Sparkling box office for Spring Festival films indicates tremendous potential for movie consumption in Chinese society

According to Chinese movie ticketing platform Taopiaopiao, the box office for the 2024 Spring Festival holidays surpassed last year's 6.766 billion yuan and entered the top two in the history of Chinese Spring Festival holidays box office. I recently watched three movies, and I think they are all good. However, their overall level is not higher than the movies from last Spring Festival holidays. The higher box office compared to last year reflects the strong potential for movie consumption in Chinese society. Our filmmakers need to make further efforts. The current development of Chinese movies has many advantages. People often complain that our film creation faces various "restricted areas," but in terms of societal topics, the space for Chinese film creation is relatively large and relaxed. For example, Zhang Yimou's film Article 20 shows protest scenes and boldly explores the issue of judicial injustice in depth. A few years ago, the film I Am Not Madame Bovary specifically discussed the sensitive issue of petitioning. Another film, Johnny Keep Walking! which was aired last year, also touches on serious social issues. The breadth and depth of these films' topics lay the foundation for their attractiveness. The improvement of China's basic film production level has played a role in boosting their success, resulting in Hollywood films being collectively pushed off the Chinese box office charts. Now, almost any domestic film can be considered "watchable." The next step is to produce world-class masterpieces and promote the collective advancement of Chinese films on the global stage. The three movies that I watched are YOLO, directed, written and starring Jia Ling, a representative of the new generation of female Chinese directors, Pegasus 2, directed by Han Han and Article 20. They are all realistic-themed films, and the actors who play the main characters have some overlap. Although each of them is good, as mentioned earlier, I personally feel that their overall quality is not as good as films screened during last year's Spring Festival holidays. So I have a feeling that Chinese movies have been spinning in place for a year in such a good market environment. Of course, I am not an expert, so what I say may not be correct, or it may be biased. The production level of Chinese films, in terms of technology, has caught up. Domestic films have surpassed Hollywood in the domestic market through competition, which is a great achievement. However, I hope that this does not mark the beginning of a "decoupling" between Chinese movies and the rest of the world, but rather a turning point for Chinese films to reach a higher level domestically and to go global. This requires Chinese realistic films to not only be loved by domestic audiences but also become increasingly "understandable" to foreigners, allowing them to empathize with us through these films. If Chinese films can gradually go global through market-oriented approaches, it will be a new process for the international community to re-recognize and understand China, and to establish common values between us. The earliest understanding of the US by the Chinese people came entirely from the shaping of news propaganda. Later, American films and TV works entered China, showcasing the rich American society. Now, Western media's portrayal of China is completely stereotyped. If Chinese films and other popular culture do not go global, and if a large number of secular elements from China do not appear on the global internet, the outside world's perception of China is likely to be dictated by Western media for a long time. So I hope that China's excellent film market can incubate outstanding works that are loved and enjoyed globally. Not only should our cultural policies provide greater space, but our internet public opinion should also be more tolerant of the interweaving and mutually influencing between Chinese and Western cultural elements. We should not restrict those elements in Chinese films that can resonate with both Chinese and foreign audiences. For example, comedies should not only make Chinese people laugh, but also be understandable to foreigners. Chinese films need to establish their own big stars, including top-tier female stars. In the past, Bruce Lee and Jackie Chan became famous in the West, but they were primarily seen as "Hollywood stars." It is a more challenging journey for Chinese stars to gain international recognition through their own films. The success of Chinese films and Chinese stars worldwide is definitely a complementary process. The backgrounds of our film stories should also be carefully selected and more diverse, enhancing the visual quality and international appeal of the films. Feng Xiaogang's film Be There or Be Square was entirely set in the US, and later, there was another film called Lost in Thailand, both of which achieved good results. Choosing such backgrounds should be encouraged as one of the approaches. In conclusion, I am delighted by the comprehensive recovery of the Chinese film market, and I also hope that the films nurtured by this market will continue to progress. To achieve this, we need to keep introducing the world's best films and collaboratively cultivate the aesthetic taste of the Chinese people alongside Chinese films. Chinese films have already stood up, but they should not monopolize this vast market. Instead, the Chinese market should serve as the stage for them to expand globally.

See Pregnant Margot Robbie Debut Her Baby Bump

This Barbie is going to be a mother. And Margot Robbie has no problem putting her burgeoning baby bump on full display. In fact, the Barbie star, who is pregnant with her Tom Ackerley’s first baby, debuted recently her bump while vacationing on Italy’s Lake Como with her husband July 7. For the outing, Margot donned a black blazer over a white tee that was cropped above her stomach, showing off a sweet baby bump. She finished off the look with low-rise black trousers, black platform sandals and a summery straw bag. For his part, Tom—whom Margot wed in a 2016 ceremony in her native Australia—wore olive green trousers and a cream-colored button-down shirt and tan sneakers. The couple were photographed waiting on a dock in Lake Como before they hopped in a boat and sailed off into a literal sunset. While Margot and Tom, both 34, haven’t spoken publicly about their upcoming bundle of joy, the I, Tonya alum has previously expressed hope to have a big family one day. As she told Porter in 2018, “If I'm looking into my future 30 years from now, I want to see a big Christmas dinner with tons of kids there.” Tom and Margot’s new chapter comes over ten years after their love story first began on the set of 2014's Suite Française, in which Margot starred while Tom worked as a third assistant director. But while she was immediately smitten, Margot was convinced her love would go unrequited. "I was always in love with him, but I thought, ‘Oh, he would never love me back,'" she admitted to Vogue in 2016. "'Don't make it weird, Margot. Don't be stupid and tell him that you like him.' And then it happened, and I was like, ‘Of course we're together. This makes so much sense, the way nothing has ever made sense before.'"

