United Airlines Boeing 757 loses tire during takeoff

United Airlines confirmed that a tire fell off a Boeing 757 passenger plane when it took off from Los Angeles International Airport in the early morning of July 8, local time. It is reported that there has been no report of any material damage or casualties in this accident. United Airlines said in a statement that the aircraft tire has been found and the investigation is ongoing.

There were 174 passengers and 7 crew members on the flight involved. The flight left Los Angeles International Airport at around 7:15 on July 8 and flew to Denver.

Unlike the aircraft tire falling incident on a United Airlines flight in March, the pilot of this flight continued the journey to Denver and landed smoothly there.

NASA plays 'blame-shifting' game with China as lunar soil research set to start

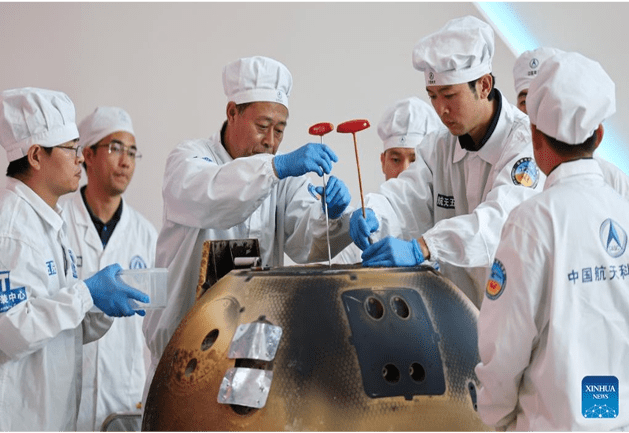

The returner of the Chang'e-6 lunar probe is opened during a ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation in Beijing, capital of China, June 26, 2024. The returner of the Chang'e-6 lunar probe was opened at a ceremony in Beijing on Wednesday afternoon. During the ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation, researchers opened the returner and examined key technical indicators. Photo: Xinhua As the US space industry recently faced yet more delays and stagnation with key components including manned spacecraft and space suits "going wrong," NASA has once again resorted to its "sour grapes" rhetoric upon seeing China's successful retrieval of fresh lunar soils from the far side of the moon, by claiming that China did not directly invite its scientists to participate in the lunar soil research. This behavior is a typical blame-shifting trick, Chinese experts said, noting it is clear to all that it is the US' own laws, not China, that are restricting space cooperation between the two sides. Instead of deceiving themselves by distorting the truth, the US should face up to its own problem of overall weakening engineering capability and the lack of long-term planning in its space industry. After the Chang'e-6 samples, weighing nearly 2 kilograms, were safely transported to a special laboratory for further study on Friday, NASA spokesperson Faith McKie told media that while China worked with the European Space Agency, France, Italy and Pakistan on this mission, "NASA wasn't invited to take part in the moon probe." NASA also didn't get "any direct invitation" to study China's moon rocks, after it welcomed all scientists from around the world to apply to study them, McKie told NatSec Daily. Responding to the remarks, Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on Monday that China is open to having space exchanges with the US, and we also welcome countries around the world to take part in the study of lunar samples. "However, the US side seems to have forgotten to mention its domestic legislation such as the Wolf Amendment. The real question is whether US scientists and institutions are allowed by their own government to participate in cooperation with China," Mao said. "The existence of the Wolf Amendment has basically shut the door to space collaboration between the two countries," Wang Yanan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times on Monday. Even if research institutions of the US have the willingness to work with China on opportunities such as lunar sample research, institutions there must obtain special approval from the US Congress due to the presence of this amendment, Wang explained. Currently, no such "green light" is in sight from the Congress. Furthermore, China's collaboration with international partners is based on equality and mutual benefit, leveraging their respective scientific resources, facilities, and expertise. However, the US only wants what it doesn't have, and its engagement with China would be advantageous only to itself, Wang noted. NASA has found itself embroiled in a number of thorny issues recently, with the latest being Boeing's Starliner manned spaceship experiencing both helium leaks and thruster issues during a June 6 docking with the International Space Station (ISS), which led to an indefinite delay for its crew's return to Earth, despite NASA's insistence that they are not "stranded" in space. The return of the Starliner capsule, while has already been delayed by two weeks, will be put on hold "well into the summer" pending results of new thruster tests, which are scheduled to start Tuesday and will take approximately two weeks or even more, per NASA officials. Previously on June 24, NASA cancelled a spacewalk on the ISS following a "serious situation," when one of the spacesuits experienced coolant leak in the hatch. While being broadcast on a livestream, the astronauts reported "literally water everywhere" as they were preparing for the extravehicular activity, space.com reported. The report said that this is the second time this particular spacewalk was postponed, after a June 13 attempt with a different astronaut group was pushed back due to a "spacesuit discomfort." The recurring issues with the spacesuits are due to their much-extended service lifespan, media reported, as the puffy white ones US astronauts currently wear were designed more than 40 years ago. Despite the pressing need to replace them, NASA announced recently that it is abandoning a plan to develop next-generation spacesuits, which had been committed to be delivered by 2026, CNN reported on Thursday. One of the root causes for such problems is that the US has developed many large technology conglomerates, which for a long time have benefited significantly from government orders and industry monopolies. Consequently, in many complex engineering fields, the level of attention given is greatly insufficient, Wang noted. It also reflected the US' lack of long-term strategic planning for its manned space program. For instance, the ageing spacesuits should have been replaced a decade ago to ensure that operational suits remain in usable condition. Failure to address this issue results in a hindrance to the space station's necessary maintenance tasks and even poses life-threatening risks to astronauts in emergency situations, experts said. The issues with Boeing's spacecraft and the spacesuits are not isolated problems, but reflected a systemic issue in the US space industry - the overall weakening of engineering capabilities, they noted.

