BRI: embracing Chinese green practices for a sustainable future

Editor's Note: This year marks the 10th anniversary of the Belt and Road Initiative (BRI) proposed by Chinese President Xi Jinping. Through the lens of foreign pundits, we take a look at 10 years of the BRI - how it achieves win-win cooperation between China and participating countries of the BRI and how it has given the people of these countries a sense of fulfillment. In an interview with Global Times (GT) reporter Li Aixin, Erik Solheim (Solheim), former under-secretary-general of the United Nations and former executive director of the UN Environment Programme, recalled how the BRI helped shorten a previously long journey in Sri Lanka to a half-hour trip. "We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together," Solheim said. This is the 18th piece of the series. GT: How do you evaluate the role of the BRI in promoting development in participating countries over the past 10 years? Solheim: The BRI has been a major driver of development since it was announced by President Xi Jinping in Kazakhstan 10 years ago. The China-Laos Railway has connected landlocked Laos to the Chinese and European rail network, making it possible for Laos to sell more goods and welcome more tourists. Rail corridors in Kenya and from Djibouti to Addis Ababa connect the interior of Africa to the coast, bringing opportunities for much faster development in East Africa. The Bandung-Jakarta railway in Indonesia, Hanoi metro, roads and ports in Sri Lanka - there are great examples of good south-south and BRI projects in almost every corner of the world. GT: In your experience of traveling around the world, has any BRI-related story left a deep impression on you? Solheim: Yes, many! I'll just mention two. When I was chief negotiator in the Sri Lanka peace process 15 years ago, it took a long time to travel from the airport to Colombo, the capital of Sri Lanka. When I came back last year, it took half an hour on wonderful Chinese-built highways. Traveling through Mombasa, a coastal city in Kenya, you see a lot of poverty and run down houses. Then all of a sudden, a green, clean, well-run oasis opens up. It's the end station of the Nairobi-Mombasa railway which links the capital Nairobi to the coast. The rail station stands out and is showing the future for Kenya. GT: The EU proposed the Global Gateway, and the US proposed the Build Back Better World. What do you think are the similarities and differences between these projects and the BRI? Solheim: I really wish success for the Western initiatives. What developing nations ask for is a choice of good cooperation with both China and the West. Unfortunately, up to now, a number of the Western-led initiatives have been more like media events. They lack structure, secretariat, finances and clear direction. Nearly all nations in the world want to see close people-to-people relations, investment and political cooperation with both China and the West. No one wants to choose. GT: Some people from the West are talking about "de-coupling" and "de-risking." Both seem to be another way of saying "de-globalization." Do you think "de-coupling" and "de-risking" will affect the BRI? And what role will the BRI play in maintaining globalization? Solheim: Decoupling is probably the most unwise idea in the world today. It's outright dangerous. Facing climate change, environmental degradation, economic troubles, war in Ukraine and other places, and the threat of pandemics, we need more, not less, cooperation. We will all be losers in a de-globalized, de-coupled world. The BRI can play a key role in bringing the world together. Almost all developing countries have made BRI agreements with China. As an example, when President Xi met all the leaders of Central Asia recently in Xi'an, Northwest China's Shaanxi Province, they made a very ambitious declaration on future green cooperation between China and Central Asia. GT: You have previously said that the BRI is a fantastic vehicle to promote green global development, which can boost the economy and ecology at the same time. Could you elaborate on how you think the BRI has achieved development of the economy and ecology? Solheim: In the beginning there were too many fossil fuel projects among BRI programs. In the BRI International Green Development Coalition, we argued this should stop. When President Xi pledged to stop building new coal-fired power projects overseas, it was one of the most important environmental decisions ever. Also, it happened at a time when important BRI nations like Bangladesh, Kenya and Pakistan decided they could grow their economies and go green without coal. The BRI will in the next decade become the world's most important vehicle for green energy and green transport. We will see massive investments in solar and wind power, hydrogen, electric batteries and more. GT: How do you view China's goal of achieving harmony between humanity and nature in modernization? In what way is China's story in pursuing harmony between humanity and nature relevant to other countries? Solheim: China now covers between 60 percent and 80 percent of all major green technologies in the world - solar, wind, hydro, batteries, electric cars and high-speed rail. Companies like Longi, BYD and CATL are the world leaders in their sectors. More remarkably and maybe less noticed abroad, China is also a global leader in protecting nature. It's embarking upon one of the most massive national park programs, with a focus on Qinghai Province and Xizang Autonomous Region. China is by far the biggest tree planter in the world and the global leader in desert control in Kubuqi, Inner Mongolia and other places. China has been hugely successful in the recovery of endangered species like the Giant Panda, Tibetan Antelope and Snow Leopard. A new center for mangrove restoration is being set up in Shenzhen and the fishing ban in the Yangtze will restore that magnificent ecosystem. The Belt and Road is a great opportunity for the world to learn from good Chinese green practices.

