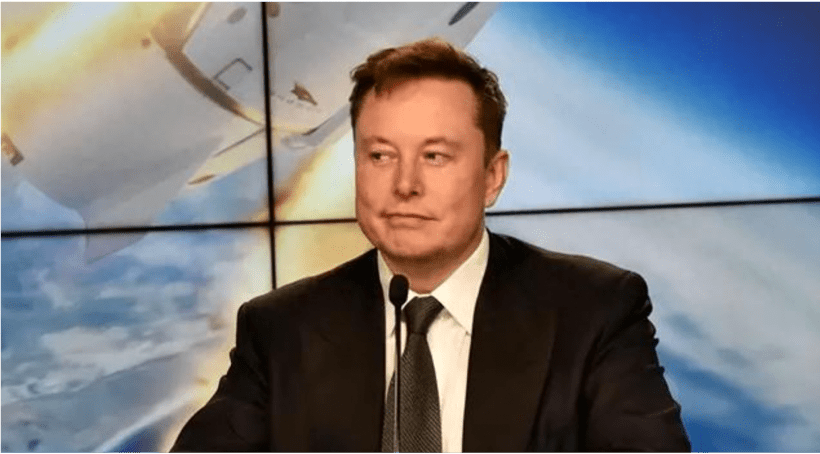

At the beginning of this year, Elon Musk had a fortune of $251 billion and could almost single-handedly solve world hunger. However, Tesla's stagnant sales, the endless struggle to buy Twitter, and the volatility of Tesla's stock price meant he lost a lot of money this year.

According to Forbes, Musk is the billionaire with the most losses so far this year, with his wealth shrinking at a rate of about $5 billion a month. According to the website, his wealth shrank by more than 10% from the end of 2023 to June 28, 2024. As the website explains:

Between December 31, 2023, and June 28, the last day of regular stock market trading for the first half of the year, Musk's net worth fell from $251.3 billion to $221.4 billion, a bigger drop than any other billionaire tracked by Forbes, but Musk remains the richest person on the planet.

The main reason for the dip in Musk's pocketbook is that a Delaware judge in January canceled Musk's then-record Tesla compensation package worth $51 billion, which led Forbes to cut the value of the equity award by 50 percent because of uncertainty about whether Musk would receive those stock options.

Excluding that bonus, Musk's wealth has remained volatile over the past six months, with the value of his 13 percent stake in Tesla shrinking by about $20 billion as falling profits and car deliveries sent the stock down 20 percent. But that was partly offset by the growth of Musk's stake in his generative artificial intelligence startup xAI to $14.4 billion (Musk also has a roughly $75 billion stake in private aerospace company SpaceX, a $7 billion stake in social media company X, And smaller stakes in other companies, such as brain experimentation startup Neuralink).