Exclusive: India's Paytm gets government panel nod to invest in payments arm, sources say

NEW DELHI, July 9 (Reuters) - India's beleaguered Paytm (PAYT.NS), opens new tab has secured approval from a government panel that oversees investments linked to China to invest 500 million rupees ($6 million) in a key subsidiary, three sources with direct knowledge of the matter said. The approval, which still has to be vetted by the finance ministry, will remove the main stumbling block to the unit, Paytm Payment Services, resuming normal business operations. Paytm Payment Services is one of the biggest remaining parts of the fintech firm's business, accounting for a quarter of consolidated revenue in the financial year ended March 2023. A separate unit, Paytm Payments Bank, was wound down this year by order of the central bank due to persistent compliance issues, triggering a meltdown in Paytm's stock. The government panel had earlier held back approval due to concerns about the 9.88% stake in Paytm held by China's Ant Group. India has intensified scrutiny of Chinese businesses since a 2020 border clash between the two countries. All in all, Paytm has been waiting for the nod from the government panel for about two years and without it, it would have had to also wind down its payment services business, which was forbidden from taking on new customers in March 2023. Once the approval has been formalised, it will be able to seek a so-called "payment aggregator" licence from the Reserve Bank of India. The sources, two of whom are government sources, declined to be identified as the decision has not been formally announced. India's foreign, home, finance and industries ministries, whose representatives sit on the panel, did not reply to emails seeking comment. A Paytm spokesperson said the company does not comment on market speculation. "We will continue to make disclosures in compliance with our obligations under the SEBI Regulations, and will inform the exchanges when there is any new material information to share," the spokesperson said.

