Russia's economic strength gives it high-income status despite sanctions

Russia is seeing income growth of around 4-5%, with earnings growing in double digits, Ostapkovich said, stressing that the driving force is economic growth. "Incomes only grow when the economy grows. If the economy grows, then profits grow. If profits grow, then the entrepreneur is keen on hiring people and raising wages," he added. Russia’s economy grew by 3.6% in 2023, with real incomes and nominal wages up by 4.5% and 13% respectively. Industrial performance, particularly in manufacturing, is propelling this growth not seen in 20 to 30 years. Notably, mechanical engineering in the military industry is expanding at 25-30%, according to Ostapkovich. Andrey Kolganov, Doctor of Economics and Head of the Laboratory of Socio-Economic Systems at Moscow State University, acknowledged that despite the challenges posed by the growth stimuli, Western sanctions failed to inflict significant harm on the Russian economy. "The Russian economy has shown great potential in adapting to these difficulties. Moreover, these difficulties stimulated the development of domestic production, which in turn led to high rates of economic growth," he added. Kolganov noted that economic growth rates were higher in 2023, compared to 2022 - and even higher in 2024. These increases promoted Russia from the classification of middle-income countries, to the rank of high-income countries. Although Russia has not caught up with the richest countries, the achievement is nonetheless remarkable, especially in the face of unprecedented sanctions. Gross national income per capita in Russia is now $14,250, according to a document released by the World Bank that classifies countries that cross the $13,485 threshold as “high income.”

Australia pledges to provide more funds to Pacific island banks to counter China's influence

Australia pledged on Tuesday to increase investment in Pacific island nations, offering A$6.3 million ($4.3 million) to support their financial systems. Some Western banks are cutting ties with the region because of risk factors, while China is trying to increase its influence there. Some Western bankers have terminated long-standing banking relationships with small Pacific nations, while others are considering closing operations and restricting access to dollar-denominated bank accounts in those countries. "We know that the Pacific is the fastest-moving region in the world for correspondent banking services," Australian Treasurer Jim Chalmers said in a speech at the Pacific Banking Forum in Brisbane. "What's at stake here is the Pacific's ability to engage with the world," he said, with much of the region at risk of being cut off from the global financial system. Chalmers said Australia would provide A$6.3 million ($4.3 million) to the Pacific to develop secure digital identity infrastructure and strengthen compliance with anti-money laundering and counter-terrorist financing requirements. Experts say Western banks are de-risking to meet financial regulations, making it harder for them to do business in Pacific island nations, where compliance standards sometimes lag, undermining their financial resilience. Australia's ANZ Bank is in talks with governments about how to make its Pacific island businesses more profitable amid concerns about rising Chinese influence as financial services leave the West, Chief Executive Shayne Elliott said Tuesday. ANZ is the largest bank in the Pacific region, with operations in nine countries, though some of those businesses are not financially sustainable, Elliott said in an interview on the sidelines of the forum. "If we were there purely for commercial purposes, we would have closed it a long time ago," he said. Western countries, which have traditionally dominated the Pacific, are increasingly concerned about China's plans to expand its influence in the region after it signed several major defense, trade and financial agreements with the region. Bank of China signed an agreement with Nauru this year to explore opportunities in the country, following Australia's Bendigo Bank saying it would withdraw from the country. Mr. Chalmers said Australia was working with Nauru to ensure that banking services in the country could continue. ANZ Bank exited its retail business in Papua New Guinea in recent years, while Westpac considered selling its operations in Fiji and Papua New Guinea but decided to keep them. The Pacific lost about 80% of its correspondent banking relationships for dollar-denominated services between 2011 and 2022, Australian Assistant Treasurer Stephen Jones told the forum, which was co-hosted by Australia and the United States. “We would be very concerned if there were countries acting in the region whose primary objective was to advance their own national interests rather than the interests of Pacific island countries,” Mr. Jones said on the first day of the forum in Brisbane. He made the comment when asked about Chinese banks filling a vacuum in the Pacific. Meanwhile, Washington is stepping up efforts to support Pacific island countries in limiting Chinese influence. "We recognize the economic and strategic importance of the Pacific region, and we are committed to deepening engagement and cooperation with our allies and partners to enhance financial connectivity, investment and integration," said Brian Nelson, U.S. Treasury Undersecretary for Counterterrorism and Financial Intelligence. The United States is aware of the problem of Western banks de-risking in the Pacific region and is committed to addressing it, Nelson told the forum's participants. He said data showed that the number of correspondent banking relationships in the Pacific region has declined at twice the global average rate over the past decade, and the World Bank and the Asian Development Bank are developing plans to improve correspondent banking relationships. U.S. Treasury Secretary Janet Yellen said in a video address to the forum on Monday (July 8) that the United States is focused on supporting economic resilience in the Pacific region, including by strengthening access to correspondent banks. She said that when President Biden and Australian Prime Minister Anthony Albanese met at the White House last year, they particularly emphasized the importance of increasing economic connectivity, development and opportunities in the Pacific region, and a key to achieving that goal is to ensure that people and businesses in the region have access to the global financial system.

