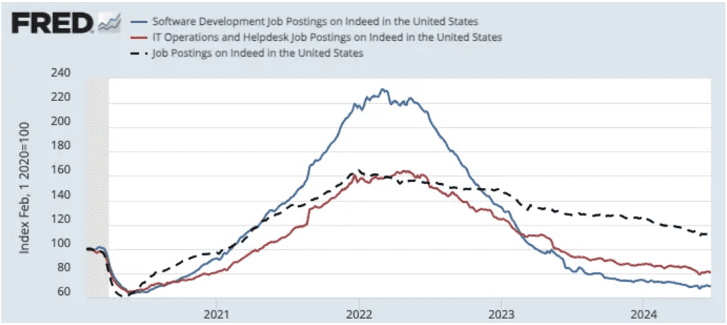

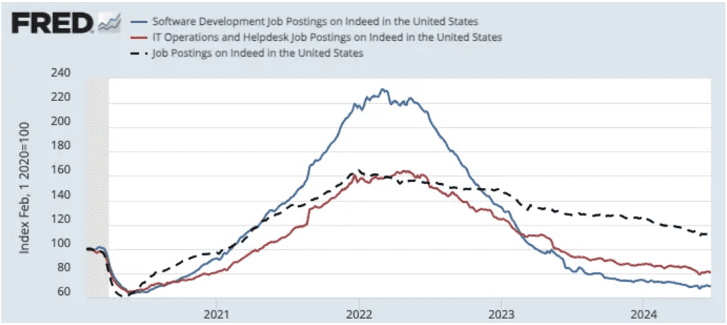

Are US development jobs falling off a cliff?

Companies are going to have fewer people and fewer layers. Ten years from now, the software development circuit may have fewer jobs, higher salaries, and more product-centric work. The reason behind it is the rapid development of AI, AI has approached human beings at the intelligence level, a lot of work relying on thinking ability may be handed over to AI, while emotion is still the territory of human beings, how to communicate and collaborate is the most important ability in the near future. When Indeed's chart for software development and operations jobs was released, we found that, as the chart shows, there was a peak in early 2022, but after that there was a precipitous decline.

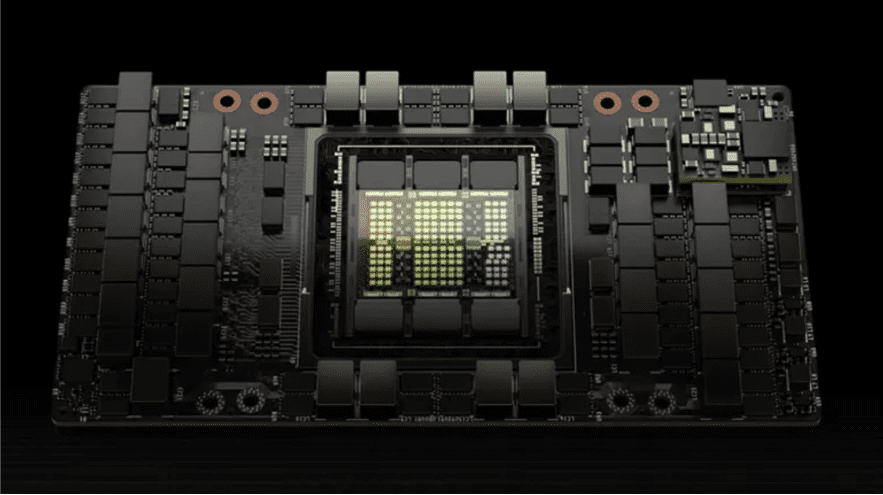

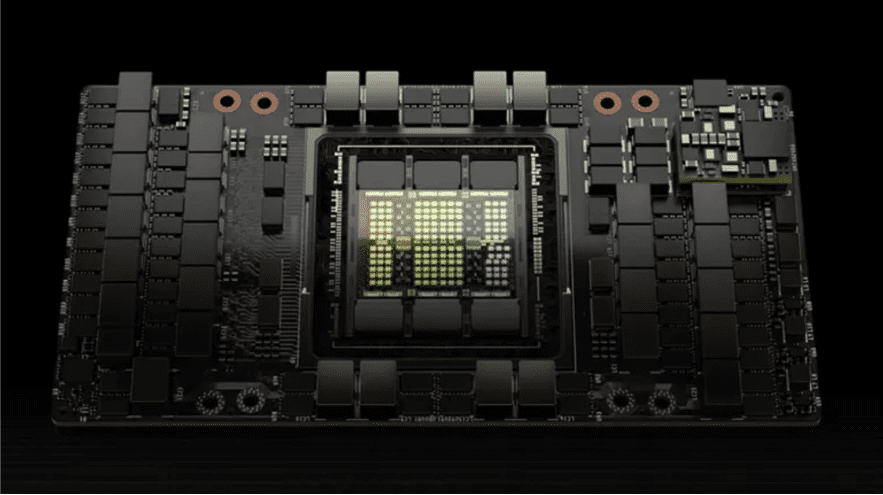

Nvidia H20 will sell 1 million units this year, contributing $12 billion in revenue!