Insurers fret over militant attacks, AI hacks at Paris Olympics

LONDON, July 5 (Reuters) - Insurers are nervous that militant attacks or AI-generated fake images could derail the Paris Olympics, risking event cancellations and millions of dollars in claims. Insurers faced losses after the 2020 Tokyo Olympics were postponed for a year due to the COVID-19 pandemic. Since then, wars in Ukraine and Gaza and a spate of elections this year, including in France, have driven up fears of politically-motivated violence at high-profile global events. The Olympics take place in Paris from July 26-Aug 11 and the Paralympics from Aug 28-Sept 8. German insurer Allianz (ALVG.DE), opens new tab is insurance partner for the Games. Other insurers, such as the Lloyd's of London (SOLYD.UL) market, are also providing cover. "We are all aware of the geopolitical situation the world is in," said Eike Buergel, head of Allianz's Olympic and Paralympic programme. "We are convinced that the IOC (International Olympic Committee), Paris 2024 and the national organising committees, together with the French authorities, are taking the right measures when it comes to challenges on the ground."

South Korean government decides not to punish interns who resign

South Korea's Minister of Health and Welfare Cho Kyu-hong said at a press conference on the 8th local time that after comprehensively considering the suggestions of frontline interns and the situation on the front line of medical care, the government decided that from that day on, all interns and residents who resigned would not be given administrative sanctions such as revoking their medical licenses. Cho Kyu-hong also said that for interns and residents who have returned to work and those who have resigned and are preparing to re-register for internship courses in September, the government will make special cases to try to minimize the internship gap and not affect the relevant doctors from obtaining specialist medical licenses. Cho Kyu-hong said that the government believes that in order to minimize the diagnosis and treatment gaps for critically ill and emergency patients and ensure the smooth training process of interns and residents, it is in the public interest, so it has made a decision not to punish interns and residents who resigned. It is hoped that major hospitals will complete the resignation processing of doctors who have not returned to work before July 15 and determine the scale of vacancies. Previously, large general hospitals in South Korea, such as Seoul National University Hospital, Yonsei University Severance Hospital, and Seoul Asan Medical Center, suspended or limited their medical services in an effort to cancel all penalties against interns and residents.

