Enhance Your Photos With NASA's Sharpening Technique

Incredible space photos like those from NASA don't look as stunning straight out of the telescope. They need significant processing, and a crucial part of that is sharpening. Coming to you from Unmesh Dinda with PiXimperfect, this fascinating video explores the APF-R plugin, developed by award-winning astrophotographer Christoph Kaltseis. APF-R stands for Absolute Point of Focus, and it's designed to enhance photo details without creating halos or artifacts. This technology has been used by space agencies with telescopes like the James Webb, and now, you can use it in Photoshop. The plugin allows for non-destructive editing, meaning you can adjust the radius and detail level without permanently altering your image. This feature is crucial for astrophotography, where preserving original details is vital. The video shows how APF-R compares to Photoshop's built-in sharpening tools. The plugin offers multiple rendering methods, each suited for different types of images. For instance, the "Center Weighted" method provides a balanced sharpening effect without making the image look overprocessed. Dinda explains how to fine-tune these settings to achieve the best results, making it clear why this plugin is a game-changer for photographers looking to enhance their images with precision. One notable feature of APF-R is its ability to work with different image types. The video demonstrates how the plugin enhances not just space photos but also landscapes and portraits. For portraits, APF-R can bring out skin textures and eye details without creating the unwanted halos that traditional sharpening methods often produce. Dinda also shows how to combine APF-R with other Photoshop tools, like Smart Sharpen, for even better results. This versatility makes APF-R a valuable addition to any photographer's toolkit. The plugin's cost is $50, which Dinda considers a bargain given its advanced capabilities. There's also a Creative Bundle subscription that includes APF-R and 20 other tools, offering great value for those looking to expand their editing options. Dinda provides discount codes in the video description, making this sophisticated tool more accessible. Check out the video above for the full rundown from Dinda.

