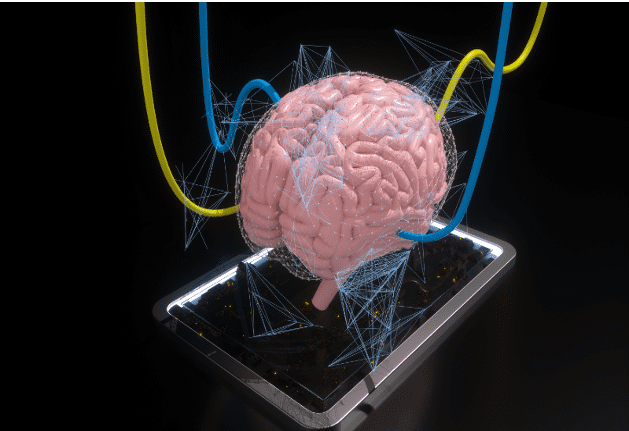

China is mulling over establishing a Brain-Computer Interface (BCI) standardization technical committee under its Ministry of Industry and Information Technology (MIIT), aiming to guide enterprises to enhance industrial standards and boost domestic innovation.

The proposed committee, revealed by the MIIT on Monday, will work on composing a BCI standards roadmap for the entire industry development as well as the standards for the research and development of the key technologies involved, according to the MIIT.

China has taken strides in developing the BCI industry over the years, not only providing abundant policy support but also generous financial investment, Li Wenyu, secretary of the Brain-Computer Interface Industrial Alliance, told the Global Times.

From last year to 2024, both the central and local governments have successively issued relevant policies to support industrial development.

The MIIT in 2023 rolled out a plan selecting and promoting a group of units with strong innovation capabilities to break through landmark technological products and accelerate the application of new technologies and products. The Beijing local government also released an action plan to accelerate the industry in the capital (2024-2030) this year.

In 2023, there were no fewer than 20 publicly disclosed financing events for BCI companies in China, with a total disclosed amount exceeding 150 million yuan ($20.6 million), Li said. “The strong support from the government has injected momentum into industrial innovation.”

The fact that China's BCI industry started later than Western countries such as the US is a reality, leading to the gap in China regarding technological breakthroughs, industrial synergy, and talent development, according to Li.

To further close gaps and solve bottlenecks in BCI industrial development, Li suggested that the industry explore various technological approaches to suit different application scenarios and encourage more medical facilities powered by BCI to initiate clinical trials by optimizing the development of BCI-related ethics.

Additionally, he highlighted that standard development is one of the aspects to enhance the overall level and competitiveness of the industry chain, which could, in turn, empower domestic BCI innovation.

While China's BCI technology generally lags behind leading countries like the US in terms of system integration and clinical application, this has not hindered the release of Neucyber, which stands as China's first "high-performance invasive BCI."

Neucyber, an invasive implanted BCI technology, was independently developed by Chinese scientists from the Chinese Institute for Brain Research in Beijing.

Li Yuan, Business Development Director of Beijing Xinzhida Neurotechnology, the company that co-developed this BCI system, told the Global Times that the breakthrough of Neucyber could not have been achieved without the efforts of the institute gathering superior resources from various teams in Beijing.

A group of mature talents were gathered within the institute, from specific fields involving electrodes, chips, algorithms, software, and materials, Li Yuan said.

Shrugging off the outside world's focus on China’s competition with the US in this regard, Li Yuan said her team doesn’t want to be imaginative and talk too much, but strives to produce a set of products step by step that can be useful in actual applications.

In addition, Li Wenyu also attributed the emergence of Neucyber to the independent research atmosphere and the well-established talent nurturing mechanism in the Chinese Institute for Brain Research.

He said that to advance China’s BCI industry, it is necessary not only to cultivate domestic talents but also to introduce foreign talents to enhance China's research and innovation capabilities.

The proposed plan for establishing the BCI standardization technical committee under the MIIT will solicit public opinions until July 30, 2024.