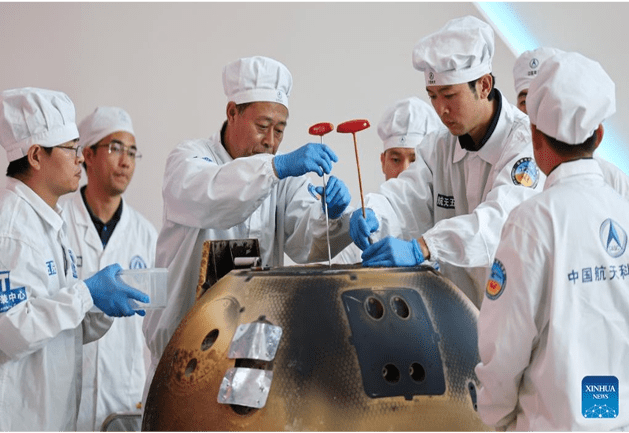

The returner of the Chang'e-6 lunar probe is opened during a ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation in Beijing, capital of China, June 26, 2024. The returner of the Chang'e-6 lunar probe was opened at a ceremony in Beijing on Wednesday afternoon. During the ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation, researchers opened the returner and examined key technical indicators. Photo: Xinhua

As the US space industry recently faced yet more delays and stagnation with key components including manned spacecraft and space suits "going wrong," NASA has once again resorted to its "sour grapes" rhetoric upon seeing China's successful retrieval of fresh lunar soils from the far side of the moon, by claiming that China did not directly invite its scientists to participate in the lunar soil research.

This behavior is a typical blame-shifting trick, Chinese experts said, noting it is clear to all that it is the US' own laws, not China, that are restricting space cooperation between the two sides. Instead of deceiving themselves by distorting the truth, the US should face up to its own problem of overall weakening engineering capability and the lack of long-term planning in its space industry.

After the Chang'e-6 samples, weighing nearly 2 kilograms, were safely transported to a special laboratory for further study on Friday, NASA spokesperson Faith McKie told media that while China worked with the European Space Agency, France, Italy and Pakistan on this mission, "NASA wasn't invited to take part in the moon probe."

NASA also didn't get "any direct invitation" to study China's moon rocks, after it welcomed all scientists from around the world to apply to study them, McKie told NatSec Daily.

Responding to the remarks, Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on Monday that China is open to having space exchanges with the US, and we also welcome countries around the world to take part in the study of lunar samples. "However, the US side seems to have forgotten to mention its domestic legislation such as the Wolf Amendment. The real question is whether US scientists and institutions are allowed by their own government to participate in cooperation with China," Mao said.

"The existence of the Wolf Amendment has basically shut the door to space collaboration between the two countries," Wang Yanan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times on Monday.

Even if research institutions of the US have the willingness to work with China on opportunities such as lunar sample research, institutions there must obtain special approval from the US Congress due to the presence of this amendment, Wang explained. Currently, no such "green light" is in sight from the Congress.

Furthermore, China's collaboration with international partners is based on equality and mutual benefit, leveraging their respective scientific resources, facilities, and expertise. However, the US only wants what it doesn't have, and its engagement with China would be advantageous only to itself, Wang noted.

NASA has found itself embroiled in a number of thorny issues recently, with the latest being Boeing's Starliner manned spaceship experiencing both helium leaks and thruster issues during a June 6 docking with the International Space Station (ISS), which led to an indefinite delay for its crew's return to Earth, despite NASA's insistence that they are not "stranded" in space.

The return of the Starliner capsule, while has already been delayed by two weeks, will be put on hold "well into the summer" pending results of new thruster tests, which are scheduled to start Tuesday and will take approximately two weeks or even more, per NASA officials.

Previously on June 24, NASA cancelled a spacewalk on the ISS following a "serious situation," when one of the spacesuits experienced coolant leak in the hatch. While being broadcast on a livestream, the astronauts reported "literally water everywhere" as they were preparing for the extravehicular activity, space.com reported.

The report said that this is the second time this particular spacewalk was postponed, after a June 13 attempt with a different astronaut group was pushed back due to a "spacesuit discomfort."

The recurring issues with the spacesuits are due to their much-extended service lifespan, media reported, as the puffy white ones US astronauts currently wear were designed more than 40 years ago.

Despite the pressing need to replace them, NASA announced recently that it is abandoning a plan to develop next-generation spacesuits, which had been committed to be delivered by 2026, CNN reported on Thursday.

One of the root causes for such problems is that the US has developed many large technology conglomerates, which for a long time have benefited significantly from government orders and industry monopolies. Consequently, in many complex engineering fields, the level of attention given is greatly insufficient, Wang noted.

It also reflected the US' lack of long-term strategic planning for its manned space program. For instance, the ageing spacesuits should have been replaced a decade ago to ensure that operational suits remain in usable condition. Failure to address this issue results in a hindrance to the space station's necessary maintenance tasks and even poses life-threatening risks to astronauts in emergency situations, experts said.

The issues with Boeing's spacecraft and the spacesuits are not isolated problems, but reflected a systemic issue in the US space industry - the overall weakening of engineering capabilities, they noted.