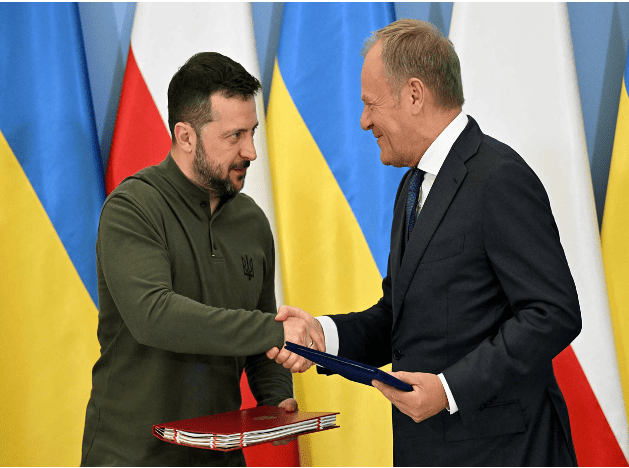

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland.

The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises."

Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.

Israeli strike kills 16 at Gaza school, military says it targeted gunmen

CAIRO/GAZA, July 6 (Reuters) - At least 16 people were killed in an Israeli strike on a school sheltering displaced Palestinian families in central Gaza on Saturday, the Palestinian health ministry said, in an attack Israel said had targeted militants. The health ministry said the attack on the school in Al-Nuseirat killed at least 16 people and wounded more than 50. The Israeli military said it took precautions to minimize risk to civilians before it targeted the gunmen who were using the area as a hideout to plan and carry out attacks against soldiers. Hamas denied its fighters were there. At the scene, Ayman al-Atouneh said he saw children among the dead. "We came here running to see the targeted area, we saw bodies of children, in pieces, this is a playground, there was a trampoline here, there were swing-sets, and vendors," he said. Mahmoud Basal, spokesman of the Gaza Civil Emergency Service, said in a statement that the number of dead could rise because many of the wounded were in critical condition. The attack meant no place in the enclave was safe for families who leave their houses to seek shelters, he said. Al-Nuseirat, one of Gaza Strip's eight historic refugee camps, was the site of stepped-up Israeli bombardment on Saturday. An air strike earlier on a house in the camp killed at least 10 people and wounded many others, according to medics. In its daily update of people killed in the nearly nine-month-old war, the Gaza health ministry said Israeli military strikes across the enclave killed at least 29 Palestinians in the past 24 hours and wounded 100 others.