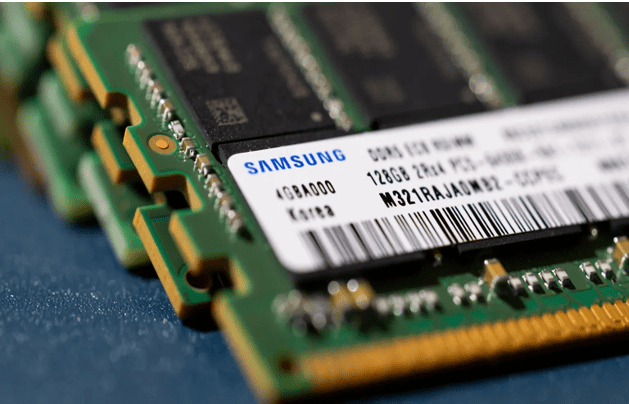

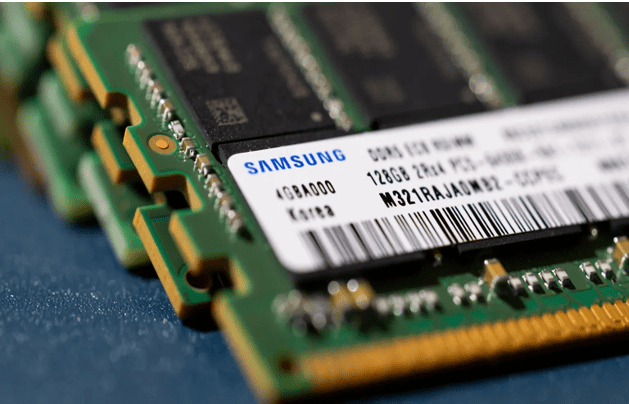

Samsung expects profits to jump by more than 1,400%

Samsung Electronics expects its profits for the three months to June 2024 to jump 15-fold compared to the same period last year. An artificial intelligence (AI) boom has lifted the prices of advanced chips, driving up the firm's forecast for the second quarter. The South Korean tech giant is the world's largest maker of memory chips, smartphones and televisions. The announcement pushed Samsung shares up more than 2% during early trading hours in Seoul. The firm also reported a more than 10-fold jump in its profits for the first three months of this year. In this quarter, it said it is expecting its profit to rise to 10.4tn won ($7.54bn; £5.9bn), from 670bn won last year. That surpasses analysts' forecasts of 8.8tn won, according to LSEG SmartEstimate. "Right now we are seeing skyrocketing demand for AI chips in data centers and smartphones," said Marc Einstein, chief analyst at Tokyo-based research and advisory firm ITR Corporation. Optimism about AI is one reason for the broader market rally over the last year, which pushed the S&P 500 and the Nasdaq in the United States to new records on Wednesday. The market value of chip-making giant Nvidia surged past $3tn last month, briefly holding the top spot as the world's most valuable company. "The AI boom which massively boosted Nvidia is also boosting Samsung's earnings and indeed those of the entire sector," Mr Einstein added. Samsung Electronics is the flagship unit of South Korean conglomerate Samsung Group. Next week, the tech company faces a possible three-day strike, which is expected to start on Monday. A union of workers is demanding a more transparent system for bonuses and time off.

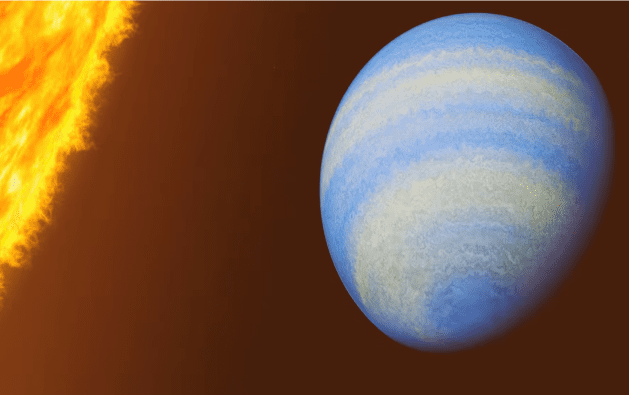

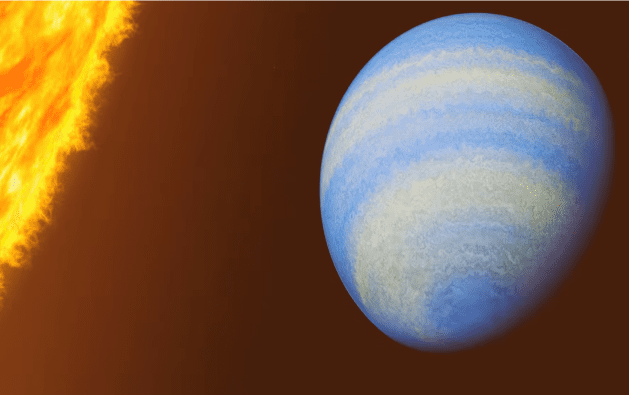

Rotten eggs chemical detected on Jupiter-like alien planet

WASHINGTON, July 8 (Reuters) - The planet known as HD 189733b, discovered in 2005, already had a reputation as a rather extreme place, a scorching hot gas giant a bit larger than Jupiter that is a striking cobalt blue color and has molten glass rain that blows sideways in its fierce atmospheric winds. So how can you top that? Add hydrogen sulfide, the chemical compound behind the stench of rotten eggs. Researchers said on Monday new data from the James Webb Space Telescope is giving a fuller picture of HD 189733b, already among the most thoroughly studied exoplanets, as planets beyond our solar system are called. A trace amount of hydrogen sulfide was detected in its atmosphere, a first for any exoplanet. "Yes, the stinky smell would certainly add to its already infamous reputation. This is not a planet we humans want to visit, but a valuable target for furthering our understanding of planetary science," said astrophysicist Guangwei Fu of Johns Hopkins University in Baltimore, lead author of the study published in the journal Nature, opens new tab. It is a type called a "hot Jupiter" - gas giants similar to the largest planet in our solar system, only much hotter owing to their close proximity to their host stars. This planet orbits 170 times closer to its host star than Jupiter does to the sun. It completes one orbit every two days as opposed to the 12 years Jupiter takes for one orbit of the sun. In fact, its orbit is 13 times nearer to its host star than our innermost planet Mercury is to the sun, leaving the temperature on the side of the planet facing the star at about 1,700 degrees Fahrenheit (930 degrees Celsius). "They are quite rare," Fu said of hot Jupiters. "About less than one in 100 star systems have them." This planet is located 64 light-years from Earth, considered in our neighborhood within the Milky Way galaxy, in the constellation Vulpecula. A light-year is the distance light travels in a year, 5.9 trillion miles (9.5 trillion km). "The close distance makes it bright and easy for detailed studies. For example, the hydrogen sulfide detection reported here would be much more challenging to make on other faraway planets," Fu said. The star it orbits is smaller and cooler than the sun, and only about a third as luminous. That star is part of a binary system, meaning it is gravitationally bound to another star. Webb, which became operational in 2022, observes a wider wavelength range than earlier space telescopes, allowing for more thorough examinations of exoplanet atmospheres.