Recently, according to the FT, citing the latest forecast data of the market research institute SemiAnalysis, AI chip giant NVIDIA will ship more than 1 million new NVIDIA H20 acceleration chips to the Chinese market this year, and it is expected that the cost of each chip is between $12,000 and $13,000. This is expected to generate more than $12 billion in revenue for Nvidia. Affected by the United States export control policy, Nvidia's advanced AI chip exports to China have been restricted, H20 is Nvidia based on H100 specifically for the Chinese market to launch the three "castration version" GPU among the strongest performance, but its AI performance is only less than 15% of H100, some performance is even less than the domestic Ascend 910B. When Nvidia launched the new H20 in the spring of this year, there were reports that due to the large castration of H20 performance, coupled with the high price, Chinese customers' interest in buying is insufficient, and they will turn more to choose China's domestic AI chips. Then there are rumors that Nvidia has lowered the price of the H20 in order to improve its competitiveness. However, the latest news shows that due to supply issues caused by the low yield of the Ascend 910B chip, Chinese manufacturers in the absence of supply and other better options, Nvidia H20 has started to attract new purchases from Chinese tech giants such as Baidu, Alibaba, Tencent and Bytedance. Analysts at both Morgan Stanley and SemiAnalysis said the H20 chip is now being shipped in bulk and is popular with Chinese customers, despite its performance degradation compared to chips Nvidia sells in the United States.

Coexisting and cooperating with China is the only choice for the US

US Secretary of State Antony Blinken declared at the Munich Security Conference: "If you're not at the table in the international system, you're going to be on the menu." The arrogant thinking of American political elites is evident: Whoever does not comply with the US will be excluded from the table of the American-led system and put on the menu. How arrogant. The US is actively pushing for "decoupling" from China and trying to persuade the entire West to "decouple" from China, using the term "de-risking." Washington hopes to ultimately contain China's development in order to maintain American hegemony. However, this time, Washington is facing a historically experienced and strategically rich Eastern civilization. Previous opponents targeted by the US have chosen to confront the US strategically. The US not only has the strongest technological and military capabilities but also controls global financial and information networks with a large number of allies. Those countries that had engaged in direct confrontations had suffered losses. Some of them had disintegrated, some had been weakened, and some had fallen into difficulties. However, what Washington sees from China is strategic composure and resilience. China is now staging an unprecedented and grand "Tai Chi." However, some Chinese people feel that this is not enough: Why can't we confront the US head-on? But I want to say that this is precisely the brilliance of China. This grand "Tai Chi" is about dismantling the pressure the US is putting on China. Europe is different from the US. A European diplomat once said in private that the topic of China has become toxic in the US, but in Europe, it is still possible to openly display friendliness toward China. There is genuine competition between the Europe and China despite Europe leans more toward the US between China and the US. Only in terms of ideology does the term "West" truly exist. In terms of fundamental economic interests, Europe has considerable independence. In terms of security, their attitude toward China also differs greatly from that of the US. In the Asia-Pacific region or China's periphery, the US wants to create an "Asian NATO." The specific situations of countries in dispute with China are very different. China has enormous influence in the region, is the largest trading partner of the vast majority of countries in the region and has friendly relations with most countries in the region. The disputes with countries are not fundamental strategic conflicts, and China has the ability to manage disputes with each specific country and push them to move toward neutrality to varying degrees without being tied to the US' policy toward China. China has a lot of trading partners and stakeholders in the US. The trade volume between China and the US, despite the decline, reached $664.4 billion in 2023, which shows China's huge presence in the US, and is the bond of the two countries in the current situation. The US is not a country where the political elites can have absolute say, and the huge interests have forced the US president and senior officials to repeatedly proclaim that they "don't want to decouple from China" and instead they want to "manage the US-China competition" and see "preventing a war with China" as clearly in everyone's best interest. China should engage in a "strategic battle" with the US at the closest possible distance. We need to maintain friendly relations with certain forces within the US, speed up the resumption of flights between the two countries, increase personnel exchanges and completely reverse the downturn of China-US contacts during the pandemic. In addition to the above dismantling, we also have the huge increment in the "Belt and Road." This initiative will increase China's power to compete with the US, greatly extending the front line that the US needs to maintain in containing China, making the US more powerless. In order to dismantle the US strategy toward China, China must become more diversified while maintaining strategic consistency. Our national diplomacy toward the US is very principled, rational and determined, which is clearly different from other countries targeted by the US. Our public diplomacy toward the US needs to be unique, with both "anti-American voices" and efforts to maintain friendly relations between the two societies and further expand economic and practical cooperation with the US. Just as eagles have their own way of flying and doves have their own formation, just as we see the US as complex, China must also be seen as complex in the eyes of the US. China is both a geopolitical concern and a profitable investment destination for them, and is one of the largest trading partners that is difficult to replace. Some American political elites proclaim China as an "enemy," but it is important to make the majority of Americans feel that China is not. No matter how intense the struggles between China and the US may be, we cannot shape the entire US toward an enemy direction. China has to make the US political elites recognize that it is futile to deal with China in the same way as it historically dealt with the Soviet Union and other major powers. Furthermore, willingly or unwillingly, coexistence and cooperation with China will be their only choice.

