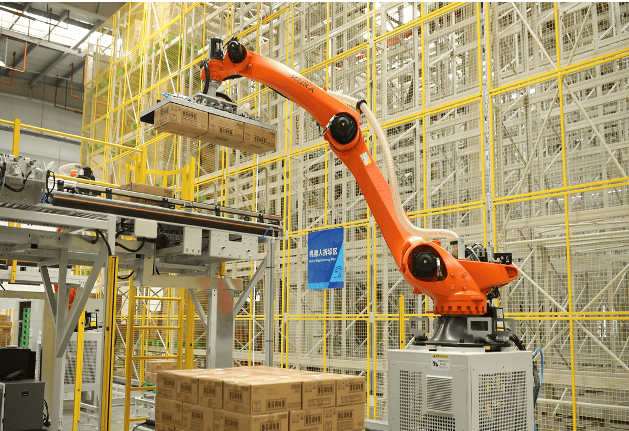

McDonald’s expands operational map in Chinese market, to roll out more outlets in the country

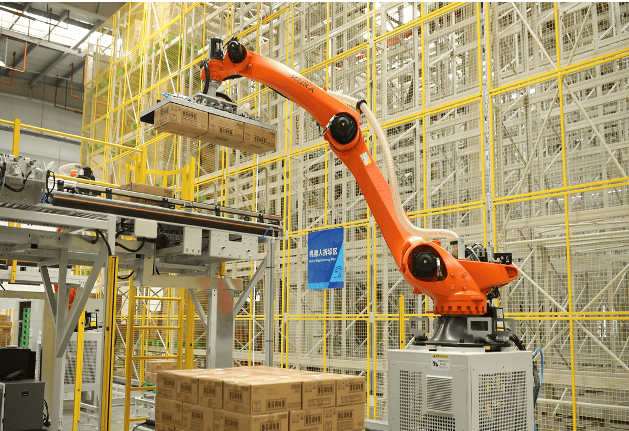

McDonald's China, together with its four major suppliers announced the launch of an industrial park in Xiaogan city, Central China's Hubei Province on Wednesday, highlighting the importance of Chinese market in terms of supply chain for food business. With a combined investment of 1.5 billion yuan ($206 million), the park, named Hubei Smart Food Industrial Park, is a joint project with Bimbo QSR, XH Supply Chain, Tyson Foods Inc, and Zidan, according to information provided to the Global Times. The park is expected to produce 34,000 tons of meat products, 270 million buns, 30 million pastries, and 2 billion packaged products annually. It also features a 25,000-square-meter high-standard automated warehouse for frozen, refrigerated, and dry goods, reducing logistics time by 90 percent from manufacturing to arriving at the destination. Leveraging local geographical advantages, the park will become a supply hub for McDonald's in central and western China, enhancing supply efficiency and stability for its outlets there, the company said. "McDonald's has been deeply rooted in China for over 30 years, and the park is an echo of our long-term development in China," said Phyllis Cheung, CEO of McDonald's China. "Without any long-term strategy, we don't have any structural advantage in China," Cheung noted. The US food giant continues to expand its business map in China. As of the end of June in 2024, there were over 6,000 restaurants and over 200,000 employees in the market. China has become the second largest and fastest-growing market of McDonald's. In 2023, McDonald's China unveiled the ambition of operating 10,000 restaurants by 2028. To support this, McDonald's and its suppliers have invested over 12 billion yuan from between 2018 to 2023 to develop new production capacities and enhance supply chain sustainability. Observers said that the industrial park reflect foreign companies' confidence in operating in China as the country takes concrete measures in furthering reform and opening-up. China's foreign direct investment from January to May 2024 reached 412.51 billion yuan, with the number of newly-established foreign-backed companies reaching 21,764, rising by 17.4 percent year-on-year, data from China's Ministry of Commerce revealed. According to a recent survey by the American Chamber of Commerce in China, the majority of US companies saw improved profitability in China in 2023, and half of the survey participants put China as their first choice or within their top three investment destinations globally. Olaf Korzinovski, EVP of Volkswagen China, who is responsible for production and components, also shared his understanding of supply chains in China with the Global Times. Volkswagen has been operating in China for about 40 years. "In order to seize greater value for our customers," Volkswagen Group is stepping up pace of innovation in China, and systematically purshing forward the digitalization process, Korzinovski noted, adding the company is strengthening local capabilities with accelerated decision-making efficiency. Global Times

Kris Jenner Shares Plans to Remove Ovaries After Tumor Diagnosis

Kris Jenner is opening up about her health. The reality star shared plans to have her ovaries surgically removed after she was diagnosed with a tumor on one of the organs. “I went to the doctor and I had my scan," she tearfully told daughters Kim Kardashian, Khloe Kardashian and Kendall Jenner on the July 4 episode of The Kardashians. "They found a cyst.” Kris continued, "They said I gotta have my ovaries taken out." While the 68-year-old—who is also mom to kids Kourtney Kardashian, Rob Kardashian and Kylie Jenner—wasn't nervous about the procedure, she did feel very emotional over having to part with her ovaries because, as she put it, "that’s where all my kids were conceived." "It’s also a thing about getting older," Kris noted. "It’s a sign of 'we’re done with this part of your life.' It’s a whole chapter that’s just closed.” She added in a separate confessional, “People often ask me what is the best job you’ve ever had, and I always say mom. The biggest blessing in my life was being able to give birth to six beautiful kids.” And in true Kardashian fashion, Kris' family quickly rallied behind her. After Kourtney called in to check on Kris, the Poosh founder said in a confessional, "I totally understand how my mom is feeling because I would feel the same way." "It’s your womanly power," Kourtney continued. "It doesn’t mean it’s taking away who she is or what she’s experienced, but I would feel this sentimental feeling of what it’s created.” Likewise, Kim empathized with Kris, saying that she feels "really sad for her." "To have a surgery and remove your ovaries is a really big deal," the SKIMS mogul shared. "I couldn’t even imagine being in that situation.” Kris' longtime boyfriend Corey Gamble also showed his support, surprising the momager with a special gift to “help your energy."

