How China can transform from passive to active amid US chip curbs

On Monday, executives from the three major chip giants in the US - Intel, Qualcomm, and Nvidia - met with US officials, including Antony Blinken, to voice their opposition to the Biden administration's plan of imposing further restrictions on chip sales to Chinese companies and investments in China. The Semiconductor Industry Association also released a similar statement, opposing the exclusion of US semiconductor companies from the Chinese market. First of all, we mustn't believe that the appeals of these companies and industry associations will collectively change the determination of US political elites to stifle China's progress. These US elites are very fearful of China's rapid development, and they see "chip chokehold" as a new discovery and a successful tactic formed under US leadership and with the cooperation of allies. Currently, the chip industry is the most complex technology in human history, with only a few companies being at the forefront. They are mainly from the Netherlands, Taiwan island, South Korea, and Japan, most of which are in the Western Pacific. These countries and regions are heavily influenced by the US. Although these companies have their own expertise, they still use some American technologies in their products. Therefore, Washington quickly persuaded them to form an alliance to collectively prevent the Chinese mainland from obtaining chips and manufacturing technology. Washington is proud of this and wants to continuously tighten the noose on China. The New York Times directly titled an article "'An Act of War': Inside America's Silicon Blockade Against China, " in which an American AI expert, Gregory Allen, publicly claimed that this is an act of war against China. He further stated that there are two dates that will echo in history from 2022: The first is February 24, when the Russia-Ukraine conflict broke out, and the second is October 7, when the US imposed a sweeping set of export controls on selling microchips to China. China must abandon its illusions and launch a challenging and effective counterattack. We already have the capability to produce 28nm chips, and we can use "small chip" technology to assemble small semiconductors into a more powerful "brain," exploring 14nm or even 7nm. Additionally, China is the world's largest commercial market for commodity semiconductors. Last year, semiconductor procurement in China amounted to $180 billion, surpassing one-third of the global total. In the past, China had been faced with the choice between independent innovation and external purchases. Due to the high returns from external purchases, it is easy for it to become the overwhelming choice over independent research and development. However, now the US is gradually blocking the option of external purchases, and China has no strategic choice but to independently innovate, which in turn puts tremendous pressure on American companies. Scientists generally expect that, although China may take some detours, such as recently apprehending several company leaders who fraudulently obtained subsidies from national semiconductor policies, China has the ability to gradually overcome the chip difficulties. And we will form our own breakthroughs and industrial chain, which is expected to put quite a lot of pressure on US companies. If domestic firms acquire half of China's $180 billion per year in chip acquisitions, this would provide a significant boost for the industry as a whole and help it advance steadily. The New York Times refers to the battle on chips as a bet by Washington. "If the controls are successful, they could handicap China for a generation; if they fail, they may backfire spectacularly, hastening the very future the United States is trying desperately to avoid," it argued. Whether it is a war or a game, when the future is uncertain, what US companies hope for most of all is that they can sell simplified versions of high-end chips to China, so that the option of external purchases by China continues to exist and remains attractive. This can not only maintain the interests of the US companies, enabling them to obtain sufficient funds to develop more advanced technologies, but also disrupt China's plans for independent innovation. This idea is entirely based on their own commercial interests and also has a certain political and national strategic appeal. Hence, there is no shortage of supporters within the US government. US Secretary of the Treasury Janet Yellen seems to be one of them, as she has repeatedly stated that the US' restrictions on China will not "fundamentally" hurt China, but will only be "narrowly targeted." The US will balance its strict suppression on China from the perspective of maintaining its technological hegemony, while also leaving some room for China, in order to undermine China's determination to counterattack in terms of independent innovation. China needs to use this mentality of the US to its advantage. On the one hand, China should continue to purchase US chips to maintain its economic fundamentals, and on the other hand, it should firmly support the development of domestic semiconductor companies from both financial and market perspectives. If China were to continue relying on exploiting the gaps in US chip policies in the long term, akin to a dependency on opium, it would only serve to weaken China further as it becomes increasingly addicted. China's market is extremely vast, and its innovation capabilities are generally improving and expanding. Although the chip industry is highly advanced, if there is one country that can win this counterattack, it is China. As long as we resolutely continue on the path of independent innovation, this road will definitely become wider. Various breakthroughs and turning points that are unimaginable today may soon occur.

