US Secretary of State Antony Blinken declared at the Munich Security Conference: "If you're not at the table in the international system, you're going to be on the menu." The arrogant thinking of American political elites is evident: Whoever does not comply with the US will be excluded from the table of the American-led system and put on the menu. How arrogant.

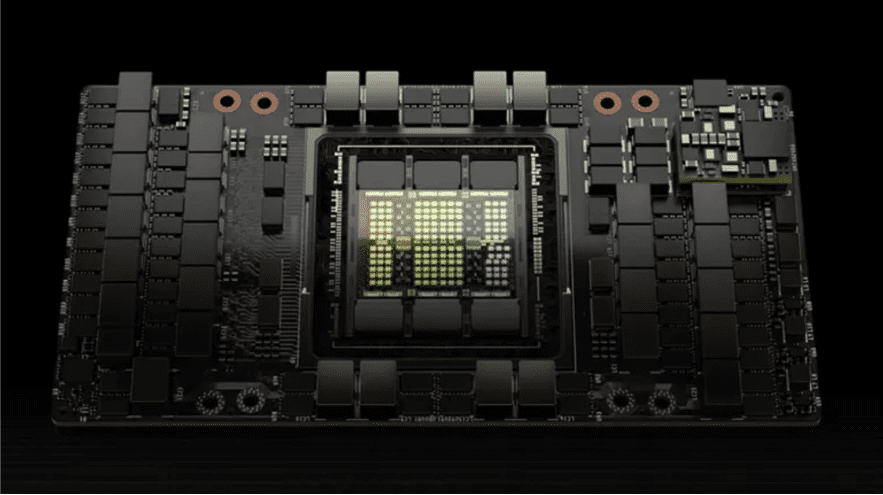

The US is actively pushing for "decoupling" from China and trying to persuade the entire West to "decouple" from China, using the term "de-risking." Washington hopes to ultimately contain China's development in order to maintain American hegemony.

However, this time, Washington is facing a historically experienced and strategically rich Eastern civilization. Previous opponents targeted by the US have chosen to confront the US strategically. The US not only has the strongest technological and military capabilities but also controls global financial and information networks with a large number of allies. Those countries that had engaged in direct confrontations had suffered losses. Some of them had disintegrated, some had been weakened, and some had fallen into difficulties. However, what Washington sees from China is strategic composure and resilience.

China is now staging an unprecedented and grand "Tai Chi." However, some Chinese people feel that this is not enough: Why can't we confront the US head-on? But I want to say that this is precisely the brilliance of China.

This grand "Tai Chi" is about dismantling the pressure the US is putting on China. Europe is different from the US. A European diplomat once said in private that the topic of China has become toxic in the US, but in Europe, it is still possible to openly display friendliness toward China. There is genuine competition between the Europe and China despite Europe leans more toward the US between China and the US. Only in terms of ideology does the term "West" truly exist. In terms of fundamental economic interests, Europe has considerable independence. In terms of security, their attitude toward China also differs greatly from that of the US.

In the Asia-Pacific region or China's periphery, the US wants to create an "Asian NATO." The specific situations of countries in dispute with China are very different. China has enormous influence in the region, is the largest trading partner of the vast majority of countries in the region and has friendly relations with most countries in the region. The disputes with countries are not fundamental strategic conflicts, and China has the ability to manage disputes with each specific country and push them to move toward neutrality to varying degrees without being tied to the US' policy toward China.

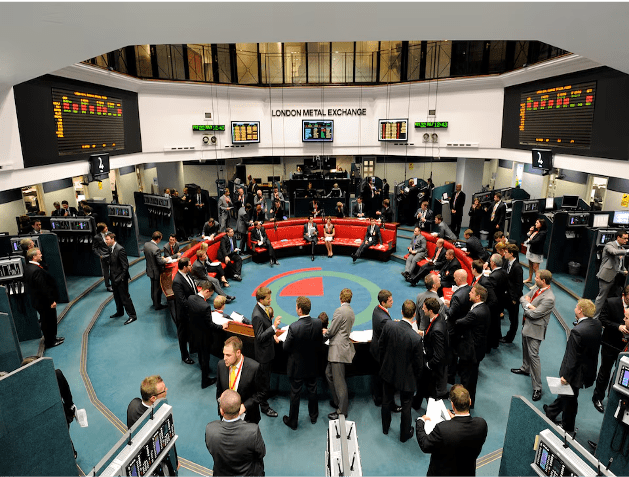

China has a lot of trading partners and stakeholders in the US. The trade volume between China and the US, despite the decline, reached $664.4 billion in 2023, which shows China's huge presence in the US, and is the bond of the two countries in the current situation. The US is not a country where the political elites can have absolute say, and the huge interests have forced the US president and senior officials to repeatedly proclaim that they "don't want to decouple from China" and instead they want to "manage the US-China competition" and see "preventing a war with China" as clearly in everyone's best interest.

China should engage in a "strategic battle" with the US at the closest possible distance. We need to maintain friendly relations with certain forces within the US, speed up the resumption of flights between the two countries, increase personnel exchanges and completely reverse the downturn of China-US contacts during the pandemic.

In addition to the above dismantling, we also have the huge increment in the "Belt and Road." This initiative will increase China's power to compete with the US, greatly extending the front line that the US needs to maintain in containing China, making the US more powerless.

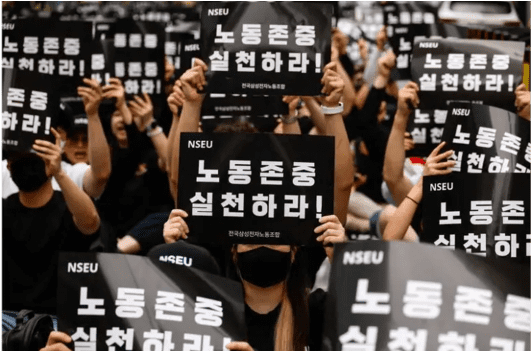

In order to dismantle the US strategy toward China, China must become more diversified while maintaining strategic consistency. Our national diplomacy toward the US is very principled, rational and determined, which is clearly different from other countries targeted by the US. Our public diplomacy toward the US needs to be unique, with both "anti-American voices" and efforts to maintain friendly relations between the two societies and further expand economic and practical cooperation with the US.

Just as eagles have their own way of flying and doves have their own formation, just as we see the US as complex, China must also be seen as complex in the eyes of the US. China is both a geopolitical concern and a profitable investment destination for them, and is one of the largest trading partners that is difficult to replace. Some American political elites proclaim China as an "enemy," but it is important to make the majority of Americans feel that China is not. No matter how intense the struggles between China and the US may be, we cannot shape the entire US toward an enemy direction.

China has to make the US political elites recognize that it is futile to deal with China in the same way as it historically dealt with the Soviet Union and other major powers. Furthermore, willingly or unwillingly, coexistence and cooperation with China will be their only choice.