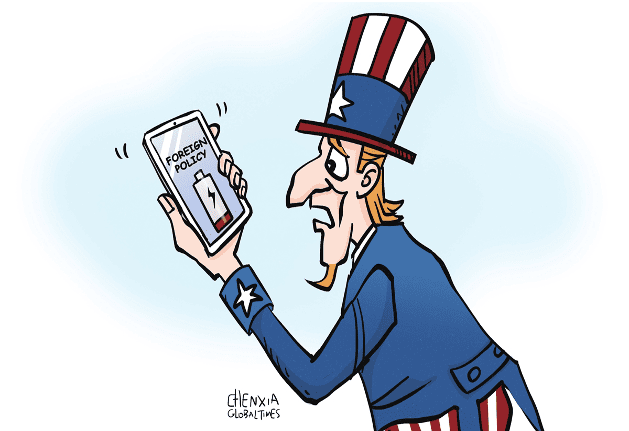

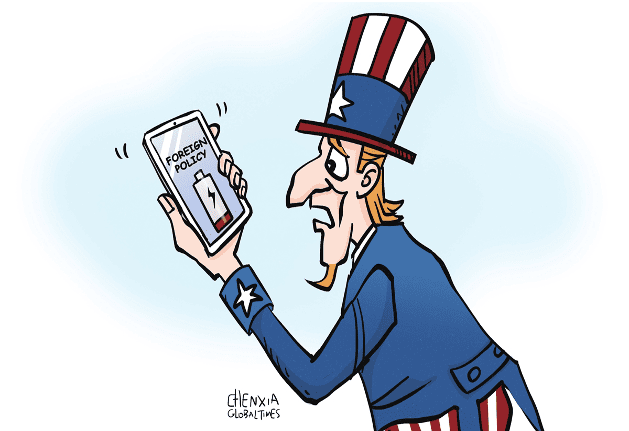

US foreign policy is advanced smartphone with weak battery

A couple of days ago, a Quad summit meeting in Sydney scheduled for May 24 was abruptly canceled. The US president had to pull out of his long-anticipated trip to Australia and Papua New Guinea. Instead, the heads of the four Quad member states got together on the margins of the G7 Summit in Hiroshima on May 20. The main reason for the change of plans was the continuous struggle between the White House and Republicans on the Hill over the national debt ceiling. If no compromise is reached, the US federal government might fail to meet its financial commitments already in June; such a technical default would have multiple negative repercussions for the US, as well as for the global economy and finance at large. Let us hope that a compromise between the two branches of US power will be found and that the ceiling of the national debt will be raised once again. However, this rather awkward last-minute cancellation of the Quad summit reflects a fundamental US problem - a growing imbalance between the US geopolitical ambitions and the fragility of the national financial foundation to serve these ambitions. The Biden administration appears to be fully committed to bringing humankind back to the unipolar world that existed right after the end of the Cold War some 30 years ago, but the White House no longer has enough resources at its disposal to sustain such an undertaking. As they say in America: You cannot not have champagne on a beer budget. The growing gap between the ends that the US seeks in international relations and the means that it has available is particularly striking in the case of the so-called dual containment policy that Washington now pursues toward Russia and China. Even half a century ago, when the US was much stronger in relative terms than it is today, the Nixon administration realized that containing both Moscow and Beijing simultaneously was not a good idea: "Dual containment" would imply prohibitively high economic costs for the US and would result in too many unpredictable political risks. The Nixon administration decided to focus on containing the Soviet Union as the most important US strategic adversary of the time. This is why Henry Kissinger flew to Beijing in July 1971 to arrange the first US-China summit in February 1972 leading to a subsequent rapid rapprochement between the two nations. In the early days of the Biden administration, it seemed that the White House was once again trying to avoid the unattractive "dual containment" option. The White House rushed to extend the New START in January 2021 and held an early US-Russia summit meeting five months later in Geneva. At that point many analysts predicted that Biden would play Henry Kissinger in reverse - that is he would try to peace with the relatively weaker opponent (Moscow) in order