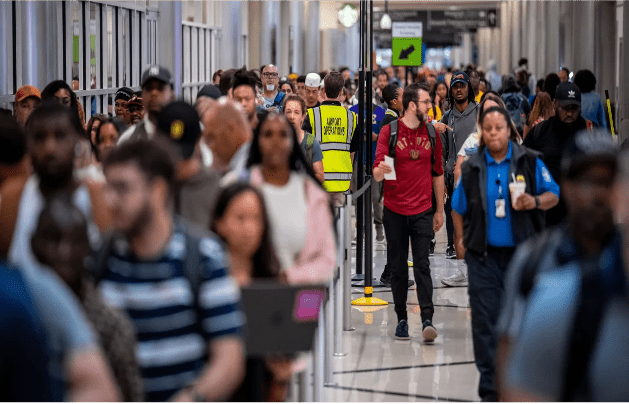

Record numbers of people are flying. So why are airlines’ profits plunging?

New York CNN — A record number of passengers are expected to pass through US airports this holiday travel week. You’d think this would be a great time to run an airline. You’d be wrong. Airlines face numerous problems, including higher costs, such as fuel, wages and interest rates. And problems at Boeing mean airlines have too few planes to expand routes to support a record numbers of flyers. Strong bookings can’t entirely offset that financial squeeze. The good news for passengers is they will be spared most of the problems hurting airlines’ bottom lines — at least in the near term. Airfares are driven far more by supply and demand, not their costs. But in the long run, the airlines’ difficulties could mean fewer airline routes, less passenger choice and ultimately a less pleasant flying experience. Profit squeeze Industry analysts expect airlines to report a drop of about $2 billion in profit, or 33%, when they report financial results for the April to June period this year. That would follow losses of nearly $800 million across the industry in the first quarter. Labor costs and jet fuel prices, the airlines’ two largest costs, are both sharply higher this year. Airline pilot unions just landed double-digit pay hikes to make up for years of stagnant wages; flight attendant unions now want comparable raises. Jet fuel prices are climbing because of higher demand in the summer. According to the International Air Transport Association’s jet fuel monitor, prices are up 1.4% in just the last week, and about 4% in the last month. Adding to the airlines’ problems is the crisis at Boeing, as well as the less-well-publicized problems with some of the jet engines on planes from rival Airbus. Since an Alaska Airlines Boeing 737 Max jet lost a door plug on a January 5 flight, leaving a gaping hole in the side of the plane 10 minutes after takeoff, the Federal Aviation Administration has limited how many jets Boeing can make over concerns about quality and safety. As a result, airlines have dramatically reduced plans to expand their fleets and replace older planes with more fuel efficient models. In some cases, airlines have asked pilots to take time off without pay, and carriers such as Southwest and United have announced pilot hiring freezes. In addition to the problems at Boeing, hundreds of the Airbus A220 and A320 family of jets globally have also been grounded for at least a month or more to deal with engine problems. Just about all the planes with those engines have been out of sevice for at least a few days to undergo examinations. And Airbus has also cut back the number of planes it expects to deliver to airlines this year because of supply chain problems. Problems for flyers For now, competition in the industry remains fierce: There are 6% more seats available this month compared to July of 2023, according to aviation analytics firm Cirium. And that’s helped to drive fares down — good news for passengers, but more bad news for airlines’ profits. Southwest announced in April that it would stop serving four airports to trim costs — Bellingham International Airport in Washington state, Cozumel International Airport in Mexico, Syracuse Hancock International Airport in New York and Houston’s George Bush Intercontinental Airport. Many more cities lost air service during the financial hard times of the pandemic. While upstart airlines are driving prices lower for travelers, those discount carriers might not survive long term. As the major carriers are making less money, many of the upstarts are flat-out losing money.

