Carlsberg to buy Britvic for $4.2 billion

Carlsberg to buy Britvic for 1,315p per share Carlsberg will also buy out Marston's from brewing joint venture Danish brewer plans to create integrated beverage business in UK Shares in Carlsberg, Britvic, Marston's all rise July 8 (Reuters) - Carlsberg (CARLb.CO), opens new tab has agreed to buy British soft drinks maker Britvic (BVIC.L), opens new tab for 3.3 billion pounds ($4.23 billion), a move the Danish brewer said would forge a UK beverage "powerhouse" and that sent both companies' shares higher. Carlsberg clinched the takeover with a sweetened bid of 1,315 pence per share - comprising cash and a special dividend of 25 pence a share - after the British company rejected 1,250 pence per share last month. The acquisition will create value for shareholders, contribute to growth and forge a combined beer and soft drink company that is unique in the UK, CEO Jacob Aarup-Andersen told investors on a conference call. "With this transaction we are creating a UK powerhouse," he said. He brushed off concerns from some analysts about integration risks, saying Carlsberg has a strong track record of running beer and soft drink businesses in several markets. Soft drinks already make up 16% of Carlsberg's volumes. COST SAVINGS As drinkers in some markets ditch beer for spirits or cut back on drinking altogether, brewers have looked to broaden their portfolio into new categories like hard seltzer, canned cocktails and cider, as well as zero-alcohol brews. Britvic sells non-alcoholic drinks in Britain, Ireland, Brazil and other international markets such as France, the Middle East and Asia. Carlsberg said the deal will deliver a number of benefits, including cost and efficiency savings worth 100 million pounds ($128 million) over five years as it takes advantage of common procurement, production and distribution networks. It will also see Carlsberg take over Britvic's bottling agreement with PepsiCo (PEP.O), opens new tab. Carlsberg already bottles PepsiCo drinks in several markets and there is scope to add more geographies in future, Aarup-Andersen said. arlsberg halted share buy backs on Monday as a result of the deal. Chief financial officer Ulrica Fearn said these would resume once Carlsberg reaches its revised target for net debt of 2.5 times EBITDA, from 3.5 times currently - a goal it expects to meet in 2027. "Whilst this represents a shift in the strategy away from organic top- and bottom-line growth and consistent returns to shareholders, we view it as a relatively low risk transaction with attractive financials," Jefferies analysts said in a note. Carlsberg also said on Monday it will buy out UK pub group Marston's (MARS.L), opens new tab from a joint venture for 206 million pounds. That will give it full ownership of the newly formed Carlsberg Britvic after the deal. ($1 = 0.7805 pounds) Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here. Reporting by Stine Jacobsen, Yadarisa Shabong and Emma Rumney Editing by Sherry Jacob-Phillips, Rashmi Aich, David Goodman and David Evans

Former British PM Sunak appoints Conservative Party shadow cabinet

On July 8, local time, former British Prime Minister Sunak announced the appointment of the Conservative Party Shadow Cabinet, which is the first shadow cabinet of the Conservative Party in 14 years. Several former British cabinet members during Sunak's tenure as prime minister were appointed to the Conservative Party Shadow Cabinet, including James Cleverly as Shadow Home Secretary and Jeremy Hunt as Shadow Chancellor of the Exchequer. But former Foreign Secretary Cameron was not appointed as Shadow Foreign Secretary. In addition, the new leader of the Conservative Party will be elected as early as this week. On July 4, the UK held a parliamentary election. The counting results showed that the British Labour Party won more than half of the seats and won an overwhelming victory; the Conservative Party suffered a disastrous defeat, ending its 14-year continuous rule.

