McDonald's China, together with its four major suppliers announced the launch of an industrial park in Xiaogan city, Central China's Hubei Province on Wednesday, highlighting the importance of Chinese market in terms of supply chain for food business.

With a combined investment of 1.5 billion yuan ($206 million), the park, named Hubei Smart Food Industrial Park, is a joint project with Bimbo QSR, XH Supply Chain, Tyson Foods Inc, and Zidan, according to information provided to the Global Times.

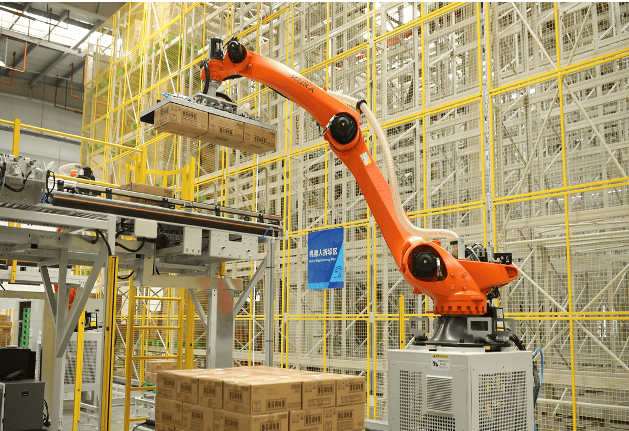

The park is expected to produce 34,000 tons of meat products, 270 million buns, 30 million pastries, and 2 billion packaged products annually. It also features a 25,000-square-meter high-standard automated warehouse for frozen, refrigerated, and dry goods, reducing logistics time by 90 percent from manufacturing to arriving at the destination.

Leveraging local geographical advantages, the park will become a supply hub for McDonald's in central and western China, enhancing supply efficiency and stability for its outlets there, the company said.

"McDonald's has been deeply rooted in China for over 30 years, and the park is an echo of our long-term development in China," said Phyllis Cheung, CEO of McDonald's China.

"Without any long-term strategy, we don't have any structural advantage in China," Cheung noted.

The US food giant continues to expand its business map in China. As of the end of June in 2024, there were over 6,000 restaurants and over 200,000 employees in the market. China has become the second largest and fastest-growing market of McDonald's. In 2023, McDonald's China unveiled the ambition of operating 10,000 restaurants by 2028.

To support this, McDonald's and its suppliers have invested over 12 billion yuan from between 2018 to 2023 to develop new production capacities and enhance supply chain sustainability.

Observers said that the industrial park reflect foreign companies' confidence in operating in China as the country takes concrete measures in furthering reform and opening-up.

China's foreign direct investment from January to May 2024 reached 412.51 billion yuan, with the number of newly-established foreign-backed companies reaching 21,764, rising by 17.4 percent year-on-year, data from China's Ministry of Commerce revealed.

According to a recent survey by the American Chamber of Commerce in China, the majority of US companies saw improved profitability in China in 2023, and half of the survey participants put China as their first choice or within their top three investment destinations globally.

Olaf Korzinovski, EVP of Volkswagen China, who is responsible for production and components, also shared his understanding of supply chains in China with the Global Times.

Volkswagen has been operating in China for about 40 years. "In order to seize greater value for our customers," Volkswagen Group is stepping up pace of innovation in China, and systematically purshing forward the digitalization process, Korzinovski noted, adding the company is strengthening local capabilities with accelerated decision-making efficiency.

Global Times