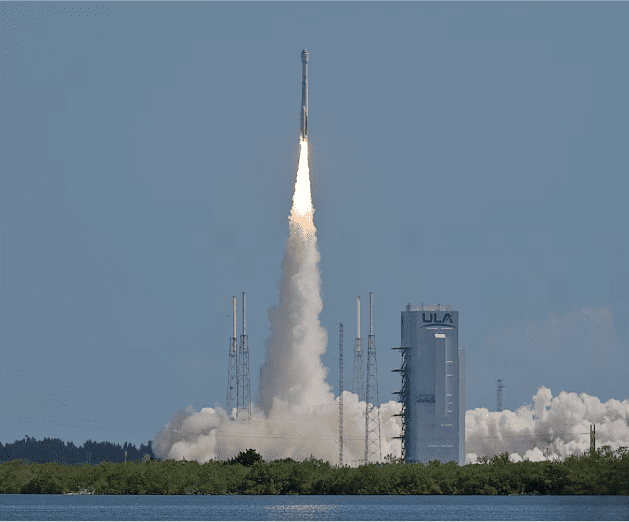

Explainer: How Boeing's Starliner can bring its astronauts back to Earth

WASHINGTON, June 24 (Reuters) - Problems with Boeing's Starliner capsule, still docked at the International Space Station (ISS), have upended the original plans for its return of its two astronauts to Earth, as last-minute fixes and tests draw out a mission crucial to the future of Boeing's (BA.N), opens new tab space division. NASA has rescheduled the planned return three times, and now has no date set for it. Since its June 5 liftoff, the capsule has had five helium leaks, five maneuvering thrusters go dead and a propellant valve fail to close completely, prompting the crew in space and mission managers in Houston to spend more time than expected pursuing fixes mid-mission. Here is an explanation of potential paths forward for Starliner and its veteran NASA astronauts, Barry "Butch" Wilmore and Sunita "Suni" Williams. THE CURRENT SITUATION Starliner can stay docked at the ISS for up to 45 days, according to comments by NASA's commercial crew manager Steve Stich to reporters. But if absolutely necessary, such as if more problems arise that mission officials cannot fix in time, it could stay docked for up to 72 days, relying on various backup systems, according to a person familiar with flight planning. Internally at NASA, Starliner's latest targeted return date is July 6, according to this source, who spoke on condition of anonymity. Such a return date would mean that the mission, originally planned for eight days, instead would last a month. Starliner's expendable propulsion system is part of the craft's "service module." The current problems center on this system, which is needed to back the capsule away from the ISS and position it to dive through Earth's atmosphere. Many of Starliner's thrusters have overheated when fired, and the leaks of helium - used to pressurize the thrusters - appear to be connected to how frequently they are used, according to Stich.

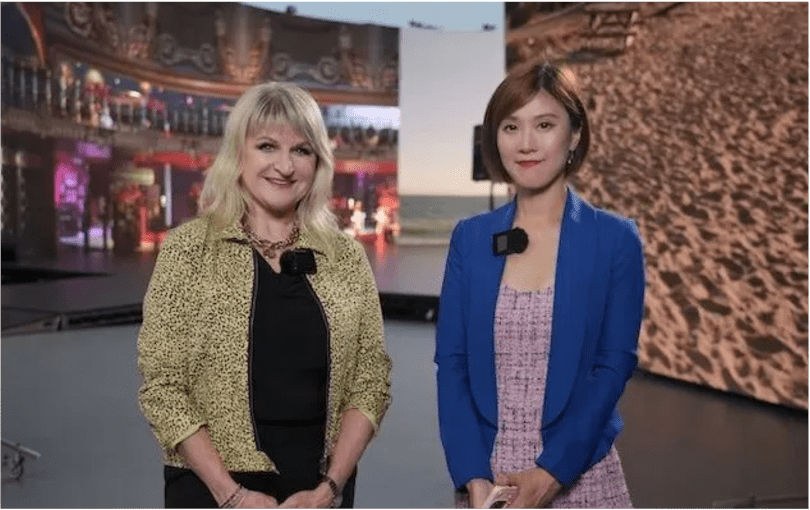

Hollywood's strongest supporting actor has been launched, AI is not far from subverting "Dreamworks"?