US foreign policy is advanced smartphone with weak battery

A couple of days ago, a Quad summit meeting in Sydney scheduled for May 24 was abruptly canceled. The US president had to pull out of his long-anticipated trip to Australia and Papua New Guinea. Instead, the heads of the four Quad member states got together on the margins of the G7 Summit in Hiroshima on May 20. The main reason for the change of plans was the continuous struggle between the White House and Republicans on the Hill over the national debt ceiling. If no compromise is reached, the US federal government might fail to meet its financial commitments already in June; such a technical default would have multiple negative repercussions for the US, as well as for the global economy and finance at large. Let us hope that a compromise between the two branches of US power will be found and that the ceiling of the national debt will be raised once again. However, this rather awkward last-minute cancellation of the Quad summit reflects a fundamental US problem - a growing imbalance between the US geopolitical ambitions and the fragility of the national financial foundation to serve these ambitions. The Biden administration appears to be fully committed to bringing humankind back to the unipolar world that existed right after the end of the Cold War some 30 years ago, but the White House no longer has enough resources at its disposal to sustain such an undertaking. As they say in America: You cannot not have champagne on a beer budget. The growing gap between the ends that the US seeks in international relations and the means that it has available is particularly striking in the case of the so-called dual containment policy that Washington now pursues toward Russia and China. Even half a century ago, when the US was much stronger in relative terms than it is today, the Nixon administration realized that containing both Moscow and Beijing simultaneously was not a good idea: "Dual containment" would imply prohibitively high economic costs for the US and would result in too many unpredictable political risks. The Nixon administration decided to focus on containing the Soviet Union as the most important US strategic adversary of the time. This is why Henry Kissinger flew to Beijing in July 1971 to arrange the first US-China summit in February 1972 leading to a subsequent rapid rapprochement between the two nations. In the early days of the Biden administration, it seemed that the White House was once again trying to avoid the unattractive "dual containment" option. The White House rushed to extend the New START in January 2021 and held an early US-Russia summit meeting five months later in Geneva. At that point many analysts predicted that Biden would play Henry Kissinger in reverse - that is he would try to peace with the relatively weaker opponent (Moscow) in order to focus on containing the stronger one (Beijing). However, after the beginning of the Russia-Ukraine conflict, it became clear that no accommodation with the Kremlin was on Biden's mind any longer. Still, having decided to take a hard-line stance toward Moscow and to lead a broad Western coalition in providing military and economic assistance to Kiev, Washington has not opted for a more accommodative or at least a more flexible policy toward Beijing. On the contrary, over last year one could observe a continuous hardening of the US' China policy - including granting more political and military support to the Taiwan island, encouraging US allies and partners in Asia to increase their defense spending, engaging in more navel activities in the Pacific and imposing more technology sanctions on China. In the meantime, economic and social problems within the US are mounting. The national debt ceiling is only the tip of an iceberg - the future of the American economy is now clouded by high US Federal Reserve interest rates that slow down growth, feed unemployment and might well lead to a recession. Moreover, the US society remains split along the same lines it was during the presidency of Donald Trump. The Biden administration has clearly failed to reunite America: Many of the social, political, regional, ethnic and even generational divisions have got only deeper since January 2021. It is hard to imagine how a nation divided so deeply and along so many lines could demonstrate continuity and strategic vision in its foreign policy, or to allocate financial resources needed to sustain a visionary and consistent global leadership. Of course, the "dual containment" policy is not the only illustration of the gap between the US ambitions and its resources. The same gap inevitably pops up at every major forum that the US conducts with select groups of countries from the Global South - Africa, Southeast Asia, Latin America or the Middle East. The Biden administration has no shortage of arguments warning these countries about potential perils of cooperating with Moscow or Beijing, but it does not offer too many plausible alternatives that would showcase the US generosity, its strategic vision, and its true commitment to the burning needs of the US interlocutors. To cut it short, Uncle Sam brings lots of sticks to such meetings, but not enough carrots to win the audience. In sum, US foreign policy under President Joe Biden reminds people of a very advanced and highly sophisticated smartphone that has a rather weak battery, which is not really energy efficient. The proud owner of the gadget has to look perennially for a power socket in order not to have the phone running out of power at any inappropriate moment. Maybe the time has come for the smartphone owner to look for another model that would have fewer fancy apps, but a stronger and a more efficient battery, which will make the appliance more convenient and reliable.

Microsoft to offer Apple devices to employees in China, cites absence of Android services

July 8 (Reuters) - Microsoft (MSFT.O), opens new tab intends to offer Apple's (AAPL.O), opens new tab iOS-based devices to its employees in China to access authentication apps, a company spokesperson said on Monday, citing absence of Google's (GOOGL.O), opens new tab Android services in the country. Microsoft has been under increased scrutiny after a series of security breaches, the latest being that of Russian hackers who spied and accessed emails of the company's employees and customers earlier this year. The development was first reported by Bloomberg News, which, citing an internal memo, said the Windows OS-maker instructed its employees in China to use Apple devices at workplace from September. As a part of Microsoft's global Secure Future Initiative, the move to switch to iOS-devices stems from the lack of availability of Google Play Store in China that limits its employees' access to security apps such as Microsoft Authenticator and Identity Pass, the report added. "Due to the lack of availability of Google Mobile Services in this region, we look to offer employees a means of accessing these required apps, such as an iOS device," a company spokesperson told Reuters in an email. Microsoft is among those U.S. companies that have a strong presence in China. It entered the Chinese market in 1992 and also operates a large research and development center in the country. The company will provide iPhone 15 models to employees, currently using Android handsets across China, including Hong Kong, the Bloomberg report said.

