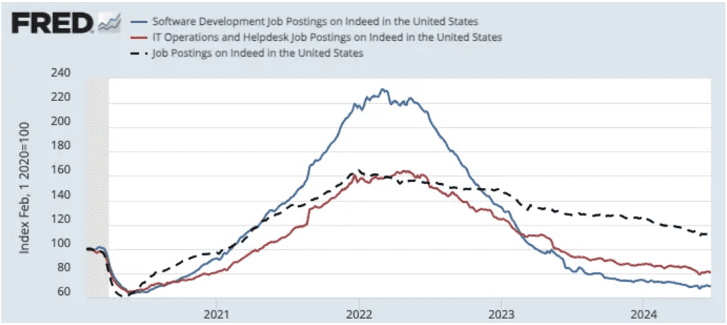

Are US development jobs falling off a cliff?

Companies are going to have fewer people and fewer layers. Ten years from now, the software development circuit may have fewer jobs, higher salaries, and more product-centric work.

The reason behind it is the rapid development of AI, AI has approached human beings at the intelligence level, a lot of work relying on thinking ability may be handed over to AI, while emotion is still the territory of human beings, how to communicate and collaborate is the most important ability in the near future. When Indeed's chart for software development and operations jobs was released, we found that, as the chart shows, there was a peak in early 2022, but after that there was a precipitous decline.

McDonald’s expands operational map in Chinese market, to roll out more outlets in the country

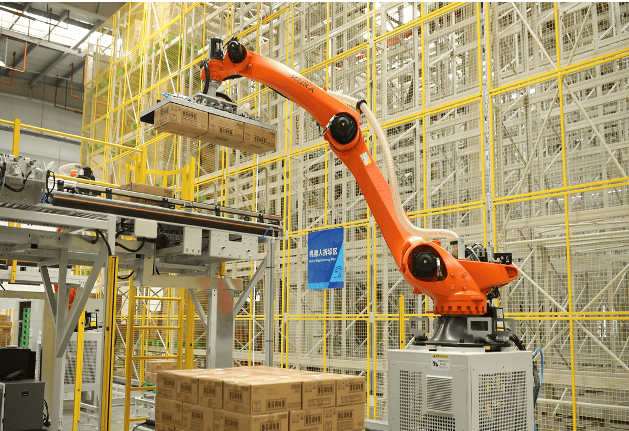

McDonald's China, together with its four major suppliers announced the launch of an industrial park in Xiaogan city, Central China's Hubei Province on Wednesday, highlighting the importance of Chinese market in terms of supply chain for food business. With a combined investment of 1.5 billion yuan ($206 million), the park, named Hubei Smart Food Industrial Park, is a joint project with Bimbo QSR, XH Supply Chain, Tyson Foods Inc, and Zidan, according to information provided to the Global Times. The park is expected to produce 34,000 tons of meat products, 270 million buns, 30 million pastries, and 2 billion packaged products annually. It also features a 25,000-square-meter high-standard automated warehouse for frozen, refrigerated, and dry goods, reducing logistics time by 90 percent from manufacturing to arriving at the destination. Leveraging local geographical advantages, the park will become a supply hub for McDonald's in central and western China, enhancing supply efficiency and stability for its outlets there, the company said. "McDonald's has been deeply rooted in China for over 30 years, and the park is an echo of our long-term development in China," said Phyllis Cheung, CEO of McDonald's China. "Without any long-term strategy, we don't have any structural advantage in China," Cheung noted. The US food giant continues to expand its business map in China. As of the end of June in 2024, there were over 6,000 restaurants and over 200,000 employees in the market. China has become the second largest and fastest-growing market of McDonald's. In 2023, McDonald's China unveiled the ambition of operating 10,000 restaurants by 2028. To support this, McDonald's and its suppliers have invested over 12 billion yuan from between 2018 to 2023 to develop new production capacities and enhance supply chain sustainability. Observers said that the industrial park reflect foreign companies' confidence in operating in China as the country takes concrete measures in furthering reform and opening-up. China's foreign direct investment from January to May 2024 reached 412.51 billion yuan, with the number of newly-established foreign-backed companies reaching 21,764, rising by 17.4 percent year-on-year, data from China's Ministry of Commerce revealed. According to a recent survey by the American Chamber of Commerce in China, the majority of US companies saw improved profitability in China in 2023, and half of the survey participants put China as their first choice or within their top three investment destinations globally. Olaf Korzinovski, EVP of Volkswagen China, who is responsible for production and components, also shared his understanding of supply chains in China with the Global Times. Volkswagen has been operating in China for about 40 years. "In order to seize greater value for our customers," Volkswagen Group is stepping up pace of innovation in China, and systematically purshing forward the digitalization process, Korzinovski noted, adding the company is strengthening local capabilities with accelerated decision-making efficiency. Global Times