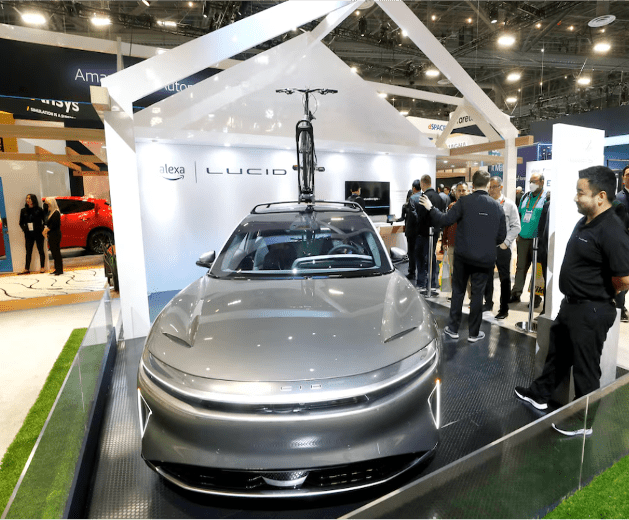

EV maker Lucid to recall over 5,200 Air luxury sedans for software error, US regulator says

July 9 (Reuters) - Lucid Group (LCID.O), opens new tab will recall about 5,251 of its 2022-2023 Air luxury sedans due to a software error that could cause a loss of power, according to a notice from the U.S. National Highway Traffic Safety Administration published on Tuesday. The regulator added the EV maker will also recall about 7,506 of its 2022-2024 Air luxury sedans due to an issue with a coolant heater that could fail to defrost the windshield. Lucid had released an over-the-air software update in June as a fix for the software error and a separate update to identify a high voltage coolant heater failure and provide a warning to the drivers of the affected vehicles. The company had reported second-quarter deliveries above market expectations on Monday, as price cuts helped boost demand for its luxury electric sedans.

Apple's low-end Apple Watch uses a plastic case

Apple is giving the Apple Watch a major update for its 10th anniversary. The watch's display will be larger, and the entire device will be thinner and lighter. Both the Apple Watch Series 10 and the new Apple Watch Ultra 3 will be equipped with new chips, which may be paving the way for future Apple AI capabilities. According to sources, the Apple Watch health detection function has encountered some technical obstacles in the upgrade process, the blood pressure measurement function or can only realistically display fluctuations and cannot display values, and the sleep apnea detection and other functions can not appear on the new product. The shell material of Apple Watch SE series products may be replaced by hard plastic from aluminum shell. The plastic-clad Apple Watch may be sold at a lower price to compete with Samsung's cheapest Watch, the Galaxy Watch FE. In addition, Siri's new features may be delayed, and AirPods with cameras may arrive in 2026.