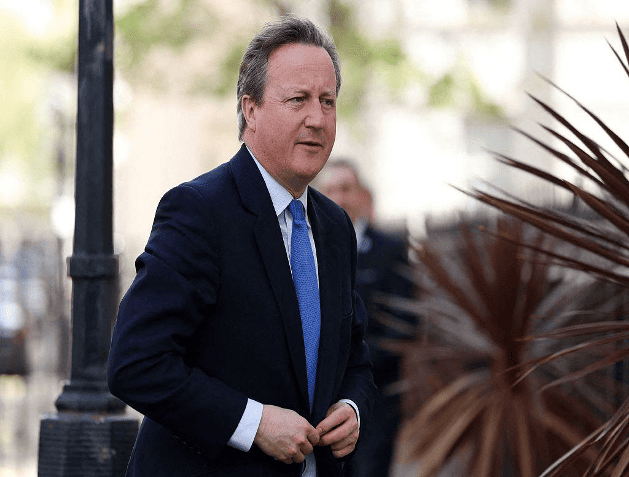

Amid rising regional tensions, the US announced that it will hold another Rim of the Pacific military exercise

The U.S. Navy's Pacific Fleet announced on Wednesday (May 22) that the 2024 Rim of the Pacific Exercise (RIMPAC 2024) is expected to take place on June 26, with 29 countries participating in and around the Hawaiian Islands, a larger lineup than the previous exercise in 2022. The Philippines, which has had multiple maritime conflicts with China recently, and Japan, which has tense diplomatic relations with China, will send troops to participate. China has been excluded from participating in the international military exercise since 2018, and its aggressive actions and reactions are causing tensions in the Pacific region to continue to rise. The biennial Rim of the Pacific military exercise is the world's largest international maritime exercise. The U.S. Navy said that the exercise will last until August 2, and it is expected to involve 29 countries, 40 surface ships, 3 submarines, 14 countries' army forces, more than 150 aircraft and more than 25,000 personnel. The U.S. Navy said that the theme of the 29th RIMPAC 2024 is "Partners: Integrated and Ready", emphasizing inclusiveness as the core, promoting multinational cooperation and trust, and using military interoperability to achieve their respective national goals to strengthen integrated and ready alliance partners. Its goal is to "enhance collective strength and promote a free and open Indo-Pacific region" through joint training and operations. The 29 countries participating in the exercise this year include Australia, Belgium, Brazil, Brunei, Canada, Chile, Colombia, Denmark, Ecuador, France, Germany, India, Indonesia, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Peru, South Korea, the Philippines, Singapore, Sri Lanka, Thailand, Tonga, the United Kingdom and the United States. Compared with the 28th RIMPAC held in 2022, which involved 26 countries, 38 surface ships, 4 submarines, 9 countries' army forces, more than 170 aircraft, and about 25,000 officers and soldiers, the number of countries, ships and army forces participating in this exercise has increased. The countries participating in this year's RIMPAC military exercise include all members of the Quadrilateral Security Dialogue (QUAD) between the United States, Japan, India and Australia, and the Australia-UK-US Trilateral Security Partnership (AUKUS), as in the previous exercise. In addition, countries surrounding the South China Sea and the South Pacific island nation of Tonga are also participating. Many analysts believe that the military exercise itself is sending a message to China: China's expansion in the Western Pacific region will be blocked and defeated. The United States invited China to participate in the RIMPAC military exercise twice in 2014 and 2016. In 2018, due to China's expansion in the South China Sea, the United States withdrew its invitation to China. In addition, despite Taiwan's repeated willingness to participate, Taiwan is still not included in the 29 countries participating in this year's RIMPAC military exercise. Analysts pointed out that the US-led RIMPAC military exercise is intended to unite allies to militarily intimidate China. If Taiwan is invited to join, it will be too provocative to China, which will not only aggravate the tension between the United States and China, but also embarrass some allies. The U.S. Navy said the commander of the U.S. Third Fleet will serve as the commander of the joint task force for the exercise, while Chilean Navy Commodore Alberto Guerrero will serve as deputy commander of the joint task force, which is a first in the history of the RIMPAC military exercise. In addition, Japan Maritime Self-Defense Force Rear Admiral Kazushi Yokota will also serve as deputy commander. Other key leaders of the multinational force exercise include Canadian Commodore Kristjan Monaghan, who will command the maritime forces, and Australian Air Force Commodore Louise Desjardins, who will command the air forces. According to the U.S. Stars and Stripes, Vice Admiral Michael Boyle is currently the commander of the U.S. Third Fleet. Vice Admiral John Wade has been nominated to replace Boyle. The U.S. Navy press release said the exercise will enhance the ability of international joint forces to "deter and defeat aggression by major powers in all domains and conflict levels," but did not provide specific information on which exercises will be held this summer. Previous RIMPAC training exercises have included sinking ships at sea with missiles, amphibious landings and the first landing of a Marine Corps Osprey aircraft on an Australian ship.