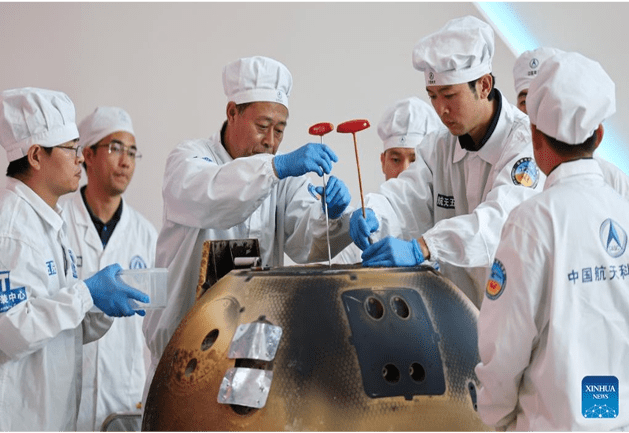

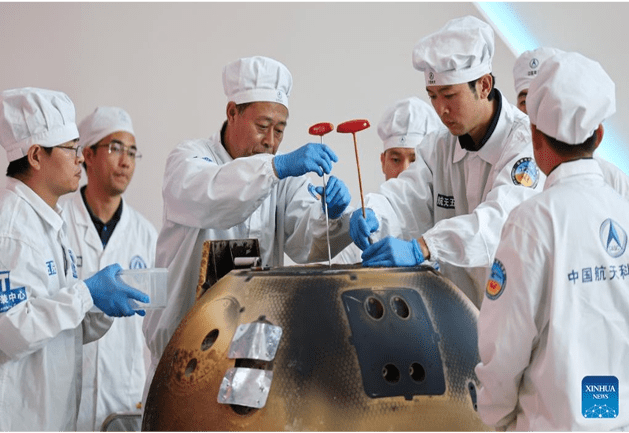

NASA plays 'blame-shifting' game with China as lunar soil research set to start

The returner of the Chang'e-6 lunar probe is opened during a ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation in Beijing, capital of China, June 26, 2024. The returner of the Chang'e-6 lunar probe was opened at a ceremony in Beijing on Wednesday afternoon. During the ceremony at the China Academy of Space Technology under the China Aerospace Science and Technology Corporation, researchers opened the returner and examined key technical indicators. Photo: Xinhua As the US space industry recently faced yet more delays and stagnation with key components including manned spacecraft and space suits "going wrong," NASA has once again resorted to its "sour grapes" rhetoric upon seeing China's successful retrieval of fresh lunar soils from the far side of the moon, by claiming that China did not directly invite its scientists to participate in the lunar soil research. This behavior is a typical blame-shifting trick, Chinese experts said, noting it is clear to all that it is the US' own laws, not China, that are restricting space cooperation between the two sides. Instead of deceiving themselves by distorting the truth, the US should face up to its own problem of overall weakening engineering capability and the lack of long-term planning in its space industry. After the Chang'e-6 samples, weighing nearly 2 kilograms, were safely transported to a special laboratory for further study on Friday, NASA spokesperson Faith McKie told media that while China worked with the European Space Agency, France, Italy and Pakistan on this mission, "NASA wasn't invited to take part in the moon probe." NASA also didn't get "any direct invitation" to study China's moon rocks, after it welcomed all scientists from around the world to apply to study them, McKie told NatSec Daily. Responding to the remarks, Chinese Foreign Ministry spokesperson Mao Ning told the Global Times on Monday that China is open to having space exchanges with the US, and we also welcome countries around the world to take part in the study of lunar samples. "However, the US side seems to have forgotten to mention its domestic legislation such as the Wolf Amendment. The real question is whether US scientists and institutions are allowed by their own government to participate in cooperation with China," Mao said. "The existence of the Wolf Amendment has basically shut the door to space collaboration between the two countries," Wang Yanan, chief editor of Beijing-based Aerospace Knowledge magazine, told the Global Times on Monday. Even if research institutions of the US have the willingness to work with China on opportunities such as lunar sample research, institutions there must obtain special approval from the US Congress due to the presence of this amendment, Wang explained. Currently, no such "green light" is in sight from the Congress. Furthermore, China's collaboration with international partners is based on equality and mutual benefit, leveraging their respective scientific resources, facilities, and expertise. However, the US only wants what it doesn't have, and its engagement with China would be advantageous only to itself, Wang noted. NASA has found itself embroiled in a number of thorny issues recently, with the latest being Boeing's Starliner manned spaceship experiencing both helium leaks and thruster issues during a June 6 docking with the International Space Station (ISS), which led to an indefinite delay for its crew's return to Earth, despite NASA's insistence that they are not "stranded" in space. The return of the Starliner capsule, while has already been delayed by two weeks, will be put on hold "well into the summer" pending results of new thruster tests, which are scheduled to start Tuesday and will take approximately two weeks or even more, per NASA officials. Previously on June 24, NASA cancelled a spacewalk on the ISS following a "serious situation," when one of the spacesuits experienced coolant leak in the hatch. While being broadcast on a livestream, the astronauts reported "literally water everywhere" as they were preparing for the extravehicular activity, space.com reported. The report said that this is the second time this particular spacewalk was postponed, after a June 13 attempt with a different astronaut group was pushed back due to a "spacesuit discomfort." The recurring issues with the spacesuits are due to their much-extended service lifespan, media reported, as the puffy white ones US astronauts currently wear were designed more than 40 years ago. Despite the pressing need to replace them, NASA announced recently that it is abandoning a plan to develop next-generation spacesuits, which had been committed to be delivered by 2026, CNN reported on Thursday. One of the root causes for such problems is that the US has developed many large technology conglomerates, which for a long time have benefited significantly from government orders and industry monopolies. Consequently, in many complex engineering fields, the level of attention given is greatly insufficient, Wang noted. It also reflected the US' lack of long-term strategic planning for its manned space program. For instance, the ageing spacesuits should have been replaced a decade ago to ensure that operational suits remain in usable condition. Failure to address this issue results in a hindrance to the space station's necessary maintenance tasks and even poses life-threatening risks to astronauts in emergency situations, experts said. The issues with Boeing's spacecraft and the spacesuits are not isolated problems, but reflected a systemic issue in the US space industry - the overall weakening of engineering capabilities, they noted.