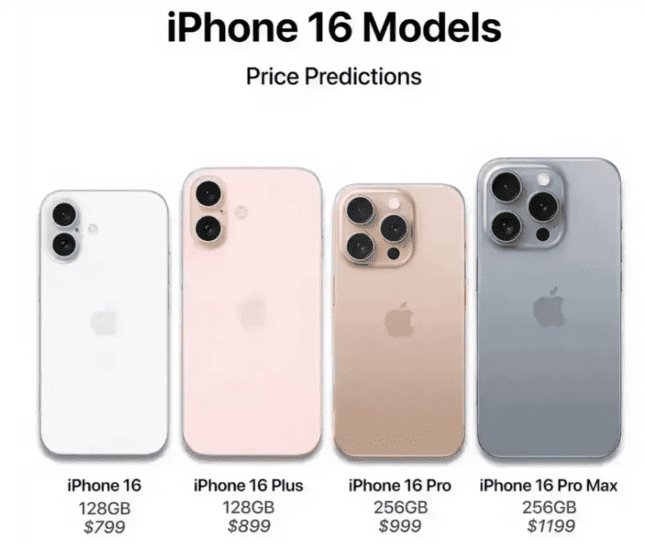

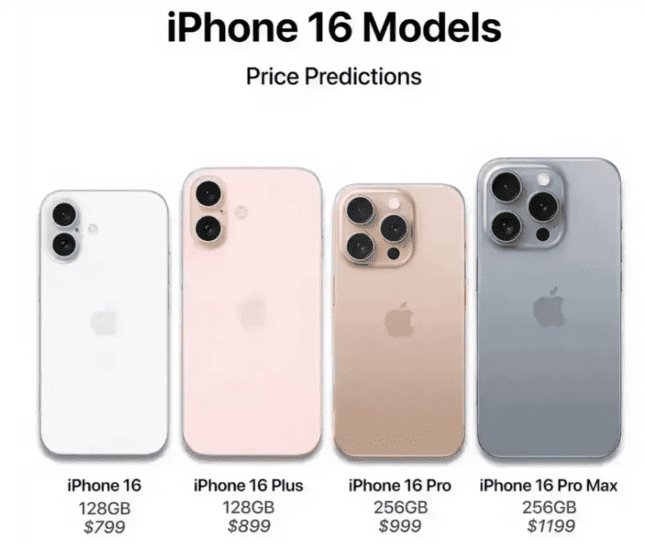

How to evaluate the product impact of the iPhone 16

At the Apple Developer Conference held earlier, the iPhone 16 series will be equipped with iOS 18 has been revealed. At the event, Apple showed off a series of convenient interactive experiences brought by Apple Intelligence, including a more powerful Siri voice assistant, Mail app that can generate complex responses, and Safari that aggregates web information. These upgrades will no doubt make the iPhone 16 line even more attractive. In order to use Apple Intelligence, a new feature of iOS 18, the iPhone 16 and 16 Pro series are equipped with A18 chips. An external blogger found in Apple's back end that the iPhone 16 series will use the same A-series chip, and the back end code mentions A new model unrelated to the existing iPhone. It includes four iPhone 16 series models, and the four identifiers all start with the same number, indicating that Apple is attributing them to the same platform. The new iPhone will have a stainless steel battery case, which will make it easier to remove the battery to meet EU market standards, while also allowing Apple to increase the density of the battery cell in line with safety regulations.

Exclusive: Nornickel in talks with China Copper to move smelting plant to China, sources say

HONG KONG, July 9 (Reuters) - Nornickel (GMKN.MM), opens new tab is in talks with China Copper to form a joint venture that would allow the Russian mining giant to move its entire copper smelting base to China, four sources with knowledge of the matter told Reuters. If the move goes ahead, it would mark Russia's first uprooting of a domestic plant since the U.S. and Britain banned metal exchanges from accepting new aluminium, copper and nickel produced by Russia. It also means Nornickel's copper will be produced within the country where it is most consumed. Nornickel said in April it planned to close its Arctic facility and build a new plant in China with an unnamed partner. Executives at China Copper, owned by the world's largest aluminium producer Chinalco (601600.SS), opens new tab, flew to Moscow in June to discuss a possible joint venture, one of the sources said, adding that details of the structure and investment are still under discussion. Nornickel declined to comment. Chinalco and China Copper did not respond to requests for comment via email and phone. Sites being considered in China include Fangchenggang and Qinzhou in the Guangxi region, the two sources said, with another source saying Qingdao in Shandong province was also possible. A decision on a joint venture will be made over the next few months, a fifth source said, adding that Nornickel's Chinese output is likely to be consumed domestically. The new facility will have capacity to produce 450,000 tonnes of copper annually, two of the sources said, amounting to around 2% of global mined supplies estimated at around 22 million metric tons this year. Nornickel, which according to its annual report produced 425,400 tonnes of refined copper last year, processed all of its concentrates in 2023 at the Arctic plant, its only operation producing finished copper suitable for delivery to exchanges.

McDonald’s expands operational map in Chinese market, to roll out more outlets in the country

McDonald's China, together with its four major suppliers announced the launch of an industrial park in Xiaogan city, Central China's Hubei Province on Wednesday, highlighting the importance of Chinese market in terms of supply chain for food business. With a combined investment of 1.5 billion yuan ($206 million), the park, named Hubei Smart Food Industrial Park, is a joint project with Bimbo QSR, XH Supply Chain, Tyson Foods Inc, and Zidan, according to information provided to the Global Times. The park is expected to produce 34,000 tons of meat products, 270 million buns, 30 million pastries, and 2 billion packaged products annually. It also features a 25,000-square-meter high-standard automated warehouse for frozen, refrigerated, and dry goods, reducing logistics time by 90 percent from manufacturing to arriving at the destination. Leveraging local geographical advantages, the park will become a supply hub for McDonald's in central and western China, enhancing supply efficiency and stability for its outlets there, the company said. "McDonald's has been deeply rooted in China for over 30 years, and the park is an echo of our long-term development in China," said Phyllis Cheung, CEO of McDonald's China. "Without any long-term strategy, we don't have any structural advantage in China," Cheung noted. The US food giant continues to expand its business map in China. As of the end of June in 2024, there were over 6,000 restaurants and over 200,000 employees in the market. China has become the second largest and fastest-growing market of McDonald's. In 2023, McDonald's China unveiled the ambition of operating 10,000 restaurants by 2028. To support this, McDonald's and its suppliers have invested over 12 billion yuan from between 2018 to 2023 to develop new production capacities and enhance supply chain sustainability. Observers said that the industrial park reflect foreign companies' confidence in operating in China as the country takes concrete measures in furthering reform and opening-up. China's foreign direct investment from January to May 2024 reached 412.51 billion yuan, with the number of newly-established foreign-backed companies reaching 21,764, rising by 17.4 percent year-on-year, data from China's Ministry of Commerce revealed. According to a recent survey by the American Chamber of Commerce in China, the majority of US companies saw improved profitability in China in 2023, and half of the survey participants put China as their first choice or within their top three investment destinations globally. Olaf Korzinovski, EVP of Volkswagen China, who is responsible for production and components, also shared his understanding of supply chains in China with the Global Times. Volkswagen has been operating in China for about 40 years. "In order to seize greater value for our customers," Volkswagen Group is stepping up pace of innovation in China, and systematically purshing forward the digitalization process, Korzinovski noted, adding the company is strengthening local capabilities with accelerated decision-making efficiency. Global Times

