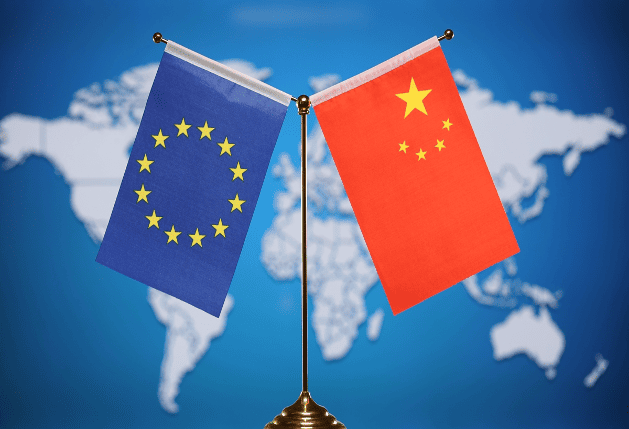

A spokesperson for the Ministry of Commerce (MOFCOM) on Monday rejected remarks from the EU Ambassador to China on the anti-subsidy investigation into Chinese electric vehicles (EVs).

MOFCOM said China had expressed strong opposition through various channels since October 2023 and has always advocated for handling economic and trade frictions through dialogue and consultation in order to maintain the overall strategic partnership between China and Europe.

EU Ambassador to China Jorge Toledo claimed on Sunday that the EU has been trying to engage with China for months regarding the imposition of tariffs on Chinese EVs but that China had only recently sought to initiate discussions. This is false, the spokesperson said.

MOFCOM said that after the European Commission (EC) officially filed a case, Chinese Commerce Minister Wang Wentao sent a letter to European Commission Executive Vice-President Valdis Dombrovskis on October 24, 2023, expressing hope to resolve the case through dialogue and negotiation.

On November 13, 2023, Wang sent another letter to the European side proposing negotiation suggestions.

In February 2024, Wang met with Dombrovskis during the WTO's 13th Ministerial Conference face to face and proposed dialogue and negotiation with the European side.

On May 19, 2024, Wang reiterated the hope for dialogue and negotiation to resolve the case in a letter to the European side.

Additionally, Chinese technical experts have been sending signals to the European side regarding on-site inspections, hearings, and other channels since the case was filed, expressing willingness to resolve trade frictions through dialogue and negotiation.

On the day the preliminary ruling was announced on June 12, Dombrovskis replied to Wang in a letter, expressing the desire for both sides to strengthen dialogue to resolve the case.

On June 22, Wang held a video conference with Dombrovskis, and they agreed to start negotiations on the EU's anti-subsidy investigation into Chinese EVs.

Subsequently, China sent a working group to Europe for negotiations on June 23, and multiple rounds of technical consultations were held simultaneously via video.

MOFCOM said that China has shown the utmost sincerity and hopes that the European side will meet China halfway, show sincerity, and push forward the negotiation process to reach a mutually acceptable solution as soon as possible.

China has always believed that trade protectionist measures are not conducive to the development of global green industries and automotive industry cooperation. Efforts should be made to adhere to dialogue and cooperation to promote economic green transformation, rather than creating divisions and disrupting global industrial and supply chains, MOFCOM said.

China firmly opposes any unilateralism and protectionism that politicizes and weaponizes economic and trade issues, and will take all necessary measures to defend its own interests against any abuse of rules and suppression of China, MOFCOM added.