As a major city in the United States and even the global film industry, Hollywood has gathered a large number of veteran film and television production companies, including Universal Pictures, Warner Bros., Paramount Pictures, Disney Pictures, MGM Pictures, etc. In addition, new streaming forces such as Netflix have also entered in recent years. When the new generation of technology represented by generative AI sweeps the world, the movie "dream factory" is also experiencing a transformative moment. In early May last year, the US film and television industry launched a series of strikes that lasted for five months. Two labor disputes, led by the Writers Guild and the Screen Actors Guild, have caused the worst industry disruption since the 2020 pandemic, forcing many film projects and TV shows to halt or delay production. The strike has been costly, with Kevin Klowden, chief global strategist at the Milken Institute think tank, estimating it has cost the U.S. economy more than $5 billion, affecting not only film and television production companies, but also surrounding service industries such as catering, trucking and dry cleaning. One of the main conflicts between labor and management is that many actors and screenwriters have expressed concerns about "unemployment" due to the "invasion" of artificial intelligence. Luo Chenya has been working in the film and television industry for more than 10 years, including scriptwriter, documentary photographer and assistant director. She told the first financial reporter that after ChatGPT became popular, she also tried to use chatbots to assist script creation. "I can talk to the AI about my ideas and ideas, and it will help analyze and refine my ideas, and even make some suggestions that I think are quite effective." But on the execution level, the idea of writing it down into a very specific scene, character action, it doesn't really help me." Luo Chenya said that AI still needs more training and evolution in script writing, but the ability to present images is amazing. "AI can directly generate images, which can indeed save labor to a great extent, and may even replace photographers in the future." In post-production, AI can beautify images and modify flaws." A place to be fought over Earlier this year, OpenAI released the Vincennes video model Sora on its website, which can create videos up to a minute long, generating complex scenes with multiple characters, specific types of movement, and precise theme and background details. In addition to being able to generate video from text, the model can also generate video from still images, precisely animating the image content. "Vincennes Video can quickly produce high-quality video content, greatly improving production efficiency, and generative AI helps to improve the analysis of user preferences and personalized recommendations, and enhance the attractiveness of content." These technologies will disrupt traditional video production and content distribution models, and media companies need to adapt and change their operating models." Wang Haoyu, CEO of Mairui Asset Management, said in an interview with the first financial reporter. For this reason, Hollywood giants have long made big bets and stepped up their layout.

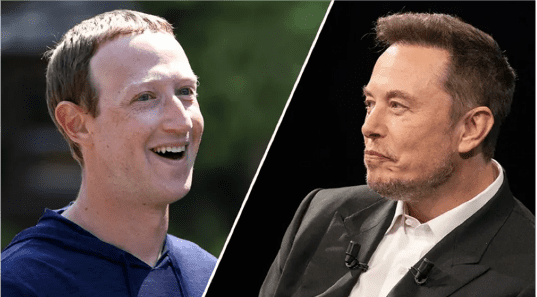

Zuckerberg surfed and drank beer on vacation, Musk: I prefer to work

After Meta CEO Mark Zuckerberg posted a video on his Facebook and Instagram accounts of his free time during the Independence Day holiday on the X platform, Musk said, "I prefer to work." Zuckerberg posted a video of himself surfing on a hydrofoil in a tuxedo, waving an American flag and drinking a beer, and wrote: "Happy birthday America." The video quickly went viral, and after greg shared it on the X platform, Musk replied: "I hope he continues to have fun on the yacht." I prefer to work." Musk, a workaholic, attended the 29th annual Barron Investment Conference in November 2022, where he said: "My workload went from 78 hours a week to 120 hours a week..." In 2018, he slept on the floor of the Gigafactory in Fremont in an effort to ramp up production of the Tesla Model 3.