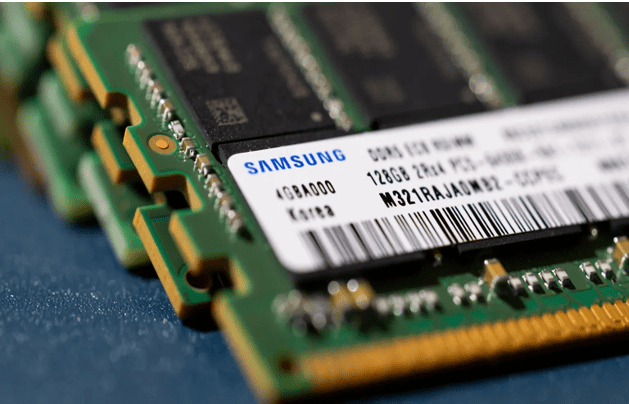

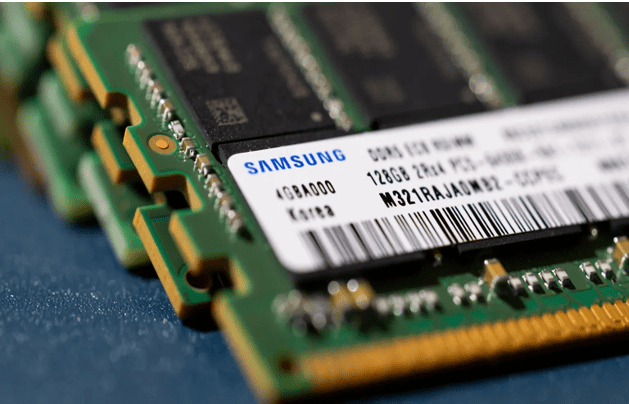

Samsung expects profits to jump by more than 1,400%

Samsung Electronics expects its profits for the three months to June 2024 to jump 15-fold compared to the same period last year. An artificial intelligence (AI) boom has lifted the prices of advanced chips, driving up the firm's forecast for the second quarter. The South Korean tech giant is the world's largest maker of memory chips, smartphones and televisions. The announcement pushed Samsung shares up more than 2% during early trading hours in Seoul. The firm also reported a more than 10-fold jump in its profits for the first three months of this year. In this quarter, it said it is expecting its profit to rise to 10.4tn won ($7.54bn; £5.9bn), from 670bn won last year. That surpasses analysts' forecasts of 8.8tn won, according to LSEG SmartEstimate. "Right now we are seeing skyrocketing demand for AI chips in data centers and smartphones," said Marc Einstein, chief analyst at Tokyo-based research and advisory firm ITR Corporation. Optimism about AI is one reason for the broader market rally over the last year, which pushed the S&P 500 and the Nasdaq in the United States to new records on Wednesday. The market value of chip-making giant Nvidia surged past $3tn last month, briefly holding the top spot as the world's most valuable company. "The AI boom which massively boosted Nvidia is also boosting Samsung's earnings and indeed those of the entire sector," Mr Einstein added. Samsung Electronics is the flagship unit of South Korean conglomerate Samsung Group. Next week, the tech company faces a possible three-day strike, which is expected to start on Monday. A union of workers is demanding a more transparent system for bonuses and time off.

Microsoft to offer Apple devices to employees in China, cites absence of Android services

July 8 (Reuters) - Microsoft (MSFT.O), opens new tab intends to offer Apple's (AAPL.O), opens new tab iOS-based devices to its employees in China to access authentication apps, a company spokesperson said on Monday, citing absence of Google's (GOOGL.O), opens new tab Android services in the country. Microsoft has been under increased scrutiny after a series of security breaches, the latest being that of Russian hackers who spied and accessed emails of the company's employees and customers earlier this year. The development was first reported by Bloomberg News, which, citing an internal memo, said the Windows OS-maker instructed its employees in China to use Apple devices at workplace from September. As a part of Microsoft's global Secure Future Initiative, the move to switch to iOS-devices stems from the lack of availability of Google Play Store in China that limits its employees' access to security apps such as Microsoft Authenticator and Identity Pass, the report added. "Due to the lack of availability of Google Mobile Services in this region, we look to offer employees a means of accessing these required apps, such as an iOS device," a company spokesperson told Reuters in an email. Microsoft is among those U.S. companies that have a strong presence in China. It entered the Chinese market in 1992 and also operates a large research and development center in the country. The company will provide iPhone 15 models to employees, currently using Android handsets across China, including Hong Kong, the Bloomberg report said.