NHTSA opens recall query into about 94,000 Jeep Wrangler 4xe SUVs

July 9 (Reuters) - The National Highway Traffic Safety Administration (NHTSA) has opened a recall query into 94,275 Stellantis-owned (STLAM.MI), opens new tab Jeep SUVs over a loss of motive power, the U.S. auto safety regulator said on Tuesday. The investigation targets Jeep's Wrangler 4xe hybrid SUVs manufactured between 2021 through 2024. Chrysler had previously recalled, opens new tab the same model in 2022 to address concerns related to an engine shutdown. A recall query is an investigation opened by safety regulators when a remedy to solve an issue appears inadequate. The complaints noted in the new report include both failures in vehicles that received the recall remedy and those not covered by the prior recall, the NHTSA said.

Enhance Your Photos With NASA's Sharpening Technique

Incredible space photos like those from NASA don't look as stunning straight out of the telescope. They need significant processing, and a crucial part of that is sharpening. Coming to you from Unmesh Dinda with PiXimperfect, this fascinating video explores the APF-R plugin, developed by award-winning astrophotographer Christoph Kaltseis. APF-R stands for Absolute Point of Focus, and it's designed to enhance photo details without creating halos or artifacts. This technology has been used by space agencies with telescopes like the James Webb, and now, you can use it in Photoshop. The plugin allows for non-destructive editing, meaning you can adjust the radius and detail level without permanently altering your image. This feature is crucial for astrophotography, where preserving original details is vital. The video shows how APF-R compares to Photoshop's built-in sharpening tools. The plugin offers multiple rendering methods, each suited for different types of images. For instance, the "Center Weighted" method provides a balanced sharpening effect without making the image look overprocessed. Dinda explains how to fine-tune these settings to achieve the best results, making it clear why this plugin is a game-changer for photographers looking to enhance their images with precision. One notable feature of APF-R is its ability to work with different image types. The video demonstrates how the plugin enhances not just space photos but also landscapes and portraits. For portraits, APF-R can bring out skin textures and eye details without creating the unwanted halos that traditional sharpening methods often produce. Dinda also shows how to combine APF-R with other Photoshop tools, like Smart Sharpen, for even better results. This versatility makes APF-R a valuable addition to any photographer's toolkit. The plugin's cost is $50, which Dinda considers a bargain given its advanced capabilities. There's also a Creative Bundle subscription that includes APF-R and 20 other tools, offering great value for those looking to expand their editing options. Dinda provides discount codes in the video description, making this sophisticated tool more accessible. Check out the video above for the full rundown from Dinda.

ChatGPT: Explained to Kids(How ChatGPT works)

Chat means chat, and GPT is the acronym for Gene Rate Pre trained Transformer. Genrative means generation, and its function is to create or produce something new; Pre trained refers to a model of artificial intelligence that is learned from a large amount of textual materials, while Transformer refers to a model of artificial intelligence. Don't worry about T, just focus on the words G and P. We mainly use its Generative function to generate various types of content; But we need to know why it can produce various types of content, and the reason lies in P. Only by learning a large amount of content can we proceed with reproduction. And this kind of learning actually has limitations, which is very natural. For example, if you have learned a lot of knowledge since childhood, can you guarantee that your answer to a question is completely correct? Almost impossible, firstly due to the limitations of knowledge, ChatGPT is no exception, as it is impossible to master all knowledge; The second is the accuracy of knowledge, how to ensure that all knowledge is accurate and error free; The third aspect is the complexity of knowledge, where the same concept is manifested differently in different contexts, making it difficult for even humans to grasp it perfectly, let alone AI. So when we use ChatGPT, we also need to monitor the accuracy of the output content of ChatGPT. It is likely not a problem, but if you want to use it on critical issues, you will need to manually review it again. And now ChatGPT has actually been upgraded twice, one is GPT4 with more accurate answering ability, and the other is the recent GPT Turbo. The current ChatGPT is a large model called multimodality, which differs from the first generation in that it can not only receive and output text, but also other types of input, such as images, documents, videos, etc. The output is also more diverse. In addition to text, it can also output images or files, and so on.