to focus on containing the stronger one (Beijing). However, after the beginning of the Russia-Ukraine conflict, it became clear that no accommodation with the Kremlin was on Biden's mind any longer. Still, having decided to take a hard-line stance toward Moscow and to lead a broad Western coalition in providing military and economic assistance to Kiev, Washington has not opted for a more accommodative or at least a more flexible policy toward Beijing. On the contrary, over last year one could observe a continuous hardening of the US' China policy - including granting more political and military support to the Taiwan island, encouraging US allies and partners in Asia to increase their defense spending, engaging in more navel activities in the Pacific and imposing more technology sanctions on China. In the meantime, economic and social problems within the US are mounting. The national debt ceiling is only the tip of an iceberg - the future of the American economy is now clouded by high US Federal Reserve interest rates that slow down growth, feed unemployment and might well lead to a recession. Moreover, the US society remains split along the same lines it was during the presidency of Donald Trump. The Biden administration has clearly failed to reunite America: Many of the social, political, regional, ethnic and even generational divisions have got only deeper since January 2021. It is hard to imagine how a nation divided so deeply and along so many lines could demonstrate continuity and strategic vision in its foreign policy, or to allocate financial resources needed to sustain a visionary and consistent global leadership. Of course, the "dual containment" policy is not the only illustration of the gap between the US ambitions and its resources. The same gap inevitably pops up at every major forum that the US conducts with select groups of countries from the Global South - Africa, Southeast Asia, Latin America or the Middle East. The Biden administration has no shortage of arguments warning these countries about potential perils of cooperating with Moscow or Beijing, but it does not offer too many plausible alternatives that would showcase the US generosity, its strategic vision, and its true commitment to the burning needs of the US interlocutors. To cut it short, Uncle Sam brings lots of sticks to such meetings, but not enough carrots to win the audience. In sum, US foreign policy under President Joe Biden reminds people of a very advanced and highly sophisticated smartphone that has a rather weak battery, which is not really energy efficient. The proud owner of the gadget has to look perennially for a power socket in order not to have the phone running out of power at any inappropriate moment. Maybe the time has come for the smartphone owner to look for another model that would have fewer fancy apps, but a stronger and a more efficient battery, which will make the appliance more convenient and reliable.

