A couple of days ago, a Quad summit meeting in Sydney scheduled for May 24 was abruptly canceled. The US president had to pull out of his long-anticipated trip to Australia and Papua New Guinea. Instead, the heads of the four Quad member states got together on the margins of the G7 Summit in Hiroshima on May 20.

The main reason for the change of plans was the continuous struggle between the White House and Republicans on the Hill over the national debt ceiling.

If no compromise is reached, the US federal government might fail to meet its financial commitments already in June; such a technical default would have multiple negative repercussions for the US, as well as for the global economy and finance at large. Let us hope that a compromise between the two branches of US power will be found and that the ceiling of the national debt will be raised once again.

However, this rather awkward last-minute cancellation of the Quad summit reflects a fundamental US problem - a growing imbalance between the US geopolitical ambitions and the fragility of the national financial foundation to serve these ambitions.

The Biden administration appears to be fully committed to bringing humankind back to the unipolar world that existed right after the end of the Cold War some 30 years ago, but the White House no longer has enough resources at its disposal to sustain such an undertaking. As they say in America: You cannot not have champagne on a beer budget.

The growing gap between the ends that the US seeks in international relations and the means that it has available is particularly striking in the case of the so-called dual containment policy that Washington now pursues toward Russia and China. Even half a century ago, when the US was much stronger in relative terms than it is today, the Nixon administration realized that containing both Moscow and Beijing simultaneously was not a good idea: "Dual containment" would imply prohibitively high economic costs for the US and would result in too many unpredictable political risks. The Nixon administration decided to focus on containing the Soviet Union as the most important US strategic adversary of the time. This is why Henry Kissinger flew to Beijing in July 1971 to arrange the first US-China summit in February 1972 leading to a subsequent rapid rapprochement between the two nations.

In the early days of the Biden administration, it seemed that the White House was once again trying to avoid the unattractive "dual containment" option. The White House rushed to extend the New START in January 2021 and held an early US-Russia summit meeting five months later in Geneva. At that point many analysts predicted that Biden would play Henry Kissinger in reverse - that is he would try to peace with the relatively weaker opponent (Moscow) in order to focus on containing the stronger one (Beijing).

However, after the beginning of the Russia-Ukraine conflict, it became clear that no accommodation with the Kremlin was on Biden's mind any longer. Still, having decided to take a hard-line stance toward Moscow and to lead a broad Western coalition in providing military and economic assistance to Kiev, Washington has not opted for a more accommodative or at least a more flexible policy toward Beijing.

On the contrary, over last year one could observe a continuous hardening of the US' China policy - including granting more political and military support to the Taiwan island, encouraging US allies and partners in Asia to increase their defense spending, engaging in more navel activities in the Pacific and imposing more technology sanctions on China.

In the meantime, economic and social problems within the US are mounting. The national debt ceiling is only the tip of an iceberg - the future of the American economy is now clouded by high US Federal Reserve interest rates that slow down growth, feed unemployment and might well lead to a recession. Moreover, the US society remains split along the same lines it was during the presidency of Donald Trump. The Biden administration has clearly failed to reunite America: Many of the social, political, regional, ethnic and even generational divisions have got only deeper since January 2021. It is hard to imagine how a nation divided so deeply and along so many lines could demonstrate continuity and strategic vision in its foreign policy, or to allocate financial resources needed to sustain a visionary and consistent global leadership.

Of course, the "dual containment" policy is not the only illustration of the gap between the US ambitions and its resources. The same gap inevitably pops up at every major forum that the US conducts with select groups of countries from the Global South - Africa, Southeast Asia, Latin America or the Middle East.

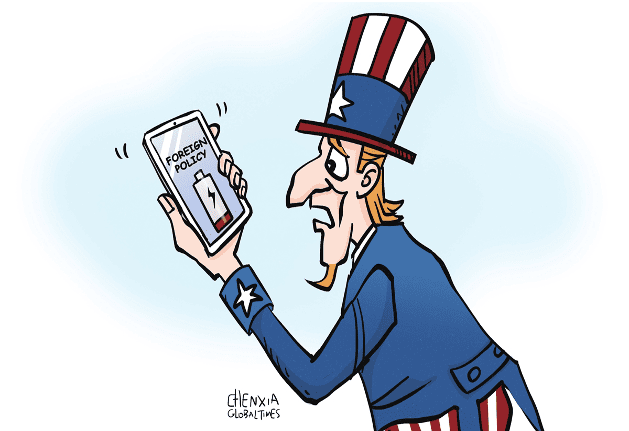

The Biden administration has no shortage of arguments warning these countries about potential perils of cooperating with Moscow or Beijing, but it does not offer too many plausible alternatives that would showcase the US generosity, its strategic vision, and its true commitment to the burning needs of the US interlocutors. To cut it short, Uncle Sam brings lots of sticks to such meetings, but not enough carrots to win the audience.

In sum, US foreign policy under President Joe Biden reminds people of a very advanced and highly sophisticated smartphone that has a rather weak battery, which is not really energy efficient. The proud owner of the gadget has to look perennially for a power socket in order not to have the phone running out of power at any inappropriate moment. Maybe the time has come for the smartphone owner to look for another model that would have fewer fancy apps, but a stronger and a more efficient battery, which will make the appliance more convenient and reliable.