World's deepest diving pool opens in Poland, 45.5 meters deep

The world's deepest diving pool, Deepspot, opened this weekend near the Polish capital Warsaw. The 45.5-meter pool contains artificial underwater caves, Mayan ruins and a small shipwreck for scuba divers and free divers to explore. Deepspot can hold 8,000 cubic meters of water, more than 20 times the capacity of a normal 25-meter swimming pool. Unlike ordinary swimming pools, Deepspot can still open despite Poland's COVID-19 epidemic prevention restrictions because it is a training center that provides courses. The operator also plans to open a hotel where guests can observe divers at a depth of 5 meters from their rooms. "This is the deepest diving pool in the world," Michael Braszczynski, 47, Deepspot's director and a diving enthusiast, told AFP at the opening yesterday. The current Guinness World Record holder is a 42-meter-deep pool in Montegrotto Terme, Italy. The 50-meter-deep Blue Abyss pool in the UK is scheduled to open in 2021. On the first day of Deepspot's opening, about a dozen people visited, including eight experienced divers who wanted to pass the instructor exam. "There are no spectacular fish or coral reefs here, so it can't replace the ocean, but it is certainly a good place to learn and train safe open water diving," said 39-year-old diving instructor Przemyslaw Kacprzak. "And it's fun! It's like a kindergarten for divers."

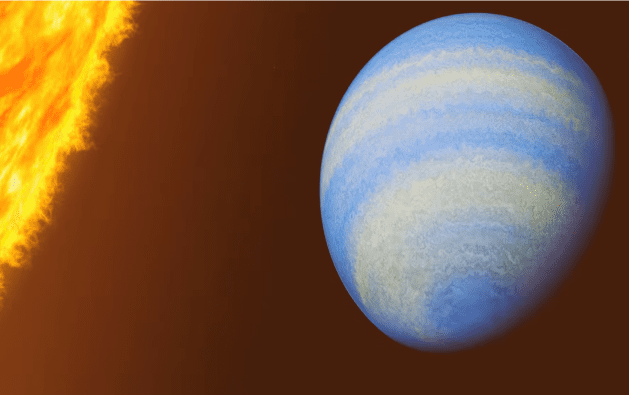

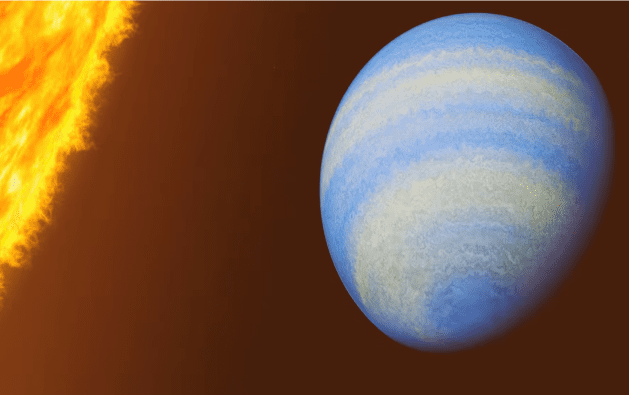

Rotten eggs chemical detected on Jupiter-like alien planet

WASHINGTON, July 8 (Reuters) - The planet known as HD 189733b, discovered in 2005, already had a reputation as a rather extreme place, a scorching hot gas giant a bit larger than Jupiter that is a striking cobalt blue color and has molten glass rain that blows sideways in its fierce atmospheric winds. So how can you top that? Add hydrogen sulfide, the chemical compound behind the stench of rotten eggs. Researchers said on Monday new data from the James Webb Space Telescope is giving a fuller picture of HD 189733b, already among the most thoroughly studied exoplanets, as planets beyond our solar system are called. A trace amount of hydrogen sulfide was detected in its atmosphere, a first for any exoplanet. "Yes, the stinky smell would certainly add to its already infamous reputation. This is not a planet we humans want to visit, but a valuable target for furthering our understanding of planetary science," said astrophysicist Guangwei Fu of Johns Hopkins University in Baltimore, lead author of the study published in the journal Nature, opens new tab. It is a type called a "hot Jupiter" - gas giants similar to the largest planet in our solar system, only much hotter owing to their close proximity to their host stars. This planet orbits 170 times closer to its host star than Jupiter does to the sun. It completes one orbit every two days as opposed to the 12 years Jupiter takes for one orbit of the sun. In fact, its orbit is 13 times nearer to its host star than our innermost planet Mercury is to the sun, leaving the temperature on the side of the planet facing the star at about 1,700 degrees Fahrenheit (930 degrees Celsius). "They are quite rare," Fu said of hot Jupiters. "About less than one in 100 star systems have them." This planet is located 64 light-years from Earth, considered in our neighborhood within the Milky Way galaxy, in the constellation Vulpecula. A light-year is the distance light travels in a year, 5.9 trillion miles (9.5 trillion km). "The close distance makes it bright and easy for detailed studies. For example, the hydrogen sulfide detection reported here would be much more challenging to make on other faraway planets," Fu said. The star it orbits is smaller and cooler than the sun, and only about a third as luminous. That star is part of a binary system, meaning it is gravitationally bound to another star. Webb, which became operational in 2022, observes a wider wavelength range than earlier space telescopes, allowing for more thorough examinations of exoplanet atmospheres.