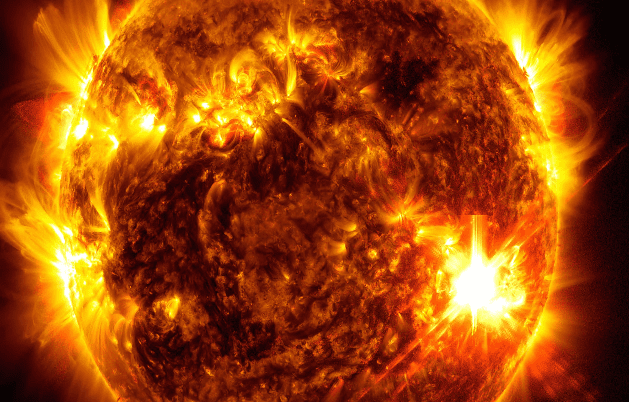

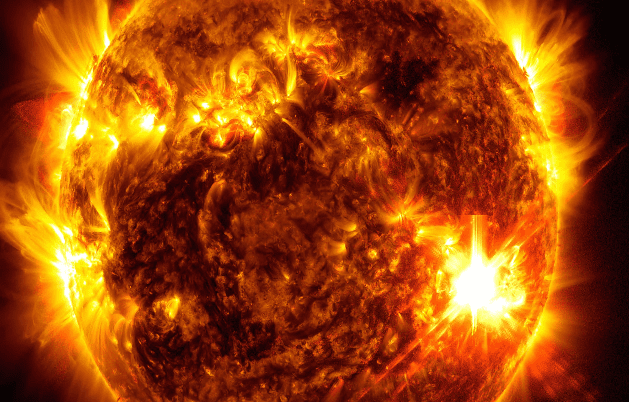

Beyond the aurorae: How solar flares spill out across the Solar System

The Sun is extremely active right now, blasting the Earth with the biggest solar storms in 20 years. This is what it is doing to the rest of the Solar System. If you happened to look skywards on a few nights in May 2024, there was a good chance of seeing something spectacular. For those at relatively low latitudes, there was a rare chance to see the flickering red, pink, green glow of our planet's aurorae. A powerful solar storm had sent bursts of charged particles barrelling towards Earth and, as they bounced around in our planet's atmosphere, they unleashed spectacular displays of the Northern and Southern Lights. The dazzling displays of aurora borealis were visible far further south than they might normally be – and far further north in the case of aurora australis thanks to the power of the geomagnetic storm, the strongest in two decades. Although some people experienced only a faint, eerie glow, others were treated to a myriad of colour as far south as London in the UK and Ohio in the US. Reports even came in from just to the north of San Francisco, California. But while this spike in activity from the Sun left many on Earth transfixed by the light display it produced, it has also had a profound effect elsewhere in the Solar System. As most of us wondered at the colours dancing across the night's sky, astronomers have been peering far beyond to see the strange ways such intense bursts of particles affect other planets and the space between them. "The Sun can fire material outwards in any direction like a garden sprinkler," says Jim Wild, a professor of space physics at Lancaster University in the UK. "The effects are felt throughout the Solar System." Our Sun is currently heading towards, or has already reached, its solar maximum – the point in an 11-year cycle where it is most active. This means the Sun produces more bursts of radiation and particles from solar flares and events known as coronal mass ejections (CMEs). If these are sprayed in our direction, they can supercharge the Earth's magnetic field, causing magnificent aurorae but also posing problems for satellites and power grids. "Things really seem to be picking up right now," says Mathew Owens, a space physicist at the University of Reading in the UK. "I think we're about at solar maximum now, so we may see more of these kinds of storms in the next couple of years." Around the Sun, multiple spacecraft are observing this increase in activity up close. One of those, the European Space Agency's (Esa) Solar Orbiter, has been studying the Sun since 2020 on an orbit that takes it within the path of Mercury. Currently the spacecraft is "on the far side of the Sun as seen from Earth", says Daniel Müller, project scientist for the Solar Orbiter mission at Esa in the Netherlands. "So we see everything that Earth doesn't see." The storm that hit Earth in May originated from an active region of solar flares and sunspots, bursts of plasma and twisting magnetic fields on the Sun's surface, known as its photosphere. Solar Orbiter was able to see "several of the flares from this monster active region that rotated out of Earth's view", says Müller, bright flashes of light and darkened regions called sunspots on the Sun's surface. One of the goals of Solar Orbiter is "to connect what's happening on the Sun to what's happening in the heliosphere," says Müller. The heliosphere is a vast bubble of plasma that envelops the Sun and the planets of the Solar System as it travels through interstellar space. What Müller and his colleagues hope to learn more about is where