Samsung Electronics wins cutting-edge AI chip order from Japan's Preferred Networks

SEOUL, July 9 (Reuters) - Samsung Electronics (005930.KS), opens new tab said on Tuesday it won an order from Japanese artificial intelligence company Preferred Networks to make chips for AI applications using the South Korean firm's 2-nanometre foundry process and advanced chip packaging service. It is the first order Samsung has revealed for its cutting-edge 2-nanometre chip contract manufacturing process. Samsung did not elaborate on the size of the order. The chips will be made using high-tech chip architecture known as gate all-around (GAA) and multiple chips will be integrated in one package to enhance inter-connection speed and reduce size, Samsung said in a statement. South Korea's Gaonchips Co (399720.KQ), opens new tab designed the chips, Samsung said. The chips will go toward Preferred Networks' high-performance computing hardware for generative AI technologies such as large language models, Junichiro Makino, Preferred Networks vice president and chief technology officer of computing architecture, said in the statement.

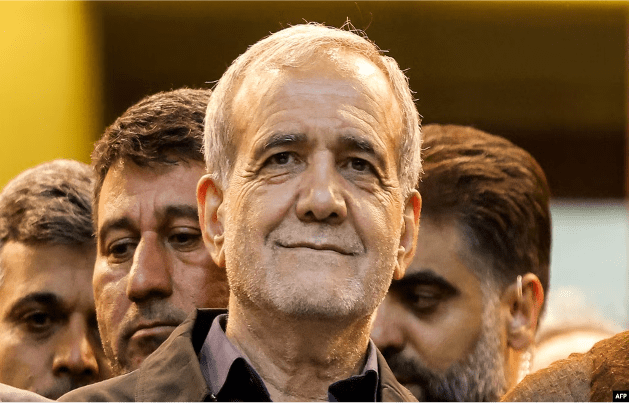

Iran's president-elect reaffirms policy toward Israel

Iran's President-elect Masoud Pezeshkian reiterated Iran's anti-Israel stance on Monday, saying resistance movements across the region will not allow Israel's "criminal policies" against Palestinians to continue. Pezeshkian told Hassan Nasrallah, the leader of Iran-backed Lebanese Hezbollah, that "the Islamic Republic will always support the people of the region in their resistance against the illegal Zionist regime." This suggests that the incoming government will not change its regional policy under the relatively moderate Pezeshkian, who defeated his hard-line opponent in a runoff election last week. Pezeshkian was quoted as saying by Iranian media, "I am sure that the regional resistance movement will not allow this regime to continue its militant and criminal policies against the oppressed people of Palestine and other countries in the region." The Shiite Muslim Hezbollah and the Palestinian Sunni Muslim Hamas are both part of the local "resistance axis" faction organization supported by Iran. Israel did not immediately comment on Pezeshkian's speech. Hamas led an attack on southern Israel on October 7. According to Israeli statistics, Hamas killed 1,200 people and kidnapped about 250 hostages, triggering the Israeli-Palestinian war. The Gaza Health Ministry said that the Israeli military attack killed more than 38,000 Palestinians and injured nearly 88,000 people.

Doctors visited the White House 8 times? White House: Biden did not receive treatment for Parkinson's disease

White House spokeswoman Karina Jean-Pierre denied a report in the U.S. media on the 8th that President Joseph Biden did not receive treatment for Parkinson's disease. Biden had the first televised debate of the 2024 presidential election with Republican opponent Donald Trump on June 27, and his poor performance on the spot triggered discussions about his physical condition. The New York Times reported that a doctor specializing in the treatment of Parkinson's disease had "visited" the White House eight times from August last year to March this year. Facing the media's questions about Biden's health, Jean-Pierre asked and answered himself at a regular White House press conference on the 8th: "Has the president received treatment for Parkinson's disease? No. Is he currently receiving treatment for Parkinson's disease? No, he is not. Is he taking medication for Parkinson's disease? No." Jean-Pierre said Biden had seen a neurologist three times, all related to his annual physical examination. She also took out the report issued by the doctor after Biden's most recent physical examination in February this year. The report said, "An extremely detailed neurological examination was once again reassuring" because no symptoms consistent with stroke, multiple sclerosis or Parkinson's disease were found. The doctor who went to the White House mentioned by the New York Times is Kevin Kanal, a neurology and movement disorder expert at the Walter Reed National Military Medical Center in Maryland and an authority on Parkinson's disease. Jean-Pierre suggested that the doctor might have come to treat military personnel on duty at the White House.