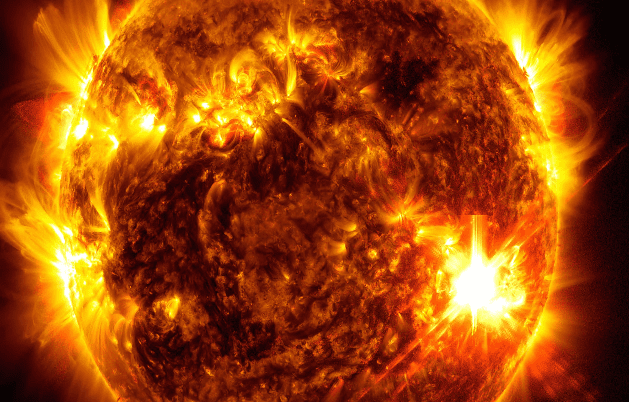

Beyond the aurorae: How solar flares spill out across the Solar System

The Sun is extremely active right now, blasting the Earth with the biggest solar storms in 20 years. This is what it is doing to the rest of the Solar System. If you happened to look skywards on a few nights in May 2024, there was a good chance of seeing something spectacular. For those at relatively low latitudes, there was a rare chance to see the flickering red, pink, green glow of our planet's aurorae. A powerful solar storm had sent bursts of charged particles barrelling towards Earth and, as they bounced around in our planet's atmosphere, they unleashed spectacular displays of the Northern and Southern Lights. The dazzling displays of aurora borealis were visible far further south than they might normally be – and far further north in the case of aurora australis thanks to the power of the geomagnetic storm, the strongest in two decades. Although some people experienced only a faint, eerie glow, others were treated to a myriad of colour as far south as London in the UK and Ohio in the US. Reports even came in from just to the north of San Francisco, California. But while this spike in activity from the Sun left many on Earth transfixed by the light display it produced, it has also had a profound effect elsewhere in the Solar System. As most of us wondered at the colours dancing across the night's sky, astronomers have been peering far beyond to see the strange ways such intense bursts of particles affect other planets and the space between them. "The Sun can fire material outwards in any direction like a garden sprinkler," says Jim Wild, a professor of space physics at Lancaster University in the UK. "The effects are felt throughout the Solar System." Our Sun is currently heading towards, or has already reached, its solar maximum – the point in an 11-year cycle where it is most active. This means the Sun produces more bursts of radiation and particles from solar flares and events known as coronal mass ejections (CMEs). If these are sprayed in our direction, they can supercharge the Earth's magnetic field, causing magnificent aurorae but also posing problems for satellites and power grids. "Things really seem to be picking up right now," says Mathew Owens, a space physicist at the University of Reading in the UK. "I think we're about at solar maximum now, so we may see more of these kinds of storms in the next couple of years." Around the Sun, multiple spacecraft are observing this increase in activity up close. One of those, the European Space Agency's (Esa) Solar Orbiter, has been studying the Sun since 2020 on an orbit that takes it within the path of Mercury. Currently the spacecraft is "on the far side of the Sun as seen from Earth", says Daniel Müller, project scientist for the Solar Orbiter mission at Esa in the Netherlands. "So we see everything that Earth doesn't see." The storm that hit Earth in May originated from an active region of solar flares and sunspots, bursts of plasma and twisting magnetic fields on the Sun's surface, known as its photosphere. Solar Orbiter was able to see "several of the flares from this monster active region that rotated out of Earth's view", says Müller, bright flashes of light and darkened regions called sunspots on the Sun's surface. One of the goals of Solar Orbiter is "to connect what's happening on the Sun to what's happening in the heliosphere," says Müller. The heliosphere is a vast bubble of plasma that envelops the Sun and the planets of the Solar System as it travels through interstellar space. What Müller and his colleagues hope to learn more about is where the solar wind – the constant