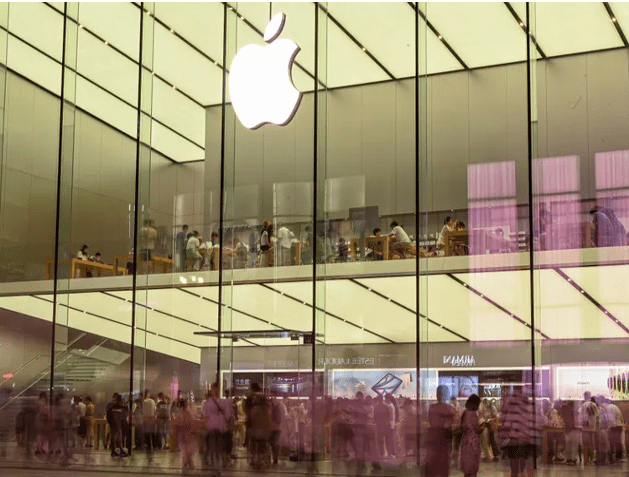

Apple could be on track to reach a $4 trillion market capitalization with the artificial intelligence (AI) iPhone 16 upgrade cycle coming, Wedbush analysts said.

The analysts said the iPhone 16 supercharged with AI could bring a "golden upgrade cycle" for Apple.

Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value.

Apple (AAPL) could be on the path to a $4 trillion market capitalization as an iPhone upgrade cycle approaches, driven by the iPhone 16 supercharged with artificial intelligence (AI) capabilities, according to Wedbush analysts.

1

Apple's recently announced iOS 18 with Apple Intelligence and OpenAI partnership are also expected to create monetization opportunities and increase share value.

AI iPhone 16 Upgrade Cycle Coming Soon

Wedbush analyst said that an AI iPhone 16 could bring "a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally."

"The Street is now starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution," they said, with 2.2 billion iOS devices globally and 1.5 billion iPhones.

Wedbush suggested a "consumer AI tidal wave" could start with the iPhone 16 in mid-September, adding that estimates indicate 270 million iPhones users have not upgraded in over four years.

Recovery in China To Support Upgrade Cycle

The analysts indicated that iPhone supply stabilization in Asia is also "a very good sign heading into a monumental iPhone 16 upgrade cycle."

Wedbush's projections come amid ongoing concerns for the iPhone maker in the China region amid increased competition, though there have been recent signs of improving shipments.

They projected that June "will be the last negative growth quarter for China with a growth turnaround beginning in the September quarter," when the iPhone 16 is expected to be released.

AI and iOS 18 Could Also Boost Share Value

Apple unveiled iOS 18 supercharged by Apple Intelligence and an AI partnership with OpenAI at its developers' conference in June.

Wedbush analysts said the partnership with the Chat-GPT maker "creates the highway for developers around the globe to focus on iOS 18 and this in turn will create a myriad of monetization opportunities for Cook & Co. over the coming years."

The analysts estimated that "this could result in incremental Services high margin growth annually of $10 billion for Apple" driven by hardware and software.

They added they believe "AI technology being introduced into the Apple ecosystem will bring monetization opportunities on both the services as well as iPhone/hardware front and adds $30 to $40 per share."

Apple shares were little changed in early trading Monday, though they have gained more than 17% since the start of the year.

Do you have a news tip for Investopedia reporters? Please email us at

tips@investopedia.com

SPONSORED

Trade on the Go. Anywhere, Anytime

One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.