BRI: embracing Chinese green practices for a sustainable future

Editor's Note: This year marks the 10th anniversary of the Belt and Road Initiative (BRI) proposed by Chinese President Xi Jinping. Through the lens of foreign pundits, we take a look at 10 years of the BRI - how it achieves win-win cooperation between China and participating countries of the BRI and how it has given the people of these countries a sense of fulfillment. In an interview with Global Times (GT) reporter Li Aixin, Erik Solheim (Solheim), former under-secretary-general of the United Nations and former executive director of the UN Environment Programme, recalled how the BRI helped shorten a previously long journey in Sri Lanka to a half-hour trip. "We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together," Solheim said. This is the 18th piece of the series. GT: How do you evaluate the role of the BRI in promoting development in participating countries over the past 10 years? Solheim: The BRI has been a major driver of development since it was announced by President Xi Jinping in Kazakhstan 10 years ago. The China-Laos Railway has connected landlocked Laos to the Chinese and European rail network, making it possible for Laos to sell more goods and welcome more tourists. Rail corridors in Kenya and from Djibouti to Addis Ababa connect the interior of Africa to the coast, bringing opportunities for much faster development in East Africa. The Bandung-Jakarta railway in Indonesia, Hanoi metro, roads and ports in Sri Lanka - there are great examples of good south-south and BRI projects in almost every corner of the world. GT: In your experience of traveling around the world, has any BRI-related story left a deep impression on you? Solheim: Yes, many! I'll just mention two. When I was chief negotiator in the Sri Lanka peace process 15 years ago, it took a long time to travel from the airport to Colombo, the capital of Sri Lanka. When I came back last year, it took half an hour on wonderful Chinese-built highways. Traveling through Mombasa, a coastal city in Kenya, you see a lot of poverty and run down houses. Then all of a sudden, a green, clean, well-run oasis opens up. It's the end station of the Nairobi-Mombasa railway which links the capital Nairobi to the coast. The rail station stands out and is showing the future for Kenya. GT: The EU proposed the Global Gateway, and the US proposed the Build Back Better World. What do you think are the similarities and differences between these projects and the BRI? Solheim: I really wish success for the Western initiatives. What developing nations ask for is a choice of good cooperation with both China and the West. Unfortunately, up to now, a number of the Western-led initiatives have been more like media events. They lack structure, secretariat, finances and clear direction. Nearly all nations in the world want to see close people-to-people relations, investment and political cooperation with both China and the West. No one wants to choose. GT: Some people from the West are talking about "de-coupling" and "de-risking." Both seem to be another way of saying "de-globalization." Do you think "de-coupling" and "de-risking" will affect the BRI? And what role will the BRI play in maintaining globalization? Solheim: Decoupling is probably the most unwise idea in the world today. It's outright dangerous. Facing climate change, environmental degradation, economic troubles, war in Ukraine and other places, and the threat of pandemics, we need more, not less, cooperation. We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together. Almost all developing countries have made BRI agreements with China. As an example, when President Xi met all the leaders of Central Asia recently in Xi'an, Northwest China's Shaanxi Province, they made a very ambitious declaration on future green cooperation between China and Central Asia. GT: You have previously said that the BRI is a fantastic vehicle to promote green global development, which can boost the economy and ecology at the same time. Could you elaborate on how you think the BRI has achieved development of the economy and ecology? Solheim: In the beginning there were too many fossil fuel projects among BRI programs. In the BRI International Green Development Coalition, we argued this should stop. When President Xi pledged to stop building new coal-fired power projects overseas, it was one of the most important environmental decisions ever. Also, it happened at a time when important BRI nations like Bangladesh, Kenya and Pakistan decided they could grow their economies and go green without coal. The BRI will in the next decade become the world's most important vehicle for green energy and green transport. We will see massive investments in solar and wind power, hydrogen, electric batteries and more. GT: How do you view China's goal of achieving harmony between humanity and nature in modernization? In what way is China's story in pursuing harmony between humanity and nature relevant to other countries? Solheim: China now covers between 60 percent and 80 percent of all major green technologies in the world - solar, wind, hydro, batteries, electric cars and high-speed rail. Companies like Longi, BYD and CATL are the world leaders in their sectors. More remarkably and maybe less noticed abroad, China is also a global leader in protecting nature. It's embarking upon one of the most massive national park programs, with a focus on Qinghai Province and Xizang Autonomous Region. China is by far the biggest tree planter in the world and the global leader in desert control in Kubuqi, Inner Mongolia and other places. China has been hugely successful in the recovery of endangered species like the Giant Panda, Tibetan Antelope and Snow Leopard. A new center for mangrove restoration is being set up in Shenzhen and the fishing ban in the Yangtze will restore that magnificent ecosystem. The Belt and Road is a great opportunity for the world to learn from good Chinese green practices.

Insurers fret over militant attacks, AI hacks at Paris Olympics

LONDON, July 5 (Reuters) - Insurers are nervous that militant attacks or AI-generated fake images could derail the Paris Olympics, risking event cancellations and millions of dollars in claims. Insurers faced losses after the 2020 Tokyo Olympics were postponed for a year due to the COVID-19 pandemic. Since then, wars in Ukraine and Gaza and a spate of elections this year, including in France, have driven up fears of politically-motivated violence at high-profile global events. The Olympics take place in Paris from July 26-Aug 11 and the Paralympics from Aug 28-Sept 8. German insurer Allianz (ALVG.DE), opens new tab is insurance partner for the Games. Other insurers, such as the Lloyd's of London (SOLYD.UL) market, are also providing cover. "We are all aware of the geopolitical situation the world is in," said Eike Buergel, head of Allianz's Olympic and Paralympic programme. "We are convinced that the IOC (International Olympic Committee), Paris 2024 and the national organising committees, together with the French authorities, are taking the right measures when it comes to challenges on the ground."