stream of particles spilling out from the Sun across the Solar System – "blows into the interstellar medium", he says. "So we are particularly interested in anything energetic on the Sun that we can find back in the turbulence of the solar wind." This particular cycle, cycle 25, appears to be "significantly more active than what people predicted", says Müller, with the relative sunspot number – an index used to measure the activity across the visible surface of the Sun – eclipsing what was seen as the peak of the previous solar cycle. The National Oceanic and Atmospheric Administration (Noaa) in the US had predicted a maximum monthly average of 124 sunspots a day in May, but the actual number was 170 on average, with one day exceeding 240, according to Müller. But the exact cause of the Sun's 11-year-long cycle and its variabilities remains a bit of a mystery. • Alien aurora: The strange displays that light up other worlds • Why Einstein was wrong about black holes • The Moon is slipping away from the Earth – and our days are getting longer The effects of these changes in solar activity, however, extend far across the Solar System. Earth is not the only planet to be hit by solar storms as they billow across interplanetary space. Mercury, the closest planet to the Sun, has a much weaker magnetic field than Earth – about 100 times less – and lacks a substantial atmosphere. But solar activity can cause the surface of the planet to glow with X-rays as solar wind rains down. Venus also lacks a substantial magnetic field, but the planet does still create auroras as the solar wind interacts with the planet's ionosphere. At Mars, the effect of solar activity is more obvious. Here, a Nasa spacecraft called Maven (Mars Atmosphere and Volatile Evolution) has been studying the planet's atmosphere from orbit since 2014. "We were on the declining side of solar cycle 24 [then]," says Shannon Curry, a planetary scientist at the University of Colorado, Boulder in the US and the lead on the mission. "We are now coming up on the peak of cycle 25, and this latest series of active regions has produced the strongest activity Maven has ever seen." Between 14 and 20 May the spacecraft detected exceptionally powerful solar activity reaching Mars, including an X8.7 – solar flares are ranked B, C, M, and X in order from weakest to strongest. Results from the event have yet to be studied, but Curry noted that a previous X8.2 flare had resulted in "a dozen papers" published in scientific journals. Another flare on 20 May, later estimated to be an even bigger X12, hurled X-rays and gamma rays towards Mars before a subsequent coronal mass ejection launched a barrage of charged particles in the same direction. Images beamed back from Nasa's Curiosity Rover on Mars revealed just now much energy struck the Martian surface. Streaks and dots caused by charged particles hitting the camera's sensors caused the images to "dance with snow", according to a press release from Nasa. Maven, meanwhile, captured glowing aurora as the particles hit the Mars' atmosphere, engulfing the entire planet in an ultraviolet glow. The flares can cause the temperature of the Martian atmosphere to "dramatically increase," says Curry. "It can even double in the upper atmosphere. The atmosphere itself inflates. The entire atmosphere expands dozens of kilometres – exciting for scientists but detrimental for spacecraft, because when the atmosphere expands there's more drag on the spacecraft." The expanding atmosphere can also cause degradation of the solar panels on spacecraft orbiting Mars from the increase in radiation. "The last two flares caused more degradation than what a third of a year would typically