the solar wind – the constant stream of particles spilling out from the Sun across the Solar System – "blows into the interstellar medium", he says. "So we are particularly interested in anything energetic on the Sun that we can find back in the turbulence of the solar wind." This particular cycle, cycle 25, appears to be "significantly more active than what people predicted", says Müller, with the relative sunspot number – an index used to measure the activity across the visible surface of the Sun – eclipsing what was seen as the peak of the previous solar cycle. The National Oceanic and Atmospheric Administration (Noaa) in the US had predicted a maximum monthly average of 124 sunspots a day in May, but the actual number was 170 on average, with one day exceeding 240, according to Müller. But the exact cause of the Sun's 11-year-long cycle and its variabilities remains a bit of a mystery. • Alien aurora: The strange displays that light up other worlds • Why Einstein was wrong about black holes • The Moon is slipping away from the Earth – and our days are getting longer The effects of these changes in solar activity, however, extend far across the Solar System. Earth is not the only planet to be hit by solar storms as they billow across interplanetary space. Mercury, the closest planet to the Sun, has a much weaker magnetic field than Earth – about 100 times less – and lacks a substantial atmosphere. But solar activity can cause the surface of the planet to glow with X-rays as solar wind rains down. Venus also lacks a substantial magnetic field, but the planet does still create auroras as the solar wind interacts with the planet's ionosphere. At Mars, the effect of solar activity is more obvious. Here, a Nasa spacecraft called Maven (Mars Atmosphere and Volatile Evolution) has been studying the planet's atmosphere from orbit since 2014. "We were on the declining side of solar cycle 24 [then]," says Shannon Curry, a planetary scientist at the University of Colorado, Boulder in the US and the lead on the mission. "We are now coming up on the peak of cycle 25, and this latest series of active regions has produced the strongest activity Maven has ever seen." Between 14 and 20 May the spacecraft detected exceptionally powerful solar activity reaching Mars, including an X8.7 – solar flares are ranked B, C, M, and X in order from weakest to strongest. Results from the event have yet to be studied, but Curry noted that a previous X8.2 flare had resulted in "a dozen papers" published in scientific journals. Another flare on 20 May, later estimated to be an even bigger X12, hurled X-rays and gamma rays towards Mars before a subsequent coronal mass ejection launched a barrage of charged particles in the same direction. Images beamed back from Nasa's Curiosity Rover on Mars revealed just now much energy struck the Martian surface. Streaks and dots caused by charged particles hitting the camera's sensors caused the images to "dance with snow", according to a press release from Nasa. Maven, meanwhile, captured glowing aurora as the particles hit the Mars' atmosphere, engulfing the entire planet in an ultraviolet glow. The flares can cause the temperature of the Martian atmosphere to "dramatically increase," says Curry. "It can even double in the upper atmosphere. The atmosphere itself inflates. The entire atmosphere expands dozens of kilometres – exciting for scientists but detrimental for spacecraft, because when the atmosphere expands there's more drag on the spacecraft." The expanding atmosphere can also cause degradation of the solar panels on spacecraft orbiting Mars from the increase in radiation. "The last two flares caused more degradation than what a third of a year