The US and Australia will work to improve financial links in the Pacific region to counter China's influence

U.S. and Australian officials said on Monday (July 8) that both countries are committed to improving financial connectivity in the Pacific and strengthening banking services in the region to resist China's growing covetousness. According to Reuters, at the two-day Pacific Banking Forum co-hosted by the United States and Australia, Australian Assistant Treasurer Stephen Jones said that Canberra hopes to be the partner of choice in the Pacific region, both in banking and defense. "If there are countries acting in this region whose main goal is to promote their own national interests rather than the interests of Pacific island countries, we will be very concerned," Jones said at the first day of the forum in Brisbane. He made this comment when asked about Chinese banks filling the vacuum in the Pacific region. The report said that as some Western banks have interrupted their long-standing business relationships with banks in small Pacific island countries, while others are preparing to close their businesses, these Pacific island countries face many challenges and their ability to obtain US dollar-dominated banking business is limited. The report said that experts said that Western banks are taking de-risking actions to meet financial regulations, which makes it more difficult to do business in Pacific island countries. This in turn weakens the financial resilience of these island nations. At the same time, Washington is also stepping up efforts to support Pacific island nations in limiting China's influence. Brian Nelson, U.S. Treasury Undersecretary for Counterterrorism and Financial Intelligence, said, "We recognize the economic and strategic importance of the Pacific region, and we are committed to deepening engagement and cooperation with our allies and partners to enhance financial connectivity, investment and integration." The report said that neither the United States nor Australia has yet announced detailed plans at the forum, but comments from officials from both countries reflect the growing unease among Western countries that have traditionally had influence in the Pacific region about China's growing influence in the region.

iPhone 16 Pro leak just confirmed a huge camera upgrade

The tetraprism lens with 5x optical zoom currently exclusive to the iPhone 15 Pro Max could be headed to both the iPhone 16 Pro and iPhone 16 Pro Max, narrowing the gap between Apple's premium flagships. That's according to a new report from analyst Ming-Chi Kuo, who cites a recent earnings call with Apple lens supplier Largan. In the call, a spokesperson from Largan said "some flagship specifications will be extended to other models" in the second half of 2024, presumably in reference to the upcoming iPhone Pro models. "Apple is Largan’s largest customer, and Largan is also Apple’s largest lens supplier," Kuo said. "Therefore, the quote likely refers to the fact that the new iPhone 16 Pro and Pro Max will have a tetraprism camera in 2H24 (while only the iPhone 15 Pro Max had this camera in 2H23).” The report goes on to say that the tetraprism camera for the iPhone 16 Pro series won't be all that different from the one in the iPhone 15 Pro Max. While the lack of an upgrade is disappointing, it's not necessarily a bad thing as these kinds of lenses are already top-of-the-line. They represent a major increase over prior models’ zoom capabilities, and they're capable of offering more depth while still fitting into super-slim smartphones. That being said, Apple does appear to be revamping the main camera and ultra-wide camera on the iPhone 16 Pro Max. Evidence continues to mount that both iPhone 16 Pro models will share the same 5x optical zoom camera. Earlier this week, DigitTimes in Asia (via 9to5Mac) reported that Apple is set to ramp up orders for tetraprism lenses as it expands their use in its upcoming iPhone series. Industry sources told the outlet that Largan and Genius Electronic Optical were tapped as the primary suppliers. Apple would be wise to streamline its Pro-level iPhones with the same camera setup; then all customers have to consider with their choice of a new iPhone is the size and price. Of course, this should all be taken with a grain of sand for now until we hear more from Apple. It's still a while yet before Apple's usual September time window for iPhone launches. In the meantime, be sure to check out all the rumors so far in our iPhone 16, iPhone 16 Pro and iPhone 16 Pro Max hubs.