do," says Curry. Mars, while it has lost most of its magnetic field, still has "crustal remnant magnetic fields, little bubbles all over the southern hemisphere", says Curry. During a solar event, charged particles can light those up and excite particles. "The entire day side lights up in what we call a diffuse aurora," says Curry. "The entire sky glows. This would most likely be visible to astronauts on the surface." By the time solar storms reach further out into the solar system, they tend to have dissipated but can still have an impact on the planets they encounter. Jupiter, Saturn, Uranus, and Neptune all have aurorae that are in part driven by charged particles from the Sun interacting with their magnetic fields. But one of the key effects of solar activity on interplanetary space that astronomers are eager to study is something called "slow solar wind", a more sluggish, but denser stream of charged particles and plasma from the Sun. Steph Yardley, a solar astronomer at Northumbria University in the UK, says solar wind is "generally classed about 500km/s (310 miles/s)", but slow wind falls below this. It also has a lower temperature and tends to be more volatile. Recent work by Yardley and her colleagues, using data from Solar Orbiter, suggests that the Sun's atmosphere, its corona, plays a role in the speed of the solar wind. Regions where the magnetic field lines, the direction of the field and charged particles are "open" – stretching out into space without looping back – provide a highway for solar wind to reach high speeds. Closed loops over some active regions – where the magnetic field lines have no beginning and end – can occasionally snap, producing slow solar wind. The variability in the slow solar wind seems to be driven by the unpredictable flow of plasma inside the Sun, which makes the magnetic field particularly chaotic. The X-class flares and coronal mass ejections seen in May transformed the interplanetary medium as they flung out material across the solar system. Solar Orbiter detected a huge spike in ions moving at thousands of kilometres per second immediately after the 20 May flare. Computers on board other spacecraft – the BepiColombo probe, which is currently on a seven-year journey to Mercury, and Mars Express, in orbit around the Red Planet – both saw a dramatic increase in the number of memory errors caused by the high energy solar particles hitting the memory cells. The day after the coronal mass ejection, magnetometers on board the Solar Orbiter also saw large swings in the magnetic field around the spacecraft as a huge bubble of plasma made up of charged particles thrown out from by the event washed past it at 1,400km/s (870 miles/s). Increased solar activity is a boon for scientists. "If you track the number of papers produced by solar physicists, you can almost see an 11-year cycle in there," says Owens. "We are all more scientifically productive when there's a lot of activity to study." As the Sun continues into solar maximum, the Solar System will see more and more activity streaming from its surface. Yet while all the planets witness at least some of the activity, our planet bears the brunt more than most. "Earth is slightly unique in that space weather can have interesting effects on human technologies," says Wild. "There's an extra dimension here on Earth." Perhaps one day those anthropogenic effects might be felt elsewhere, too. "If you're going to fly to Mars and you have a six-month flight through the interplanetary environment, you're going to potentially suck up a lot of space weather events," says Wild. "How you protect your astronauts is an interplanetary issue that we need to get our heads around."

