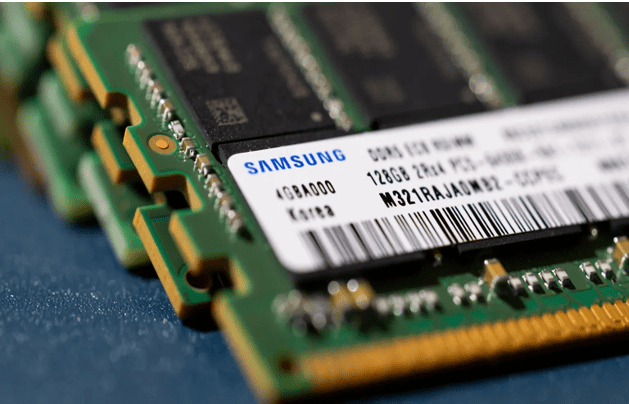

Samsung Electronics expects its profits for the three months to June 2024 to jump 15-fold compared to the same period last year.

An artificial intelligence (AI) boom has lifted the prices of advanced chips, driving up the firm's forecast for the second quarter.

The South Korean tech giant is the world's largest maker of memory chips, smartphones and televisions.

The announcement pushed Samsung shares up more than 2% during early trading hours in Seoul.

The firm also reported a more than 10-fold jump in its profits for the first three months of this year.

In this quarter, it said it is expecting its profit to rise to 10.4tn won ($7.54bn; £5.9bn), from 670bn won last year.

That surpasses analysts' forecasts of 8.8tn won, according to LSEG SmartEstimate.

"Right now we are seeing skyrocketing demand for AI chips in data centers and smartphones," said Marc Einstein, chief analyst at Tokyo-based research and advisory firm ITR Corporation.

Optimism about AI is one reason for the broader market rally over the last year, which pushed the S&P 500 and the Nasdaq in the United States to new records on Wednesday.

The market value of chip-making giant Nvidia surged past $3tn last month, briefly holding the top spot as the world's most valuable company.

"The AI boom which massively boosted Nvidia is also boosting Samsung's earnings and indeed those of the entire sector," Mr Einstein added.

Samsung Electronics is the flagship unit of South Korean conglomerate Samsung Group.

Next week, the tech company faces a possible three-day strike, which is expected to start on Monday. A union of workers is demanding a more transparent system for bonuses and time off.