BRI: embracing Chinese green practices for a sustainable future

Editor's Note: This year marks the 10th anniversary of the Belt and Road Initiative (BRI) proposed by Chinese President Xi Jinping. Through the lens of foreign pundits, we take a look at 10 years of the BRI - how it achieves win-win cooperation between China and participating countries of the BRI and how it has given the people of these countries a sense of fulfillment. In an interview with Global Times (GT) reporter Li Aixin, Erik Solheim (Solheim), former under-secretary-general of the United Nations and former executive director of the UN Environment Programme, recalled how the BRI helped shorten a previously long journey in Sri Lanka to a half-hour trip. "We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together," Solheim said. This is the 18th piece of the series. GT: How do you evaluate the role of the BRI in promoting development in participating countries over the past 10 years? Solheim: The BRI has been a major driver of development since it was announced by President Xi Jinping in Kazakhstan 10 years ago. The China-Laos Railway has connected landlocked Laos to the Chinese and European rail network, making it possible for Laos to sell more goods and welcome more tourists. Rail corridors in Kenya and from Djibouti to Addis Ababa connect the interior of Africa to the coast, bringing opportunities for much faster development in East Africa. The Bandung-Jakarta railway in Indonesia, Hanoi metro, roads and ports in Sri Lanka - there are great examples of good south-south and BRI projects in almost every corner of the world. GT: In your experience of traveling around the world, has any BRI-related story left a deep impression on you? Solheim: Yes, many! I'll just mention two. When I was chief negotiator in the Sri Lanka peace process 15 years ago, it took a long time to travel from the airport to Colombo, the capital of Sri Lanka. When I came back last year, it took half an hour on wonderful Chinese-built highways. Traveling through Mombasa, a coastal city in Kenya, you see a lot of poverty and run down houses. Then all of a sudden, a green, clean, well-run oasis opens up. It's the end station of the Nairobi-Mombasa railway which links the capital Nairobi to the coast. The rail station stands out and is showing the future for Kenya. GT: The EU proposed the Global Gateway, and the US proposed the Build Back Better World. What do you think are the similarities and differences between these projects and the BRI? Solheim: I really wish success for the Western initiatives. What developing nations ask for is a choice of good cooperation with both China and the West. Unfortunately, up to now, a number of the Western-led initiatives have been more like media events. They lack structure, secretariat, finances and clear direction. Nearly all nations in the world want to see close people-to-people relations, investment and political cooperation with both China and the West. No one wants to choose. GT: Some people from the West are talking about "de-coupling" and "de-risking." Both seem to be another way of saying "de-globalization." Do you think "de-coupling" and "de-risking" will affect the BRI? And what role will the BRI play in maintaining globalization? Solheim: Decoupling is probably the most unwise idea in the world today. It's outright dangerous. Facing climate change, environmental degradation, economic troubles, war in Ukraine and other places, and the threat of pandemics, we need more, not less, cooperation. We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together. Almost all developing countries have made BRI agreements with China. As an example, when President Xi met all the leaders of Central Asia recently in Xi'an, Northwest China's Shaanxi Province, they made a very ambitious declaration on future green cooperation between China and Central Asia. GT: You have previously said that the BRI is a fantastic vehicle to promote green global development, which can boost the economy and ecology at the same time. Could you elaborate on how you think the BRI has achieved development of the economy and ecology? Solheim: In the beginning there were too many fossil fuel projects among BRI programs. In the BRI International Green Development Coalition, we argued this should stop. When President Xi pledged to stop building new coal-fired power projects overseas, it was one of the most important environmental decisions ever. Also, it happened at a time when important BRI nations like Bangladesh, Kenya and Pakistan decided they could grow their economies and go green without coal. The BRI will in the next decade become the world's most important vehicle for green energy and green transport. We will see massive investments in solar and wind power, hydrogen, electric batteries and more. GT: How do you view China's goal of achieving harmony between humanity and nature in modernization? In what way is China's story in pursuing harmony between humanity and nature relevant to other countries? Solheim: China now covers between 60 percent and 80 percent of all major green technologies in the world - solar, wind, hydro, batteries, electric cars and high-speed rail. Companies like Longi, BYD and CATL are the world leaders in their sectors. More remarkably and maybe less noticed abroad, China is also a global leader in protecting nature. It's embarking upon one of the most massive national park programs, with a focus on Qinghai Province and Xizang Autonomous Region. China is by far the biggest tree planter in the world and the global leader in desert control in Kubuqi, Inner Mongolia and other places. China has been hugely successful in the recovery of endangered species like the Giant Panda, Tibetan Antelope and Snow Leopard. A new center for mangrove restoration is being set up in Shenzhen and the fishing ban in the Yangtze will restore that magnificent ecosystem. The Belt and Road is a great opportunity for the world to learn from good Chinese green practices.