Workers warn of additional walkouts unless demands are met

Members of the National Samsung Electronics Union stage a rally near the company's Hwaseong Campus in Gyeonggi Province, Monday, beginning a three-day strike. Korea Times photo by Shim Hyun-chul By Nam Hyun-woo The biggest labor union at Samsung Electronics initiated a three-day strike on Monday, threatening to disrupt the company's chip manufacturing lines unless management agrees to a wage hike and higher incentives. This marks the first strike by unionized workers in the tech giant's 55-year history. The National Samsung Electronics Union (NSEU) claimed that about 4,000 unionized workers from Samsung's plants nationwide participated in a rally at the company's Hwaseong Campus in Gyeonggi Province. Police estimated that approximately 3,000 union members were present at the rally. According to its own survey, the union reported that a total of 6,540 members expressed their intention to participate in the strike. They emphasized that disruptions in manufacturing are anticipated, with over 5,000 members from facility, manufacturing, and development divisions joining the strike. The comments seem to address market expectations that the walkout is unlikely to cause significant disruptions in the chipmaker's operations, largely because most manufacturing lines are automated. The union said that it may launch another strike for an undetermined period, unless management responds to the union’s demand. Since January, the union has been pressing management for a higher wage increase rate for all members, fulfillment of promises regarding paid leave, and improvements to incentive criteria. With negotiations at an impasse, the union announced on May 29 that it would launch a strike. The NSEU has some 30,000 members, accounting for 24 percent of all Samsung employees. Among the union members, about 80 percent work at the device solutions division, which manufactures semiconductors.

Diphtheria outbreak in Vietnam kills one person

On the afternoon of July 8, local time, the Vietnamese Ministry of Health issued a notice stating that an 18-year-old girl in the country died of diphtheria. The Ministry of Health asked Nghe An Province and Bac Giang Province to take urgent action to control the epidemic. Diphtheria is an acute respiratory infectious disease caused by Corynebacterium diphtheriae, which is mainly transmitted through droplets and can also be indirectly transmitted by contact with objects containing Corynebacterium diphtheriae. Severe cases may show symptoms of poisoning throughout the body, complicated by myocarditis and peripheral nerve paralysis.

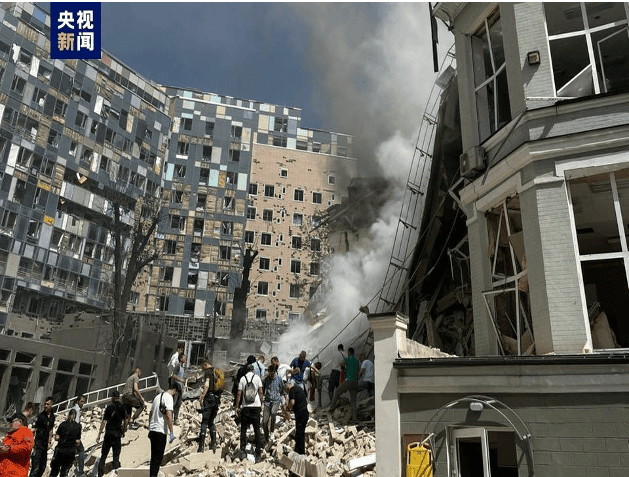

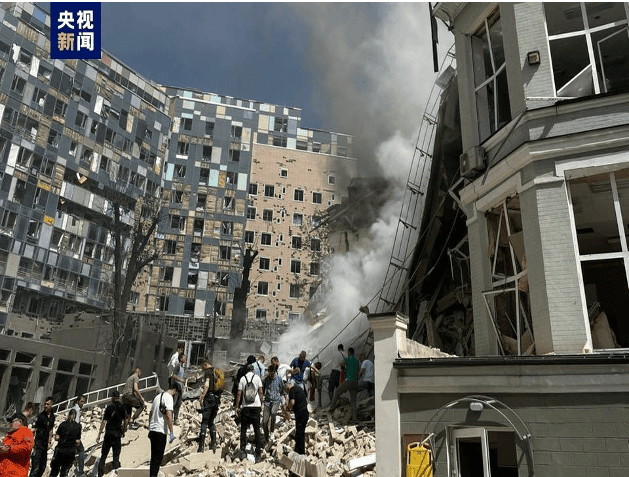

Ukrainian Presidential Office: Russia's attacks on multiple locations in Ukraine have killed 36 people

The Ukrainian presidential office said on July 8 local time that Russia's large-scale attacks on many parts of Ukraine have killed 36 people and injured 140 others. According to the Ukrainian State Emergency Service, a total of 619 rescue workers and 132 equipment participated in the rescue work across Ukraine that day. Ukrainian President Zelensky said on social media on the 8th that Russia launched more than 40 missiles of various types at Ukraine that day. Residential buildings and infrastructure in many cities in Ukraine were damaged in varying degrees of attacks, and a children's hospital was destroyed. Rescue departments are currently conducting emergency rescue on the scene. The Russian Ministry of Defense issued a statement on the 8th local time saying that Ukrainian officials' claim that Russia used missiles to attack Ukrainian civilian facilities was untrue. The damage suffered by Kiev was caused by the fall of missiles launched by the city's air defense system.