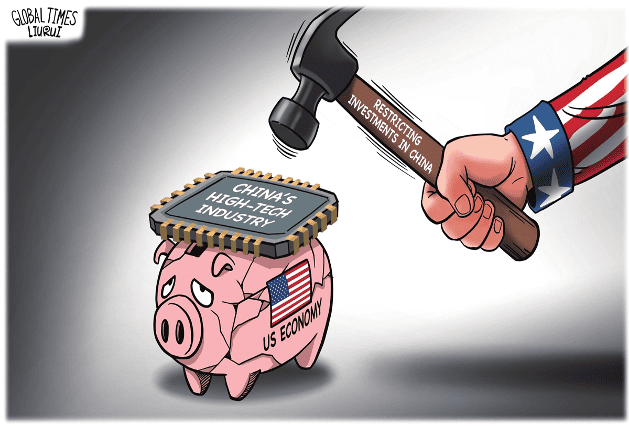

US' ban on high-tech investment cannot stifle China's high-tech development

US President Joe Biden signed an executive order on Wednesday restricting investments in China, intended to further stymie China's advances in three cutting-edge technology areas: semiconductors and microelectronics, quantum information technologies and certain artificial intelligence systems. The "decoupling" of high tech from China began under Donald Trump, and the Biden administration has continued that ambition. However, the new order doesn't target US investments already invested in China, but the new ones. The Biden administration has repeatedly claimed that the US restrictions will be narrowly targeted and will not "have a fundamental impact on affecting the investment climate for China." Biden's new executive order is still subject to consultation with the US business community and the public and is not expected to take effect until next year. The order has been brewed for a long time and has generated a lot of publicity. But almost no one believes that this executive order will deal a new practical blow to Chinese high technology, because almost everyone knows that China needs American technology more than American money. The order has gained much attention because it is seen as part of a broader trend of the US drifting away from China. The promulgation and brewing process of the executive order reflects the strong desire of American political elites to suppress China's high-tech development, as well as a fierce game between those supporting the executive order and the concerns of the technology and economic sectors about a potential backfire on the US. It is a kind of compromise. Washington obviously hopes that major allies will follow Biden's executive order. The UK's Sunak government has made cautious statements, stating that it is consulting business and the financial sector before deciding whether to follow suit. In fact, China also has the ability to influence the extent to which Biden's executive order is implemented, as well as the extent to which the US will go in terms of "decoupling" from China. We are definitely not just passive recipients of US policies. American political elites are eager to "decouple" from China as quickly and deeply as possible, but they fear two things: First, this will immediately damage the performance of relevant high-tech companies in the US, undermine their influence and further innovation. The current Biden administration, in particular, does not want to incur strong resentment from Silicon Valley and Wall Street toward the escalating "decoupling," which will ultimately lead to the loss of support for the Democratic Party. Second, they are afraid of pushing China toward more resolute independent innovation to achieve breakthroughs in key technologies such as chips. If the US "decoupling" policy gives birth to major technological achievements in China, it means that Washington will completely lose the gamble: They originally wants to stifle China's high-tech development, but ends up strangling their own companies. What China needs to do next is to fully unleash our innovation vitality, continuously reduce our dependence on high-tech products from the US, and prove that as long as we are determined to achieve independent innovation, we have the ability to accomplish things. We need to prove that being pressured by the US will only make us stronger. As long as there are several solid proofs of this trend, the US policy community will fall into unprecedented chaos, and their panic will be much more severe than when they saw the rapid expansion of the Chinese economy before Trump started the trade war. Regardless of the future of China-US relations, the current battle will be the key battle that determines the future competition between China and the US. China can only win and cannot afford to lose. High-tech products such as chips are not isolated. The innovation power of China's entire manufacturing industry and the creative vitality of the whole society are the foundation for shaping these key achievements. When pressured by the US, our society needs to generate confidence and resilience from all directions, and we need to accelerate and seize every opportunity, rather than shrink and simply defend. Otherwise, the US will gain the upper hand in momentum, and we will truly be in a passive and defensive position. We must see that the US is on the offensive, but its offensive is becoming weaker and weaker, and it is always hesitant with each step. What is presented to China are difficulties and risks, but also the dawn of victory.