Coexisting and cooperating with China is the only choice for the US

US Secretary of State Antony Blinken declared at the Munich Security Conference: "If you're not at the table in the international system, you're going to be on the menu." The arrogant thinking of American political elites is evident: Whoever does not comply with the US will be excluded from the table of the American-led system and put on the menu. How arrogant. The US is actively pushing for "decoupling" from China and trying to persuade the entire West to "decouple" from China, using the term "de-risking." Washington hopes to ultimately contain China's development in order to maintain American hegemony. However, this time, Washington is facing a historically experienced and strategically rich Eastern civilization. Previous opponents targeted by the US have chosen to confront the US strategically. The US not only has the strongest technological and military capabilities but also controls global financial and information networks with a large number of allies. Those countries that had engaged in direct confrontations had suffered losses. Some of them had disintegrated, some had been weakened, and some had fallen into difficulties. However, what Washington sees from China is strategic composure and resilience. China is now staging an unprecedented and grand "Tai Chi." However, some Chinese people feel that this is not enough: Why can't we confront the US head-on? But I want to say that this is precisely the brilliance of China. This grand "Tai Chi" is about dismantling the pressure the US is putting on China. Europe is different from the US. A European diplomat once said in private that the topic of China has become toxic in the US, but in Europe, it is still possible to openly display friendliness toward China. There is genuine competition between the Europe and China despite Europe leans more toward the US between China and the US. Only in terms of ideology does the term "West" truly exist. In terms of fundamental economic interests, Europe has considerable independence. In terms of security, their attitude toward China also differs greatly from that of the US. In the Asia-Pacific region or China's periphery, the US wants to create an "Asian NATO." The specific situations of countries in dispute with China are very different. China has enormous influence in the region, is the largest trading partner of the vast majority of countries in the region and has friendly relations with most countries in the region. The disputes with countries are not fundamental strategic conflicts, and China has the ability to manage disputes with each specific country and push them to move toward neutrality to varying degrees without being tied to the US' policy toward China. China has a lot of trading partners and stakeholders in the US. The trade volume between China and the US, despite the decline, reached $664.4 billion in 2023, which shows China's huge presence in the US, and is the bond of the two countries in the current situation. The US is not a country where the political elites can have absolute say, and the huge interests have forced the US president and senior officials to repeatedly proclaim that they "don't want to decouple from China" and instead they want to "manage the US-China competition" and see "preventing a war with China" as clearly in everyone's best interest. China should engage in a "strategic battle" with the US at the closest possible distance. We need to maintain friendly relations with certain forces within the US, speed up the resumption of flights between the two countries, increase personnel exchanges and completely reverse the downturn of China-US contacts during the pandemic. In addition to the above dismantling, we also have the huge increment in the "Belt and Road." This initiative will increase China's power to compete with the US, greatly extending the front line that the US needs to maintain in containing China, making the US more powerless. In order to dismantle the US strategy toward China, China must become more diversified while maintaining strategic consistency. Our national diplomacy toward the US is very principled, rational and determined, which is clearly different from other countries targeted by the US. Our public diplomacy toward the US needs to be unique, with both "anti-American voices" and efforts to maintain friendly relations between the two societies and further expand economic and practical cooperation with the US. Just as eagles have their own way of flying and doves have their own formation, just as we see the US as complex, China must also be seen as complex in the eyes of the US. China is both a geopolitical concern and a profitable investment destination for them, and is one of the largest trading partners that is difficult to replace. Some American political elites proclaim China as an "enemy," but it is important to make the majority of Americans feel that China is not. No matter how intense the struggles between China and the US may be, we cannot shape the entire US toward an enemy direction. China has to make the US political elites recognize that it is futile to deal with China in the same way as it historically dealt with the Soviet Union and other major powers. Furthermore, willingly or unwillingly, coexistence and cooperation with China will be their only choice.