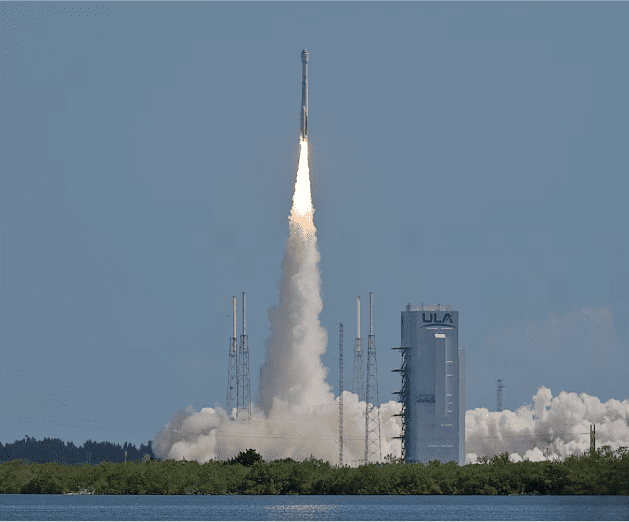

Explainer: How Boeing's Starliner can bring its astronauts back to Earth

WASHINGTON, June 24 (Reuters) - Problems with Boeing's Starliner capsule, still docked at the International Space Station (ISS), have upended the original plans for its return of its two astronauts to Earth, as last-minute fixes and tests draw out a mission crucial to the future of Boeing's (BA.N), opens new tab space division. NASA has rescheduled the planned return three times, and now has no date set for it. Since its June 5 liftoff, the capsule has had five helium leaks, five maneuvering thrusters go dead and a propellant valve fail to close completely, prompting the crew in space and mission managers in Houston to spend more time than expected pursuing fixes mid-mission. Here is an explanation of potential paths forward for Starliner and its veteran NASA astronauts, Barry "Butch" Wilmore and Sunita "Suni" Williams. THE CURRENT SITUATION Starliner can stay docked at the ISS for up to 45 days, according to comments by NASA's commercial crew manager Steve Stich to reporters. But if absolutely necessary, such as if more problems arise that mission officials cannot fix in time, it could stay docked for up to 72 days, relying on various backup systems, according to a person familiar with flight planning. Internally at NASA, Starliner's latest targeted return date is July 6, according to this source, who spoke on condition of anonymity. Such a return date would mean that the mission, originally planned for eight days, instead would last a month. Starliner's expendable propulsion system is part of the craft's "service module." The current problems center on this system, which is needed to back the capsule away from the ISS and position it to dive through Earth's atmosphere. Many of Starliner's thrusters have overheated when fired, and the leaks of helium - used to pressurize the thrusters - appear to be connected to how frequently they are used, according to Stich.

NHTSA opens recall query into about 94,000 Jeep Wrangler 4xe SUVs

July 9 (Reuters) - The National Highway Traffic Safety Administration (NHTSA) has opened a recall query into 94,275 Stellantis-owned (STLAM.MI), opens new tab Jeep SUVs over a loss of motive power, the U.S. auto safety regulator said on Tuesday. The investigation targets Jeep's Wrangler 4xe hybrid SUVs manufactured between 2021 through 2024. Chrysler had previously recalled, opens new tab the same model in 2022 to address concerns related to an engine shutdown. A recall query is an investigation opened by safety regulators when a remedy to solve an issue appears inadequate. The complaints noted in the new report include both failures in vehicles that received the recall remedy and those not covered by the prior recall, the NHTSA said.

OpenAI's internal AI details stolen in 2023 breach, NYT reports

July 4 (Reuters) - A hacker gained access to the internal messaging systems at OpenAI last year and stole details about the design of the company's artificial intelligence technologies, the New York Times reported, opens new tab on Thursday. The hacker lifted details from discussions in an online forum where employees talked about OpenAI's latest technologies, the report said, citing two people familiar with the incident. However, they did not get into the systems where OpenAI, the firm behind chatbot sensation ChatGPT, houses and builds its AI, the report added. OpenAI executives informed both employees at an all-hands meeting in April last year and the company's board about the breach, according to the report, but executives decided not to share the news publicly as no information about customers or partners had been stolen. OpenAI executives did not consider the incident a national security threat, believing the hacker was a private individual with no known ties to a foreign government, the report said. The San Francisco-based company did not inform the federal law enforcement agencies about the breach, it added. OpenAI in May said it had disrupted five covert influence operations that sought to use its AI models for "deceptive activity" across the internet, the latest to stir safety concerns about the potential misuse of the technology. The Biden administration was poised to open up a new front in its effort to safeguard the U.S. AI technology from China and Russia with preliminary plans to place guardrails around the most advanced AI Models including ChatGPT, Reuters earlier reported, citing sources.