Amid rising regional tensions, the US announced that it will hold another Rim of the Pacific military exercise

The U.S. Navy's Pacific Fleet announced on Wednesday (May 22) that the 2024 Rim of the Pacific Exercise (RIMPAC 2024) is expected to take place on June 26, with 29 countries participating in and around the Hawaiian Islands, a larger lineup than the previous exercise in 2022. The Philippines, which has had multiple maritime conflicts with China recently, and Japan, which has tense diplomatic relations with China, will send troops to participate. China has been excluded from participating in the international military exercise since 2018, and its aggressive actions and reactions are causing tensions in the Pacific region to continue to rise. The biennial Rim of the Pacific military exercise is the world's largest international maritime exercise. The U.S. Navy said that the exercise will last until August 2, and it is expected to involve 29 countries, 40 surface ships, 3 submarines, 14 countries' army forces, more than 150 aircraft and more than 25,000 personnel. The U.S. Navy said that the theme of the 29th RIMPAC 2024 is "Partners: Integrated and Ready", emphasizing inclusiveness as the core, promoting multinational cooperation and trust, and using military interoperability to achieve their respective national goals to strengthen integrated and ready alliance partners. Its goal is to "enhance collective strength and promote a free and open Indo-Pacific region" through joint training and operations. The 29 countries participating in the exercise this year include Australia, Belgium, Brazil, Brunei, Canada, Chile, Colombia, Denmark, Ecuador, France, Germany, India, Indonesia, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Peru, South Korea, the Philippines, Singapore, Sri Lanka, Thailand, Tonga, the United Kingdom and the United States. Compared with the 28th RIMPAC held in 2022, which involved 26 countries, 38 surface ships, 4 submarines, 9 countries' army forces, more than 170 aircraft, and about 25,000 officers and soldiers, the number of countries, ships and army forces participating in this exercise has increased. The countries participating in this year's RIMPAC military exercise include all members of the Quadrilateral Security Dialogue (QUAD) between the United States, Japan, India and Australia, and the Australia-UK-US Trilateral Security Partnership (AUKUS), as in the previous exercise. In addition, countries surrounding the South China Sea and the South Pacific island nation of Tonga are also participating. Many analysts believe that the military exercise itself is sending a message to China: China's expansion in the Western Pacific region will be blocked and defeated. The United States invited China to participate in the RIMPAC military exercise twice in 2014 and 2016. In 2018, due to China's expansion in the South China Sea, the United States withdrew its invitation to China. In addition, despite Taiwan's repeated willingness to participate, Taiwan is still not included in the 29 countries participating in this year's RIMPAC military exercise. Analysts pointed out that the US-led RIMPAC military exercise is intended to unite allies to militarily intimidate China. If Taiwan is invited to join, it will be too provocative to China, which will not only aggravate the tension between the United States and China, but also embarrass some allies. The U.S. Navy said the commander of the U.S. Third Fleet will serve as the commander of the joint task force for the exercise, while Chilean Navy Commodore Alberto Guerrero will serve as deputy commander of the joint task force, which is a first in the history of the RIMPAC military exercise. In addition, Japan Maritime Self-Defense Force Rear Admiral Kazushi Yokota will also serve as deputy commander. Other key leaders of the multinational force exercise include Canadian Commodore Kristjan Monaghan, who will command the maritime forces, and Australian Air Force Commodore Louise Desjardins, who will command the air forces. According to the U.S. Stars and Stripes, Vice Admiral Michael Boyle is currently the commander of the U.S. Third Fleet. Vice Admiral John Wade has been nominated to replace Boyle. The U.S. Navy press release said the exercise will enhance the ability of international joint forces to "deter and defeat aggression by major powers in all domains and conflict levels," but did not provide specific information on which exercises will be held this summer. Previous RIMPAC training exercises have included sinking ships at sea with missiles, amphibious landings and the first landing of a Marine Corps Osprey aircraft on an Australian ship.

Argentina's government reform bill officially takes effect: granting the president special powers in areas such as administration

On the 8th, the Argentine government promulgated the "Foundations and Starting Points for Argentine Freedom" comprehensive bill and a package of fiscal measures, marking the official entry into force of the government reform bill. According to the official gazette of the Argentine government, Argentine President Milley, Chief Cabinet Minister Guillermo Francos and Economy Minister Luis Caputo jointly signed Decrees No. 592 and No. 593 to promulgate these two new reform measures. The comprehensive bill declared Argentina to enter a one-year public emergency in the administrative, economic, financial and energy fields, and granted the president special powers in these fields. It also includes the relaxation of economic regulations, labor reforms and the implementation of a large-scale investment incentive system. The package of fiscal measures involves anti-money laundering, tax deferral, tariffs, re-imposition of high-salary income tax and reduction of personal property taxes. On June 28, after six months of negotiations, the two reform bills were finally passed by the Argentine Congress.