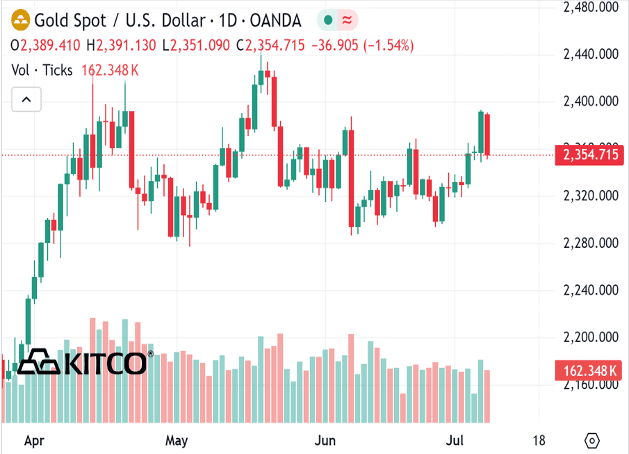

(Kitco News) - Gold and silver prices are sharply lower in midday U.S. trading Monday, on heavy profit-taking from the shorter-term futures traders after recent good price advances. The selling pressure today across most of the raw commodity spectrum is also keeping the precious metals bulls on the sidelines to start the trading week. August gold was last down $37.50 at $2,360.10. September silver was down $0.849 at $30.85.

U.S. stock indexes mixed but near their record highs scored last week. The rallying stock market is a bearish element for the gold and silver markets, from a competing asset class perspective. The key U.S. data points of the week include Fed Chairman Powell’s speeches to the U.S. Congress on Tuesday and Wednesday, and the consumer and producer price indexes on Thursday and Friday, respectively.

The key outside markets today see the U.S. dollar index slightly higher. Nymex crude oil prices are lower and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.288%.

Technically, August gold bulls have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the June high of $2,406.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at $2,382.60 and then at $2,400070. First support is seen at $2,350.00 and then at last week’s low of $2,327.40. Wyckoff's Market Rating: 6.0.

September silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at the June low of $28.90. First resistance is seen at $31.00 and then at $31.50. Next support is seen at Friday’s low of $30.45 and then at $30.00. Wyckoff's Market Rating: 6.5.

(Hey! My “Markets Front Burner” weekly email report is my best writing and

analysis, I think, because I get to look ahead at the marketplace and do

some market price forecasting. Plus, I’ll throw in an educational feature

to move you up the ladder of trading/investing success. And it’s free!

Email me at jim@jimwyckoff.com and I’ll add your email address to my Front

Burner list.)