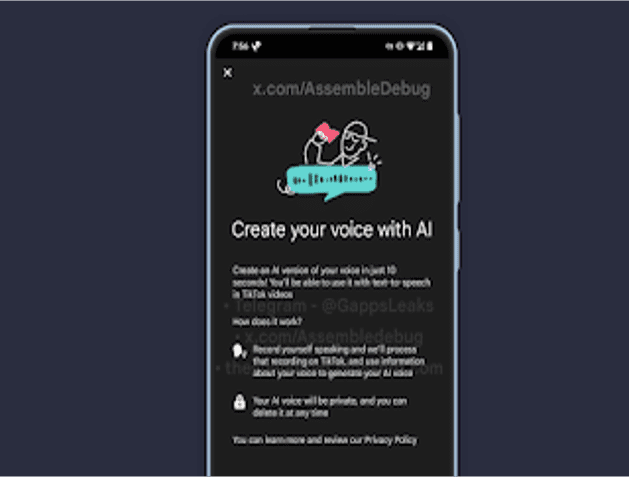

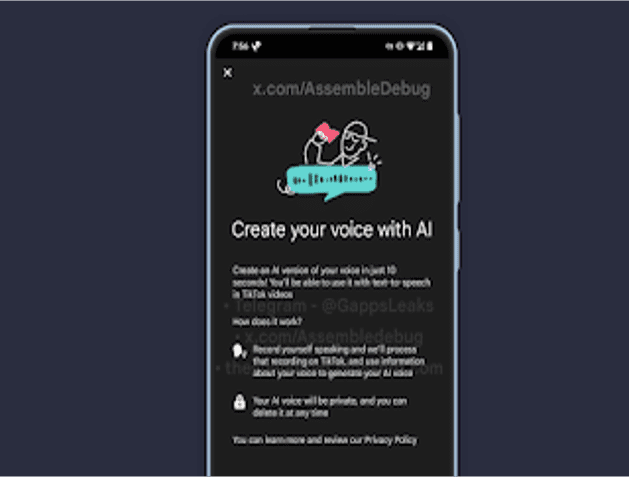

TikTok to introduce a new feature that can clone your voice with AI in just 10 second

Use of AI is certainly the hottest topic in the tech industry and every major and minor player in this industry is using AI in some way. Tools like ChatGPT can help you do a wide range of task and even help you generate images. The other thing is - Voice Cloning. OpenAI recently introduced a voice engine that can generate clone of your voice with just 15 seconds of your audio. There is no shortage of voice cloning tools on the web which can help you do the same. The newest tech giant which is going to use AI to clone your voice is - TikTok. We all know TikTok, posting short videos with filters, effects and all other kind of things. So TikTok found a way to use the voice cloning AI in its app. TikTok is working on this feature, which does not seem to really have a proper name, it just references it as "Create your voice with AI" and "TikTok Voice Library". In the latest version of TikTok I came across some strings which indicates that TikTok is working on it. I was also able to access the initial UI which introduces the feature and was able to see the terms and condition of "TikTok Voice Library" which user have to accept in order to use the feature. Here are the screenshots from the app- As you can in the screenshot above, this is the initial screen which a user will see for the first time they access this feature. Tiktok claims that it can create an AI verison of your voice in just 10 seconds. The generated AI voice clone can be used with text-to-speech in TikTok videos. It also outline the process of how it will work. You have to record yourself speaking and TikTok will process the voice and use information about your voice to generate your AI voice. When it comes to privacy, your AI voice will stay private and you can delete it anytime. Tapping the "Continue" button brings "TikTok Voice Library Terms" screen which a user should definitely read, you can see here and read as well - How it will work After agreeing to terms and conditions I was introduced with a screen where TikTok will show some text and user have to press the record button while reading the text. Now unfortunately I did not see any text. This is probably because the feature is not fully ready or the backend from which it fetches the text is not live yet. Manually pressing the record button and saying random things also shows an error. So, it's also not possible to provide any sample voice generated with it and see how it compares to other voice cloning competitors. If it starts working someday, it will process your recorded voice and generate AI version of your voice. Here is a screenshot of that screen - My guess is that whenever the feature starts working, users have to clone voice only one time and the saved AI voice can be used through the text-to-speech method to add voice in your videos. You just have to type the words, choice is yours :p

Apple's low-end Apple Watch uses a plastic case

Apple is giving the Apple Watch a major update for its 10th anniversary. The watch's display will be larger, and the entire device will be thinner and lighter. Both the Apple Watch Series 10 and the new Apple Watch Ultra 3 will be equipped with new chips, which may be paving the way for future Apple AI capabilities. According to sources, the Apple Watch health detection function has encountered some technical obstacles in the upgrade process, the blood pressure measurement function or can only realistically display fluctuations and cannot display values, and the sleep apnea detection and other functions can not appear on the new product. The shell material of Apple Watch SE series products may be replaced by hard plastic from aluminum shell. The plastic-clad Apple Watch may be sold at a lower price to compete with Samsung's cheapest Watch, the Galaxy Watch FE. In addition, Siri's new features may be delayed, and AirPods with cameras may arrive in 2026.