Google may bring Google Wallet for Indian users

Google Wallet can help you store your IDs, driving license, loyalty cards, concert tickets and more. You can also store your payment cards and use tap to pay to pay anywhere Google Pay is accepted. Google wallet is available in various countries but Google never launched it in India. Google let indian users stick with the Gpay which facilitates UPI payments. Tap to pay is not part of it. Also we can not store things such as IDs and Passes in indian version of Gpay. This might change and Google may launch Google Wallet in India. With the recent version of Google Wallet and Google Play Services, Google has added some flags and code which indicate that Google is working on something for Indian users regarding wallet. The first change I noticed recently when going through the Google Play Services apk was addition of two new flags Both flags are part of com.google.android.gms.pay package in the Google Play Services. This package contains all the flags for features of Gpay/Wallet. Google does server side flipping of flags to enable/disable features for users. So both these flags doesn't really provide any info about what features enabling these flags is going to bring. But the point here is that Google Wallet is not launched in India so why Google added these flags inside Play Services ? The answer could be that Google may be working on bringing Google Wallet to India. It can enable tap to pay, store payments and various other features for Indian users which we don't have in the current Gpay for India. I found similar flags in the analysis Google Wallet APK - These flags are also disabled by default. But this is again a clear indication of Google working towards something for Indian users. In both cases, enabling the flags doesn't bring anything noticeable UI or feature because there is nothing much added besides flags. Google has dogfood/testing versions internally, so the code will show up slowly in upcoming versions. The last piece of code I found is also from Google Play Services. In case you don't know, Google was working on Digilocker integration in the Google Files app which was supposed to bring your digital document inside the app such as driving license, COVID certificates, aadhar card. But Google has ditched the effort of bringing these features and they removed the "Important" tab (where digilocker was supposed to be integrated) from the Google Files app completely. So things are going to change and here is how. This is the code which I found in the Google Play Services - So the word "PASS" along with PAN, DRIVERS LICENCE, VACC CERTIFICATE & AADHAR CARD, is clear indication of the possibility of Google adding support for these directly through Google Wallet using Digilocker, just like Samsung Pass does it. This code is not old as I have checked older beta versions of Play Services where this code is not present. Here is a string which was added in a previous beta version a few weeks ago but I completely ignored it because it didn't make any sense without flags and the other code - This addition was surprising because there was nothing regarding digilocker before in the Play Services. In the words "pay_valuable", the "pay" to Wallet/Gpay and "valuable" refers to the things like Passes, loyalty cards and transit cards. Since we are talking about digilocker, these "valuable" are driving license, vaccination certificate, PAN card and Aadhar card which can be store in Google Wallet after digilocker integration. That's all about it. We will know more about it in upcoming app updates or maybe Google can itself annouce something about this.