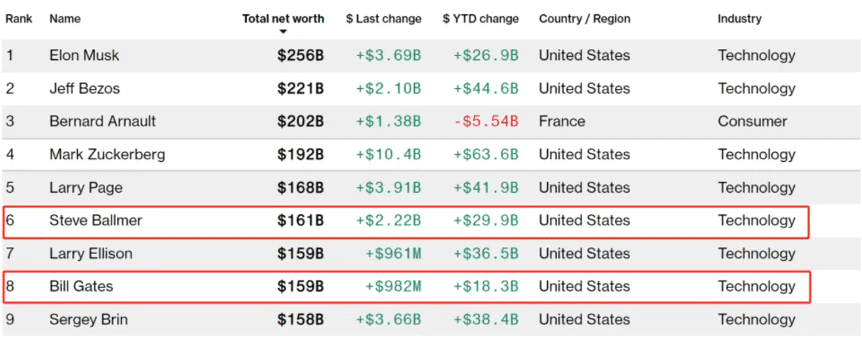

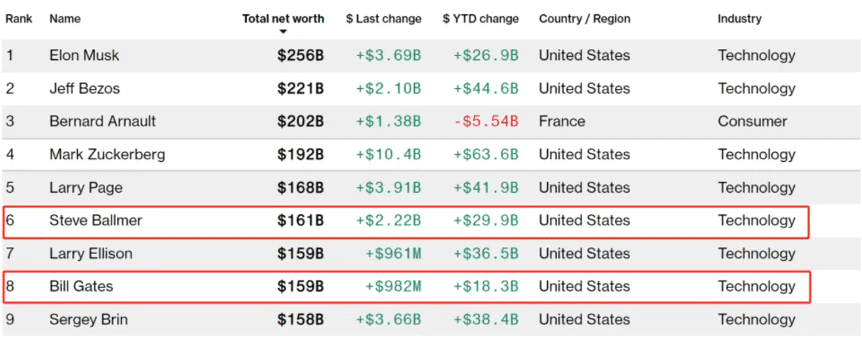

Former Microsoft CEO Ballmer wealth surpassed Gates, he only did one thing

On July 1, former Microsoft CEO and President Steve Ballmer surpassed Microsoft co-founder Bill Gates for the first time on the Bloomberg list of the world's richest people to become the sixth richest person in the world. According to the data, as of the same day, Ballmer's net worth reached $157.2 billion, while Gates's wealth was $156.7 billion, falling to seventh place. The latest figures, as of July 6, show that Ballmer's wealth has grown further to $161 billion, and Gates' wealth is $159 billion. This is the first time Ballmer's net worth has surpassed Gates', and it is also the rare time in history that an employee's net worth has surpassed that of a company founder. Unlike Musk, Jeff Bezos and others, Ballmer's wealth was not accumulated through entrepreneurial success as a business founder, but simply because he chose to hold Microsoft "indefinitely." As Fortune previously reported, Ballmer is the only individual with a net worth of more than $100 billion as an employee rather than a founder.