New York

CNN

—

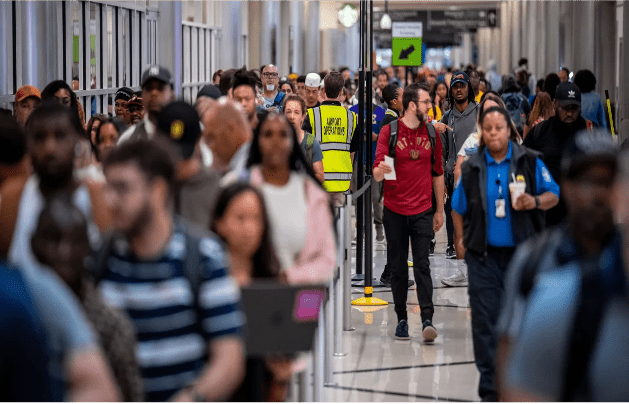

A record number of passengers are expected to pass through US airports this holiday travel week. You’d think this would be a great time to run an airline.

You’d be wrong.

Airlines face numerous problems, including higher costs, such as fuel, wages and interest rates. And problems at Boeing mean airlines have too few planes to expand routes to support a record numbers of flyers. Strong bookings can’t entirely offset that financial squeeze.

The good news for passengers is they will be spared most of the problems hurting airlines’ bottom lines — at least in the near term. Airfares are driven far more by supply and demand, not their costs.

But in the long run, the airlines’ difficulties could mean fewer airline routes, less passenger choice and ultimately a less pleasant flying experience.

Profit squeeze

Industry analysts expect airlines to report a drop of about $2 billion in profit, or 33%, when they report financial results for the April to June period this year. That would follow losses of nearly $800 million across the industry in the first quarter.

Labor costs and jet fuel prices, the airlines’ two largest costs, are both sharply higher this year. Airline pilot unions just landed double-digit pay hikes to make up for years of stagnant wages; flight attendant unions now want comparable raises.

Jet fuel prices are climbing because of higher demand in the summer. According to the International Air Transport Association’s jet fuel monitor, prices are up 1.4% in just the last week, and about 4% in the last month.

Adding to the airlines’ problems is the crisis at Boeing, as well as the less-well-publicized problems with some of the jet engines on planes from rival Airbus.

Since an Alaska Airlines Boeing 737 Max jet lost a door plug on a January 5 flight, leaving a gaping hole in the side of the plane 10 minutes after takeoff, the Federal Aviation Administration has limited how many jets Boeing can make over concerns about quality and safety.

As a result, airlines have dramatically reduced plans to expand their fleets and replace older planes with more fuel efficient models. In some cases, airlines have asked pilots to take time off without pay, and carriers such as Southwest and United have announced pilot hiring freezes.

In addition to the problems at Boeing, hundreds of the Airbus A220 and A320 family of jets globally have also been grounded for at least a month or more to deal with engine problems. Just about all the planes with those engines have been out of sevice for at least a few days to undergo examinations. And Airbus has also cut back the number of planes it expects to deliver to airlines this year because of supply chain problems.

Problems for flyers

For now, competition in the industry remains fierce: There are 6% more seats available this month compared to July of 2023, according to aviation analytics firm Cirium. And that’s helped to drive fares down — good news for passengers, but more bad news for airlines’ profits.

Southwest announced in April that it would stop serving four airports to trim costs — Bellingham International Airport in Washington state, Cozumel International Airport in Mexico, Syracuse Hancock International Airport in New York and Houston’s George Bush Intercontinental Airport. Many more cities lost air service during the financial hard times of the pandemic.

While upstart airlines are driving prices lower for travelers, those discount carriers might not survive long term. As the major carriers are making less money, many of the upstarts are flat-out losing money.