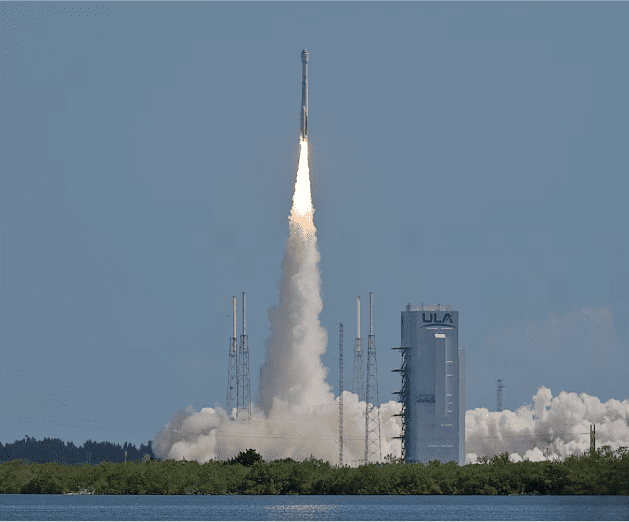

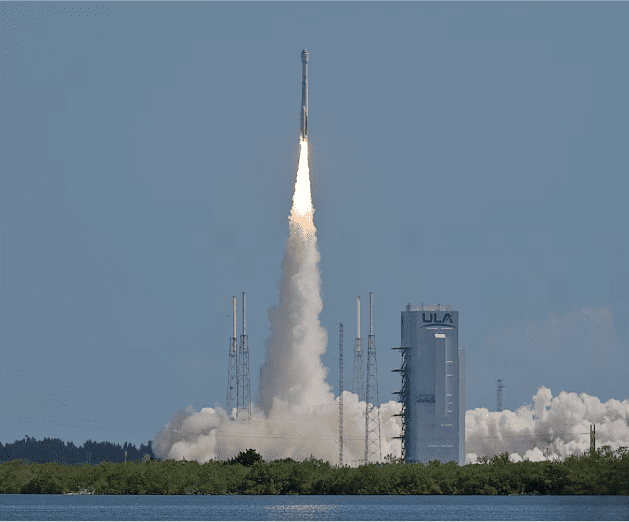

Explainer: How Boeing's Starliner can bring its astronauts back to Earth

WASHINGTON, June 24 (Reuters) - Problems with Boeing's Starliner capsule, still docked at the International Space Station (ISS), have upended the original plans for its return of its two astronauts to Earth, as last-minute fixes and tests draw out a mission crucial to the future of Boeing's (BA.N), opens new tab space division. NASA has rescheduled the planned return three times, and now has no date set for it. Since its June 5 liftoff, the capsule has had five helium leaks, five maneuvering thrusters go dead and a propellant valve fail to close completely, prompting the crew in space and mission managers in Houston to spend more time than expected pursuing fixes mid-mission. Here is an explanation of potential paths forward for Starliner and its veteran NASA astronauts, Barry "Butch" Wilmore and Sunita "Suni" Williams. THE CURRENT SITUATION Starliner can stay docked at the ISS for up to 45 days, according to comments by NASA's commercial crew manager Steve Stich to reporters. But if absolutely necessary, such as if more problems arise that mission officials cannot fix in time, it could stay docked for up to 72 days, relying on various backup systems, according to a person familiar with flight planning. Internally at NASA, Starliner's latest targeted return date is July 6, according to this source, who spoke on condition of anonymity. Such a return date would mean that the mission, originally planned for eight days, instead would last a month. Starliner's expendable propulsion system is part of the craft's "service module." The current problems center on this system, which is needed to back the capsule away from the ISS and position it to dive through Earth's atmosphere. Many of Starliner's thrusters have overheated when fired, and the leaks of helium - used to pressurize the thrusters - appear to be connected to how frequently they are used, according to Stich.

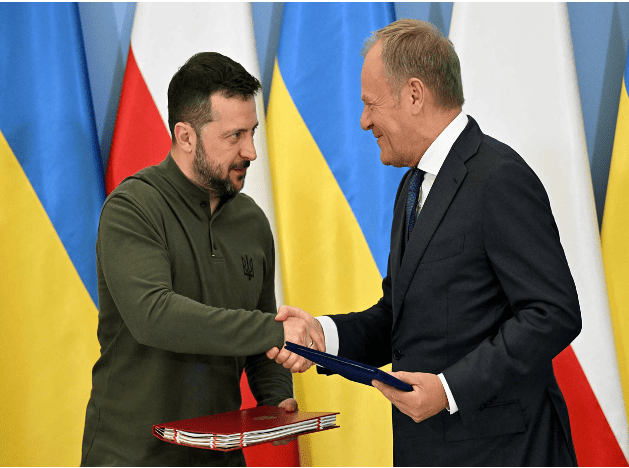

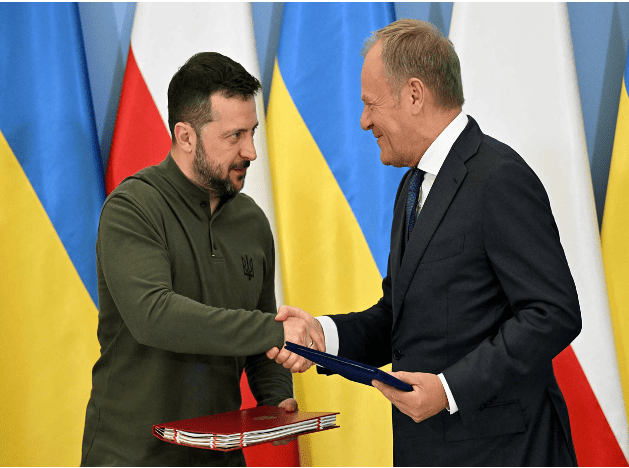

Poland and Ukraine sign bilateral security agreement

On July 8, Ukrainian President Zelensky, who was visiting Poland, and Polish Prime Minister Tusk signed a bilateral security agreement in Warsaw, the capital of Poland. The agreement clearly states that Poland will provide support to Ukraine in air defense, energy security and reconstruction. After signing the agreement, Tusk said that the agreement includes actual bilateral commitments, not "empty promises." Previously, the United States, Britain, France, Germany and other countries as well as the European Union signed similar agreements with Ukraine.