would typically do," says Curry. Mars, while it has lost most of its magnetic field, still has "crustal remnant magnetic fields, little bubbles all over the southern hemisphere", says Curry. During a solar event, charged particles can light those up and excite particles. "The entire day side lights up in what we call a diffuse aurora," says Curry. "The entire sky glows. This would most likely be visible to astronauts on the surface." By the time solar storms reach further out into the solar system, they tend to have dissipated but can still have an impact on the planets they encounter. Jupiter, Saturn, Uranus, and Neptune all have aurorae that are in part driven by charged particles from the Sun interacting with their magnetic fields. But one of the key effects of solar activity on interplanetary space that astronomers are eager to study is something called "slow solar wind", a more sluggish, but denser stream of charged particles and plasma from the Sun. Steph Yardley, a solar astronomer at Northumbria University in the UK, says solar wind is "generally classed about 500km/s (310 miles/s)", but slow wind falls below this. It also has a lower temperature and tends to be more volatile. Recent work by Yardley and her colleagues, using data from Solar Orbiter, suggests that the Sun's atmosphere, its corona, plays a role in the speed of the solar wind. Regions where the magnetic field lines, the direction of the field and charged particles are "open" – stretching out into space without looping back – provide a highway for solar wind to reach high speeds. Closed loops over some active regions – where the magnetic field lines have no beginning and end – can occasionally snap, producing slow solar wind. The variability in the slow solar wind seems to be driven by the unpredictable flow of plasma inside the Sun, which makes the magnetic field particularly chaotic. The X-class flares and coronal mass ejections seen in May transformed the interplanetary medium as they flung out material across the solar system. Solar Orbiter detected a huge spike in ions moving at thousands of kilometres per second immediately after the 20 May flare. Computers on board other spacecraft – the BepiColombo probe, which is currently on a seven-year journey to Mercury, and Mars Express, in orbit around the Red Planet – both saw a dramatic increase in the number of memory errors caused by the high energy solar particles hitting the memory cells. The day after the coronal mass ejection, magnetometers on board the Solar Orbiter also saw large swings in the magnetic field around the spacecraft as a huge bubble of plasma made up of charged particles thrown out from by the event washed past it at 1,400km/s (870 miles/s). Increased solar activity is a boon for scientists. "If you track the number of papers produced by solar physicists, you can almost see an 11-year cycle in there," says Owens. "We are all more scientifically productive when there's a lot of activity to study." As the Sun continues into solar maximum, the Solar System will see more and more activity streaming from its surface. Yet while all the planets witness at least some of the activity, our planet bears the brunt more than most. "Earth is slightly unique in that space weather can have interesting effects on human technologies," says Wild. "There's an extra dimension here on Earth." Perhaps one day those anthropogenic effects might be felt elsewhere, too. "If you're going to fly to Mars and you have a six-month flight through the interplanetary environment, you're going to potentially suck up a lot of space weather events," says Wild. "How you protect your astronauts is an interplanetary issue that we need to get our heads around."

