Members of the National Samsung Electronics Union stage a rally near the company's Hwaseong Campus in Gyeonggi Province, Monday, beginning a three-day strike. Korea Times photo by Shim Hyun-chul

By Nam Hyun-woo

The biggest labor union at Samsung Electronics initiated a three-day strike on Monday, threatening to disrupt the company's chip manufacturing lines unless management agrees to a wage hike and higher incentives. This marks the first strike by unionized workers in the tech giant's 55-year history.

The National Samsung Electronics Union (NSEU) claimed that about 4,000 unionized workers from Samsung's plants nationwide participated in a rally at the company's Hwaseong Campus in Gyeonggi Province. Police estimated that approximately 3,000 union members were present at the rally.

According to its own survey, the union reported that a total of 6,540 members expressed their intention to participate in the strike. They emphasized that disruptions in manufacturing are anticipated, with over 5,000 members from facility, manufacturing, and development divisions joining the strike.

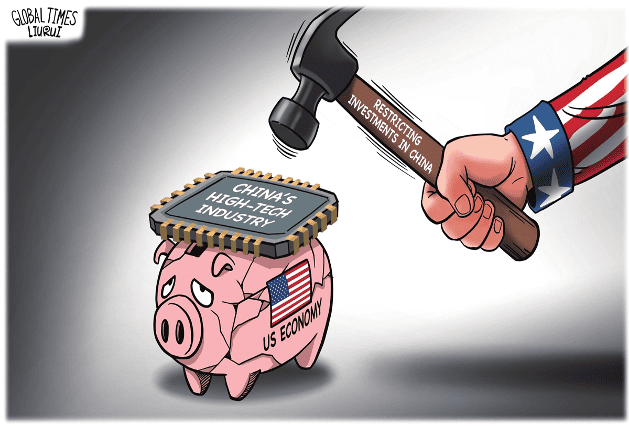

The comments seem to address market expectations that the walkout is unlikely to cause significant disruptions in the chipmaker's operations, largely because most manufacturing lines are automated.

The union said that it may launch another strike for an undetermined period, unless management responds to the union’s demand.

Since January, the union has been pressing management for a higher wage increase rate for all members, fulfillment of promises regarding paid leave, and improvements to incentive criteria. With negotiations at an impasse, the union announced on May 29 that it would launch a strike.

The NSEU has some 30,000 members, accounting for 24 percent of all Samsung employees. Among the union members, about 80 percent work at the device solutions division, which manufactures semiconductors.