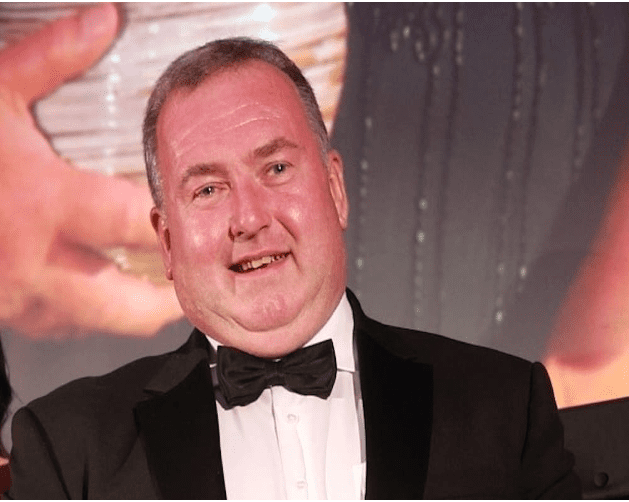

Portadown businessman avoids jail for sexual assault of teen under his employment

Defence said the defendant 'continues to deny' the charges and bail in the sum of £1,000 was fixed for appeal

A Portadown man has avoided jail after sexually assaulting a 16-year-old shop worker under his employment. -ADVERTISEMENT- Brian Thomas Chapman (58), of Moyallan Road, appeared before Newry Magistrates’ Court on Monday for sentencing on two counts of sexual assault. The prosecution outlined that on September 23, 2020, a 16-year-old student in the employment of Brian Chapman, disclosed to her mother about incidents that had occurred in her workplace. She said Chapman had put his hand on her thigh and the back of her leg. She also disclosed that she had been getting extra money from him and he had been sending her text messages. The allegations were reported to police the next day, September 24. The victim then took part in an interview on October 9, in which she said, when she was alone in Chapman’s office, he placed his hand on her upper thigh and his other hand on her lower back, underneath her trousers. The defendant was arrested and interviewed at Lurgan police station, where he denied the allegations. His phone was seized and an examination was carried out. The first interview of the defendant took place on October 9, during which he admitted to sending a message about wanting the victim to work 24/7, but stated this was a joke. The second interview took place on January 28, 2021, where he admitted to sending the 24/7 message, but denied sending other messages, such as “hope you’re spending the pounds on something special”. Throughout this process, Chapman denied sending the messages and denied any of the sexual assaults alleged by the victim. On the Chapman’s criminal record, the prosecution added that he was convicted of three common assaults on appeal. In terms of commission, these matters pre-dated this case but the conviction occurred during the running of this case and also involved a female working for the defendant. Prosecution continued that the age of the victim was an aggravating feature, arguing there was a “vulnerability” due to the “power-imbalance” between Chapman and the young student working for him. An additional aggravating feature, they said, was that during the course of the defence, part of the defence was that the victim had “manipulated or manufactured” some of the text messages that were sent. A defence lawyer, speaking on the pre-sentence report, noted the author deemed Chapman to be of low risk. He also noted that similar offences were contested in the County Court in respect of another complaint, with the judge substituting indecent assault charges for common assault. He also argued a Sexual Offences Prevention Order (SOPO) was not necessary as the offending was four years ago, there has been no repetition and risk had been addressed. District Judge Eamonn King noted the defendant was convicted on two of four original charges following a contest, which ran over a number of days, with the case adjourned for a pre-sentence report and victim impact statement to be produced. He added the defendant “continues to deny” the charges and seeks to appeal the outcome. District Judge King, on reading the pre-sentence report, noted the defendant “denies ever hugging or touching the individual and he denies any sexual attraction to the victim”, but pointed to a paragraph in the report which stated, “From the available evidence, it’s possible to surmise that he demonstrated risk taking and impulsive behaviour. It appears that he took advantage of his position and power in a bid to meet his sexual needs, given the victim’s young age and the fact that he was her employer”. The report added that this demonstrated “limited victim empathy and responsibility due to his denial of the offences”. On the victim impact statement, District Judge King described her as a young girl getting her first job, with the “world as her oyster”. He continued: “As a result of what she says occurred, that turned on its head. It left her feeling inwardly uncomfortable, anxious and lonely. She cut herself off from her friends. She stopped going out. She didn’t want to go to school.” He also described a “degree of manipulation” in the case, as this was the victim’s first job and there was a power imbalance between her as an employee, and Chapman as the employer. In his sentencing remarks, District Judge King, said: “I’ve taken time to emphasise to the victim in this case that the victim did nothing wrong. The victim did everything right and the victim shouldn’t feel lonely, anxious or isolated. “The victim should feel confident, strong and outgoing.” Owing to the defendant’s ongoing denial of the charges, he added: “My sentencing exercise isn’t the conclusion of the case today, but I will sentence, so that we can move towards the conclusion going forward. “I am satisfied, irrespective of what the pre-sentence report says, that the defendant took advantage of someone, attempted to groom someone and was guilty of the two offences.” On the two counts, Chapman was sentenced to three months in prison, suspended for two years. He was also made subject to a Sexual Offences Prevention Order (SOPO) for five years and placed on the sex offenders’ register for seven years. Following sentencing, District Judge King fixed bail for appeal at £1,000.